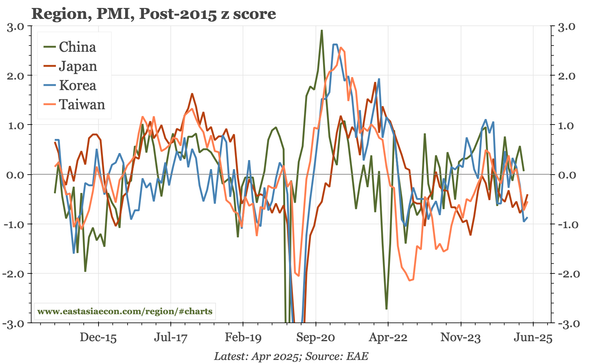

China – two unusual features of the export transition

Given regional history, China's transition to exporting more capital goods shouldn't be unexpected. More unusual is that 1) this transition hasn't been accompanied by slower overall export growth, and 2) has occurred at the same time as a sharp slowing of imports. Chart pack attached.