China - export growth stops

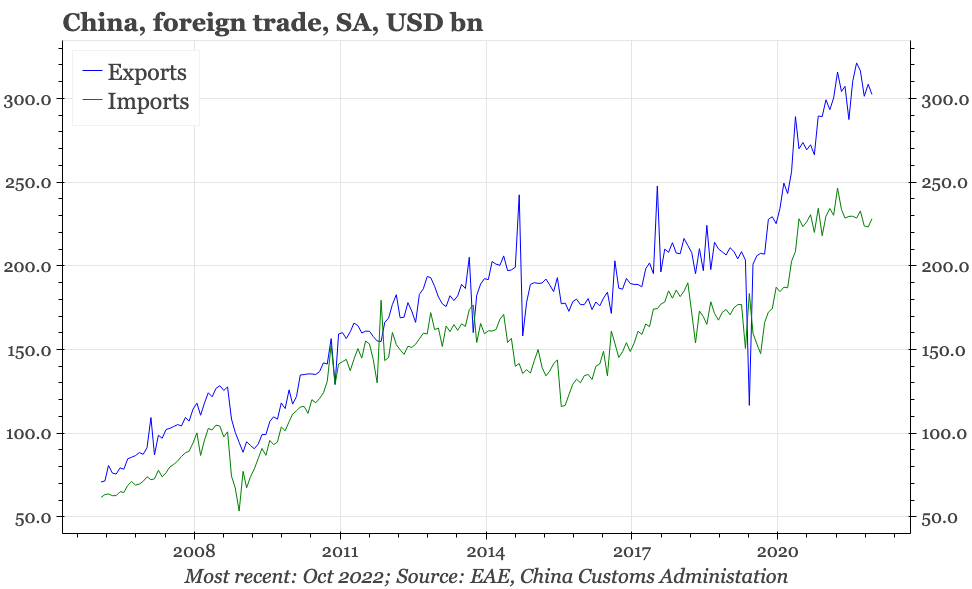

YoY export growth fell to zero in October. More downside is ahead, though surging car shipments suggest autos might buck this trend. Import demand is also slowing. It should contract aggressively in the next 6M, though that looks pessimistic given commodity prices and imports in the PMI.

October foreign trade

China's exports haven't turned down as sharply as those of neighbouring economies, but it is very likely that even for the mainland, external demand is past the best. Exports in October fell slightly, back to the same level as August, leaving them 6% below the peak in June.

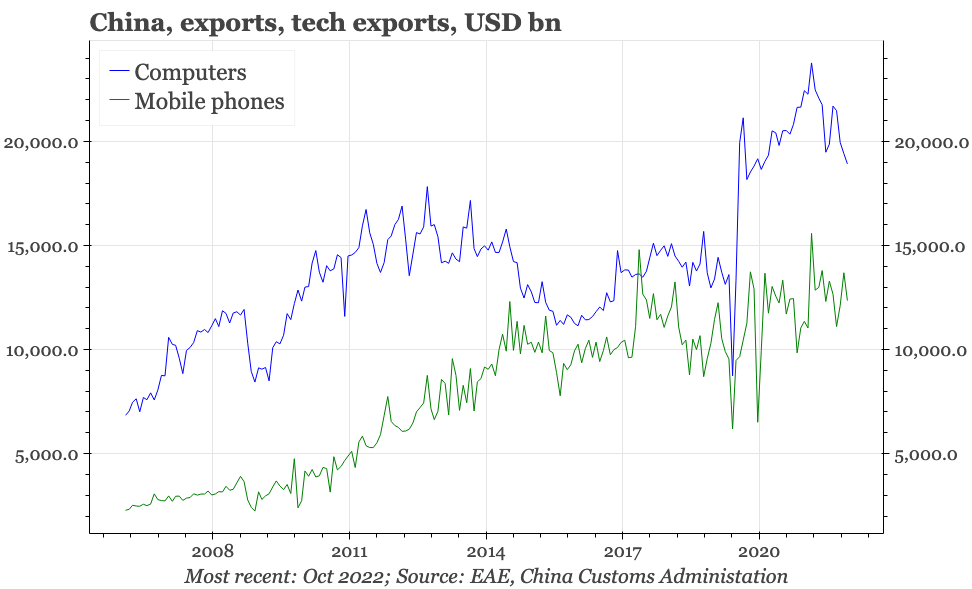

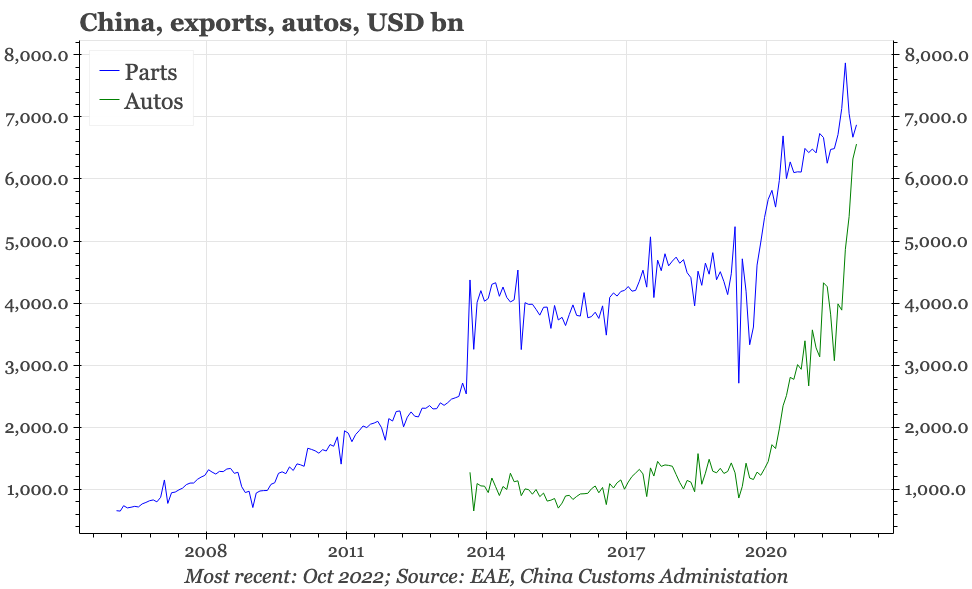

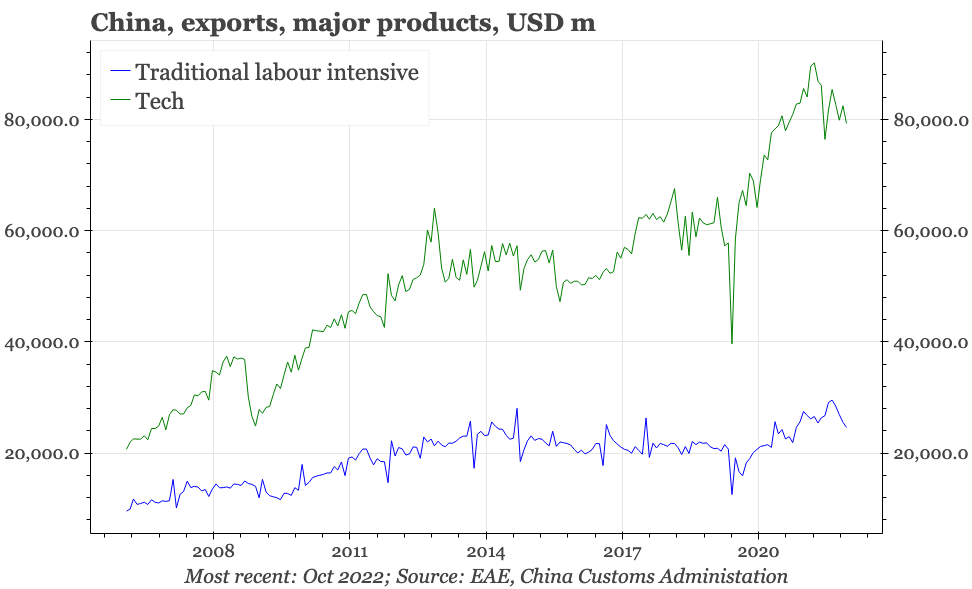

Shipments of traditional exports like clothes are now starting to fall, but the turn is most obvious in exports of tech products. Overall, those have now fallen 12% since the all-time high reached at the beginning of this year, with sales of computers down by a fifth. In terms of products, the one sector that is bucking the trend is autos, which rose again in October. Car exports have now risen by a multiple of seven since 2020. Given the strategic and capital-intensive nature of the industry, this increase is significant from a global perspective. That said, it is coming off a low base, and even now, autos only account for 2% of China's total exports.

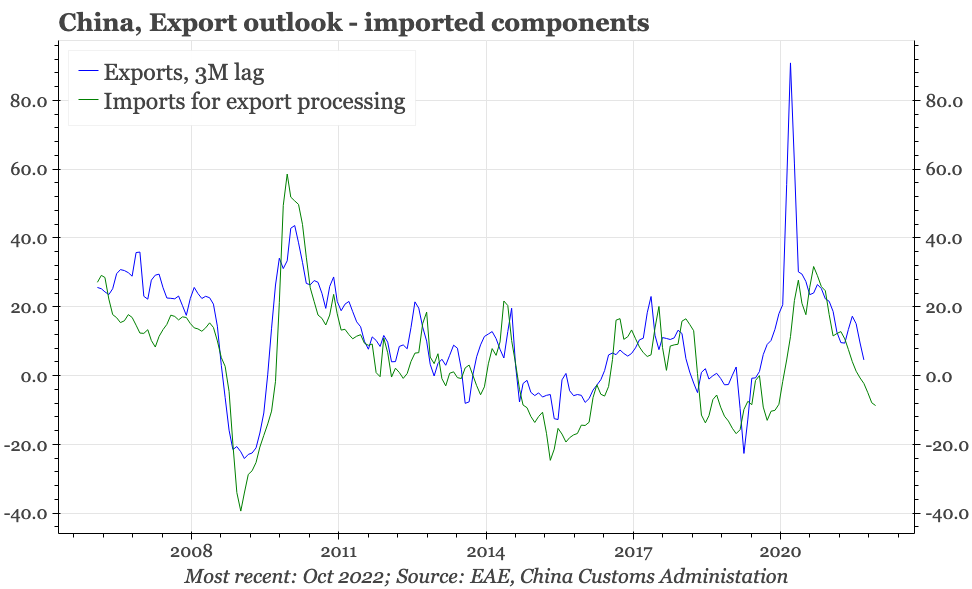

According to China's data, exports to the US have already fallen by 15% (US data for Chinese imports indicate the fall has been greater still). But shipments to the EU, while softening, still look elevated. Our regional model continues to point to downside risk for overall Asian exports in the next few months; the fact that today's data shows imports of components softening again in October keeps the outlook for China consistent with that picture. From basically unchanged YoY this month, it is probable that exports will be contracting by around 10% YoY by early next year.

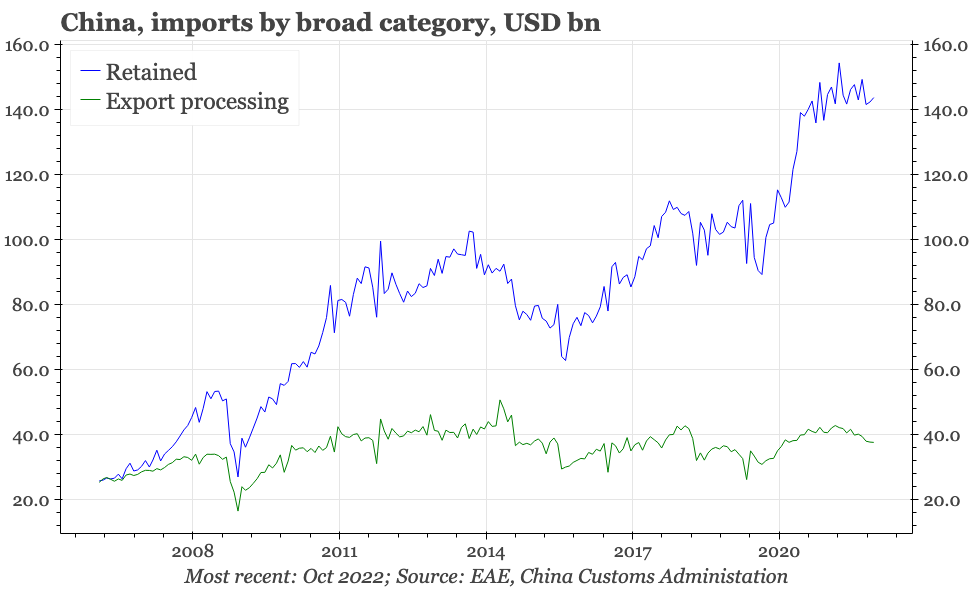

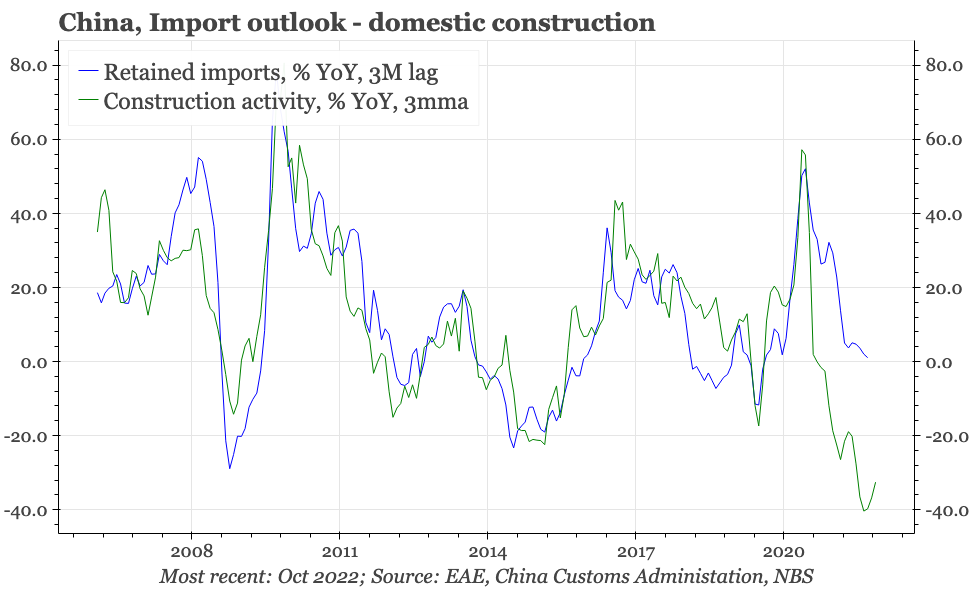

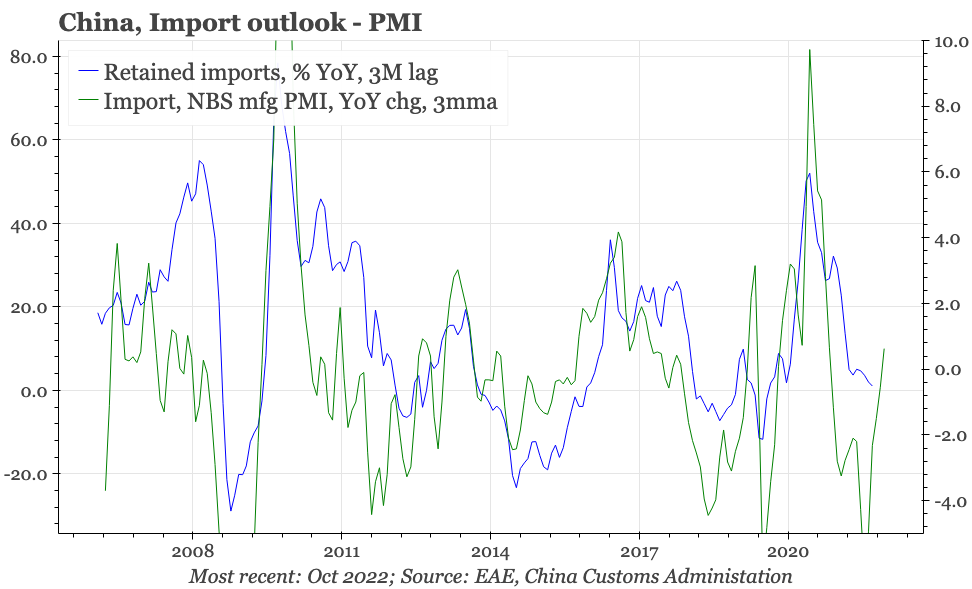

The YoY change in retained imports was also about zero in October. That isn't at all surprising, as retained imports tend to follow the domestic construction cycle, and the depression in that suggests retained imports will be contracting as much as 40% YoY in the next six months. That forecast might prove overly pessimistic, depending on what happens with commodity prices. The PMI also shows import orders have started to pick up, which is worth noting, being another tentative sign that the domestic economy has started to bottom out.

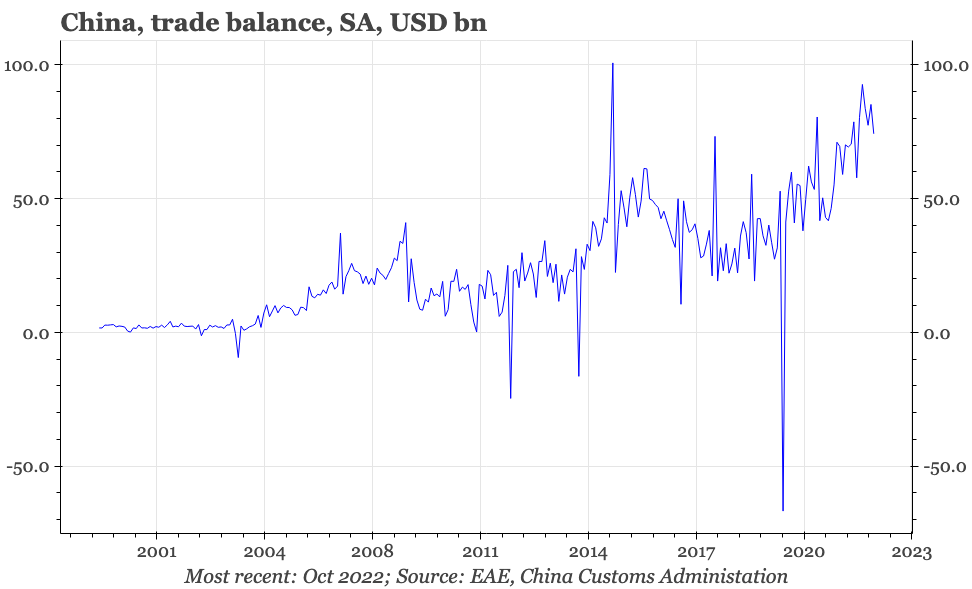

The peaking of exports is starting to feed into the trade surplus, which at last has started to decline. It does though remain large, and is an important support for the current account surplus. That said, the customs trade surplus would suggest that the surplus on merchandise trade within the current account surplus should be much bigger than it is. It isn't yet clear what explains this discrepancy.