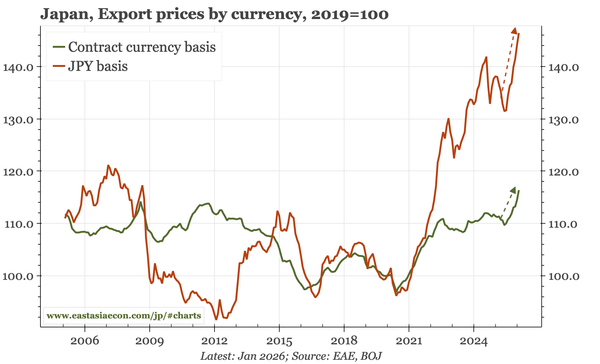

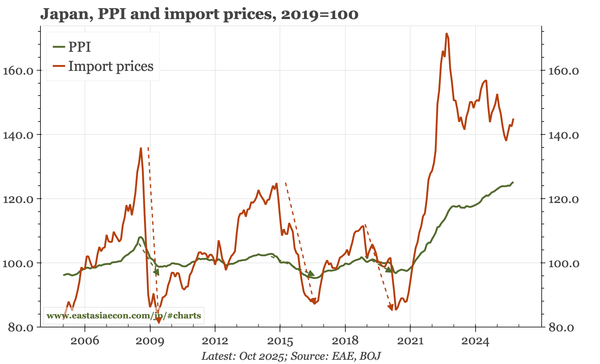

Japan – import prices up, but export prices up more

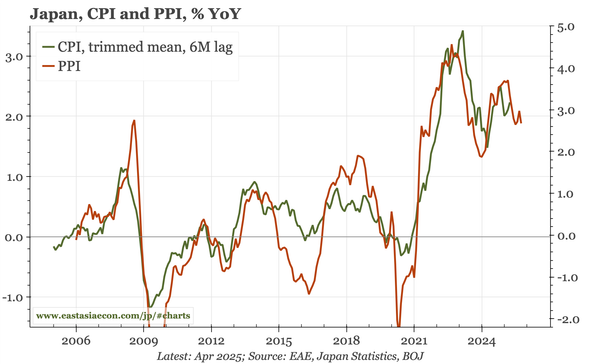

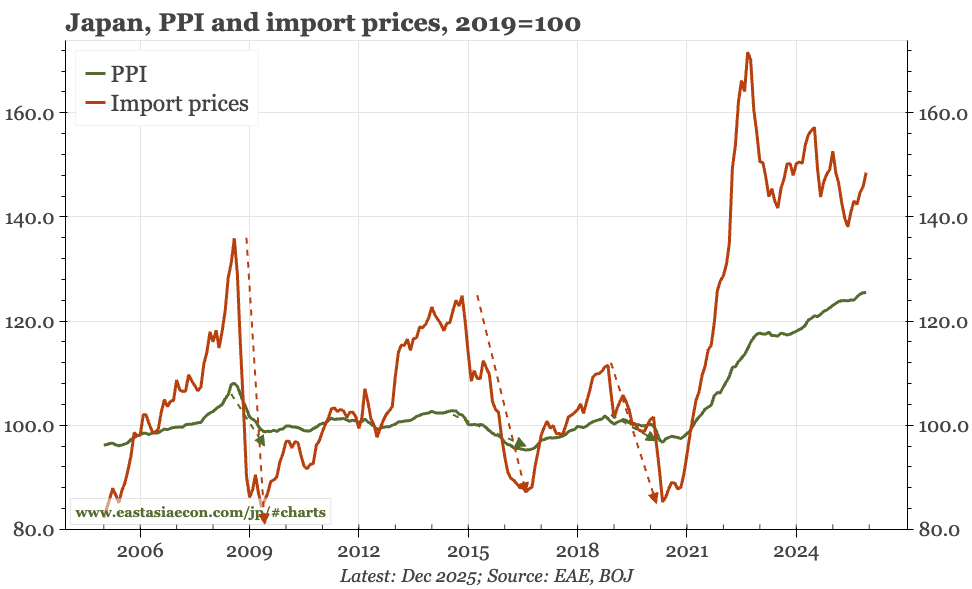

Import prices aren't rising quickly, but they do remain elevated, supporting PPI in a way that wasn't true during Japan's long deflation. More interesting now is the strength of export prices, a dynamic that boosts exporter profits, and via the terms of trade, provides a tailwind for domestic income

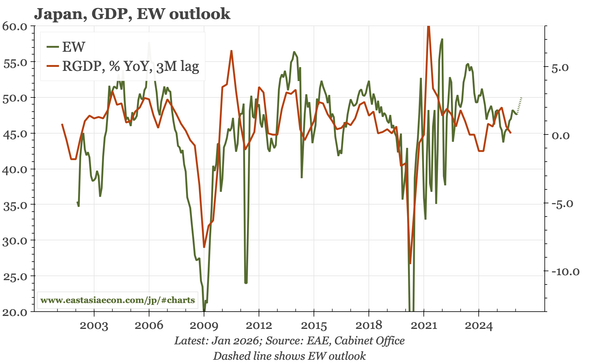

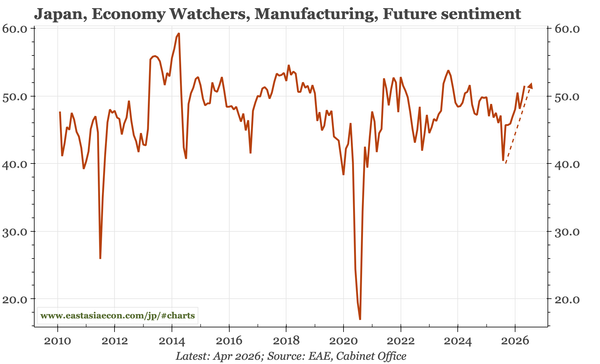

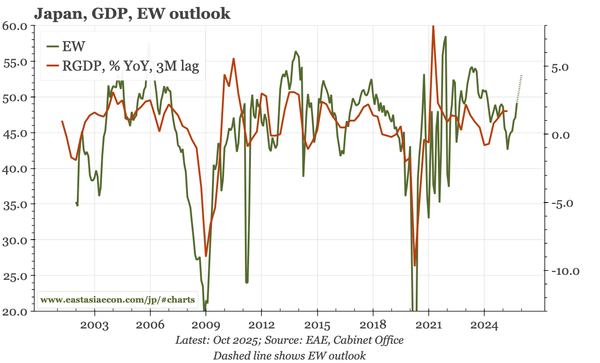

Japan – cycle still strengthening

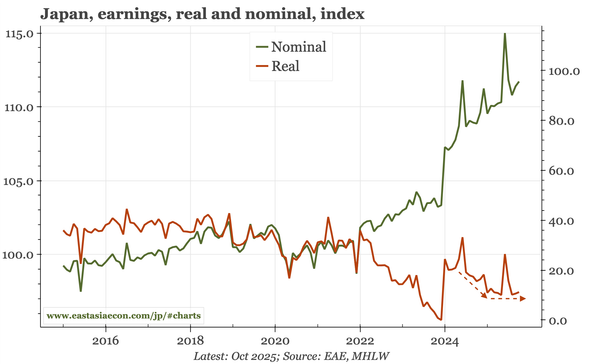

Takaichi's huge win comes when the cycle is looking stronger, with real wages close to rising, manufacturing sentiment improving and bank lending strong. This should give the BOJ confidence, and, with the current account surplus in 2025 reaching the highest level in forty years, also help the JPY.

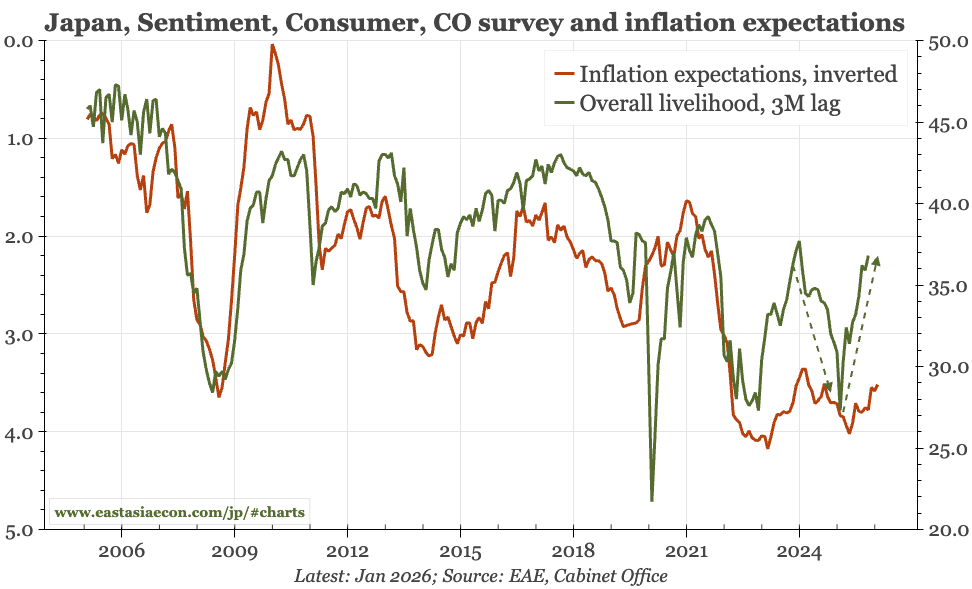

Japan – falling inflation = higher consumption?

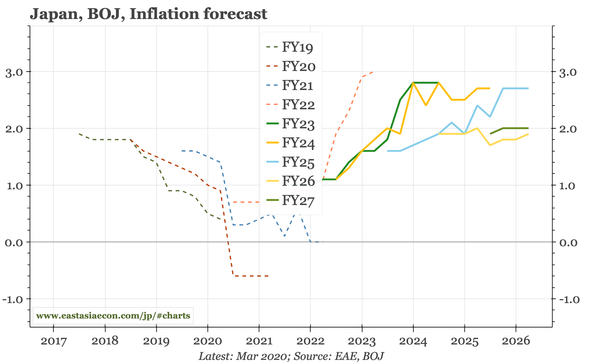

With policy efforts reducing headline inflation, the bullish case for Japan is once again a rise in real wages that pushes up consumer spending and aggregate demand. The consumer confidence survey points to just that scenario, but it isn't in the hard data yet, with December retail sales still soft.

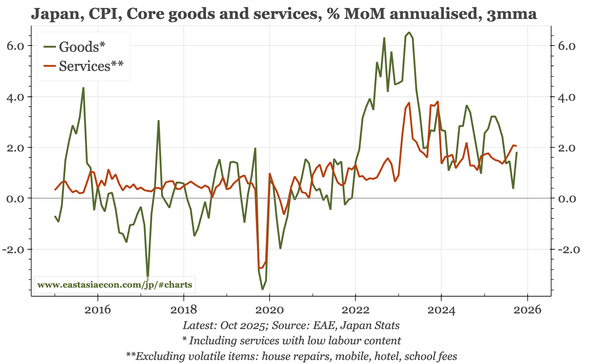

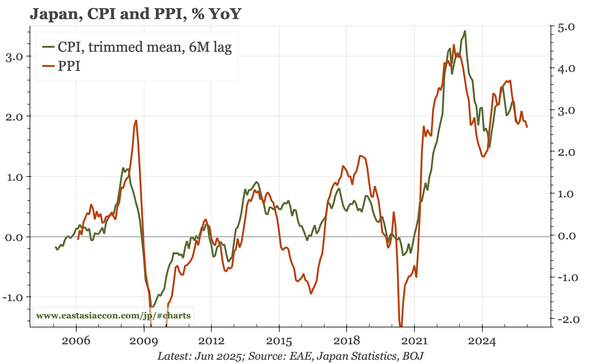

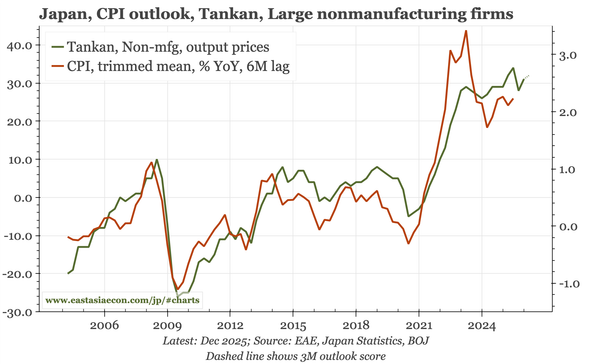

Japan – easing inflationary pressure

Some of the slowdown in services PPI inflation is due to lower goods price inflation, but the combined result points to softer downstream inflation. SPPI inflation in high labour-intensive sectors is still over 3% YoY, but the recent MoM run-rate of under 2% is too low for the BOJ's inflation target

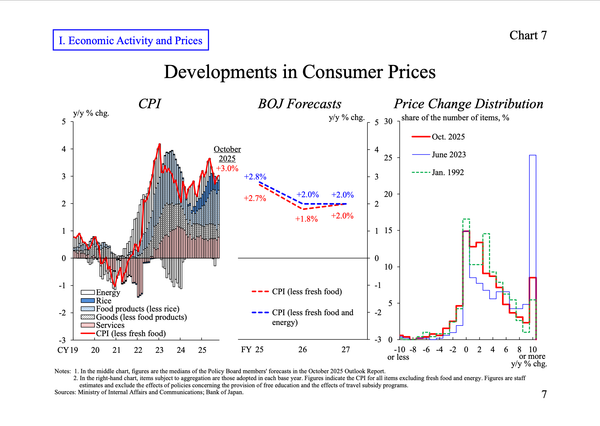

Japan – JPY matters more for CPI

The BOJ's full outlook report that was released today includes analysis arguing that the pass-through from JPY to CPI has risen, reflecting not only greater direct effects, "but also stronger secondary spillover effects, such as more active wage- and price-setting behavior of firms"

Japan – Takaichi stresses fiscal responsibility

At its meeting today, the BOJ was again more positive on the outlook, but only incrementally. However, the authorities overall have been trying to put a lid on market volatility, perhaps via intervention, but also an interview by Takaichi. Data, meanwhile, show the economy still has good momentum.

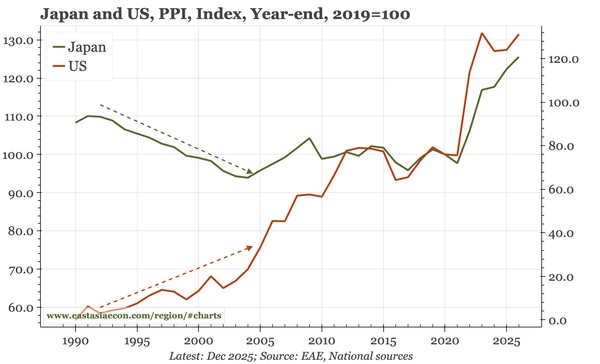

Japan – PPI still firm

Japan's current run of PPI inflation is almost the longest since at least the 1980s, but looks well-supported. Prices have recoupled with the global cycle, and are being boosted by JPY weakness. Furthermore, while it was feared that tariffs would be deflationary, export prices are rising.

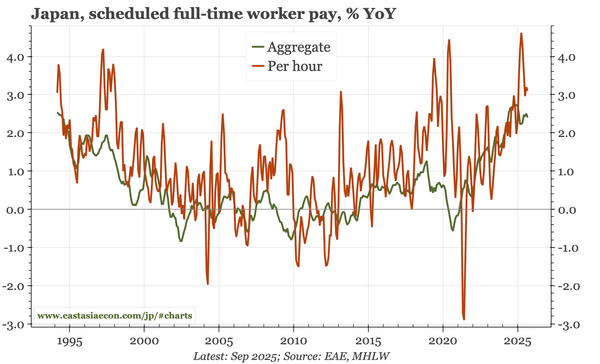

Japan – wage data mixed, but sentiment firm

The BOJ's quarterly regional sakura report shows conditions holding up, and the dip in consumer confidence in December isn't concerning given the post-March bounce. Wage growth in November was mixed, but can be expected to rebound in December on stronger bonuses.

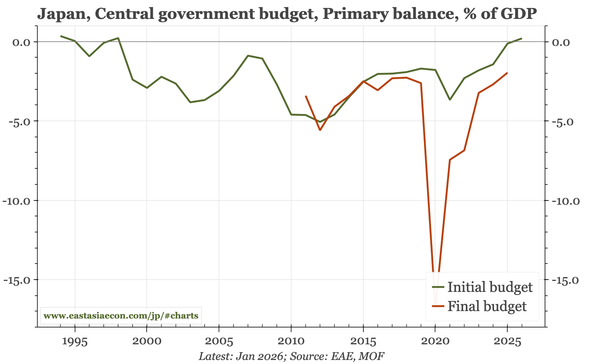

Japan – a big budget...but also a budget surplus

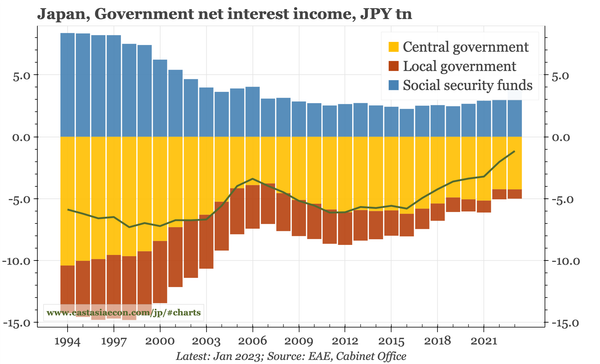

Headlines that the FY2026 budget is the biggest ever suit the idea of Takaichi as an Abe-style loosener. However, government expenditure is stable relative to GDP, revenue is rising more, a primary surplus is planned, and though Q125, the government received more in interest than it paid out.

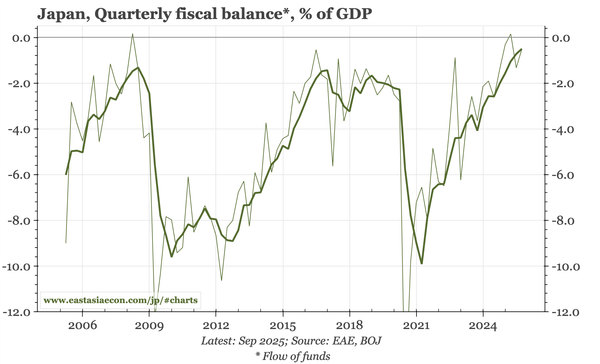

Japan – strong cycle and savings

Data releases the last couple of days give more evidence that tariffs haven't derailed exports or capex. Even so, the flow of funds for Q3 show corporates remain net savers. With the fiscal deficit now also now narrowing to the lowest level since the 1990s, the result is a growing CA surplus.

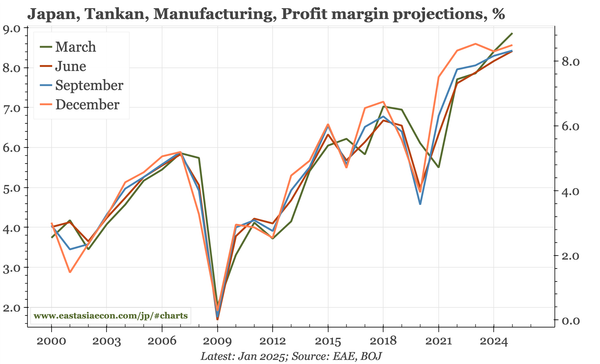

Japan – strong Tankan details

The BOJ has been concerned that tariffs would reduce profits, cutting into wages and capex. The Tankan shows no evidence of that: profit and investment expectations remain firm, as do inflation expectations, with the backdrop being a labour market that is tight for all industries.

Japan – a strong Tankan

In Q4 business sentiment improved, the labour market tightened, price pressures picked up, and capex intentions stayed elevated. The BOJ is set to hike on Friday. Today's survey, like other recent data, raise the risk that the bank can also send a clearer message about the outlook for rates in 2026.

Japan – overcoming fiscal fear

The supplementary budget looks big, but this year's fiscal deficit is still budgeted to narrow. Gross debt is high, but the government's net liabilities have fallen. Interest rates have risen, but before Takaichi took office, net annual interest payments by the government had fallen to near zero.

Japan – real wages stop falling

A few releases today – October wages and CA, November Economy Watchers survey, and Q3 revised GDP. The overall picture is mixed, though the acceleration in inflation and drop in real wages into early 2025 has now stabilised, and that is allowing an improvement in household sentiment.

Japan – Ueda becomes constructive again

The tone of governor Ueda's speech today suggests a rate hike is close. He claims that risks to the US are receding, identifies five recent positive wage developments, and with firms' price and wage behaviour changing, argues that exchange rate changes are more likely to affect prices.

Japan – SPPI inflation soft in October

Headline SPPI inflation was stable in October, but weak for high labour-intensive sectors, while part-time wages were strong, likely on the back of the minimum wage hike. That's an unclear picture. But right now, with the JPY so weak, the BOJ will focus more on headline CPI than these messy details.

Japan – PPI still rising

The gap between import prices and PPI in the October data illustrates the sort of pent-up inflationary pressure in Japan that is likely to be exposed if the JPY remains so weak. Today's data also show a decent rise in auto export prices, but to a level that is still 6% below the pre-tariff level.

Japan – EW survey lifts strongly

The sharp recovery in sentiment in the EW survey continued in October. The improvement is broad-based, affecting both corporates and households. That shows a lessening of the tariff and inflation shocks of 1H25, and should be reflected in the BOJ becoming more optimistic about the outlook.

Japan – Board thinks the time for another hike is getting closer

The summary of the October BOJ meeting show a stronger consensus that the time is approaching for another rate hike. That is partly because concern about tariffs is fading. It is less about domestic demand: data today show consumption trending up, but still only very slowly.

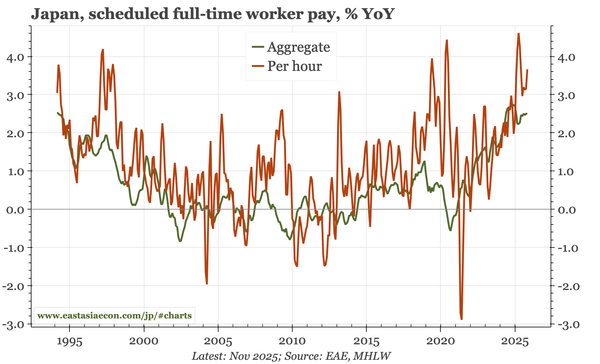

Japan – soft headline wages, details a bit better

Wage growth was softer in September. The continued slowdown in part-time wages per hour will be a bigger concern if it persists beyond the October rise in the minimum wage. Per hour full-time wage growth is stronger than the headline, though the data are noisy.