Paul Cavey

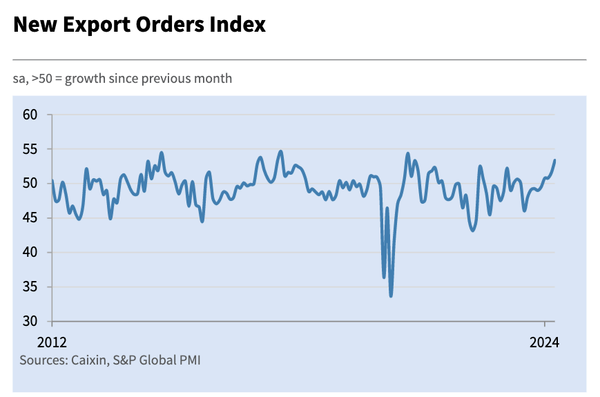

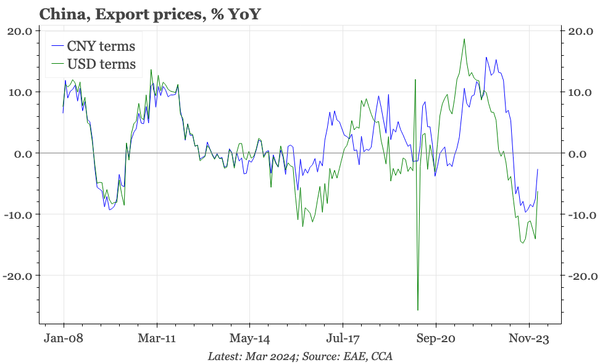

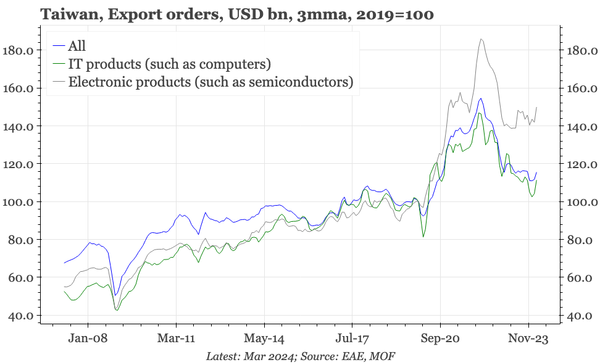

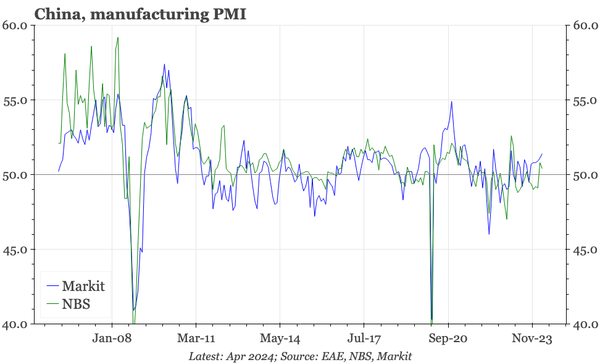

China – exports lift the PMI

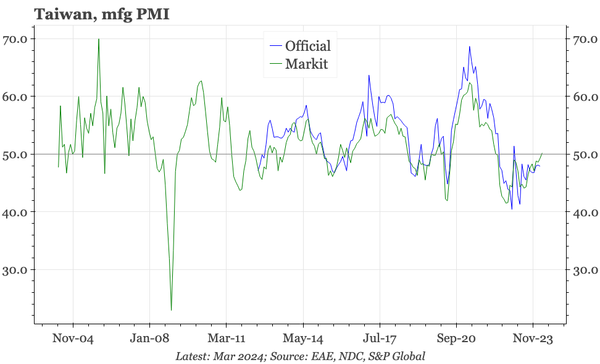

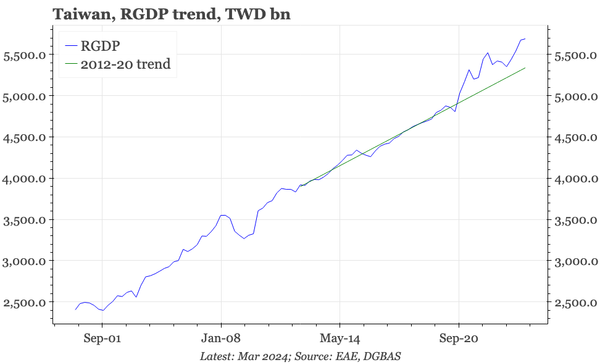

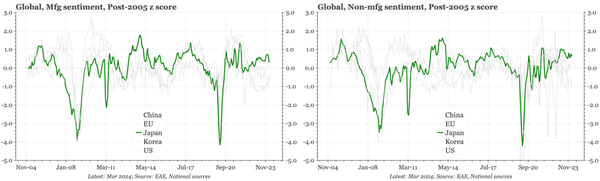

The mfg PMIs continue to suggest the industrial cycle, in terms of activity and pricing, is through the worst. For now, though, the strength is mainly in exports. As a growth driver, that shouldn't be dismissed, but the upturn would feel more sustainable if domestic indicators were improving more.

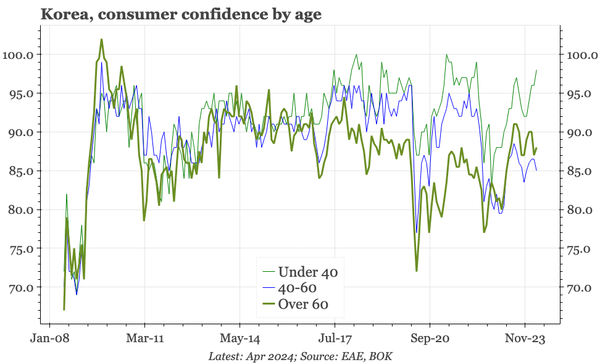

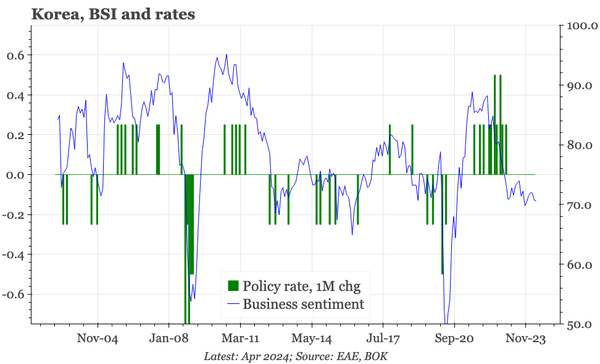

Korea – incrementally weaker

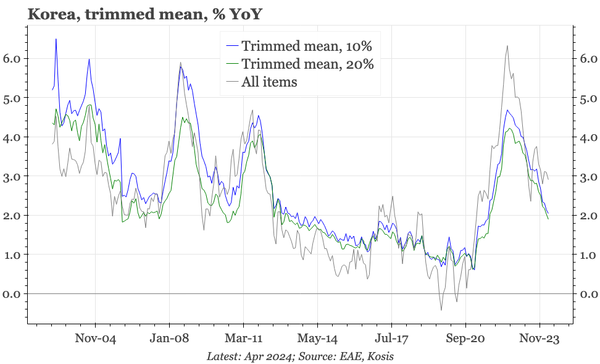

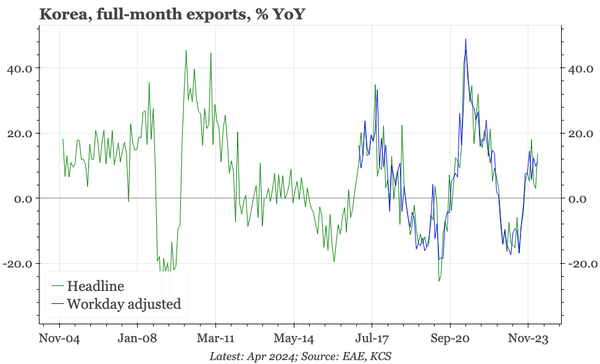

Q1 GDP was solid, but the weakness in business sentiment in April makes us feel economic momentum is incrementally weaker. The consumer survey showed price expectations remaining elevated, which fits with weekly price data showing no big slowdown in food or energy price inflation through April.

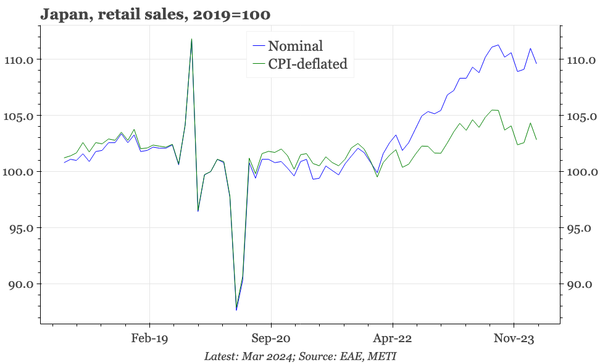

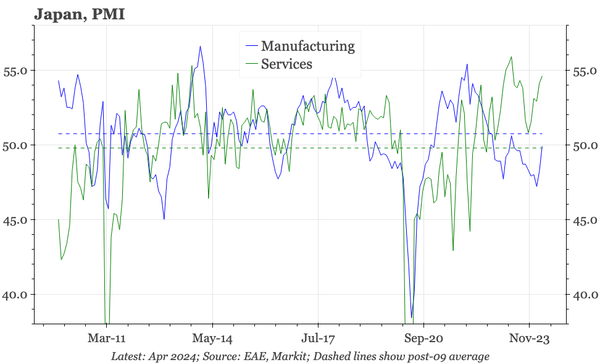

Japan – why isn't the JPY helping exports?

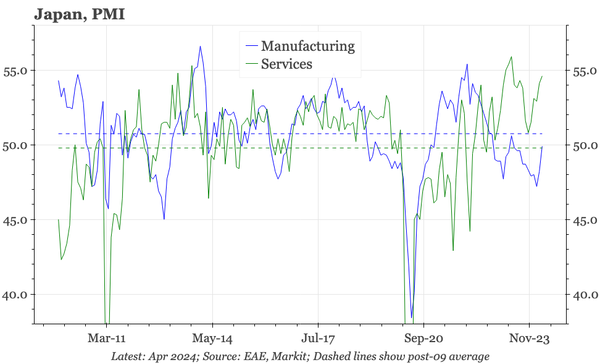

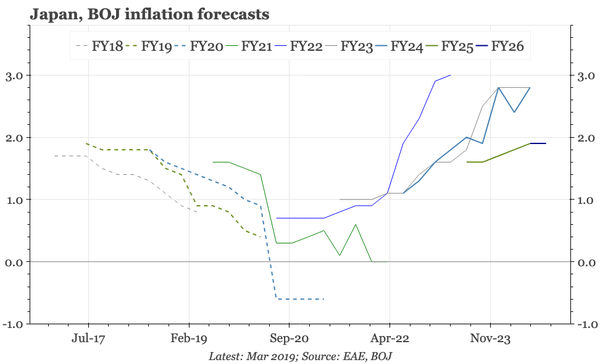

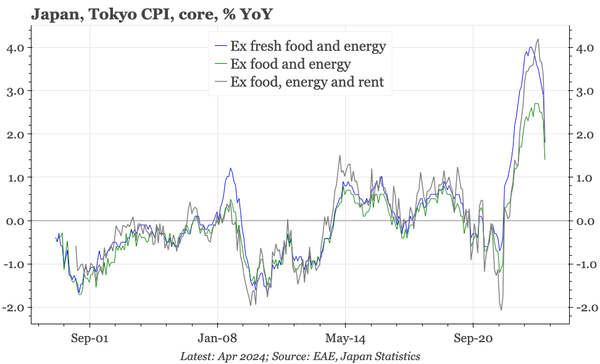

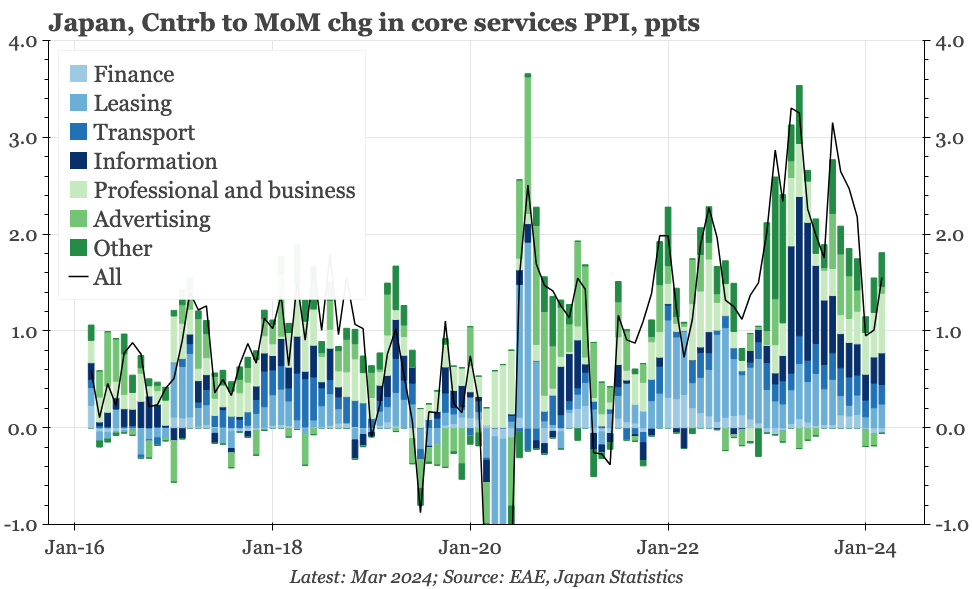

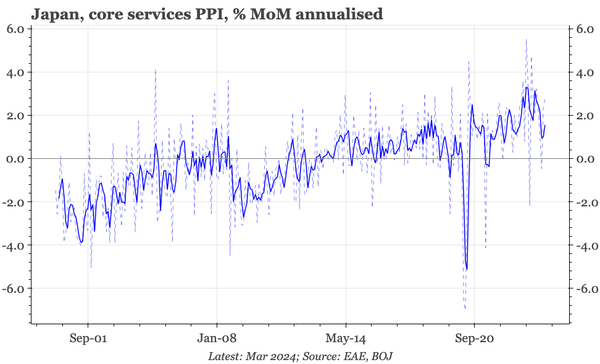

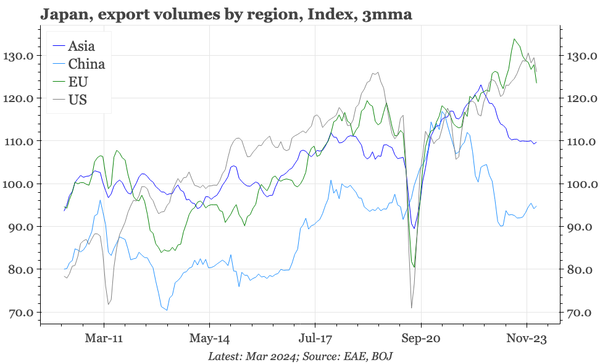

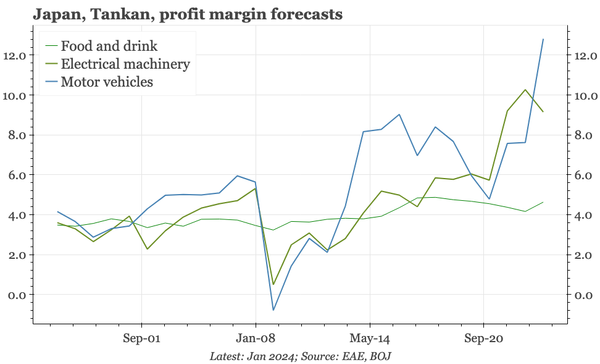

Export volumes haven't responded to JPY weakness, but profits have. That's feeding into manufacturing sentiment, which is better than history, and better than the rest of the world. With services sentiment also strong, the BOJ can continue to argue the macro cycle is warming up.