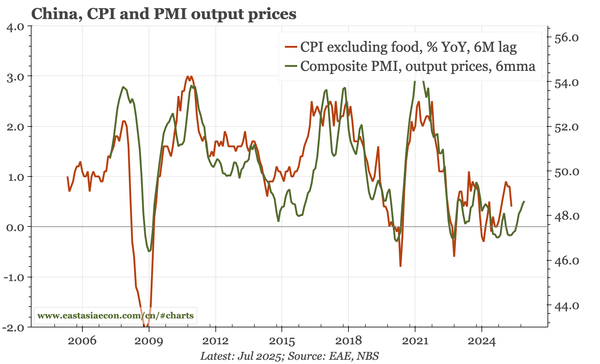

China – the end of deflation

Deflation momentum continued to lessen in February, a trend that will now be given a further boost by global oil prices. But with this shift in the direction of deflation being driven by external factors, it isn't based on the sort of improvement in domestic growth that is needed for sustainability.