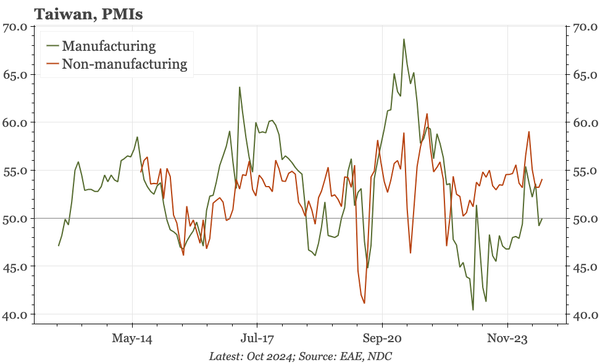

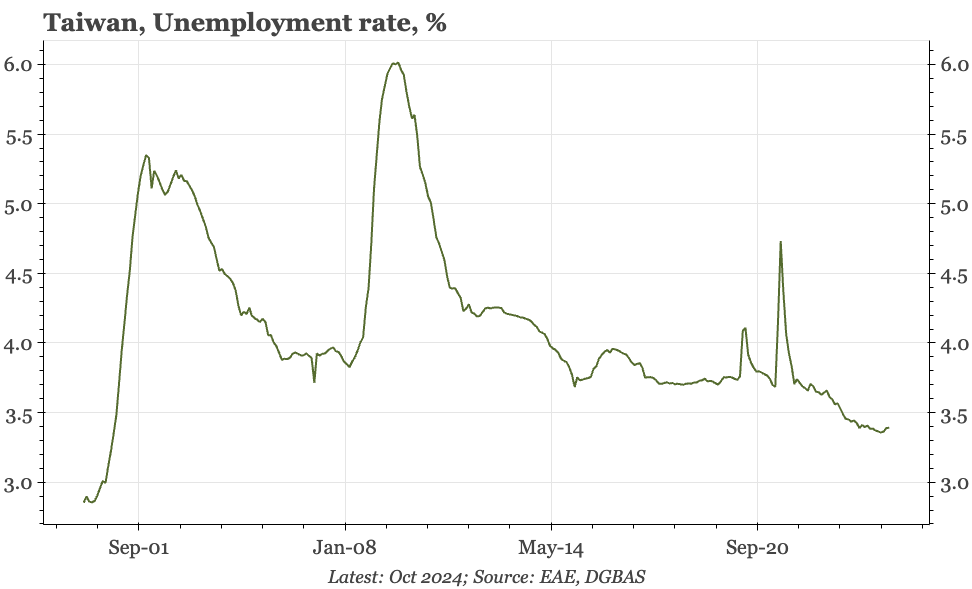

Taiwan – unemployment rate still low

It looks like labour market tightness has peaked, but the change isn't big enough yet to impact monetary policy. After ticking up in September, the unemployment rate was stable at 3.4% in October. That keeps it at a level not seen since the early 2000s.