Paul Cavey

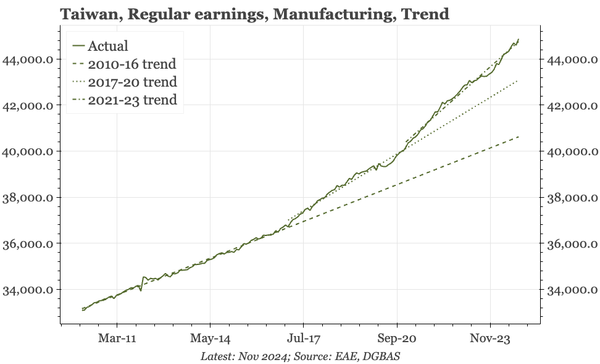

Taiwan – TSMC continuing to support the cycle

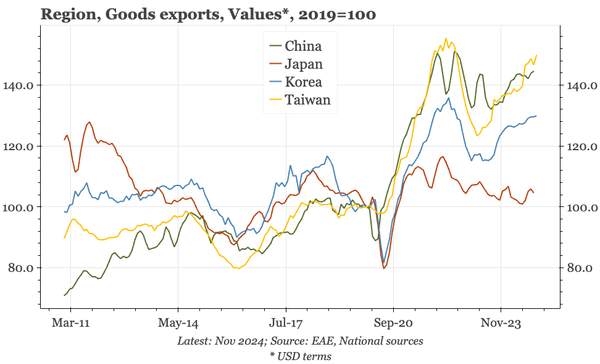

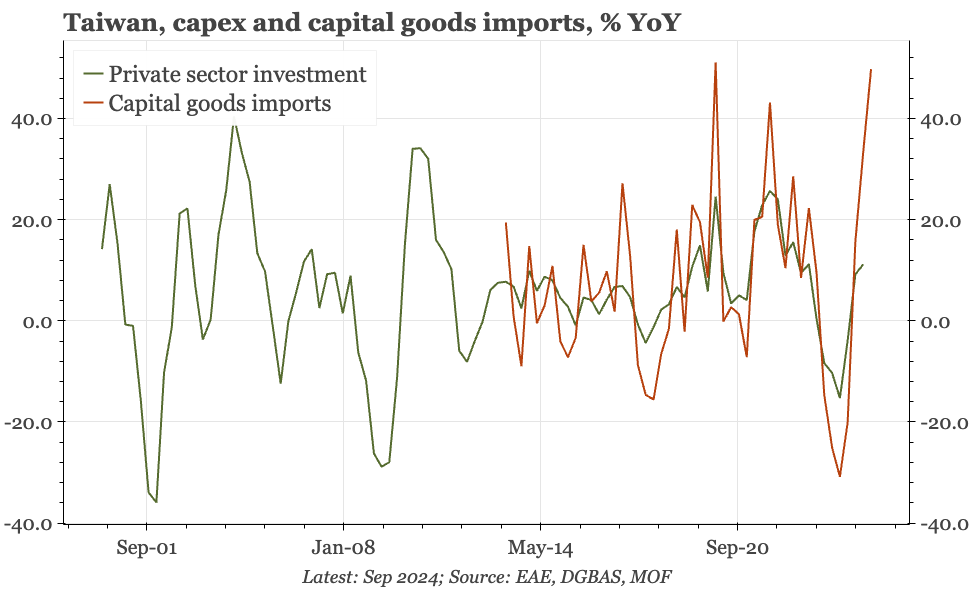

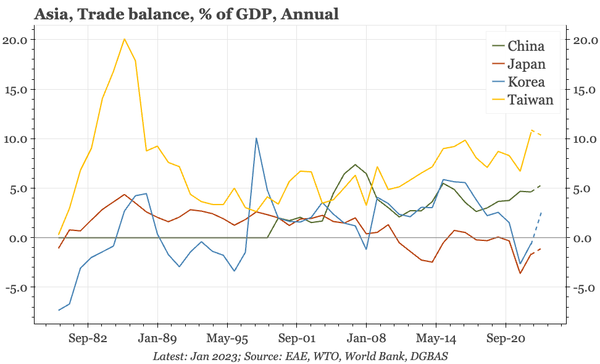

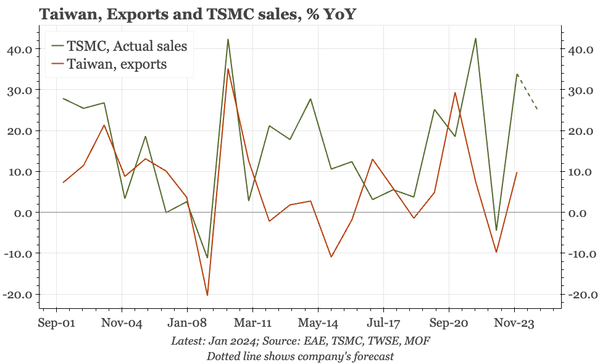

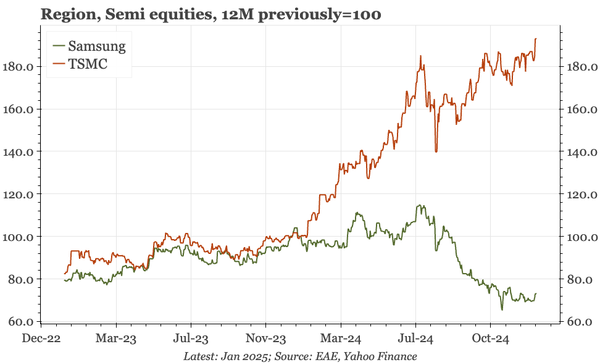

Already Taiwan's dominant firm, strong 2024 results mean TSMC has now doubled in size just since 2021. The firm remaining bullish for 2025 is this a reason to be optimistic about Taiwan's exports, but also to think the domestic cycle can warm up further. The contrast with Korea is huge.

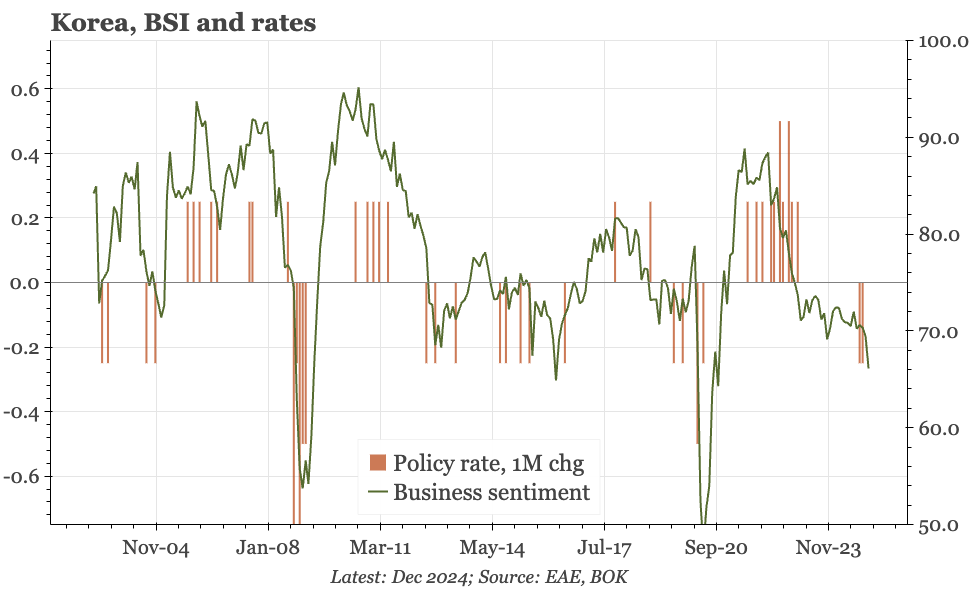

Korea – doveish hold

Contrary to my thinking, the bank didn't cut today. The reasoning – KRW weakness and political uncertainty – wasn't a shock. However, the tone of the meeting was very doveish, with the bank talking about "intensified" downside risks to growth. Korea really looks very different to Japan and Taiwan.

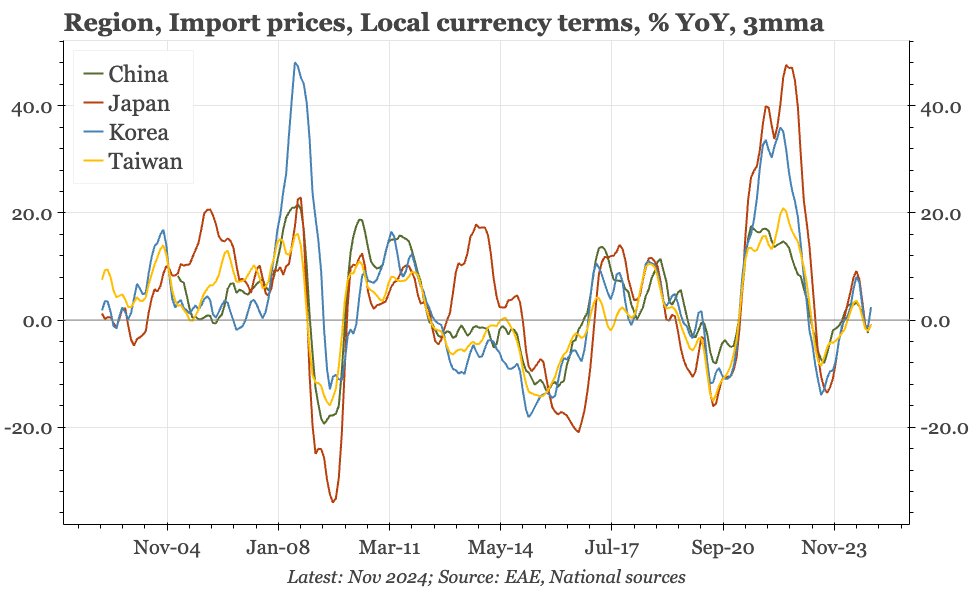

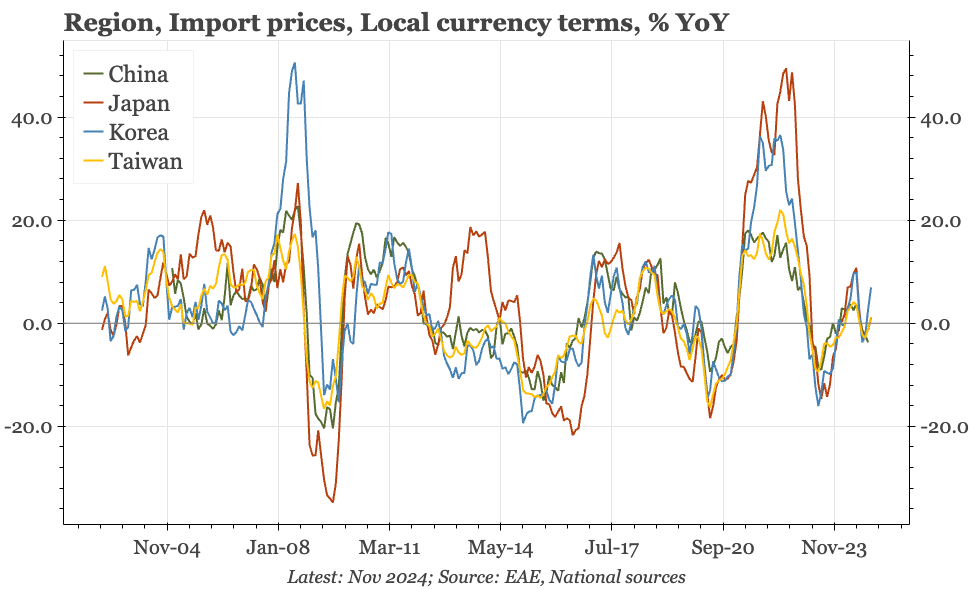

Region – modest rebound in import prices

The rebound in import prices is obviously bigger in Korea where the currency has weakened more. Even there, though, the 7% rise is modest compared with the double-digit increases in 2021-22. And the YoY comparison will be dampened in the next few months by the rise in import price inflation in 1H24.

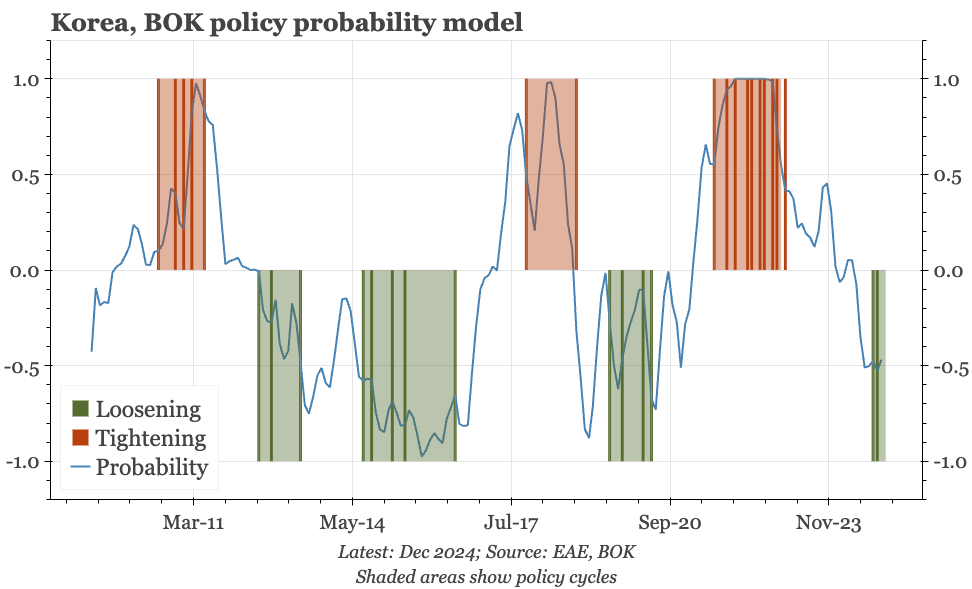

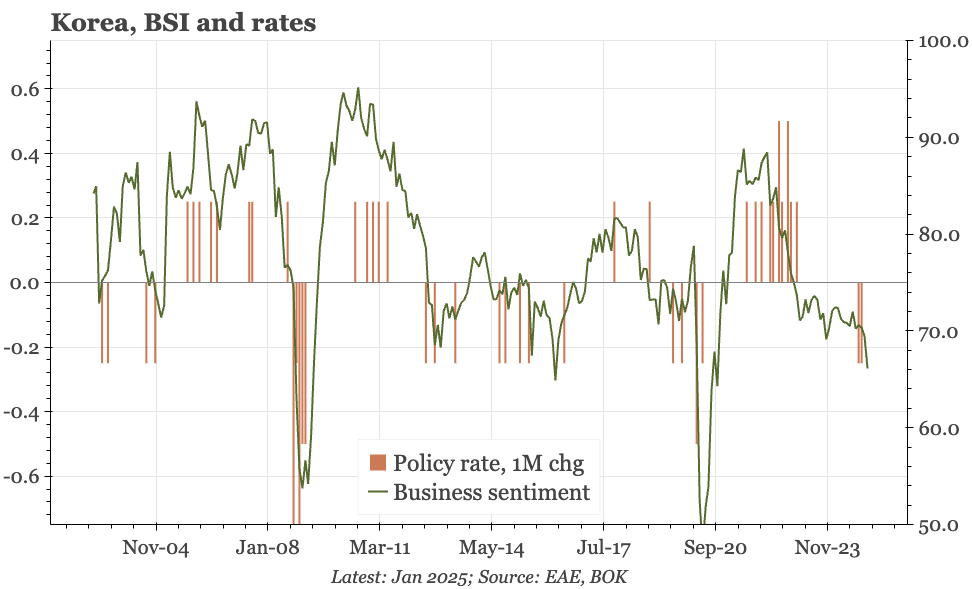

Korea – re-quantifying the BOK's reaction function

I've revised my model for the BOK's reaction function. That suggests the probability of loosening tomorrow is about the same as the Q4 meetings when rates were cut. Considerations for later in the year are yesterday's SLO survey warning of a rebound in housing, and firm services CPI.

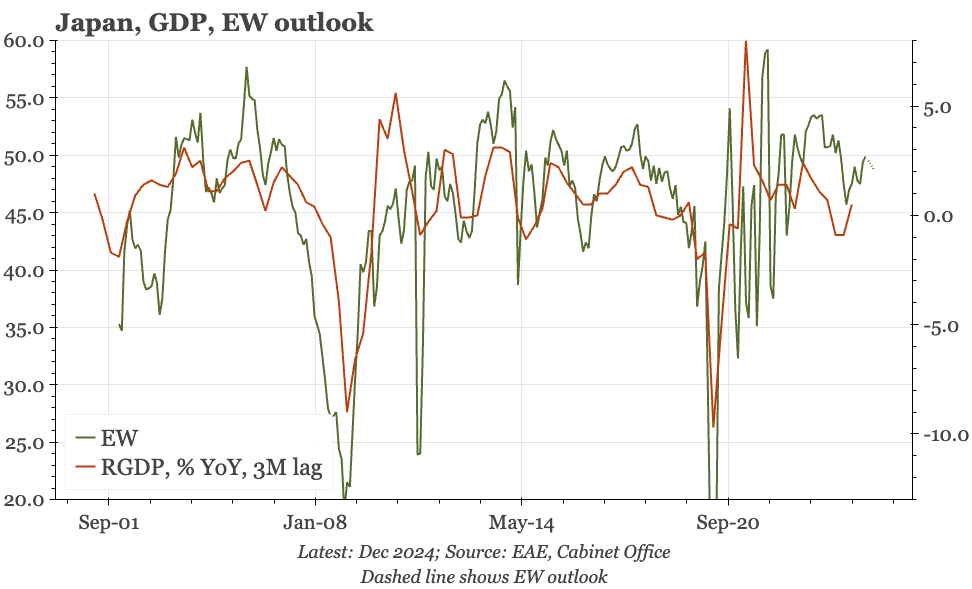

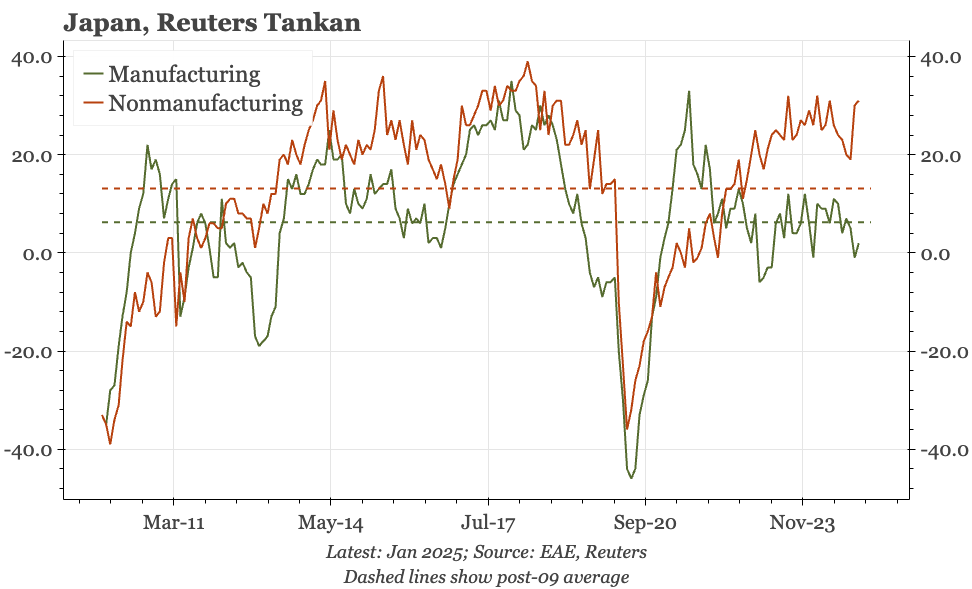

Japan – another firm Reuters Tankan

After a dip in 2H24, the non-manufacturing survey is now back to cycle highs. One retailer was quoted as saying: "With high domestic consumer confidence, the number of customer visits....is growing steadily". That's interesting: official surveys don't show consumer confidence is that strong.

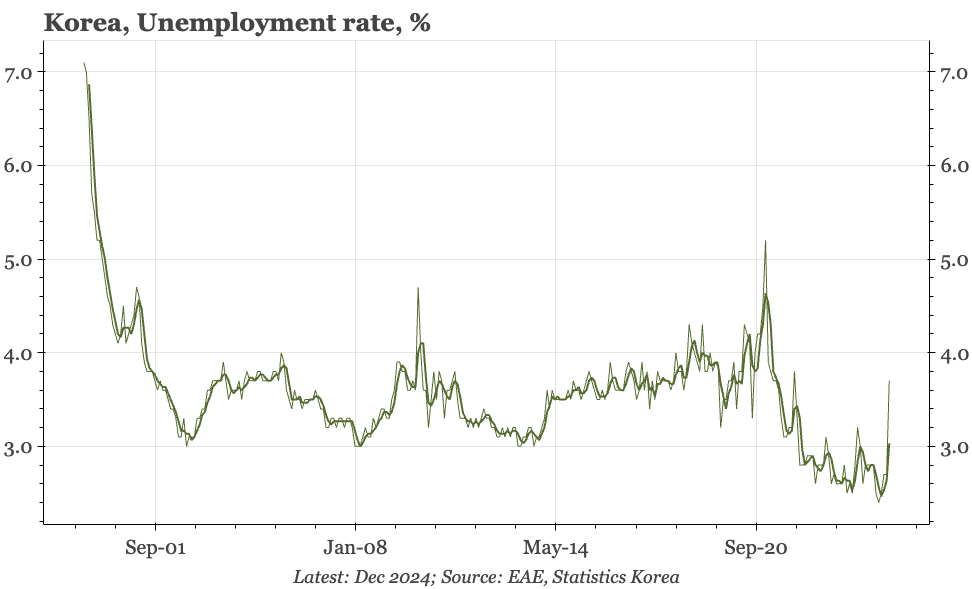

Korea – nasty employment data

December employment fell sharply, and while that can be explained by the ending of some government jobs projects, it fits with the sharper downturn in the cycle in Q424. That will likely be the focus for the BOK tomorrow, despite other data today showing KRW weakness pushing up import prices.

Japan – a step closer

Deputy governor Himino today downplayed the risks from the US that were the BOJ's focus in 2H24. He mentioned plenty of caveats too, not least being that speeches shouldn't be read as telegraphing any MPC outcome. But it feels like the BOJ is getting closer to hiking again.

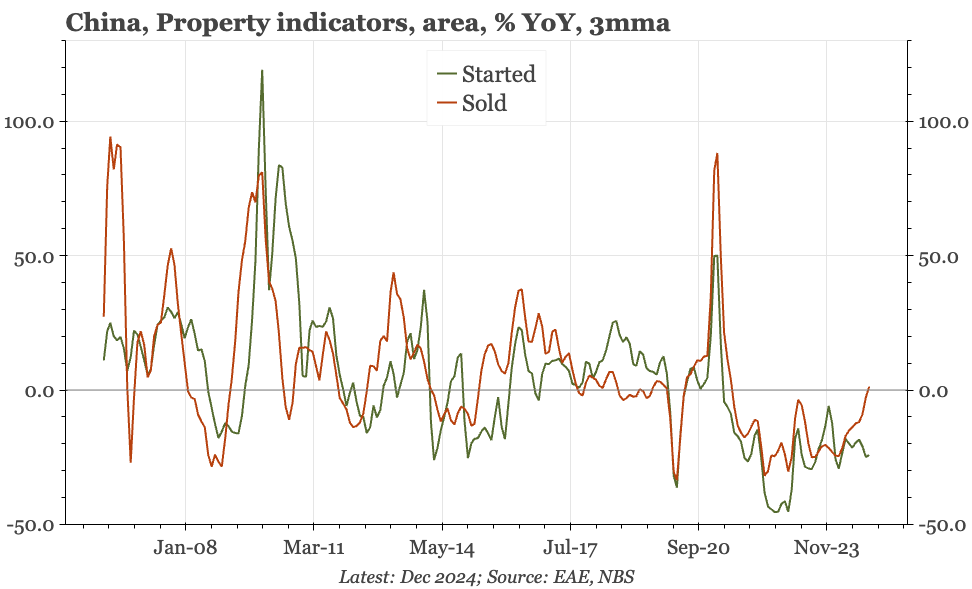

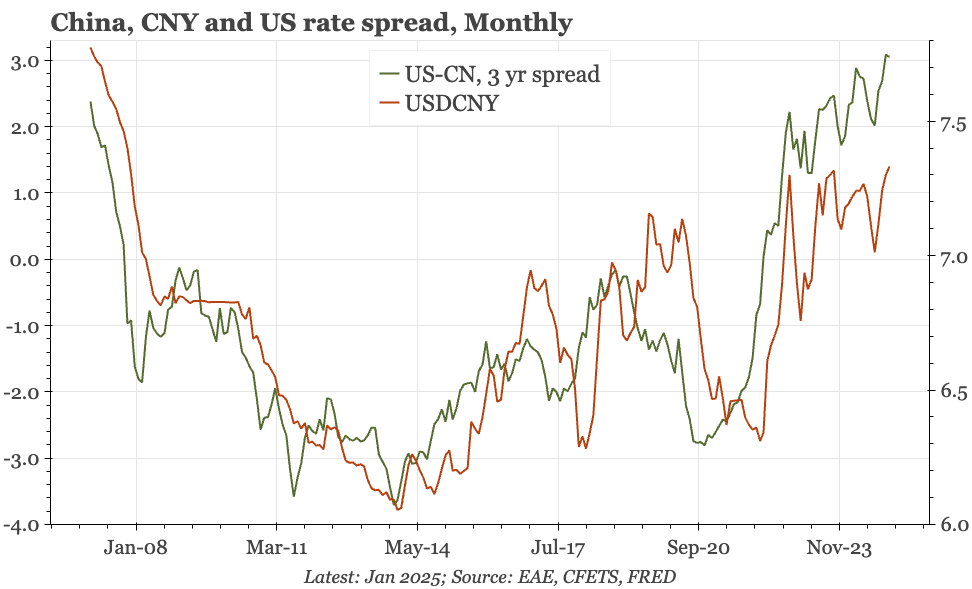

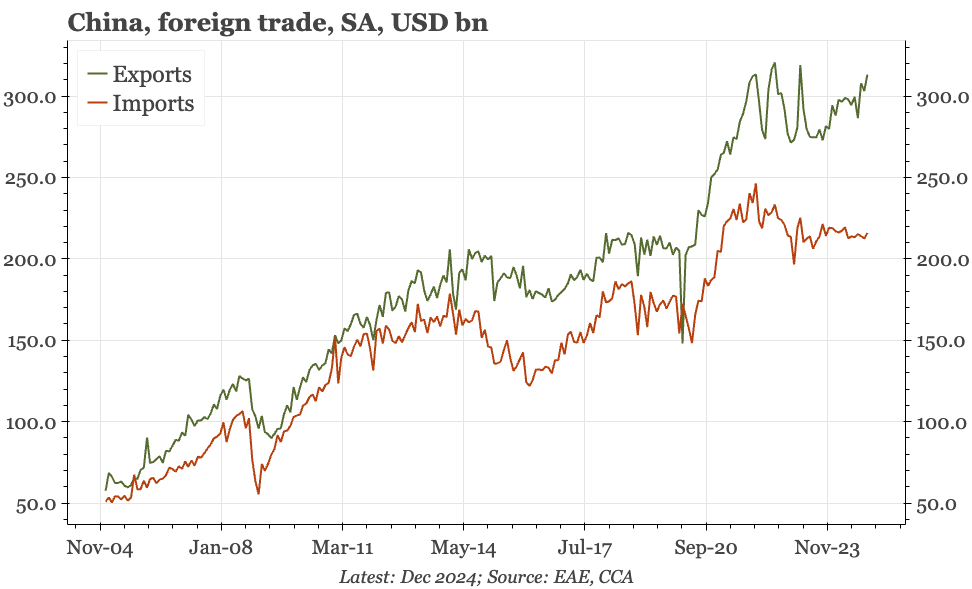

China – strong exports, surging surplus

China's exports rose strongly into year-end, while imports remained flat, sending the trade surplus surging. Maybe there's front-loading to beat Trump II tariffs, but it is notable how resilient China's exports have remained when the Trump I tariffs remain firmly in place.

Taiwan – peaking, but not yet slowing

Taiwan has the strongest cyclical picture in the region. It isn't gaining further momentum, so rate hikes aren't likely, but nor are cuts. The other big factor is Trump. He won't like either Taiwan's massive trade surplus, or its modest military spending.

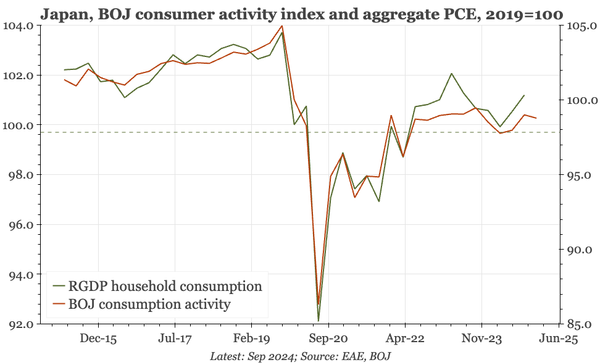

Japan – consumption still soft

Data today show consumption still weak. But I don't think this is critical. Ueda recently was talking about better spending, which is clear in per capita terms. The aggregate is held down by the falling population, but that decline is also behind the increasingly clear trend of wage growth.

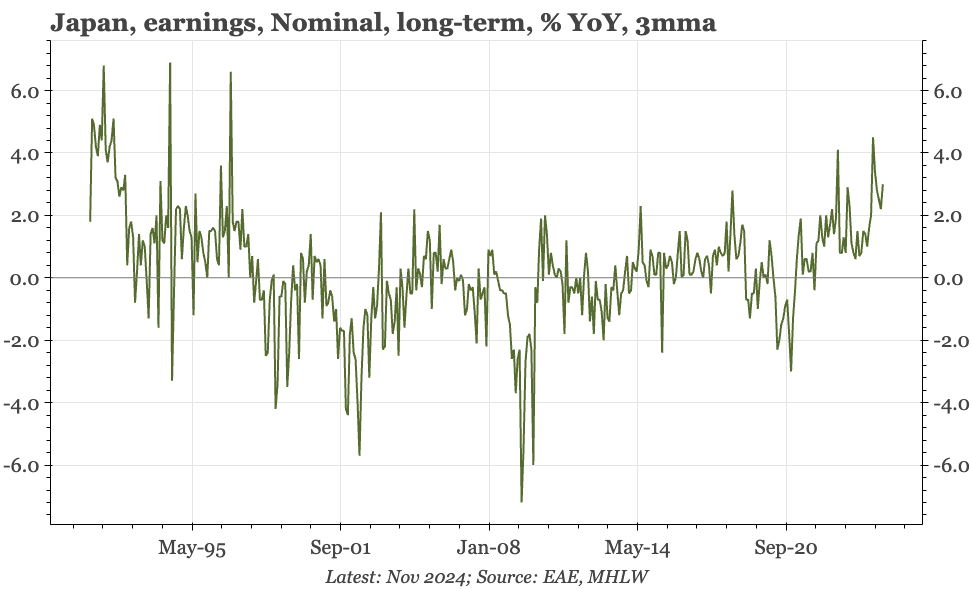

Japan – more incrementally positive wage indicators

Today's labour market indicators – official wage data for November, and the Q1 regional report from the BOJ – don't suggest that momentum is picking up sharply. But they do indicate that the labour market is tight, and wage growth continuing to trend up.

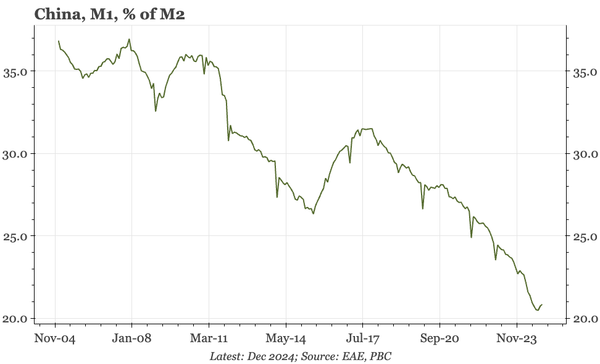

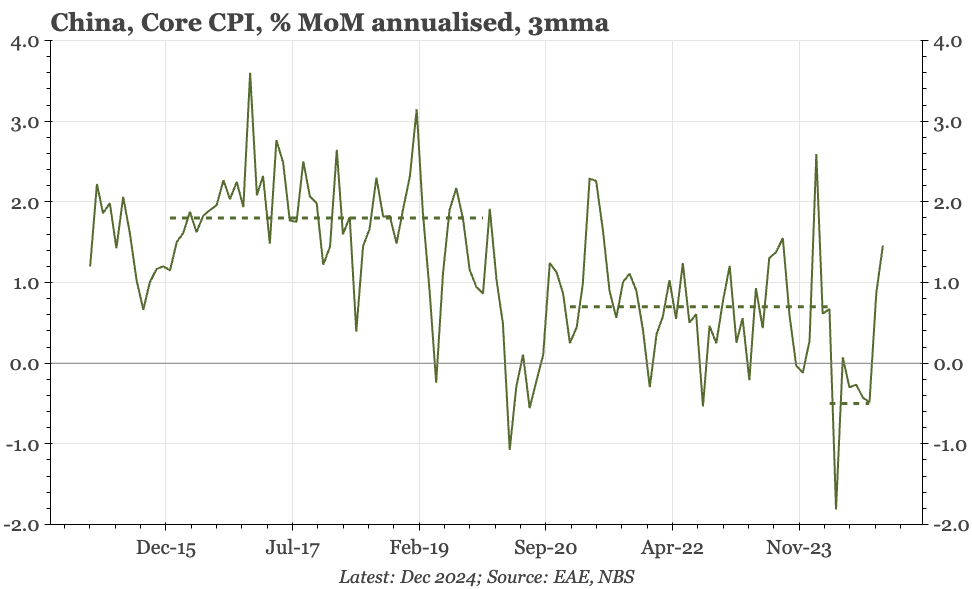

China – core CPI back to +1%

After being -ve for most of 2024, core CPI saar rose in Q4. That seems unlikely to sustain, given the 2024 policy boost is fading. However, that core has picked up is at odds with the consensus interpretation of today's data, while being in line with the relative stability of PMI output prices.

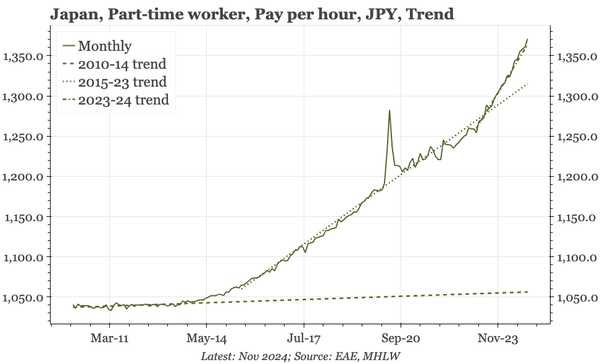

Japan – part-time wage strength

Base pay for full-time workers has plateaued at a bit below 3% since Q324. That loss of momentum isn't especially worrying: in 2023/24 there was a similar pause before real-acceleration. Part-time wage growth continues to trend up, reaching 4.7% YoY in November.

Region - Samsung v TSMC = Korea v Taiwan

There are other things that explain Korea's economic underperformance relative to Taiwan since 2020, with consumption being one of them. But the stumbles at Samsung are still particularly important, happening while TSMC goes from strength to strength.

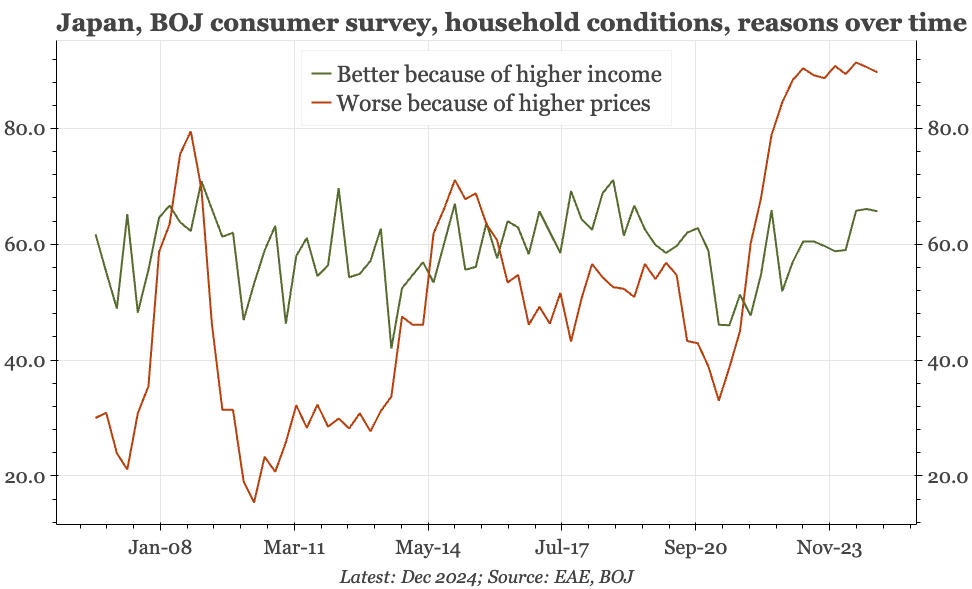

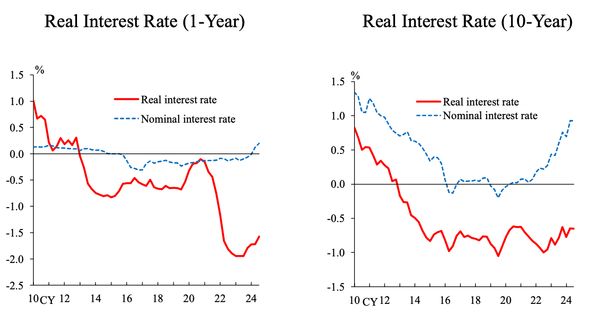

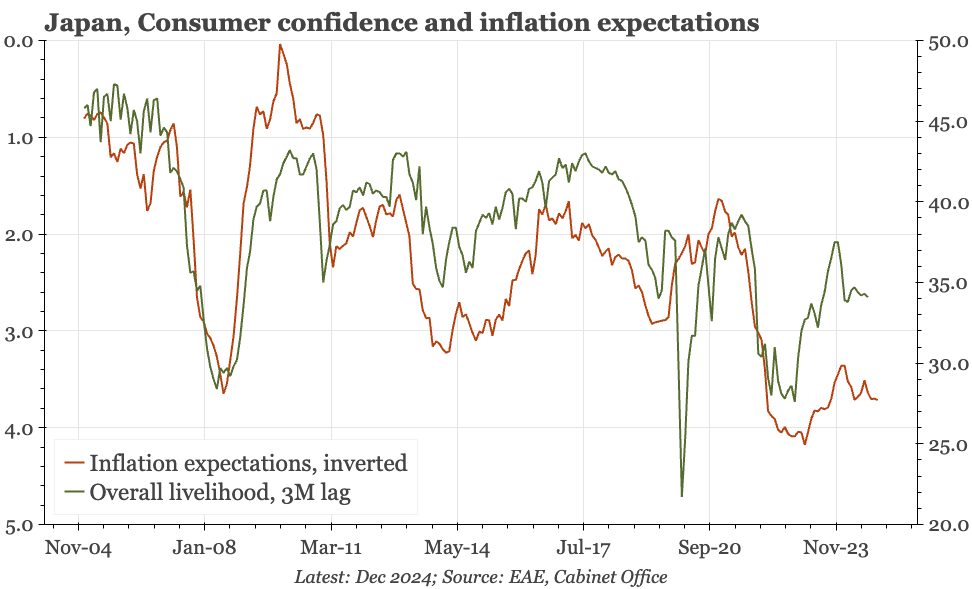

Japan – a hint of real reflation

Given the relationship is far from perfect, it would be wrong to read too much into this first chart. However, it is still notable that the rebound in consumer confidence hasn't relapsed despite the continued strength of inflation expectations. That at least gives a hint of substantive change.

Korea – another step lower

Recent data and the minutes of the November BOK meeting offer a good opportunity to look at Korea in light of the latest bout of political turmoil. The conclusion: a weak cycle is getting weaker, and so exchange rate depreciation is unlikely to stop the BOK cutting further.