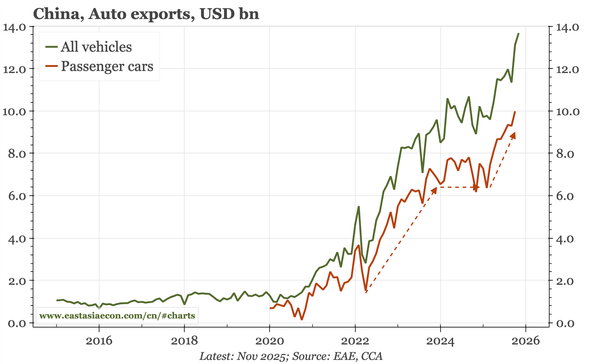

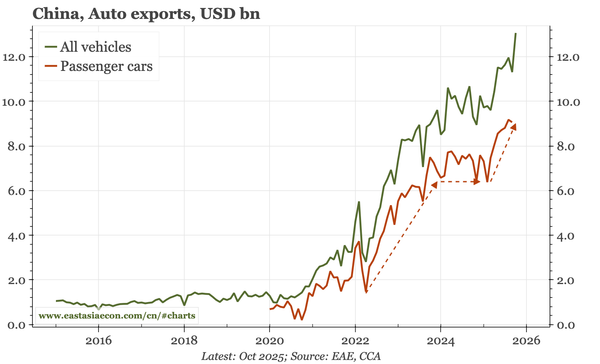

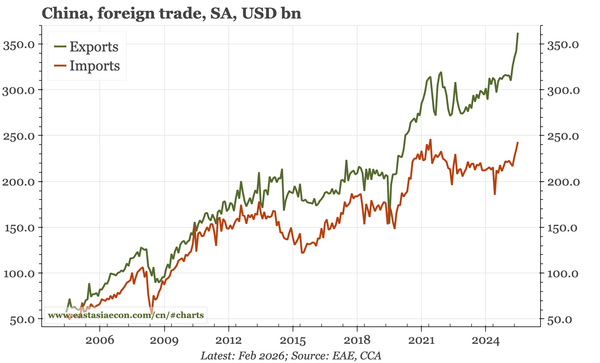

China – semiconductors lift exports

Exports in YoY and SA terms were strong in Jan-Feb. That looks too good to be true, and I'd expect new year distortions won't totally disappear until March. Still, one trend that looks real is the rise in chip exports, as China benefits from the same semi super cycle lifting the rest of the region.