Taiwan – madly strong exports, TWD reducing inflation

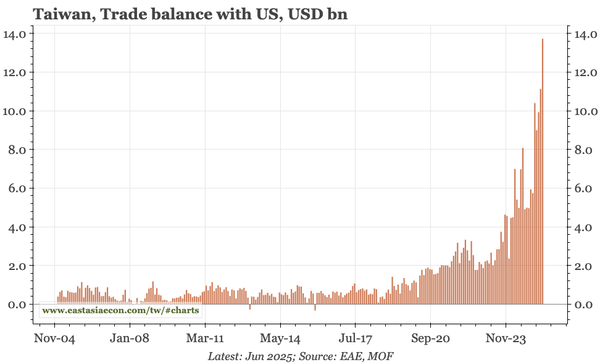

Overall exports, and the trade surplus with the US, continued to surge in June. That Taiwan nonetheless wasn't the recipient of a Trump letter may be because of the sharp rise in the TWD. Other data today show that helping to push down inflation, opening up space for interest rate cuts.

Taiwan – use rates, or the currency?

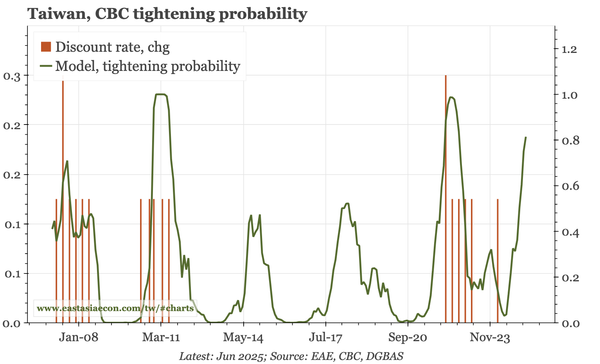

My model points to a rising risk of CBC tightening. But that reflects the export blow-out of 1H25, and neither markets nor officials expect that to persist. Moreover, there are the inklings of a structural rise in the TWD, which would mean tightening via the currency. Rates could actually be cut.

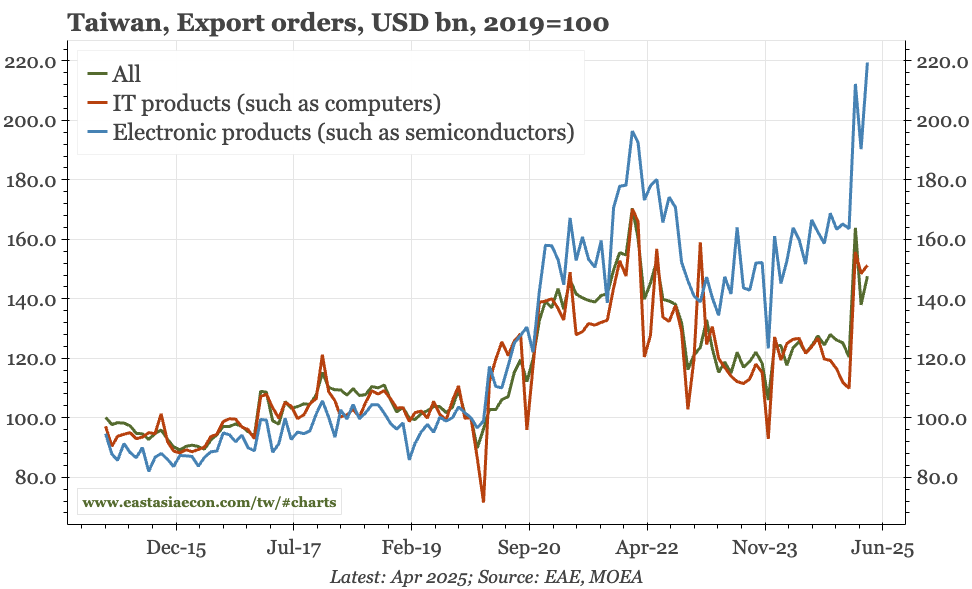

Taiwan – export orders still flying

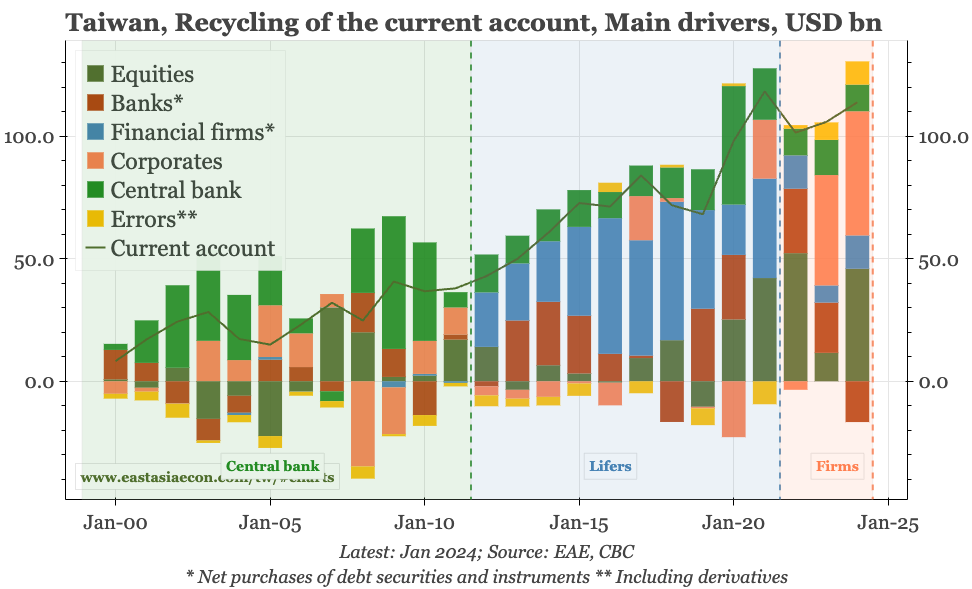

This year's surge in export orders continued in April, but the drop in the diffusion is warning of a pullback. For the current account, the strength in exports this year has been offset by rising imports and a smaller income surplus. For the TWD, export inflows have been offset by equity outflows.

Taiwan – structure, cycle and the TWD

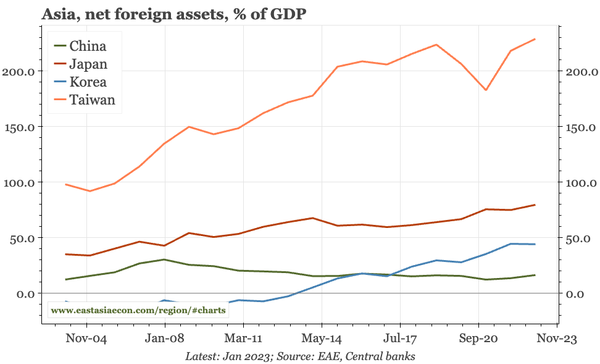

The market sees TWD moves as a function of US pressure and lifers. The CBC says it is all about exporters. I see a step-change in exports from 2020 that has ended deflation and exacerbated the CA surplus. The TWD consequences of that shift are stronger if US tariffs don't trigger a global recession.

Taiwan – TSMC, Trump and the TWD

I can't claim to have expected the 10% surge in the TWD in the last couple of days. But I have been arguing for a while that the risks of a structural appreciation of the currency were real and rising. This is a brief presentation from March that highlights the issues.

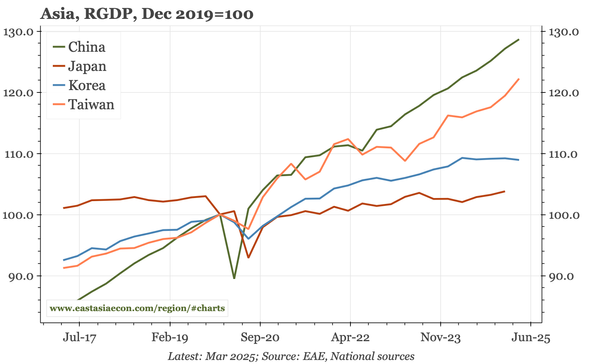

Taiwan – still the strongest cyclical story

GDP growth in Q125 reached almost 10% saar. That is all about exports, and so is vulnerable to tariffs. But it also furthers the step-change in growth evident since 2020. Before then, Taiwan was growing at a similar pace to Korea. Now, the two economies couldn't look more different.

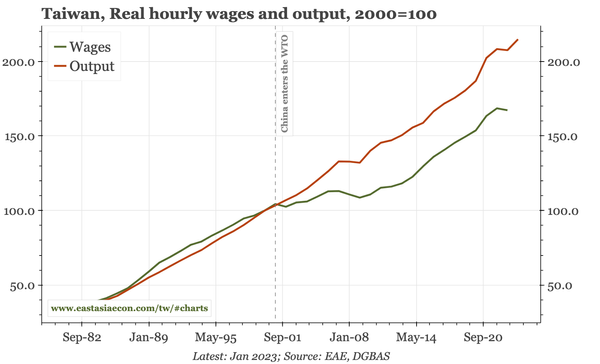

Taiwan – how to cope with the US shock

Taiwan macro doesn't attract much attention, but its experience matters. Taiwan was most exposed to the 2000s China shock. That it then suffered near-deflation reflected tight fiscal policy, a lesson that needs to be learnt in dealing with the latest shock, this time emanating from the US.

Taiwan – TSMC, Trump and the TWD

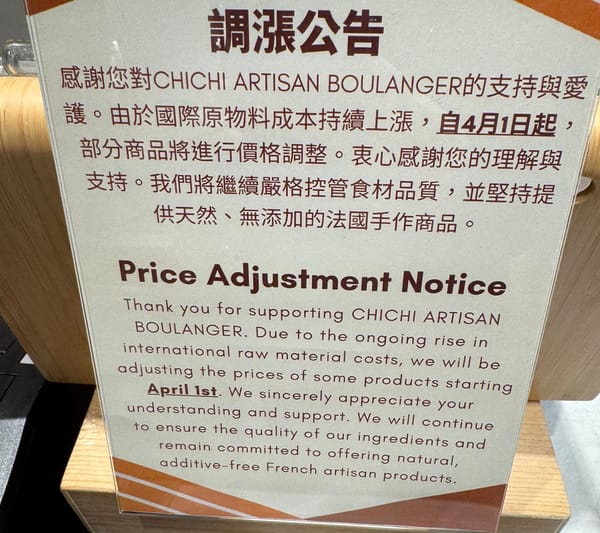

In advance of the CBC meeting this week, a short slide pack on the key themes in Taiwan. In particular, the rise in inflation (I took the photo at my favourite bread shop here today) and Trump's agenda keep the TWD in play for a structural realignment stronger.