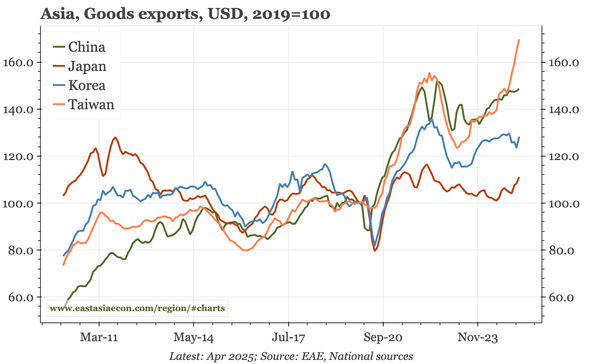

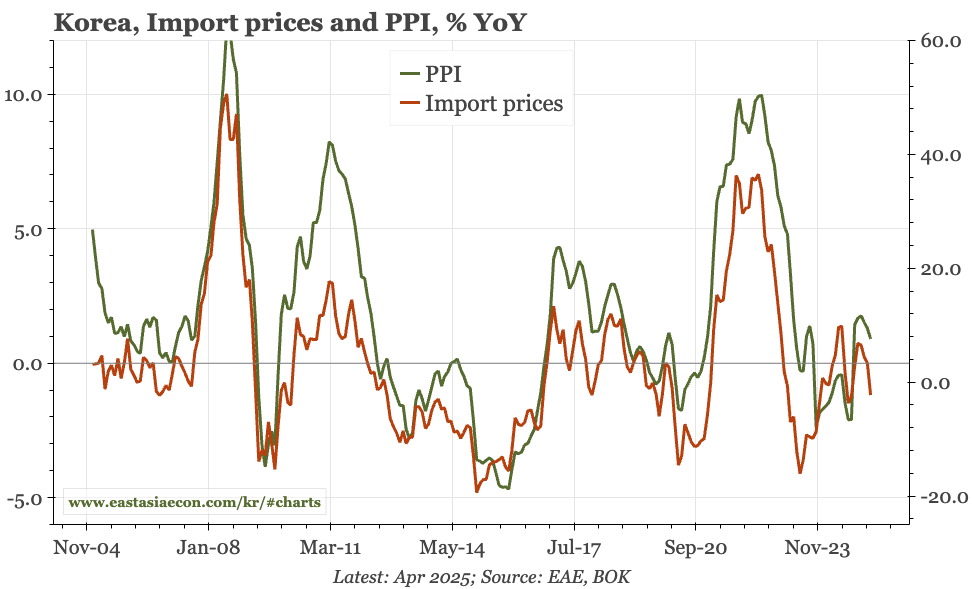

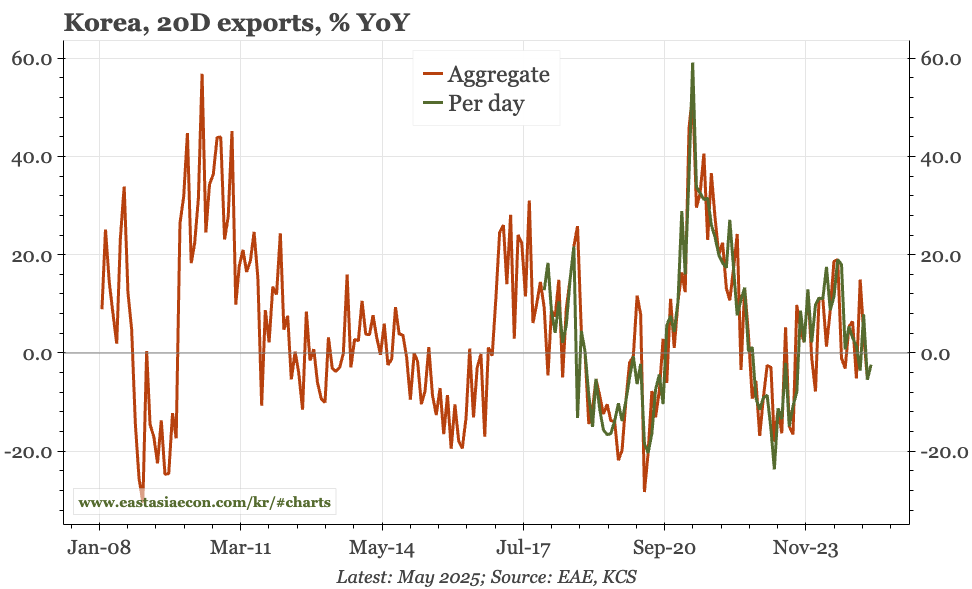

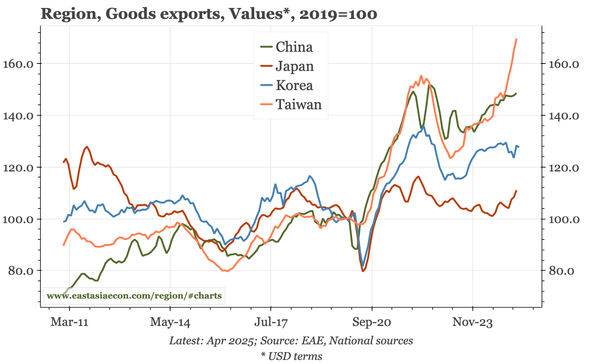

Korea – exports still underperforming

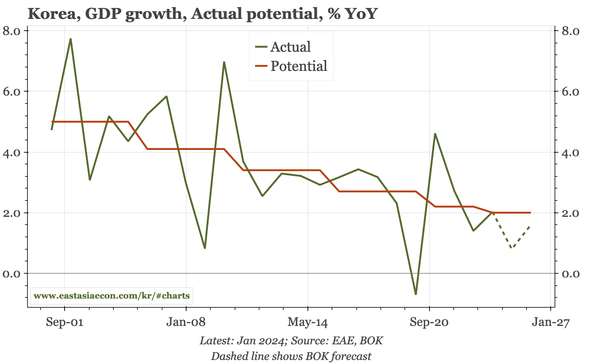

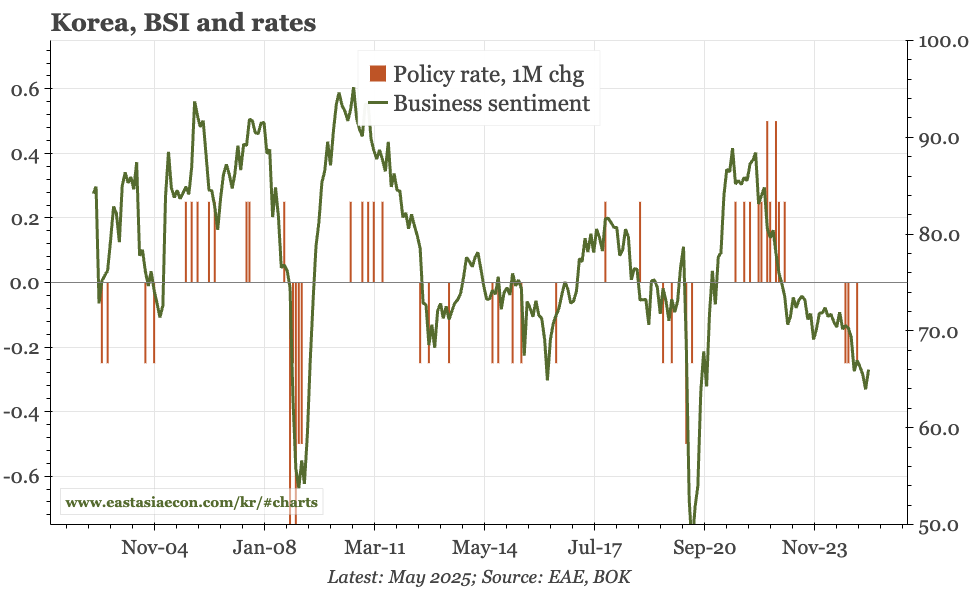

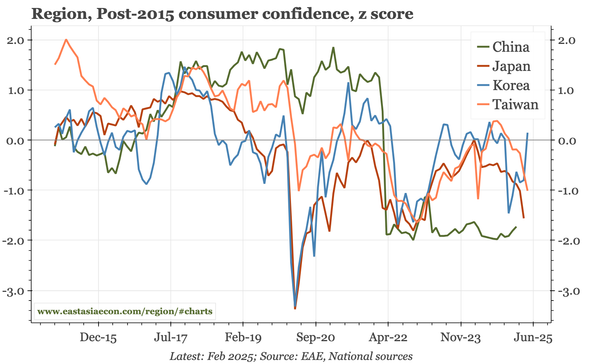

Even with a rebound in semi exports, overall Korean exports continue to go sideways. As a result, the underperformance relative to the rest of the region of the last 6M continues. This presidential election won't affect that, though it should bring stronger fiscal policy, boosting domestic demand.