China – August CPI/PPI

Food prices pose something of an upside risk, but underlying price trends, particularly in PPI, continue to look more deflationary than inflationary.

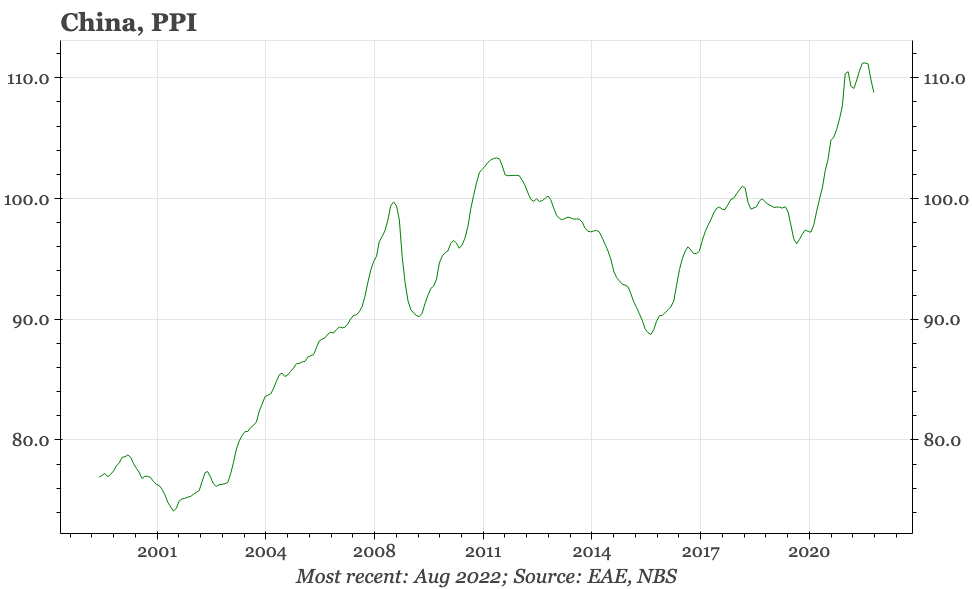

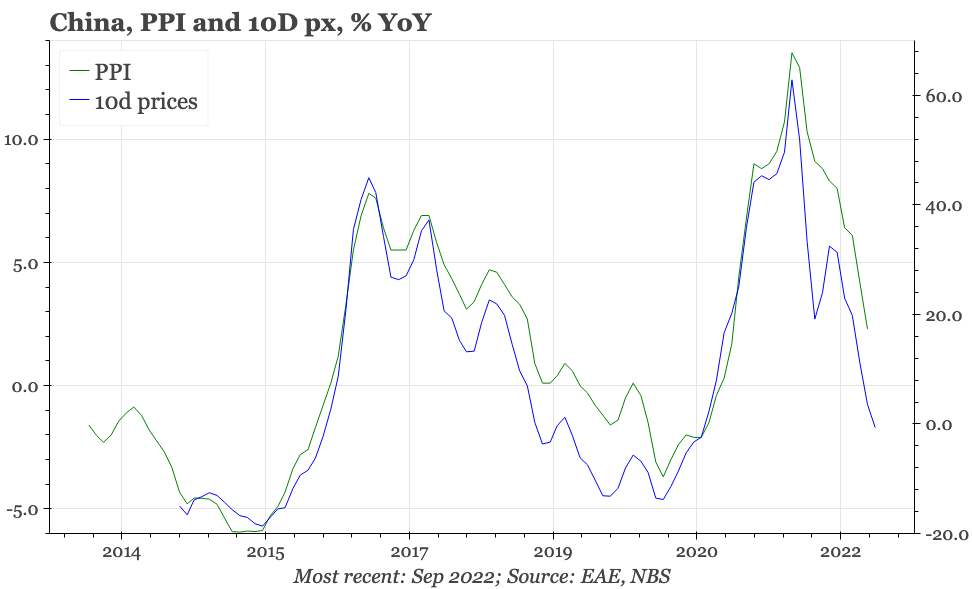

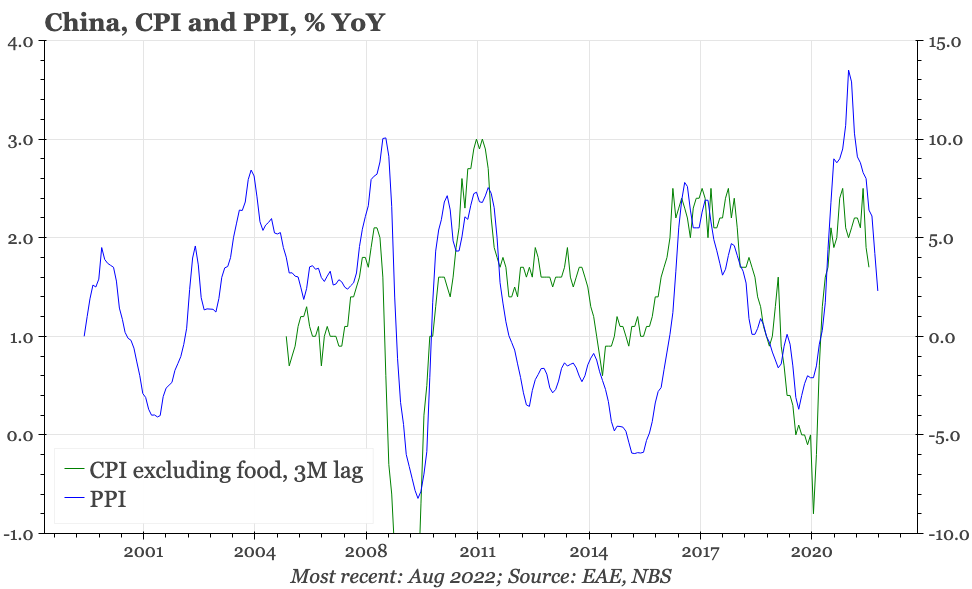

On a PPI basis, inflation slowed again in August, and more than both the market, and we, were expecting, to 2.3% YoY. The PPI has now fallen by more than 2% from the peak in June. Given the weakness of domestic construction demand and the strength of the USD, a further drop in PPI inflation is highly likely.

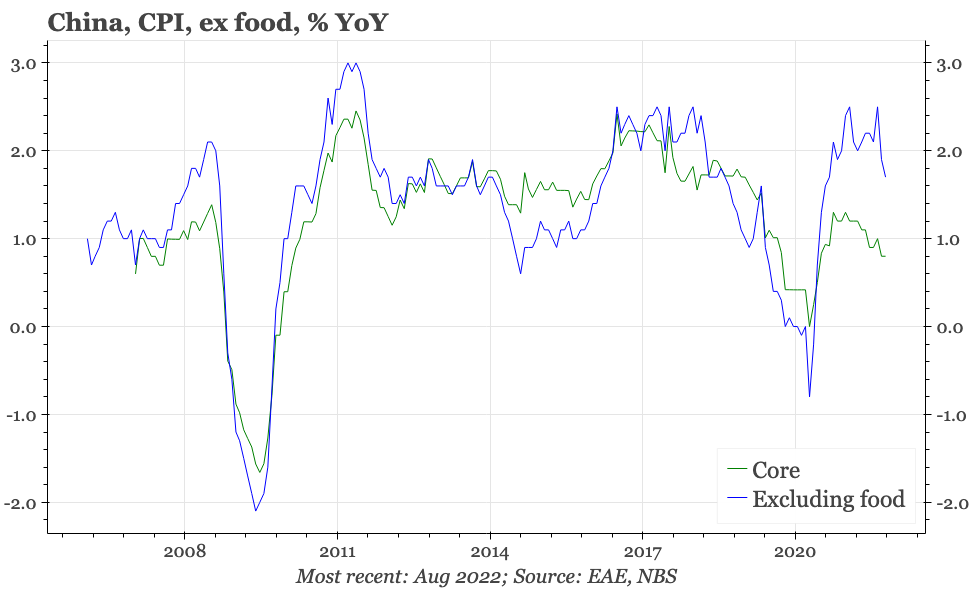

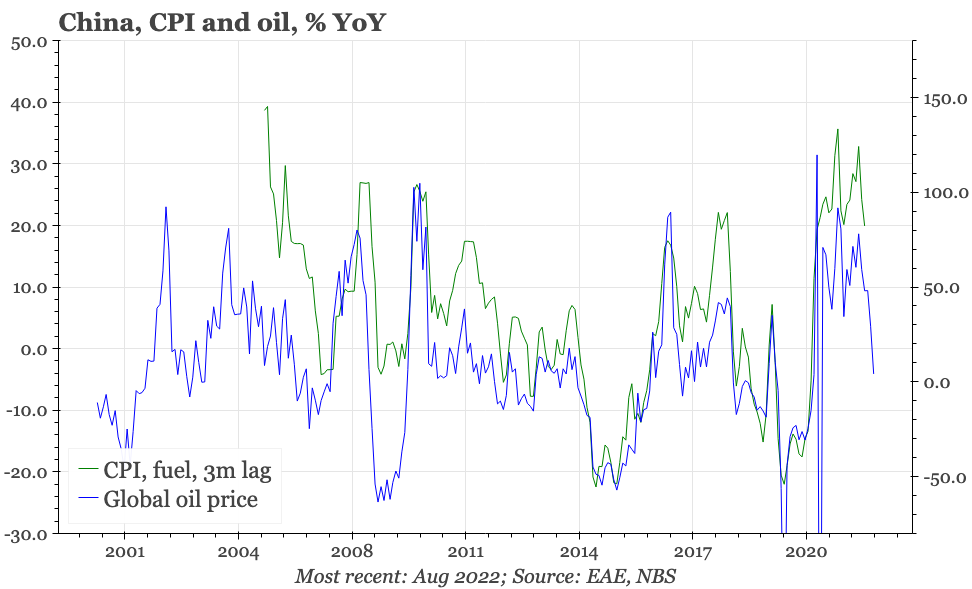

Based on the CPI, and inflation also slowed, from 2.7% YoY in July to 2.5%, which was also below market expectations. The softness in the CPI is being driven by two factors: first, feed through from the fall in the PPI in general, and oil in particular, and; second, the weakness of services demand, as shown by the fall in non-manufacturing output prices in the PMI. Both suggest underlying CPI inflation is likely to slower further from here.

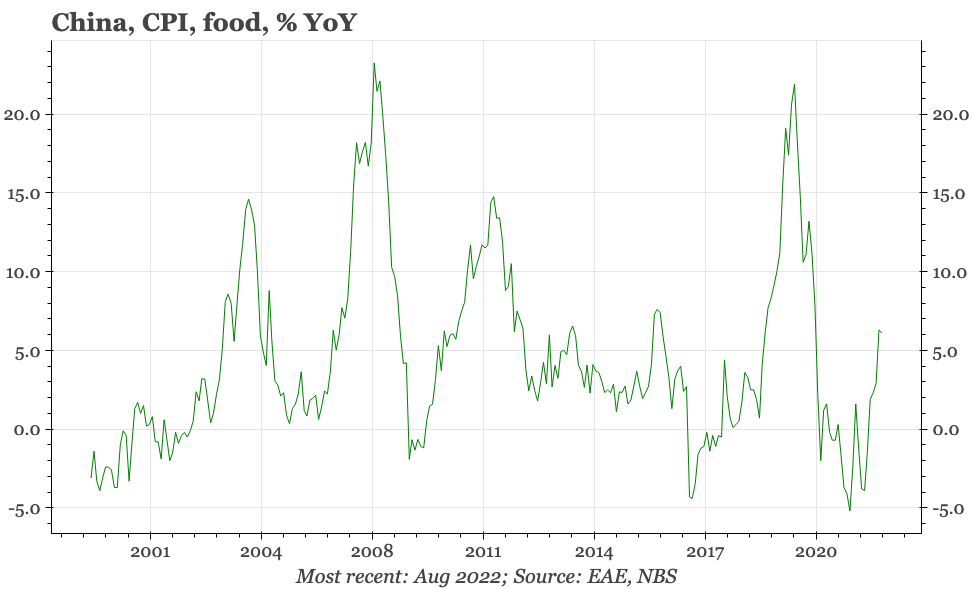

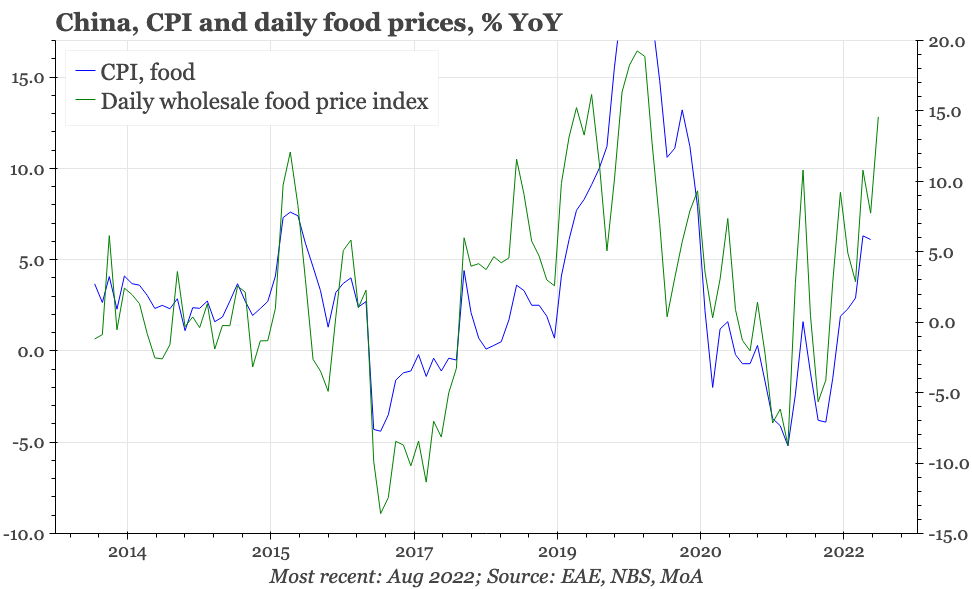

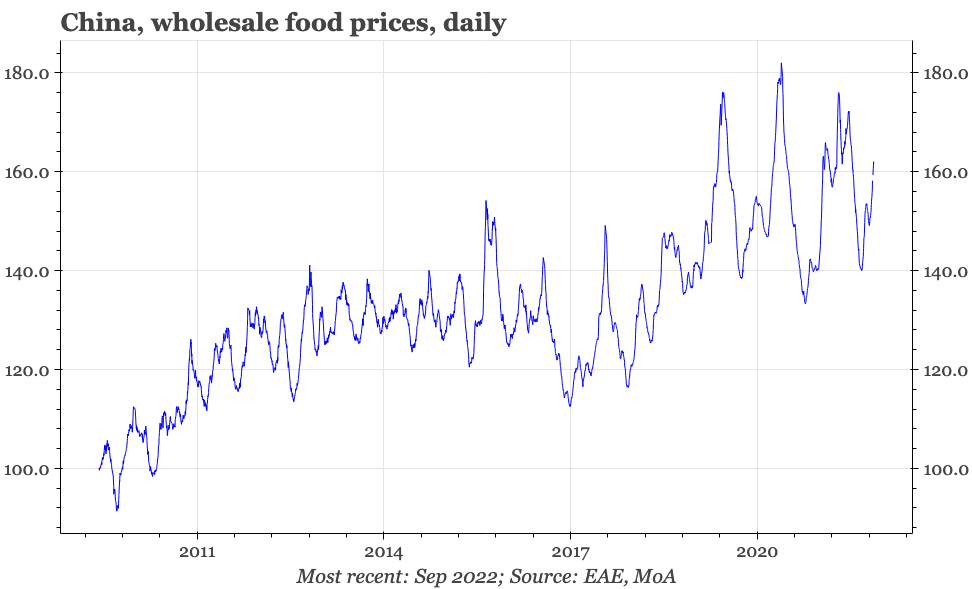

The one upside risk is from food prices, with a new pork price cycle, and the drought affecting supplies of other agricultural products. It is usual for food prices in China to rise over the summer months, but the increase since June this year has been quite sharp, and does point to food CPI heading higher.

If PPI and core CPI remain as contained as seems likely, it is unlikely rising food prices on their own become an inflationary worry for the PBC. The early indicators of that changing would be a rise in inflation expectations in the central bank's upcoming Q3 depositor survey, and a turn up in liquidity preference in the monthly monetary release.