Korea – incrementally weaker

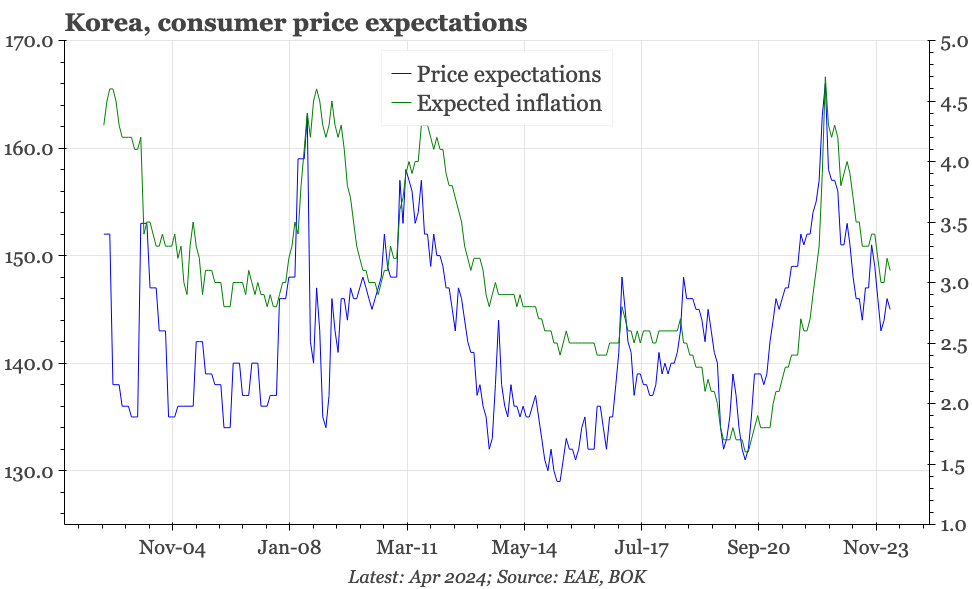

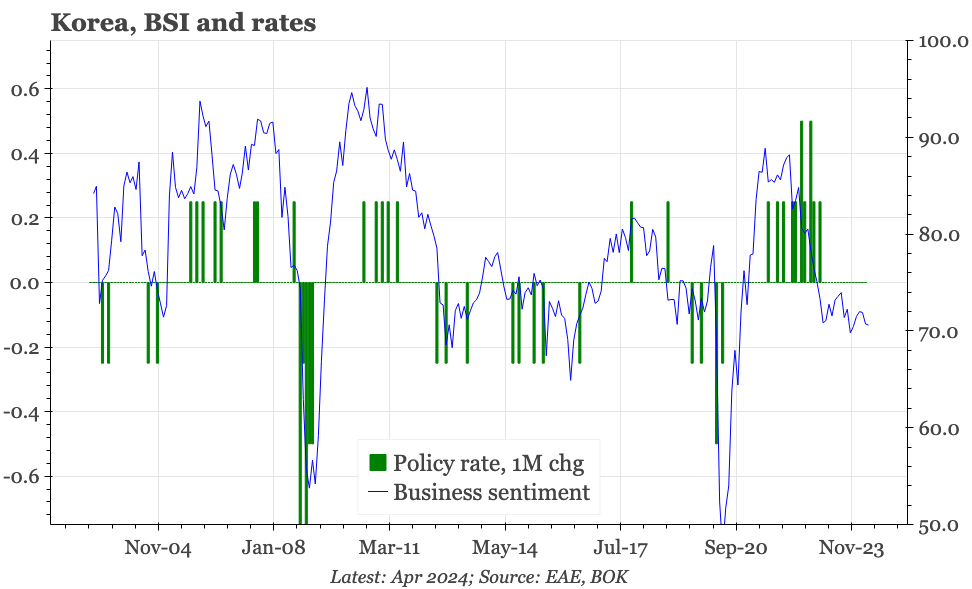

Q1 GDP was solid, but the weakness in business sentiment in April makes us feel economic momentum is incrementally weaker. The consumer survey showed price expectations remaining elevated, which fits with weekly price data showing no big slowdown in food or energy price inflation through April.

Q1 GDP, April sentiment surveys

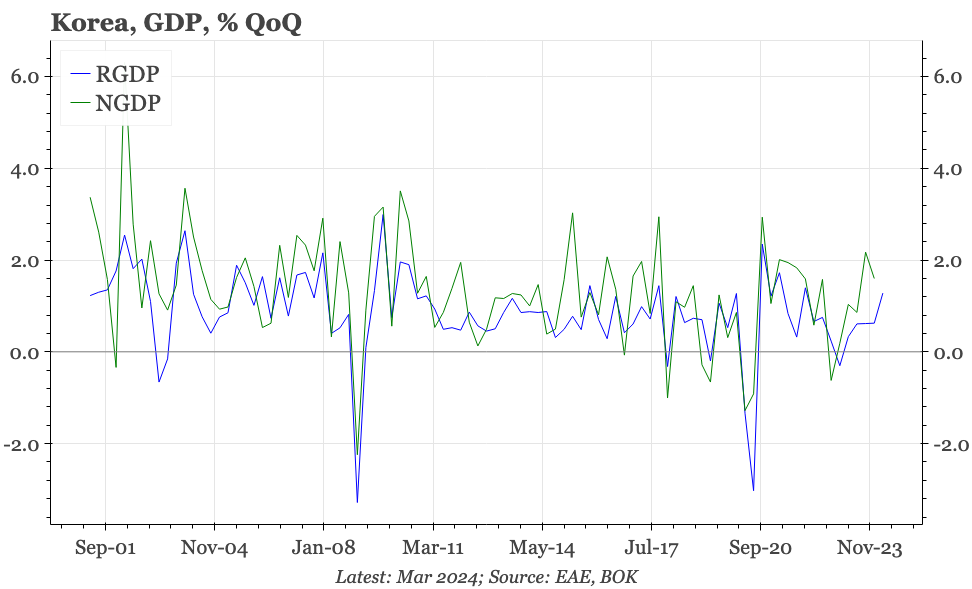

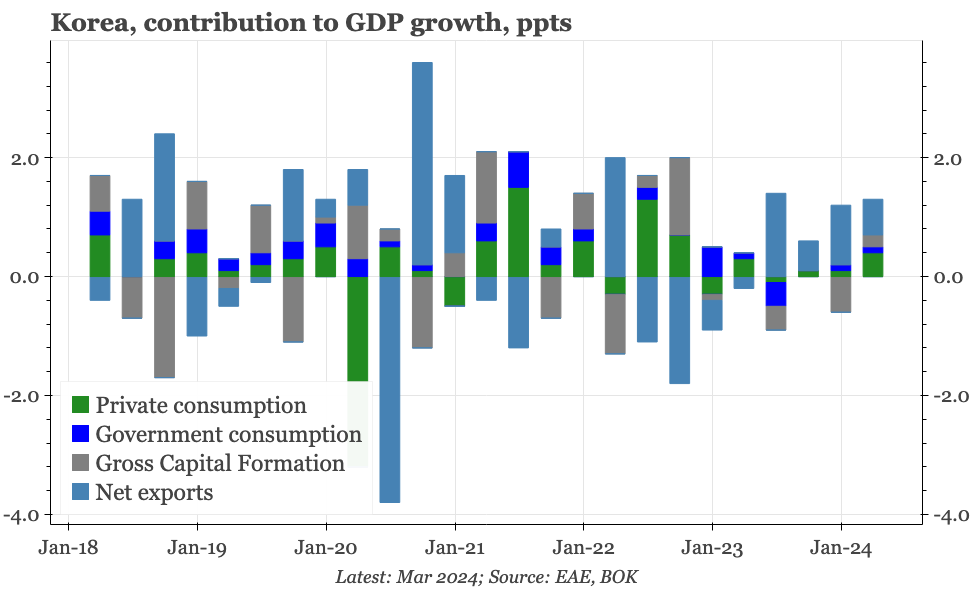

Q1 GDP growth accelerated to 1.3% QoQ, the strongest since the final quarter of 2021. The details were solid too. The biggest driver of growth continued to be net exports, but capex and inventories together made a positive contribution for the first time in more than a year, and private consumption was also mildly stronger. At 3.2% YoY, growth in Q1 was well above the BOK's full-year forecast, and consistent with the bank's comment at the last policy meeting that growth in 2024 is likely "to be consistent with or could be higher than the February forecast of 2.1%".

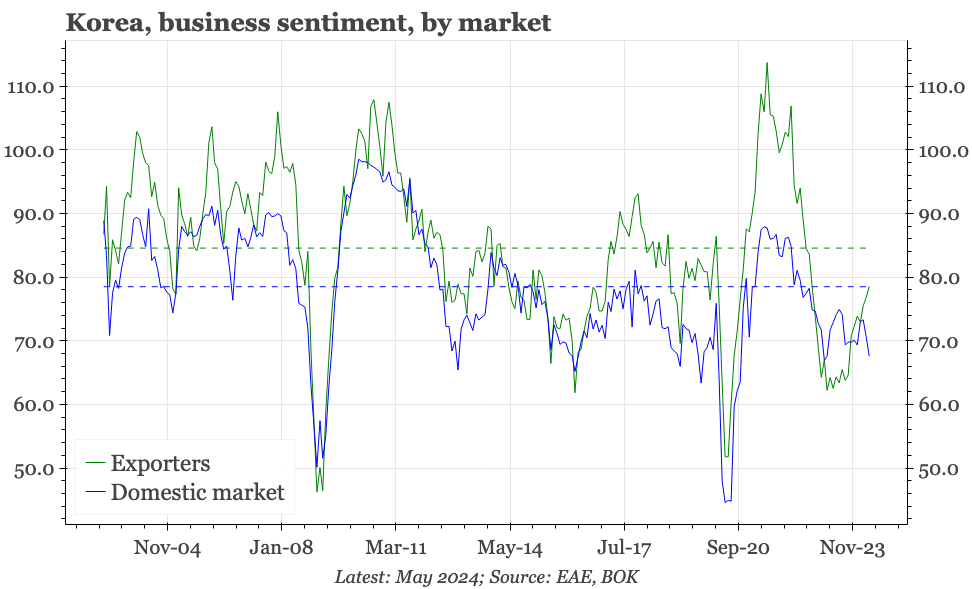

Relative export strength can be seen in the BOK's business confidence survey too, with exporter sentiment rising again into May. That is now well up from the lows of mid-2023. The post-covid dive in the export sector was, however, very deep, so even now, exporter sentiment is still far from strong, being comfortably below the long-term average.

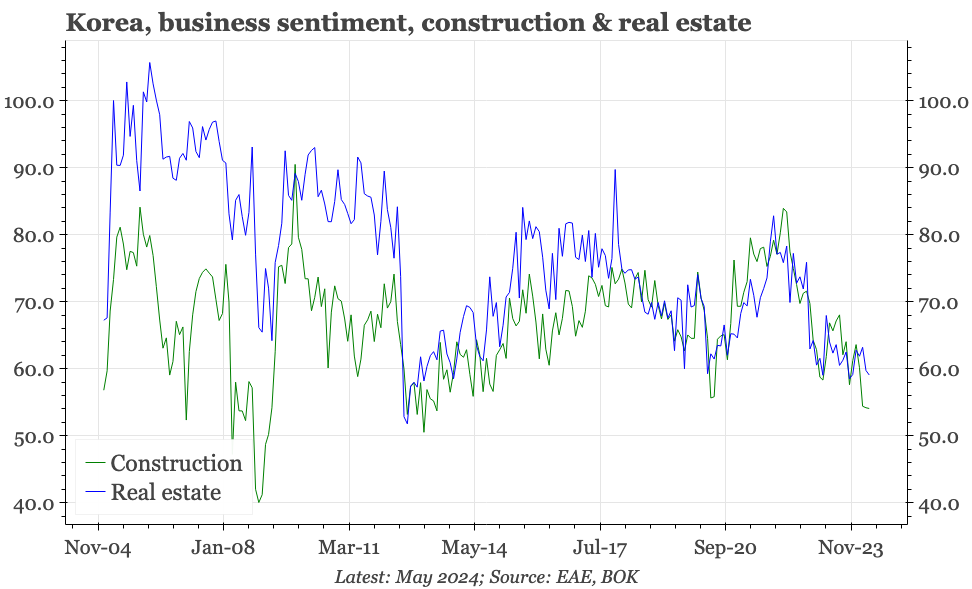

At the same time, mirroring the rise in exporter sentiment is a fall in confidence among firms focused on the domestic economy. That now isn't much above the lows reached in the initial decline that followed the BOK's tightening cycle of 2021-22. As might be expected, the weakness is most pronounced in the real estate and construction, and when looked at in terms of company size, the pessimism is clearest among small firms.

It is the weakness of these other sectors that explains some of the BOK's recent concern about consumer spending. There certainly are some measures of consumption that look weak, particularly retailer sentiment in the business confidence survey. But yesterday's survey for April showed consumer confidence remaining at around the long-term average. So that isn't particularly low relative to history, or, for that matter, compared with current consumer confidence in neighbouring economies. At the same time, it clearly isn't strong, which matters when activity in other sectors of the economy is more obviously soft.

As has been the case for the many months, business sentiment remains at a level where the BOK has historically cut rates. The hold-up has been inflation. In April, consumer inflation expectations ticked down, but remain above 3%. Weekly data show food and energy price inflation hasn't accelerated again this month but, equally, hasn't yet slowed down, suggesting not much change in headline CPI when the data are released next week.

GDP data aside, the activity case for a loosening in monetary policy at the margin feels stronger. However, the GDP data likely will matter, meaning an upwards revision in the BOK's full-year forecast at the bank's next meeting in May. With headline inflation also likely holding up this month, policymakers still seem unlikely to react just yet to the weakness in other measures of economic activity, particularly when the interest rate moves in the US continue to put upwards pressure on $KRW.