China – taking stock

The latest fall in Covid-19 cases could lift activity in August. But with property still very weak, inflation momentum softening and exports slowing, it feels that any upturn in growth would be short-lived.

It is possible to find a few bits of positive news for the cycle. There's been a renewed decline in Covid-19 cases, which fell to 277 yesterday, down from over 800 a week ago. Furthermore, it is helpful that financial market conditions – outside specific sectors – remain loose, with short-end rates low and onshore spreads are generally tight. The construction PMI also improved in July, which could be a sign of government stimulus gaining traction.

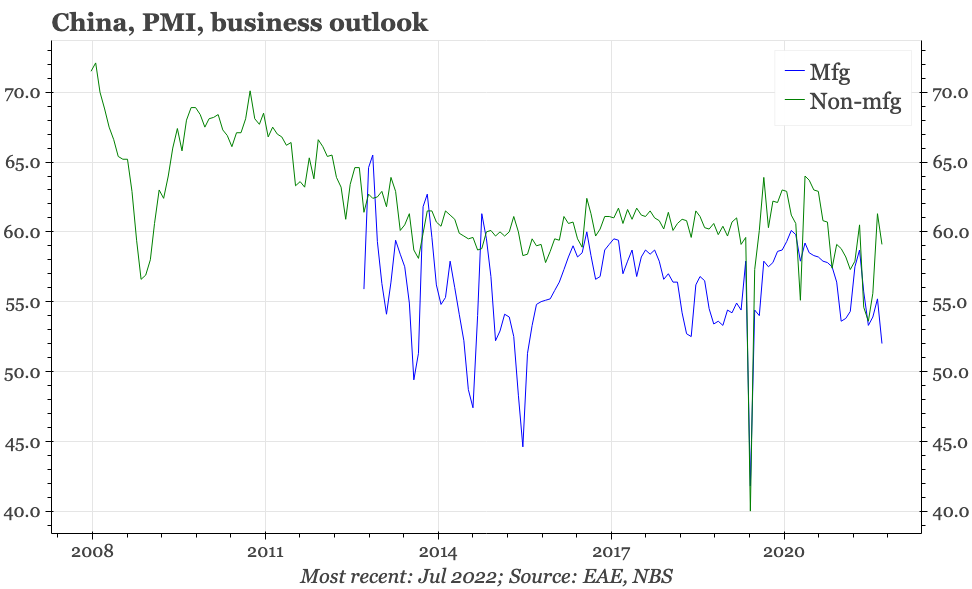

Most other datapoints, however, have been negative, and continue to suggest that activity growth is more likely to slow. Four developments are of particular importance. First, there is the weakness in yesterday's official July manufacturing PMI. The National Bureau of Statistics blamed that partly on seasonality, which isn't a great explanation when the headline series are supposed to be seasonally adjusted, but is even less convincing as a reason for the fall in the outlook score to the lowest since the Wuhan lockdown. Since that time, business expectations have remained reasonably buoyant, suggesting companies think the frequent cyclical difficulties would prove temporary. It is important that this underlying optimism now shows signs of fading.

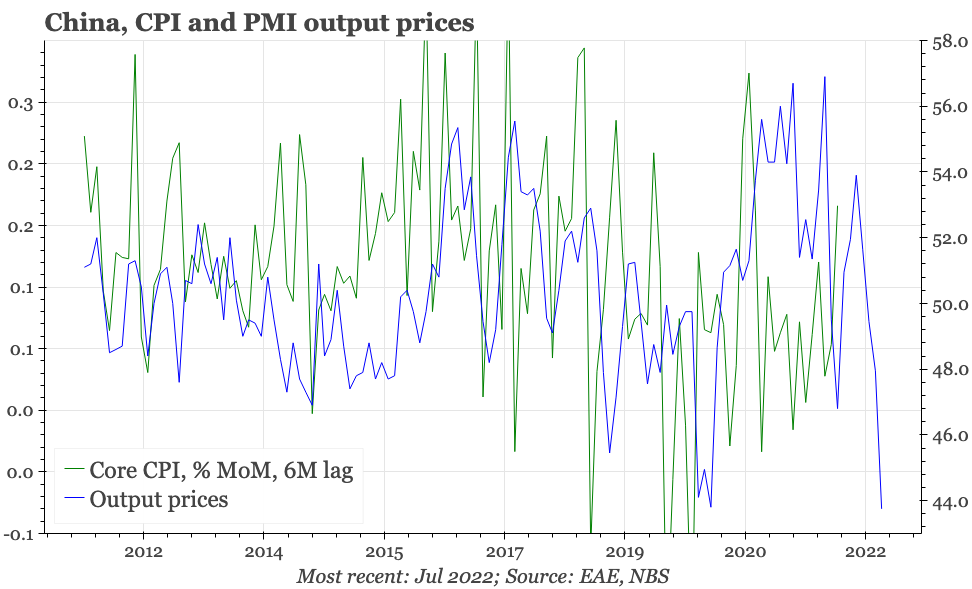

Second, inflation momentum continues to weaken. In many other places in the world right now, this would be a welcome development. But in China, given inflation is already relatively low, a further move down increases the risks of deflation. The weakness of output prices in yesterday's PPI does indeed warn that core CPI could already be falling.

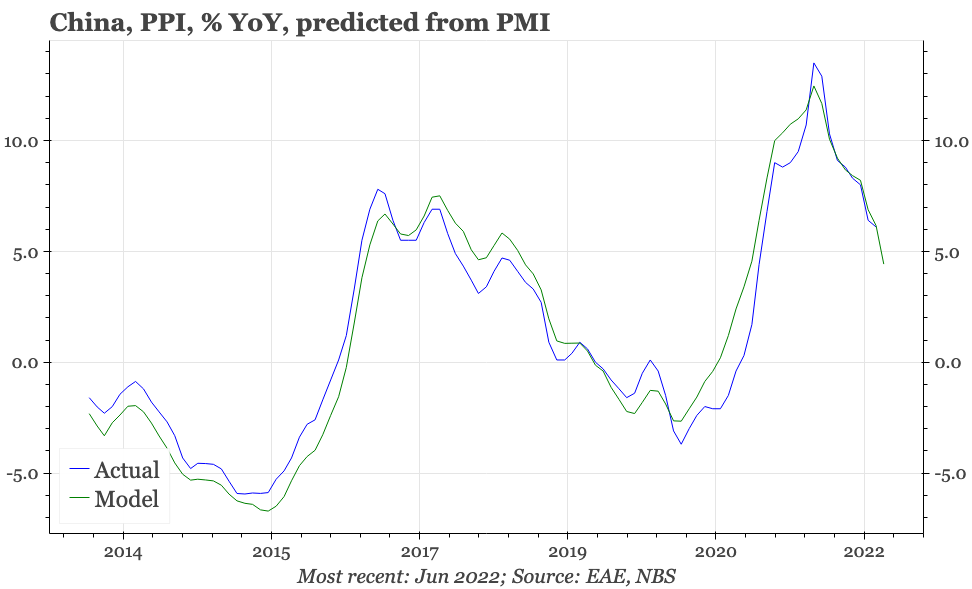

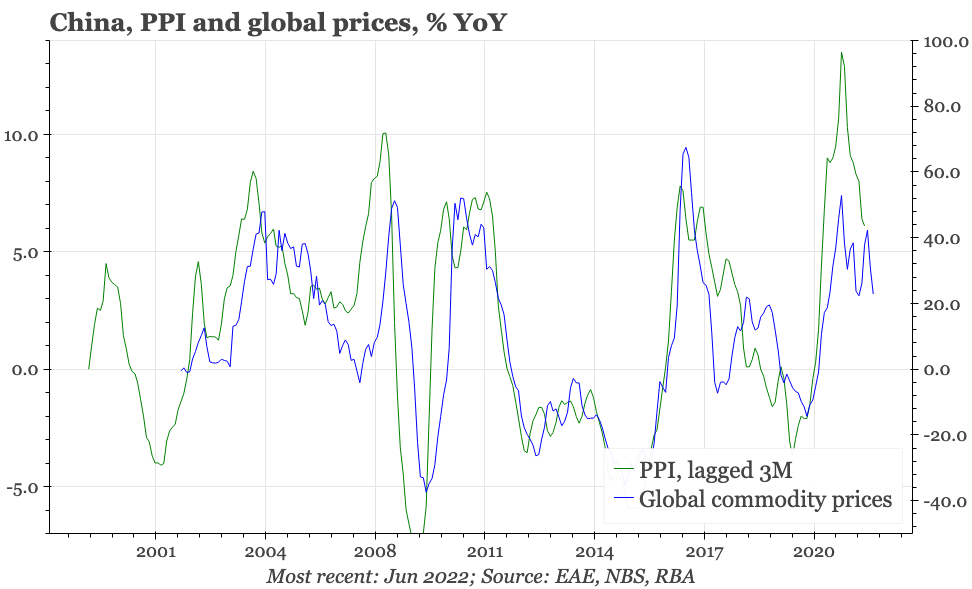

Input prices were also weak in July, indicating PPI inflation last month of 4.4% YoY, down from 6.1% in June. That is probably good news for smaller, downstream firms. But falling PPI isn't usually associated with strengthening activity overall. Moreover, while PPI above 4% isn't particularly weak, other leads suggest there's more downside for PPI inflation beyond July. Lower inflation that dampens nominal GDP won't help flatter China's debt profile.

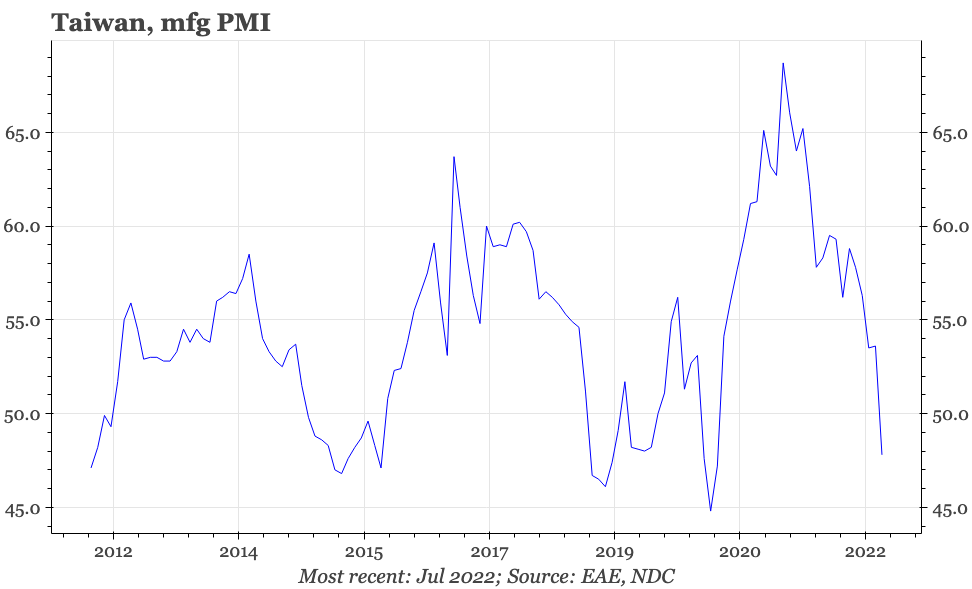

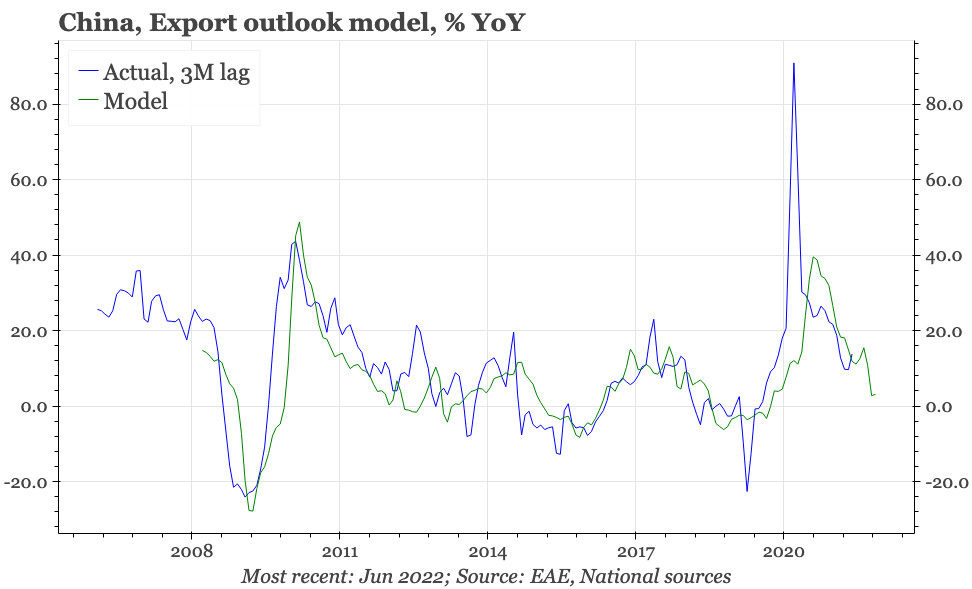

It also continues to look like the region's pandemic export boom is over. Taiwan's PMI today fell to 47.8, with new export orders down to just 36.6. Other datapoints haven't been that weak, with Korean exports in July edging up. But still, while the end of boom doesn't necessarily mean bust, it does seem likely that export growth will be in single-digits at best in 2H22. That's an important development for China, given exports have helped offset some of the macro weakness stemming from the problems in the property sector.

And the real estate sector still shows no signs of turning around. Early data show momentum remained poor in July, in terms of both property prices and transactions. Sentiment towards property developers did improve for a while last week on the back of reports of government action to address the mortgage strike by buyers of unfinished properties, but the mood remains fragile at best.

Last week's usual July Politburo meeting to discuss the economic situation exhibited a bit more concern for the real estate sector, notably putting a reference to “stabilising” the market before the usual (these days) notice that “property is for living, not speculation”. But that's an incremental change, continuing the cautious easing since last September. Given that gradual approach hasn't turned the market around yet, it is not clear why this latest shift will be effective.

The government is relying on other means to support growth, particularly infrastructure investment. There was an indirect reference to that in last week's statement, with a call on local governments to use funds raised from the ramped-up special bond issuance of 1H22. So perhaps economic activity can improve while property is in the doldrums, and export weak. That would be one way of interpreting July's better construction PMI.

But it would be easier to buy into that way of thinking if the improvement wasn't only visible in the construction PMI, and for example was also showing up in new orders in the PMI and pricing. It could just be timing, but at least for the time being, it feels like downside risks are continuing to grow, which points to continued weakness in equities and lower interest rates.