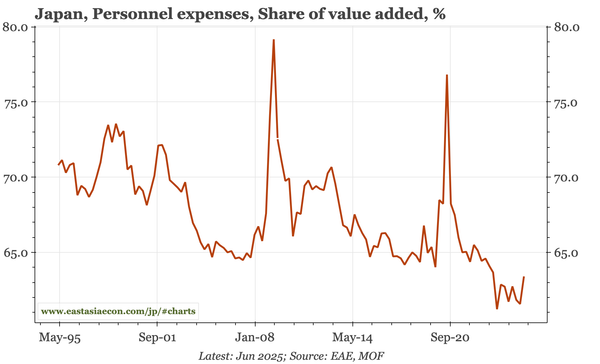

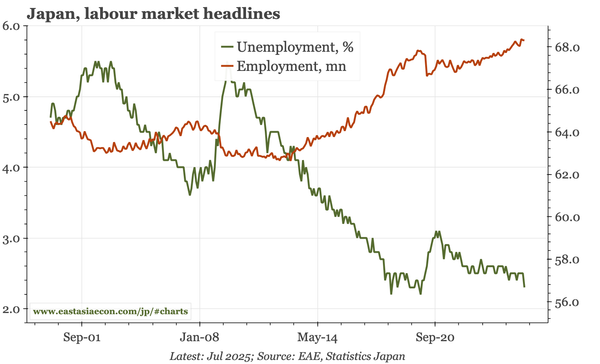

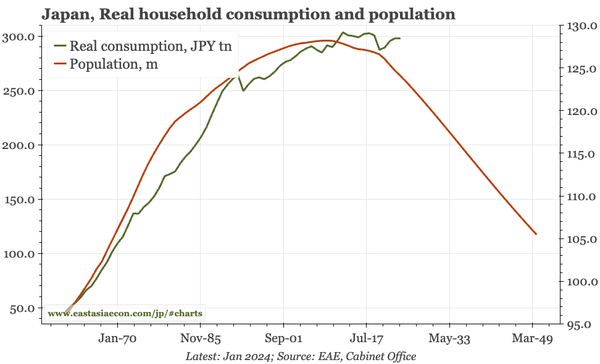

Japan – will consumption ever grow again?

My latest video, discussing the important question posed in a report of a few weeks ago. Japan's population peaked in 2010, and aggregate consumption stopped growing shortly after. With the number of people continuing to shrink, can consumption – and thus the broader economy – ever grow again?