Korea – inflation still stable

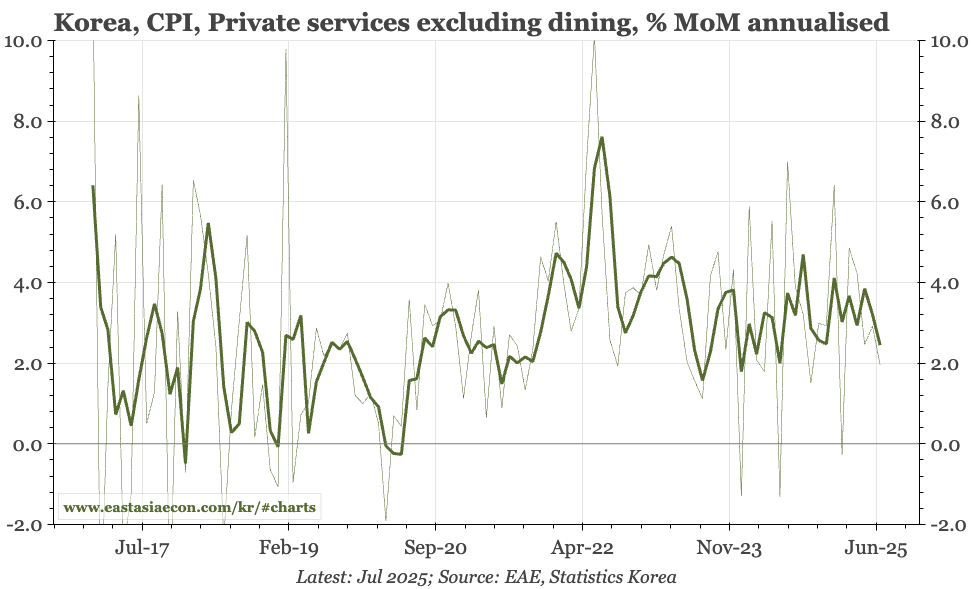

The BOK hasn't sounded concerned about inflation for a while, and the July CPI data is unlikely to change that, with headline and core remaining close to 2%. Food prices will rise in August following the recent bad weather, but energy prices should fall. Core is also now starting to look softer.