The China Diviner

Exports in March were so strong, and the trade surplus so big, that we continue to think they must have been boosted by one-off effects. But it is worth asking the implications if that assumption is wrong, because if it is, it would matter for growth, the currency, and protectionism.

China's remarkable export data

As data surprises go, Thursday's release of March trade data from China was a biggie. Exports and the trade surplus were so big, that we continue to think they must have been boosted by one-off effects – perhaps the passing of Lunar New Year, or the fulfilment of orders that had been delayed by China's covid-induced chaos in the months before the holiday began. Going forward, China still faces the risk of the long-awaited DM recession.

That said, the official PMI this year has been lifted by export orders (more than domestic orders) and signs of better overseas demand were also visible in the PBC's Q1 corporate survey. To be sure, the increases in orders were modest, but were still more than expected given the apparent state of DM demand. In other words, while the March actual export data were particularly sprightly, they also contained some trends which might be more structural. That being the case, it is worth asking what the implications will be if the March data show the new normal.

What happened in March?

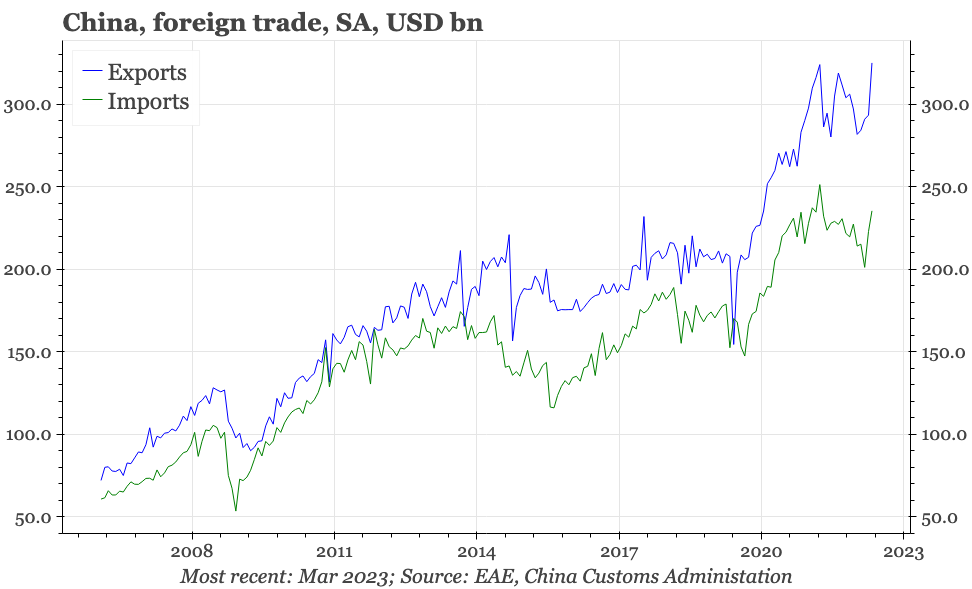

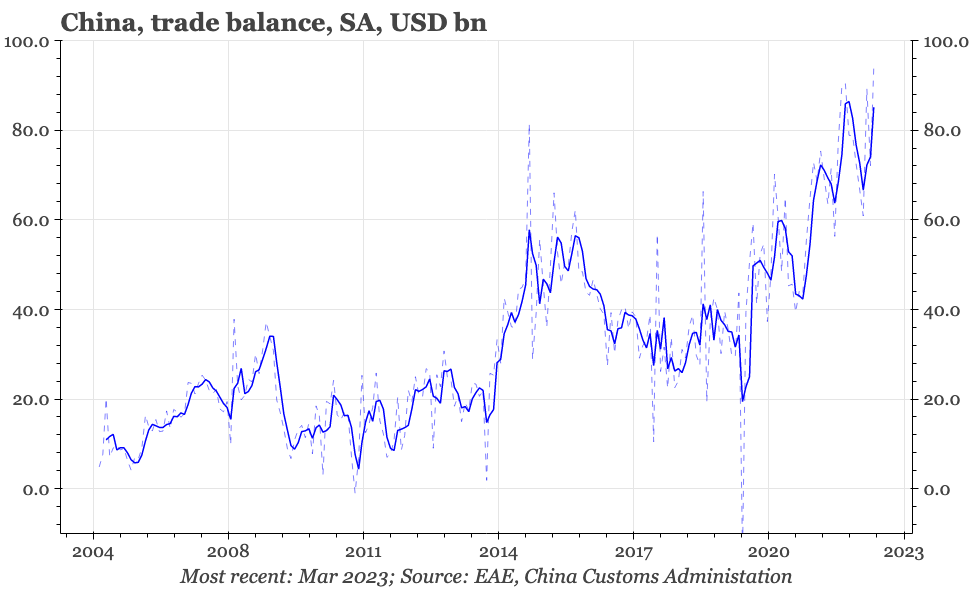

First of all, it is worth stressing that the Lunar New Year impact on China's economy is large, and particularly for foreign trade data, sometimes extends from February into March. We prefer to look at the data in seasonally adjusted level terms, but that means the picture is sensitive to how the adjustment is made. We've been playing around with that methodology the last few days, party because or our initial estimates of the data in March were so big. Still, the main takeaways remain the same regardless of the approach: there was a big jump in both the trade surplus and exports in March.

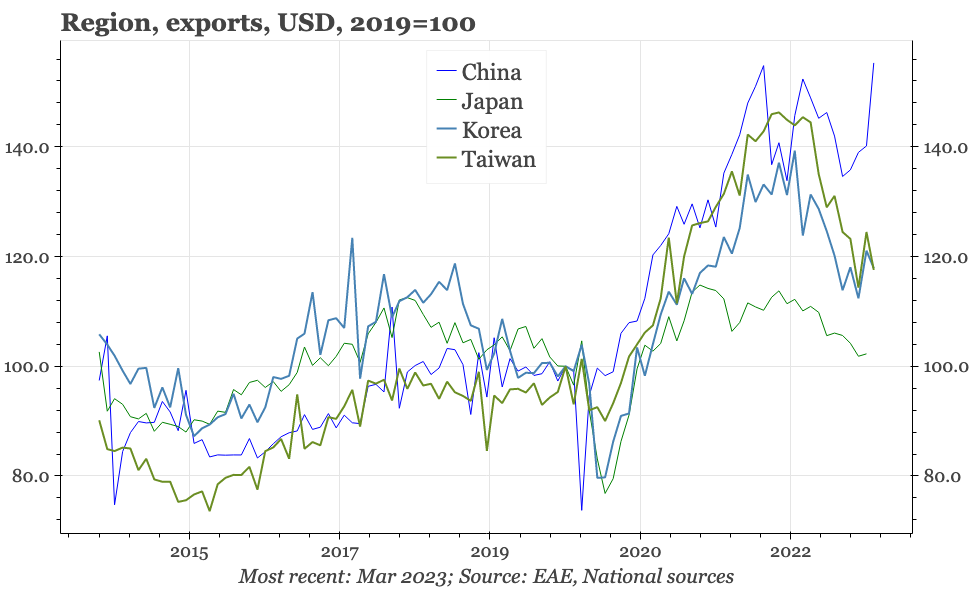

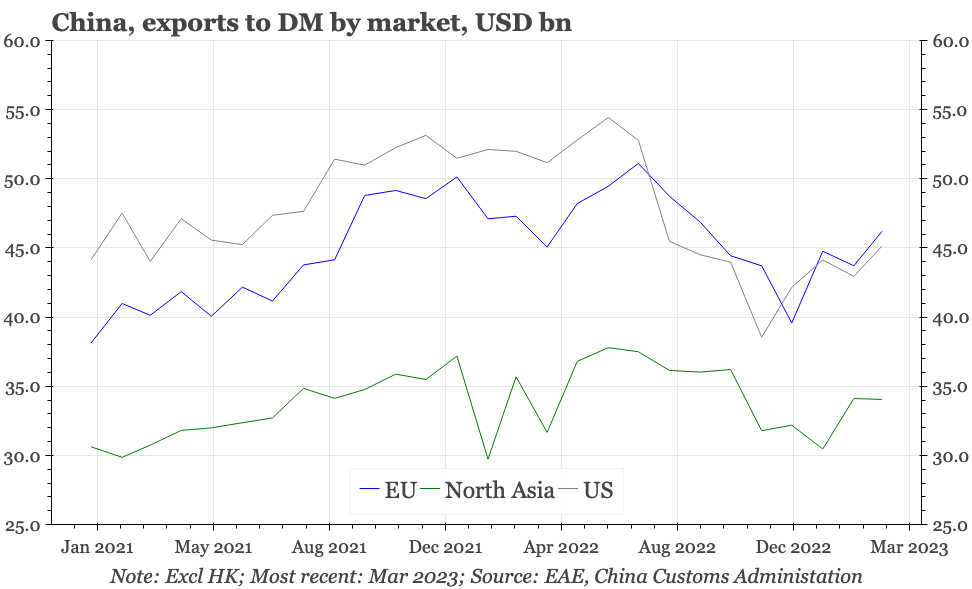

To set the scene, exports from other economies in the region are down around 20% from the 2022 peak. That fits with the big decline in growth in China itself (an important market for all the regional economies), but also the deterioration in the manufacturing cycle in the EU and US. China’s exports had been following that same downwards trend, but in March, completely bucked it, and surged 11% MoM to a new all-time high. And that’s after they’d already risen 50% in 2020-21.

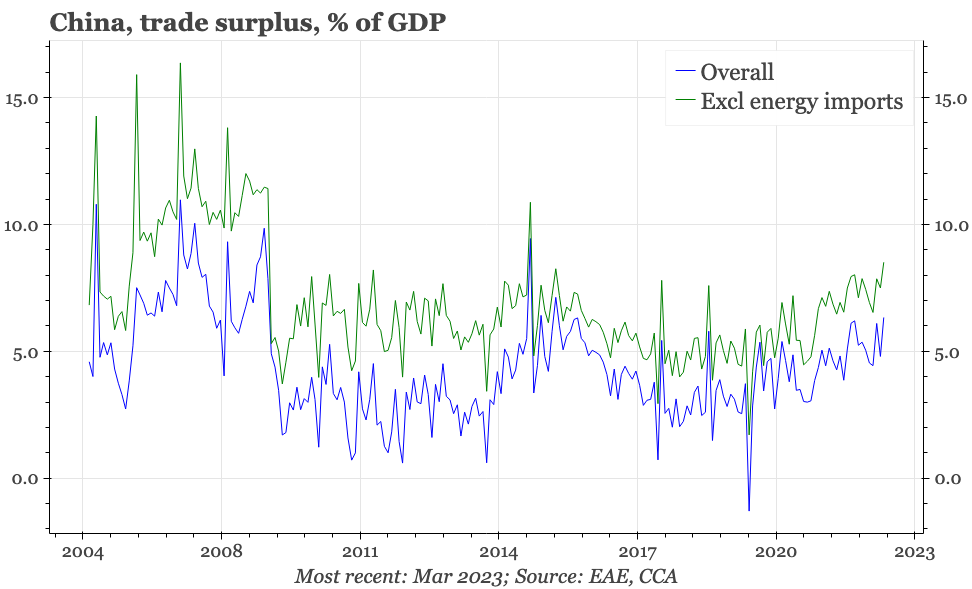

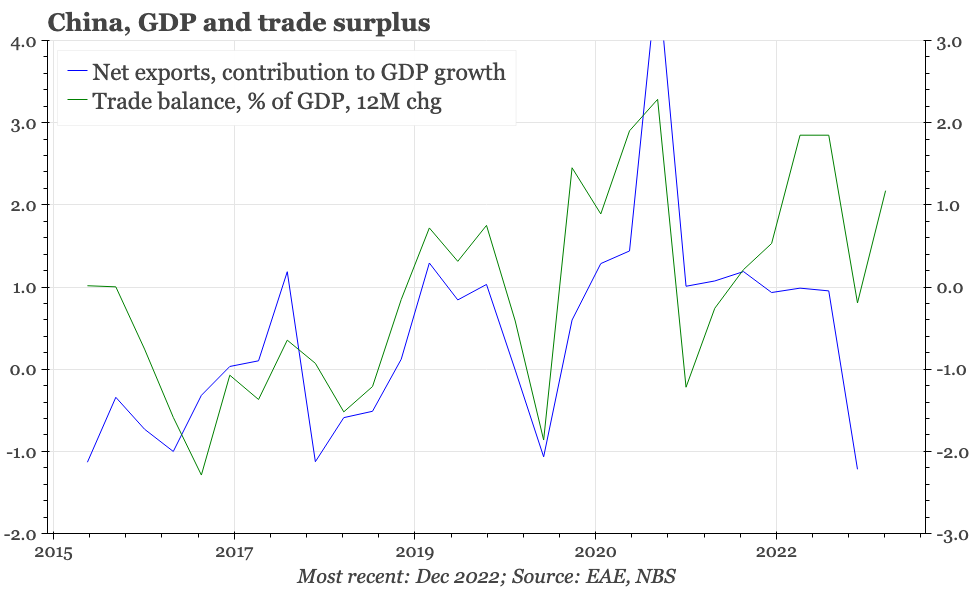

With domestic demand in China remaining tepid and so imports staying depressed, the trade surplus also increased last month. On our calculations, the seasonally adjusted surplus rose in March to almost USD95bn, a new record high. As with exports, the trade surplus had already grown dramatically in 2020-21, and there was a strong consensus that this year it would start to shrink in 2023. Instead, the trade surplus in March reached over 6% of GDP, and was back above 5% of GDP for Q1 as a whole. Excluding energy imports and the surplus in March was more than 8% of GDP.

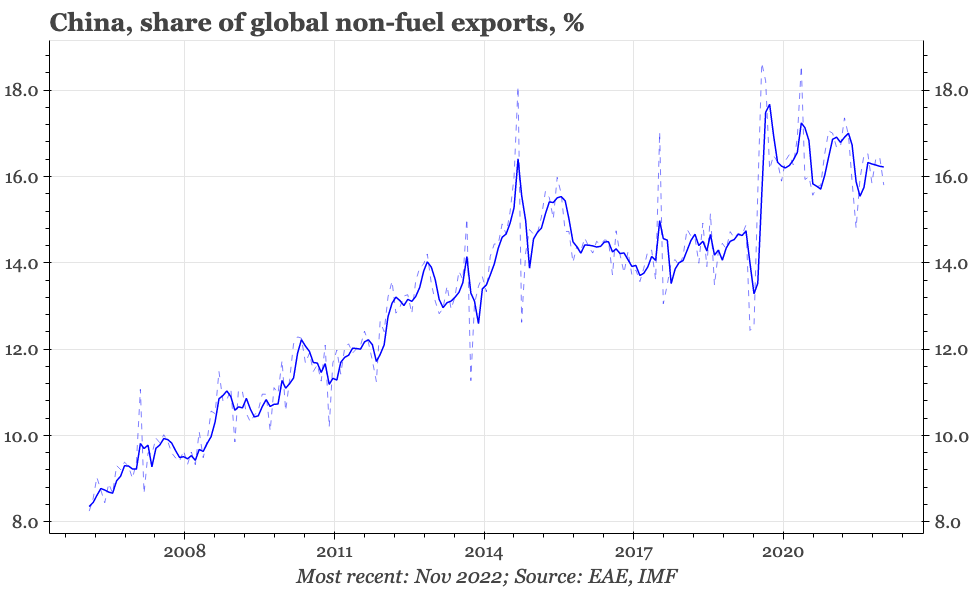

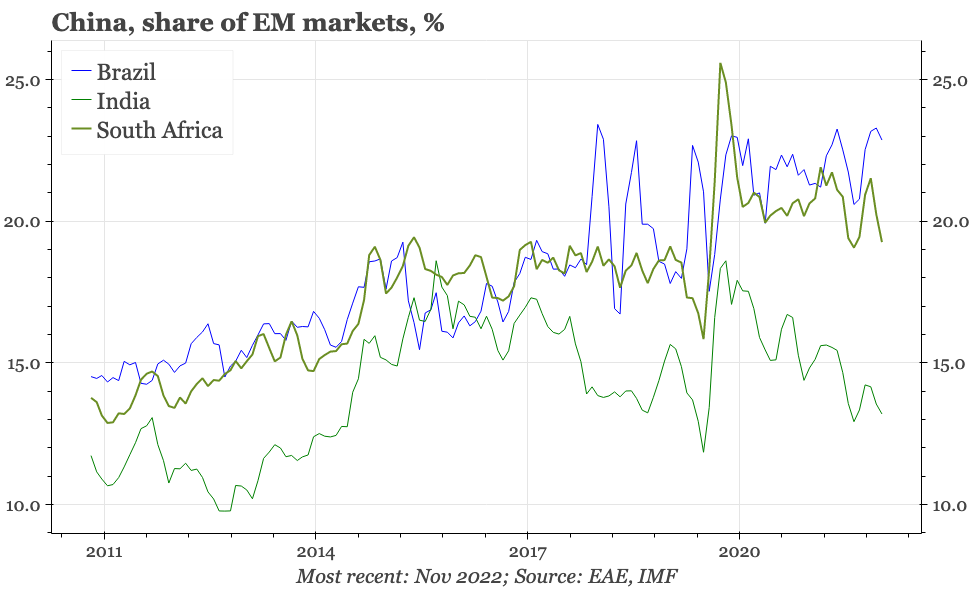

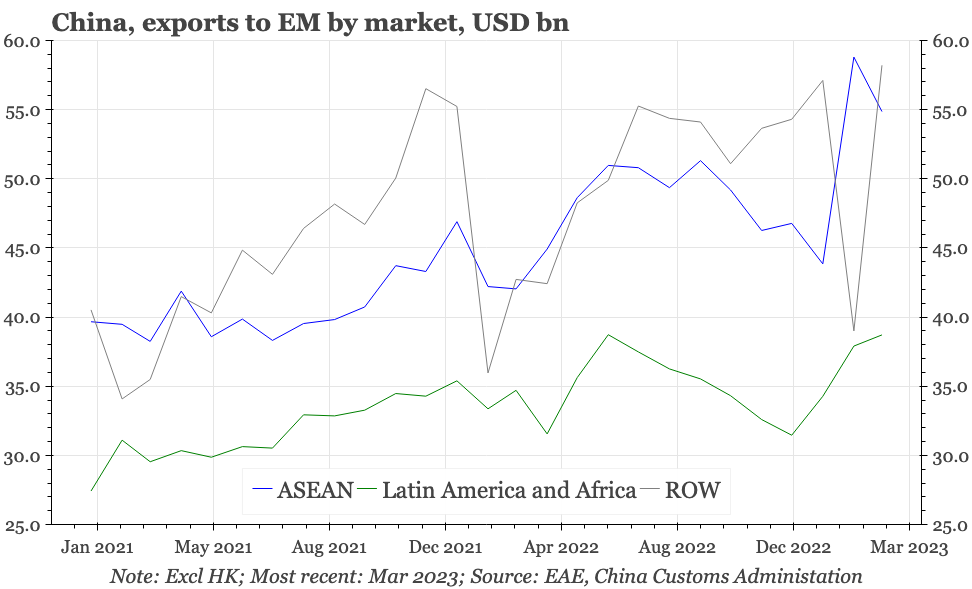

How did this happen? Exports to just about everywhere were up in March. But the biggest increases were in shipments to EM and the Global South. Indeed, the data show that for the first time, DM isn't China’s most important export market. Part of this is the big increase in exports to Russia, which rose to over USD10bn in March; in 2021, before the war with Ukraine, China's exports to Russia had averaged under USD6bn a month. But that's only a part of the overall story. Exports to ASEAN in March remained high, with South-east Asia staying as a bigger market for China than either the US or EU.

A lot of market attention has been focused on the rise of ASEAN, with a few different explanations for why Chinese sales there have risen so much. One suggestion is the upgrading of China's industry. Perhaps the most common one though is a restructuring of supply chains from China through ASEAN. There's an idea that this is being encouraged by RCEP, the free-trade agreement between ASEAN, China, Japan, South Korea, Australia and New Zealand. That provides a framework for both foreign and Chinese firms to relocate some manufacturing capacity to South-east Asia, with one incentive being the desire to maintain access to the US and EU markets as governments there seek to reduce reliance on China.

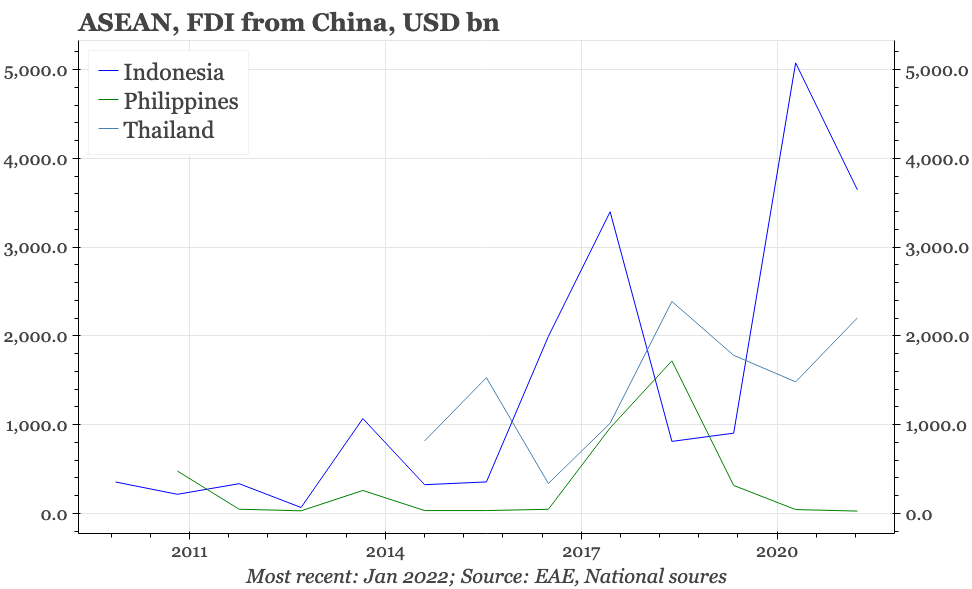

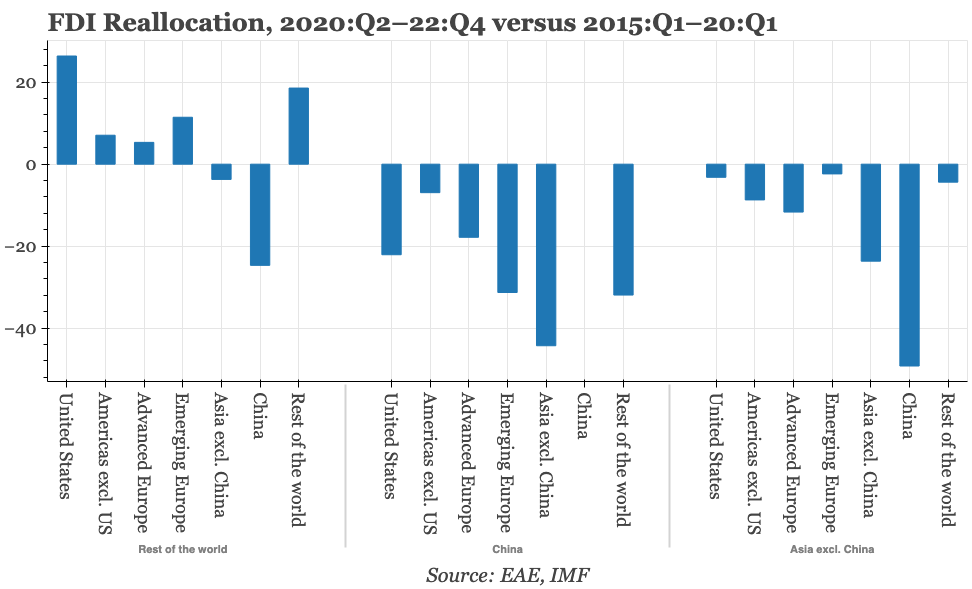

There is anecdotal evidence for this occurring, but it isn't yet supported by the headline data. For one thing, ASEAN isn't the only EM market where China's exports have been strong. Indeed, exports to Africa and Latin America, and to the Rest of the World, all reached record high levels in March. Moreover, the restructuring of supply chains to ASEAN isn't strongly supported by FDI data. There are some signs of Chinese investment in the region, but data in last week's World Economic Outlook report from the IMF suggest overall FDI in China, the rest of Asia, and from China to Asia, has fallen.

The product data available so far might be consistent with a supply chain story, with March data showing the big rise was in exports of machinery and electrical products. But that's a general, catch-all category that doesn't really tell us very much. Separately, the surge in auto exports is continuing, and that is a significant trend for the future, but car sales still only account for 2.5% of China's total exports (to put that in context, it is up from 0.5% in 2019). Overall, the information we can glean from the product data is still patchy. To know more, we need to wait for the more detailed trade data that will be released next week.

Implications

With China’s domestic demand remaining disappointing, exports are needed for growth. It isn’t statistically or theoretically a simple read through from the trade surplus to GDP: the trade data are in value terms whereas for GDP growth we need volumes; we don't yet have services trade data for March; and China doesn't publish any level data for GDP by expenditure on a quarterly basis. But the continued size of the excess of exports over imports means there should be a decent bounce back for the net export contribution to growth (a series that the government does publish), implying some upside risk for next week's Q1 GDP data.

In terms of the cycle going forward, the strength of exports in March does look to be good to be true. But other signs of a turn in the regional export cycle have been starting to appear, and if China is getting some structural lift, then there's some chance of exports at least growing modestly in 2023 as a whole.

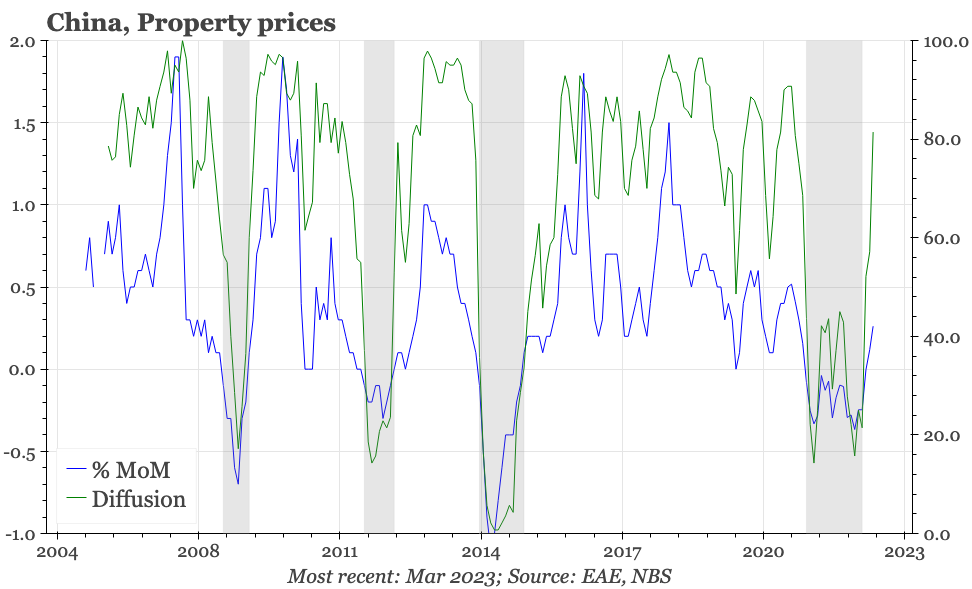

With domestic credit growth this week being strong and multiple signs appearing of a rebound in the property market, exports showing resilience too would mean all of China's usual growth drivers are falling into place. None of these engines look as powerful as they have been in the past, but equally, the revival of all three show China's growth story in 2023 isn't shaping up as the sort of spontaneous consumption-driven recovery that was widely envisioned when China first exited zero covid.

By boosting growth, the strength of exports will be welcomed by the authorities. To the extent they reflect China's underlying competitiveness, the strength of exports and the manufacturing surplus are reasons to expect the CNY to be stronger against the USD than would be suggested by simple interest rate differentials alone. With the authorities always keen for “two-way moves” and “stability”, this will also be greeted as a positive development by the authorities.

However, the widening of the trade surplus isn't all a positive development. Again, the surplus was already huge in 2022. If it is still widening, then it seems likely to pull China back into the crosshairs of the debate on global imbalances.

Of course, given the collapse in US-China relations, the government in Beijing can be presumed to care even less about US views of its trade balance and currency policy even than it did in the years running up to the financial crisis in 2008. But given China's new geostrategic positioning, with its emphasis on the Global South, then Beijing probably will need to be sensitive to any criticism that emerges from EM. And if China's March trade data are in any way more than a one-off, then some China-focused resentment is likely. It doesn’t feel like the surge in China’s exports is based on booming demand. That would mean it is market share gains. It wouldn't seem EM will ultimately be any keener to see China take over domestic markets than DM has been.