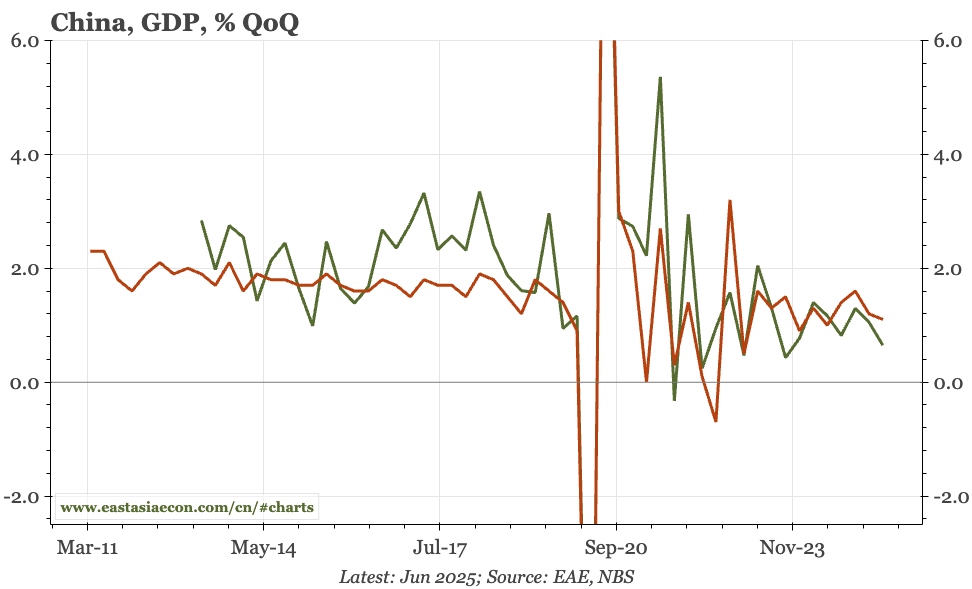

China – nominal momentum still weak

Two things stand out in today's big macro release. First, more signs of property bottoming. But there's no indication of a pick-up, which matters given the second takeaway: the weakness of nominal GDP. On my numbers, that grew just 2.4% QoQ annualised, with the fall in the deflator accelerating.

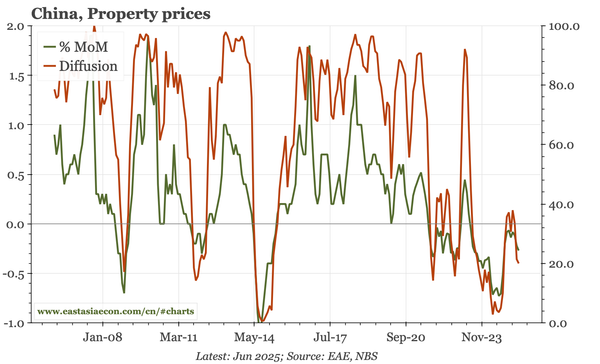

China – property prices weaker again

Property price deflation intensified in June, albeit only mildly. Leading indicators suggest there shouldn't be a new step-down, but only interest rates point to real upside – and interest rates stopped being a reliable lead for the property market some time ago.

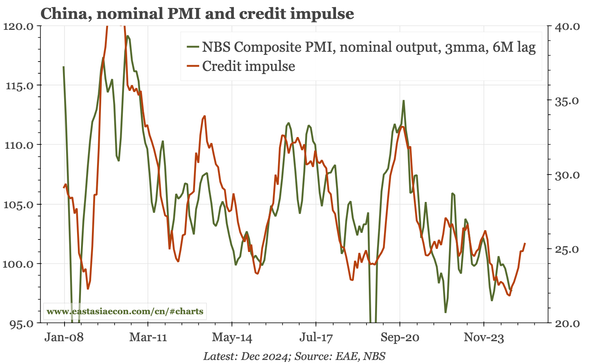

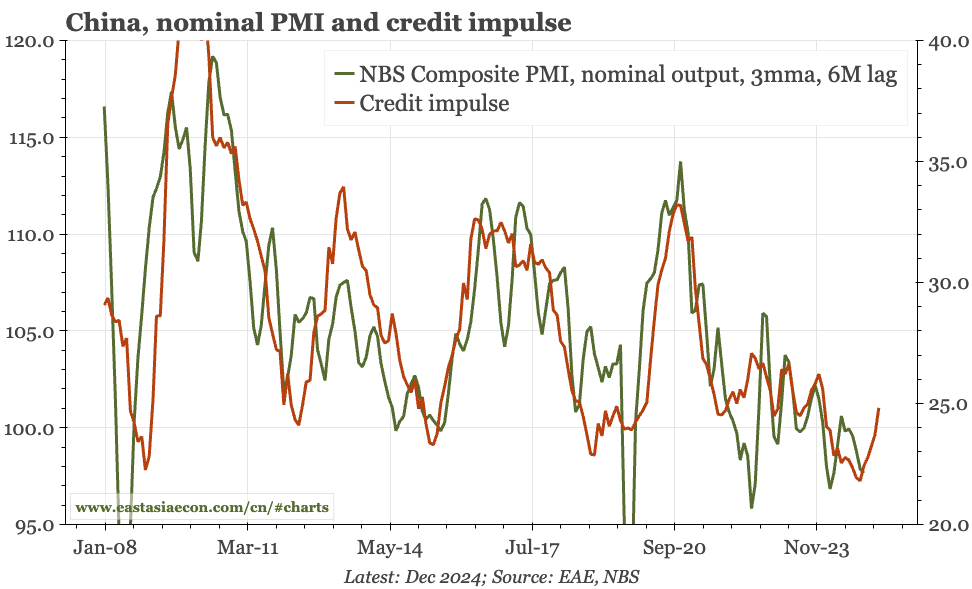

China – not just government boosting the credit impulse

Continuing recent trends, credit and money data were stronger in June. That helps put a floor under the cycle. The details were softer, with credit growth dependent on government borrowing and mortgage lending still slow. But there are some signs of an upturn in lending to the non-state sector.

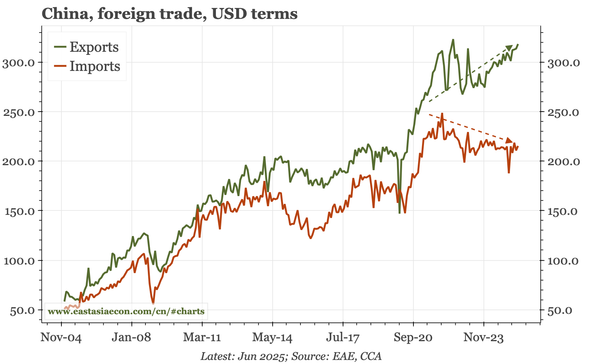

China – exports up again

There aren't signs – yet – of China's export juggernaut hitting a wall. The big fall in US exports eased in June, allowing overall exports to continue to creep up, reaching a new post-2022 high. Imports, meanwhile, continue to flat-line, so the trade surplus remains large.

China – deepening deflation

I am away from my desk, so for now, just a few charts on the CPI/PPI release. Deflation is deepening, which for PPI is broad-based. Core CPI is more stable, but that's partly due to a rise in "other" prices. Headline CPI is lower on food prices, which have started dropping again.

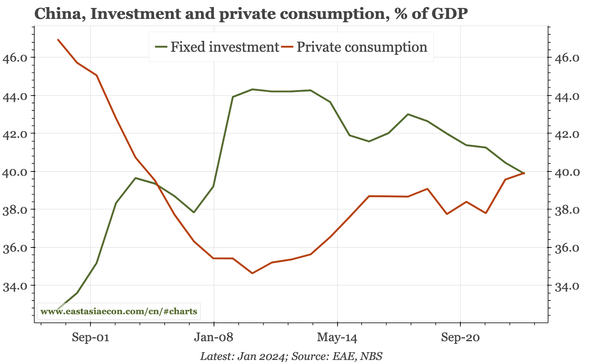

China – structure of GDP shifting, but slowly

Recent data show investment fell in 2024 to under 40% for the first time since 2008. On the flip side, consumption edged up, helped by a stabilisation of the savings ratio and a rise in welfare spending. But none of these changes are happening fast enough to boost the cycle.

China – still looking like a soft floor

At a headline level, the industrial PMIs were better in June, but the details were weak, and there was no improvement in the services PMI. The rise in the credit impulse is taking away some of the downside risk for the cycle, but there aren't indications that the cycle is about to really improve.

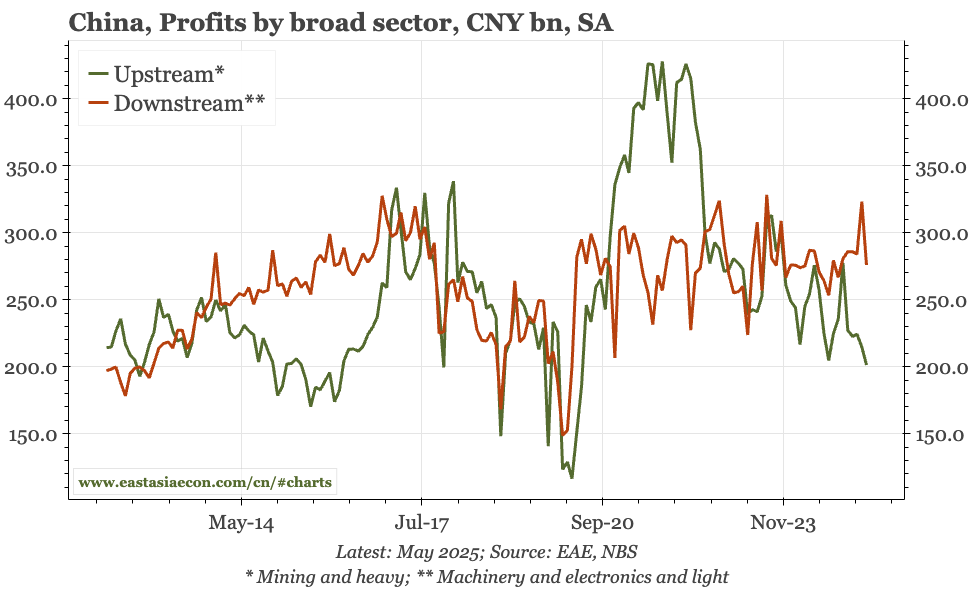

China – prices dragging down profits

Profits fell 9% YoY in May, and are now close to 5% of GDP, a level that's only been breached twice in the last 15 years. The driver is more demand- than supply-side, in the sense that the upstream profits, hit by the property downturn, are weakest. But even in machinery, profits aren't rising.

China – two unusual features of the export transition

Given regional history, China's transition to exporting more capital goods shouldn't be unexpected. More unusual is that 1) this transition hasn't been accompanied by slower overall export growth, and 2) has occurred at the same time as a sharp slowing of imports. Chart pack attached.