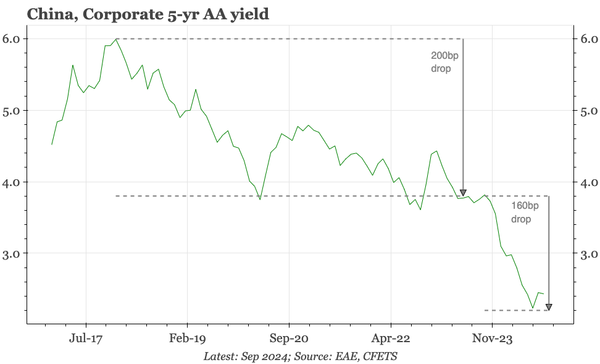

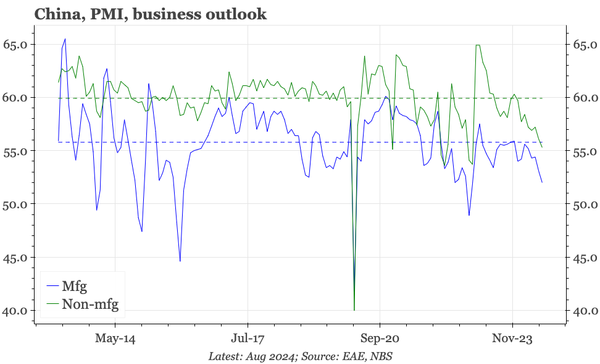

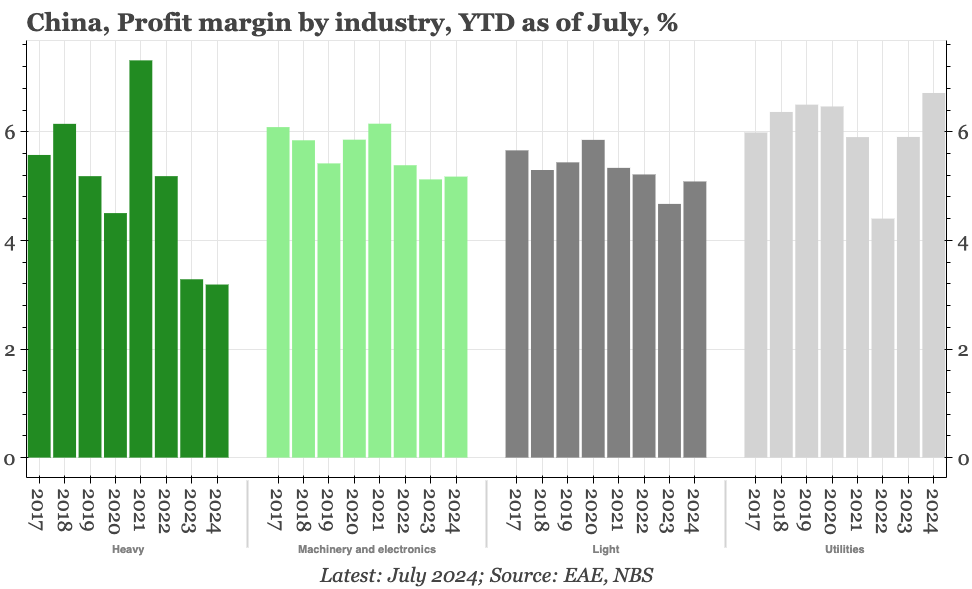

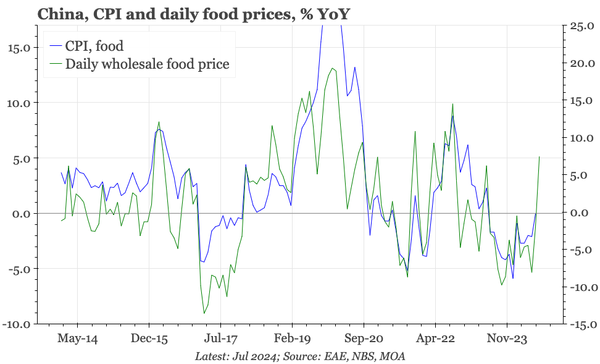

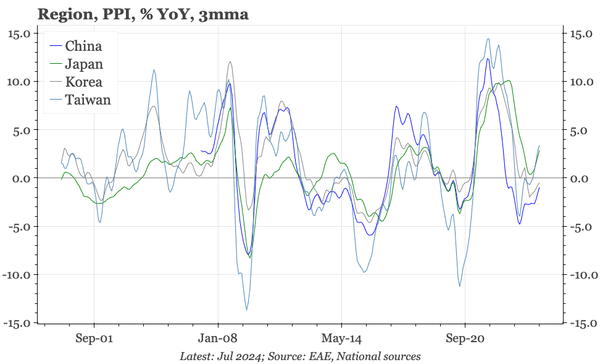

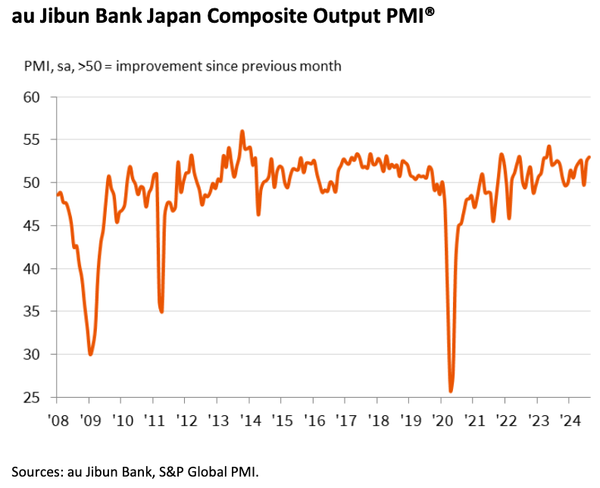

QTC: China: PPI rolling over again

It can be seen in the PMI and 10-D upstream prices: the mild firming of PPI of 1H24 is now rolling over. It is also evident in global commodity prices, so this isn't a China-specific phenomenon. But when inflation is already so low, it matters more for macro in China. Click to see the other charts.