Korea – BOK still more worried about growth

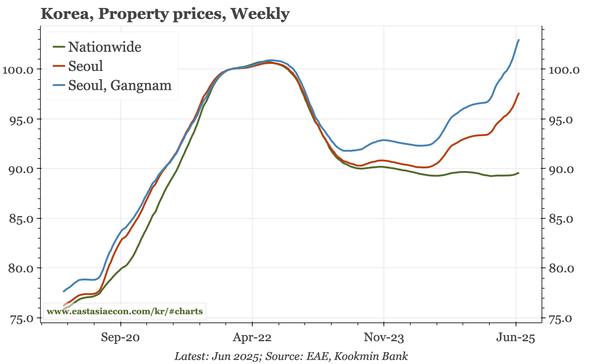

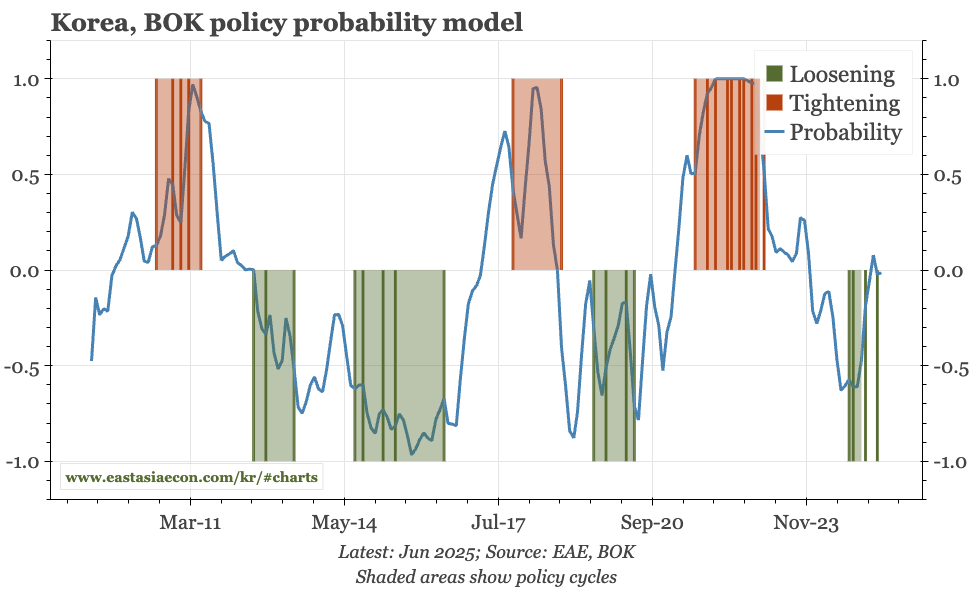

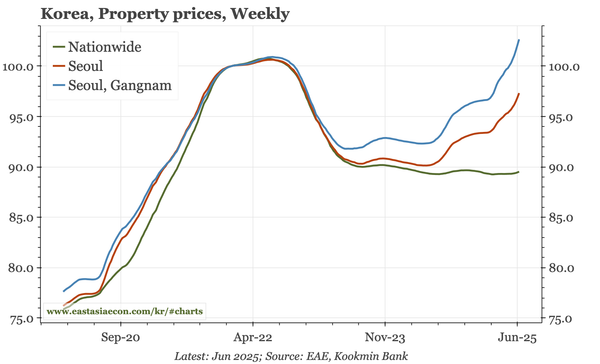

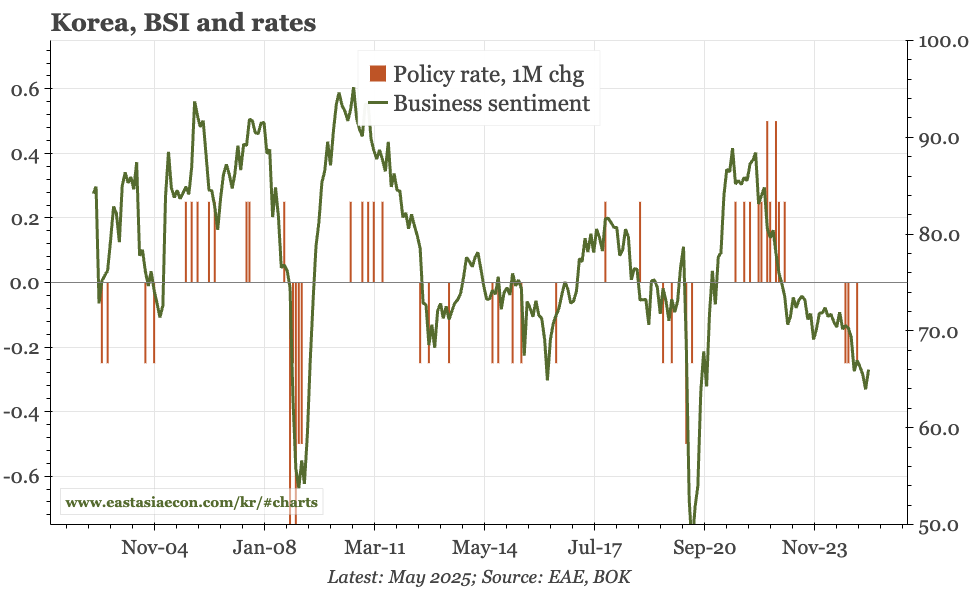

Given the rise in house prices, that the BOK didn't cut rates today wasn't a surprise. However, the bank sounded much more confident than I'd expected that the rebound in house prices would be temporary. So, this really is just a pause, and the bank made no change in its "rate cut stance"

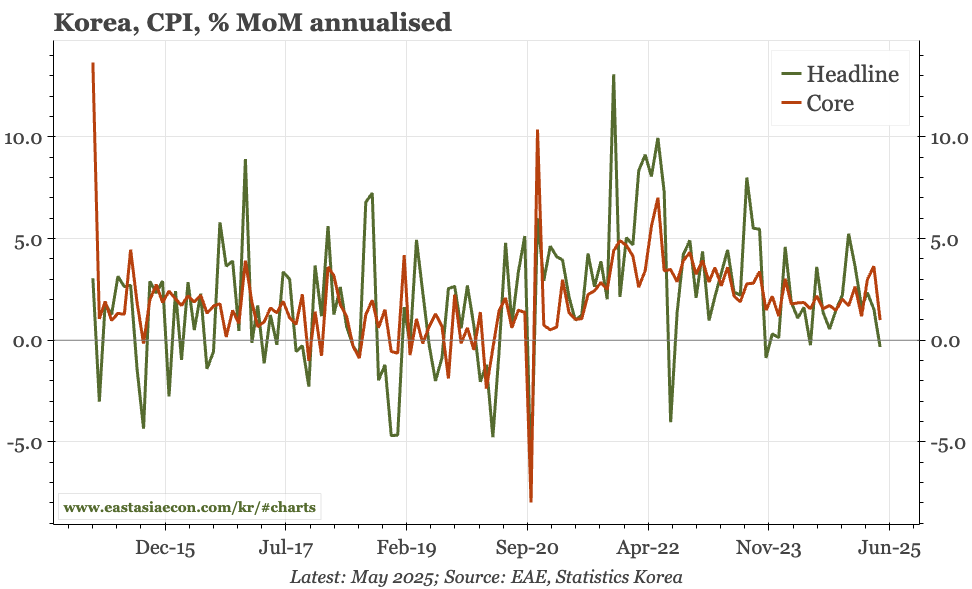

Korea – headline CPI ticks up, but should now fade

Leads suggest the mild rise in headline CPI in June should now fade. Core inflation is more stable, in part because services inflation remains on the high side. In next week's meeting, the BOK is unlikely to show much concern about that, with the focus instead being the rebound in property prices.

Korea – finally, export perk up

Today's full-month June export statistics show exports finally breaking out of the range of recent months. I wouldn't think that will continue. It is all because of semi, big exporters like Samsung, Kia and Hyundai haven't benefited from the recent Kospi rally, and exporter sentiment remains weak.

Korea – a change, even if it's not fundamental

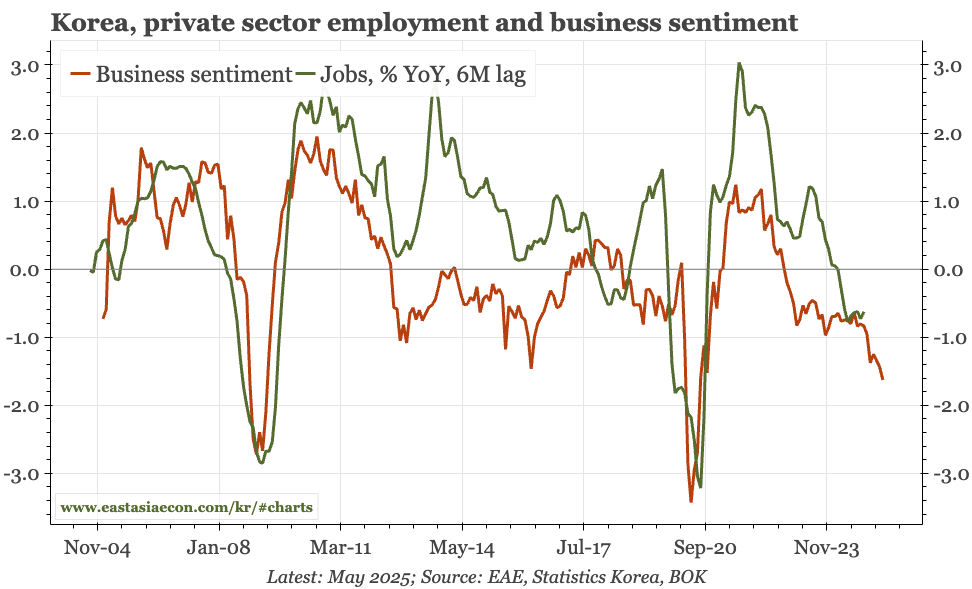

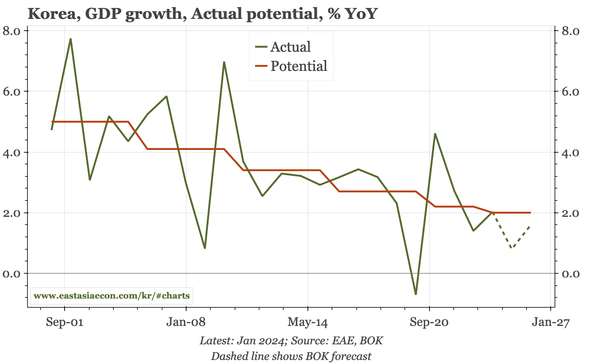

Inflation is likely declining, the labour market continues to weaken, and business confidence remains poor. So the fundamentals are weak. But consumer confidence, the DRAM price, Kopsi and house prices have all rebounded. The latter changes the BOK outlook. Further rate cuts will take longer.

Korea – employment and exports still sluggish

Today's labour market data show unemployment low but private sector employment weak. Business confidence should improve after the election, but other data released today for trade in the first 10 days of June show overall exports remaining lacklustre, even as semi exports start to pick up again.

Korea – core CPI lower in May

The important detail in today's CPI release for May was the drop in MoM core. Given the weakness of demand – now beginning to show up more clearly in the labour market – that moderation should persist. With global commodity prices weighing on headline, inflation should be less of an issue in 2H25.

Korea – rates down again

The BOK cut rates again to 2.5% on the back of further downgrades to the outlook for growth. That forecast makes further cuts likely, though remarks today suggest a sharpening of the debater within the MPC about the need to boost growth versus the risk of rate cuts just pushing up asset prices.

Korea – business sentiment still weak, BOK still cutting

Despite an improvement in consumer confidence, all-economy sentiment remained weak in May, dragged down by poor confidence in the corporate sector. However, inflation indicators are falling too. Everyone – it seems – expects the BOK to cut tomorrow, and that likely won't be the last in the cycle.

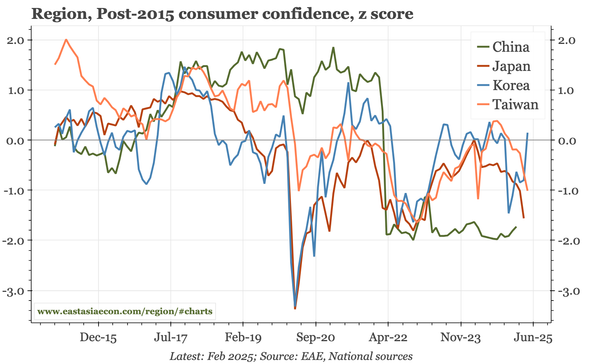

Region – at last, Korea bucks the trend

In Taiwan and Japan, rising inflation is eroding consumer confidence. In Korea, by contrast, less domestic uncertainty and lower inflation triggered a bounce in confidence in May. The differing inflation pictures offer a good illustration of why the BOK is cutting, while the BOJ and CBC are not.