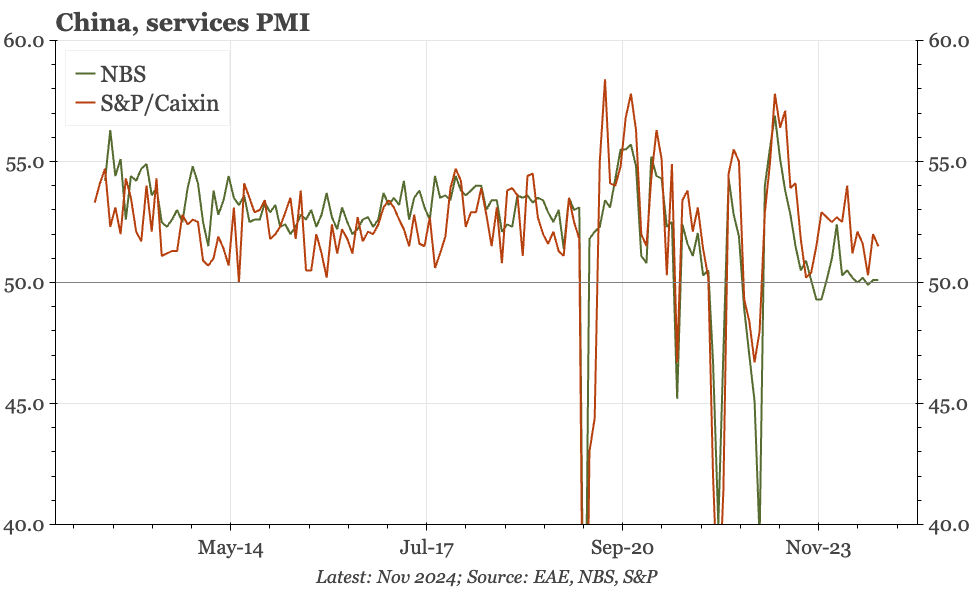

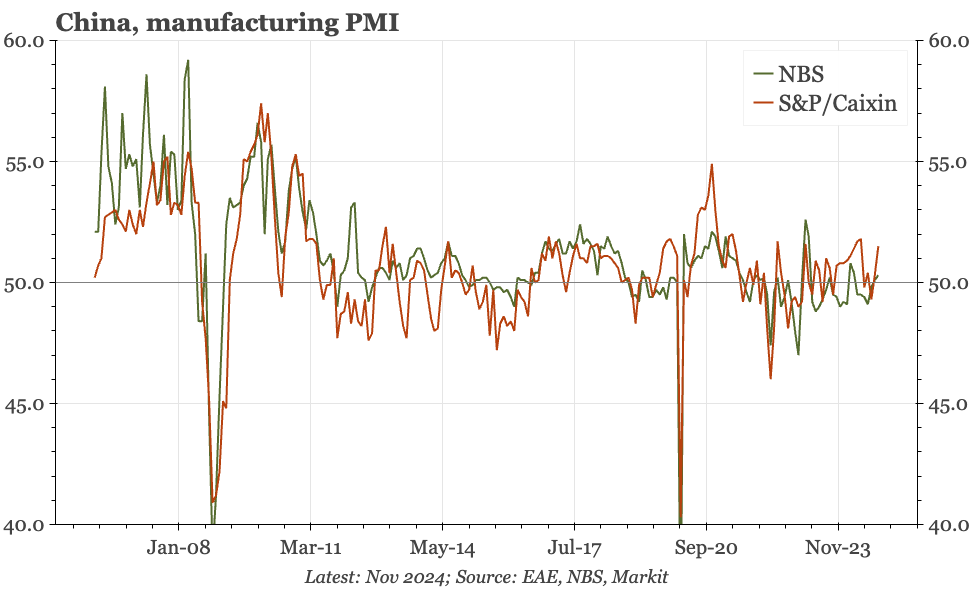

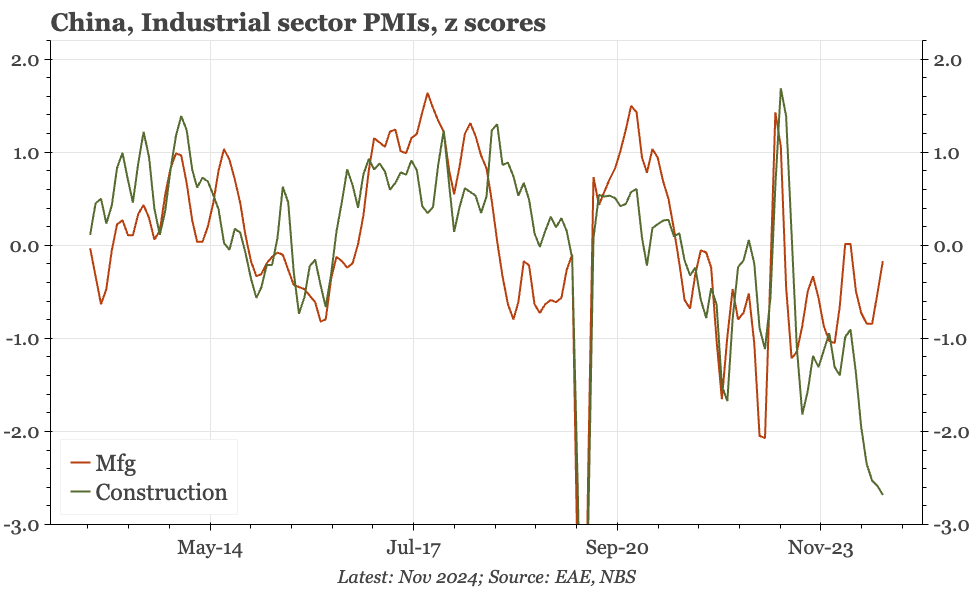

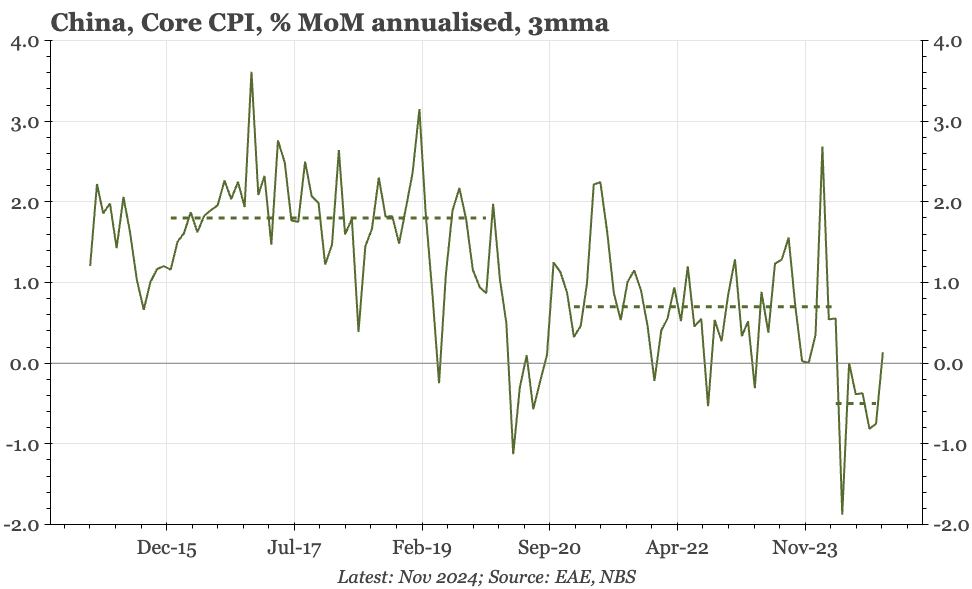

China – CPI details a bit better than headlines

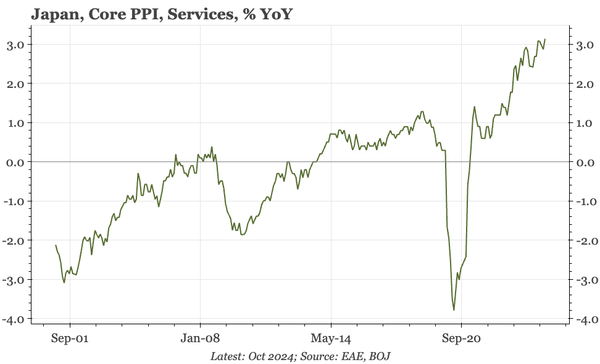

After falling for most of the year, core CPI rose MoM in November. However, the impact on overall CPI was offset by a renewed softening of food prices, and PPI also remained in deflation. PPI will likely strengthen a bit more from here, but overall, deflation is still the bigger risk than inflation.