East Asia Today

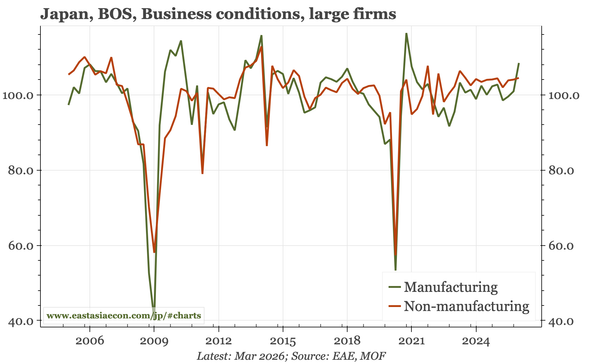

Today's quarterly business sentiment survey from the Cabinet Office and MOF in Japan shows the same bounce in manufacturing confidence that has been visible in the different monthly surveys. Korean job openings for January were weak, but that could reflect this year's rebasing of the data.