Paul Cavey

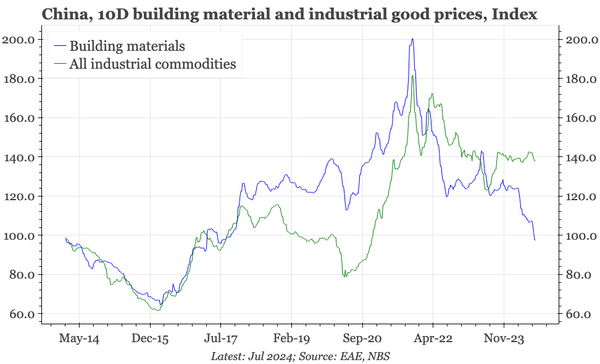

QTC: China – industrial prices stable despite property

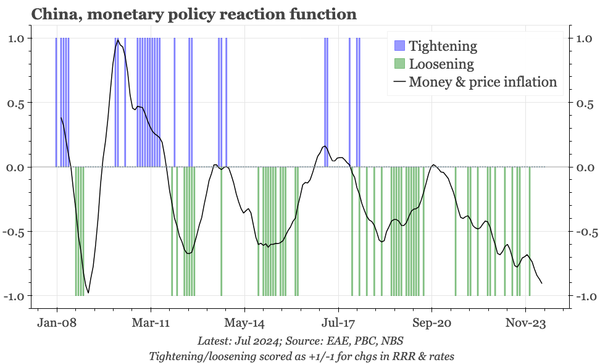

The collapse in property market activity is showing up in sharply lower prices for building materials: they've now fallen by 50% from the peak. But overall industrial prices haven't fallen in the same way, and continue to point to PPI inflation of around 0%.

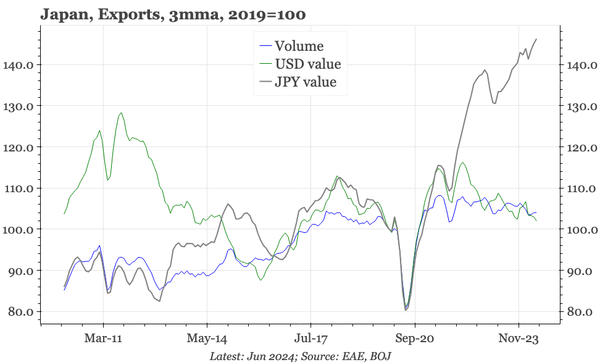

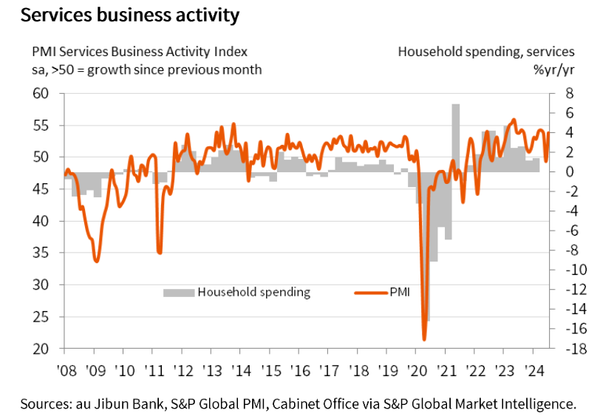

QTC: Japan – services PMI stronger again

Some lessening of confidence in June made sense given the fall in the JPY, but last month's sharp drop in the services PMI still seemed overdone. In July, it rebounded back to a strong level, with the commentary highlighting rising employment and capacity pressures.

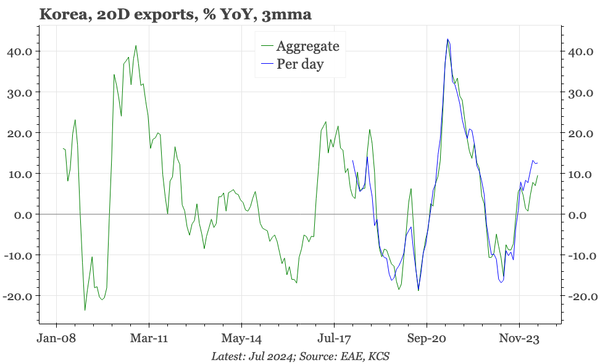

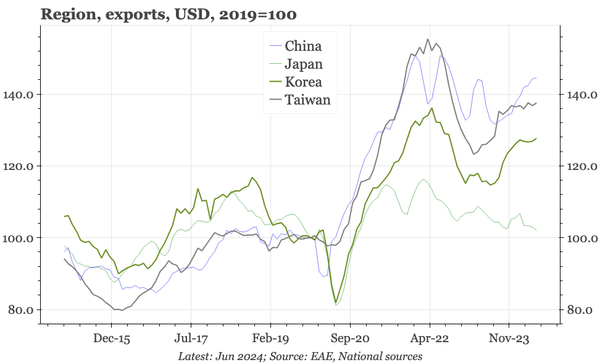

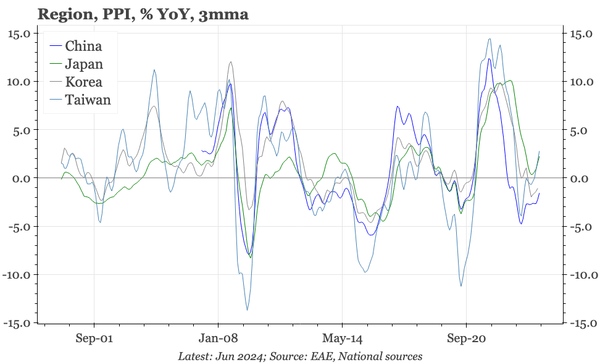

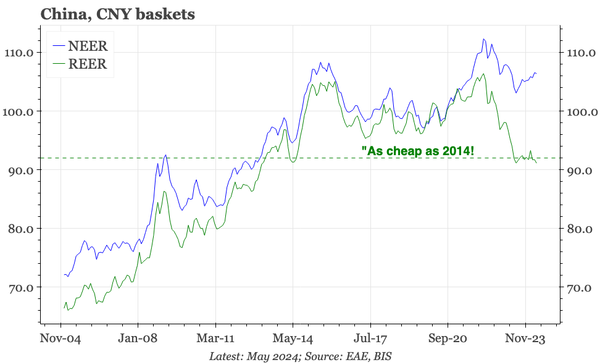

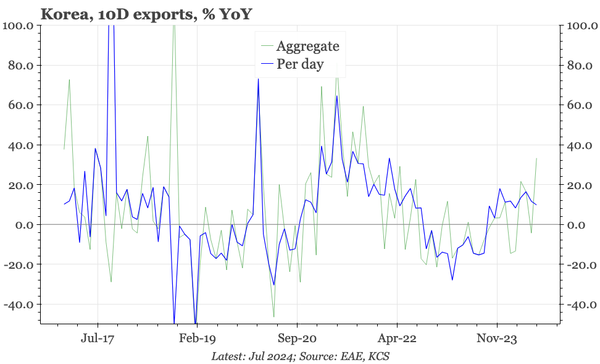

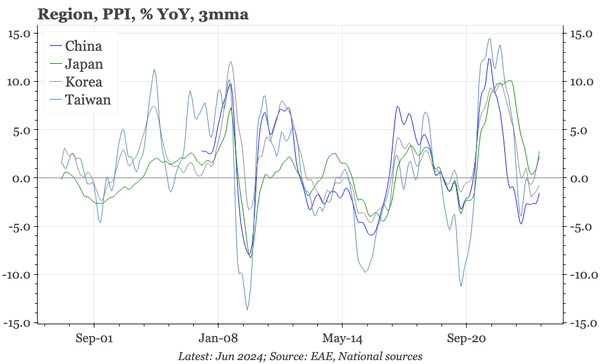

QTC: Region – PPI rebounds, even in China

Korea's data today completes the PPI picture for the region for June. It shows two things: that the inflation cycle has modestly picked up, and that most of China's PPI deflation reflects this bigger global cycle rather than local factors specific to China.

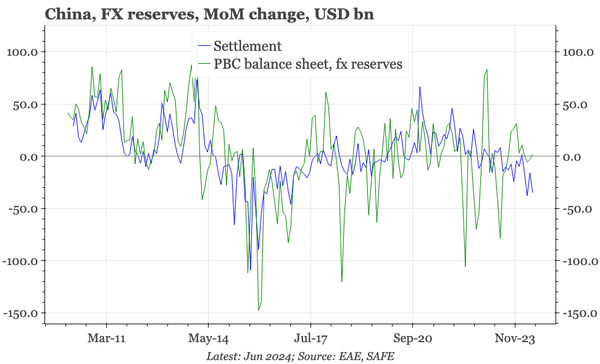

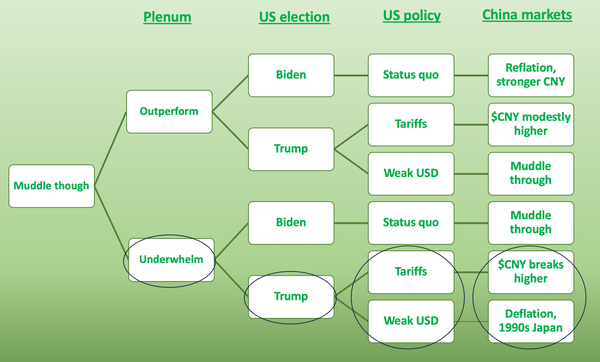

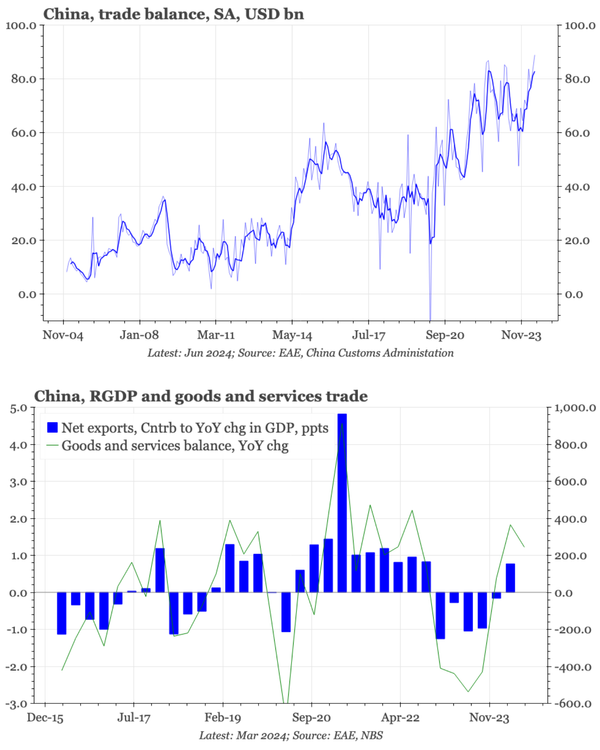

China – deposits not as bearish as loans

Even allowing for a change in credit intensity, June headline credit and money data are bearish. The one positive trend is data through May showing household demand deposits no longer falling so quickly. That shift continuing would help sustain China's macro muddle through.

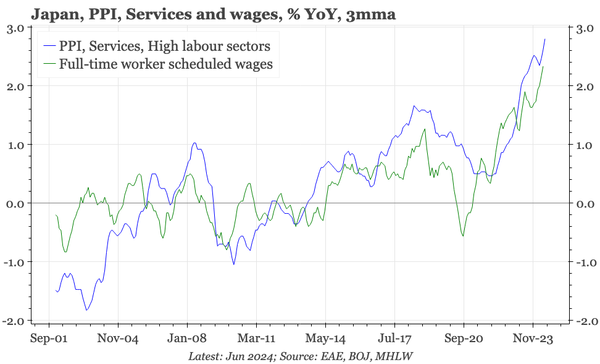

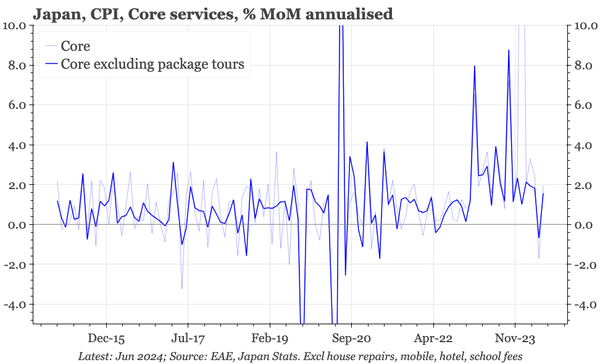

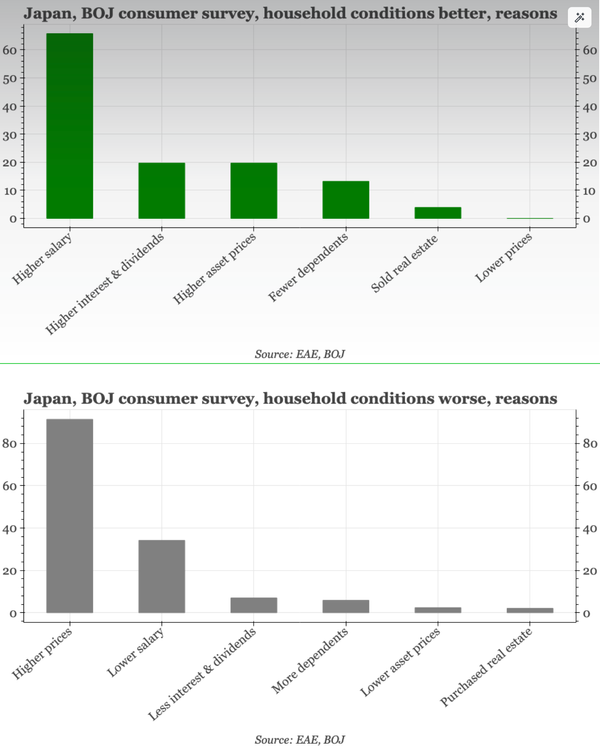

QTC: Japan – the BOJ's consumer dilemma

In the BOJ's Q2 survey, 65% of respondents saying they felt more positive cited higher incomes, an outcome helped by policy stimulus. But 90% of people saying they felt worse blamed higher prices, with low rates and the weak JPY also the result of policy.