China - weekly update

Policy rhetoric is becoming easier, and FCI is easing. But there are two big headwinds to any of this having an impact: investor scepticism, and covid.

In the days running up to the May Day holiday, which ends tomorrow, there were two developments which should be helpful for the cycle. For one thing, official actions continued to be incrementally more doveish. There were two examples just on Friday. Early in the day came the statement on economic policy from the Politburo. That delivered more pledges on tech regulation, and the language on property was the both the broadest and most explicit of this policy cycle. Later, the PBC gave details of its two new two re-lending programmes, one for supporting science and technology innovation, and the other for "Inclusive Elderly Care Services".

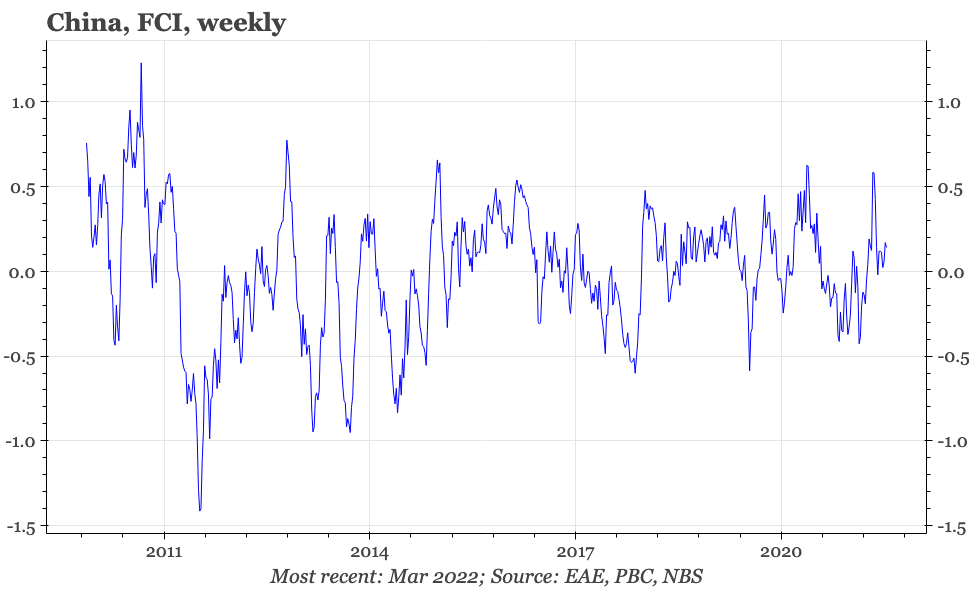

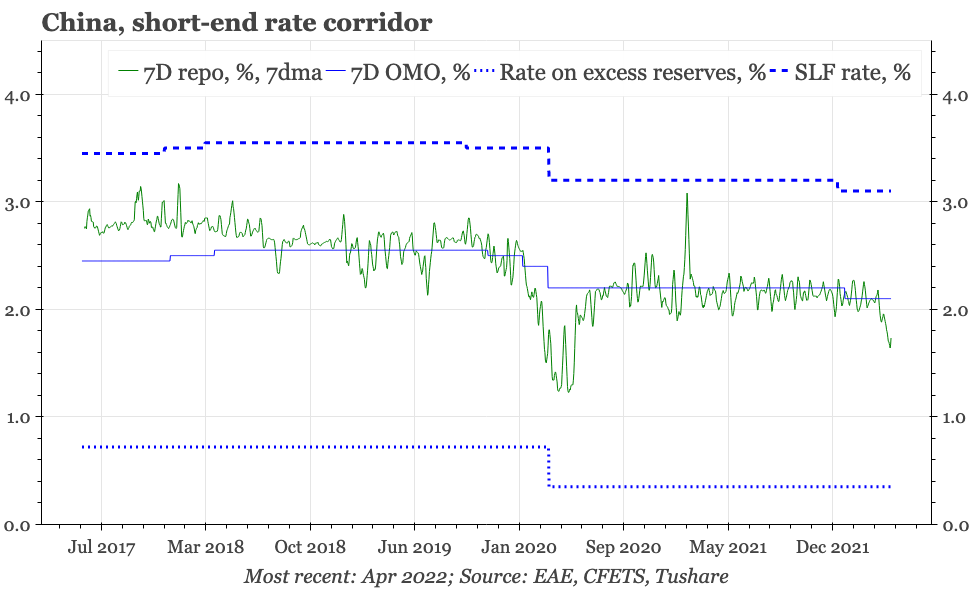

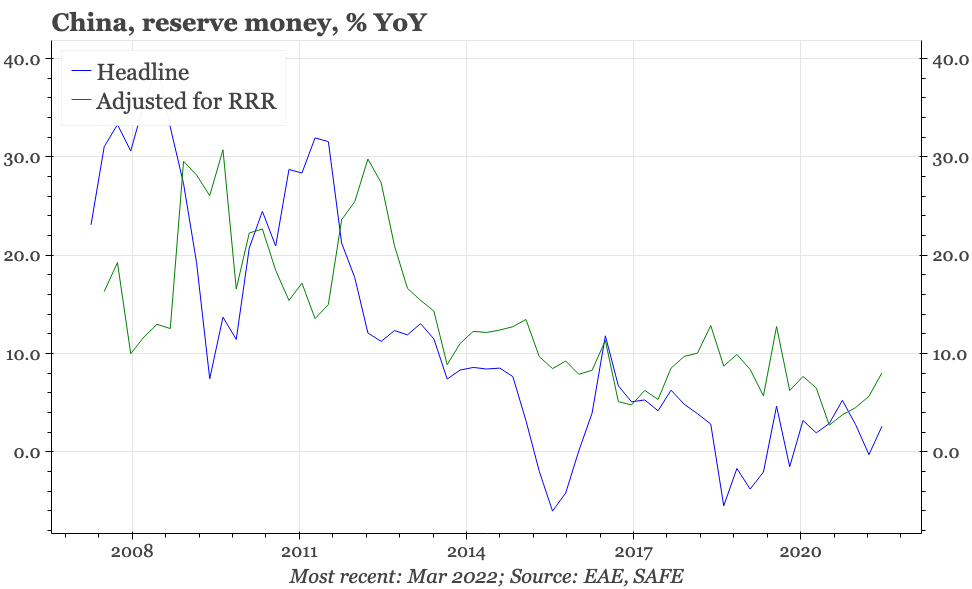

In addition to the general doveish tone of policy, it should also be useful for the cycle that onshore financial conditions have been easing. My FCI remains somewhat loose, at a level that suggests the PMI should be a bit above 50. For financial conditions, the collapse in equities obviously isn't helpful, but that is being offset by the weakening of the CNY, a tightening of spreads, and a modest steepening of the curve. The latter change has been helped by front-end rates, which have fallen more sharply than at any time since the first wave of covid in 2020.

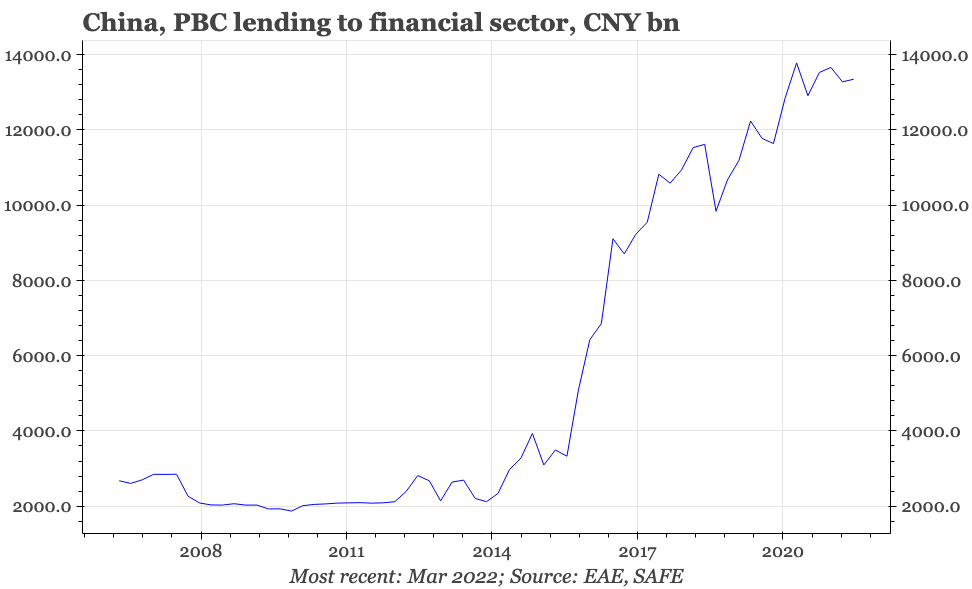

These two broad trends - government easing, and an actual loosening of financial conditions - should obviously be related. This time, the PBC hasn't yet cut official interest rates, but that front-end rates have fallen anyway does suggest the central bank has been pushing extra liquidity into the economy. The two new re-lending schemes, totalling CNY240bn, are part of this injection, though that's only equivalent to 0.6% of the assets currently on the PBC's balance sheet. By comparison, in the cycle of central bank easing in 2015-17, its lending to other financial institutions rose by CNY6trn.

The long-suffering equity market did react positively to these developments on Friday, and some of the gains at least have persisted in Hong Kong as the offshore market opened on Tuesday. But such policy-related bounces have been seen a few times in recent months, never to sustain. One obstacle is official credibility. At the beginning of 2021 that was on the up, with a sense in some quarters that the government could do no wrong. But after a torrid few months, there is a lot more scepticism, and more of a feeling that officials can actually do no right.

The switch from one extreme to the other probably means the current scepticism is overdone. But it will take more than a supportive government statement to prove that. As an illustration of the skittishness, there was a new kerfuffle this week caused by the Hangzhou government announcing an investigation of a "certain" Ma. Many were quick to assume that meant Jack Ma of Hangzhou-headquartered Alibaba. Those particular rumours have been laid to rest for now, but for a sustainable bounce in the beaten-up tech sector, either the government needs to produce some kind of tangible reprieve, or the market will need some time to be assured that no major new regulation is coming.

Of course, for macro, it now isn't enough just for the government to show it is sincere in wanting to turn the ship around. Some of the challenge, as with tech, is overcoming investor scepticism. For example, there's been even more doubt than usual about the accuracy of government data in Q1 suggesting a bottoming out of real estate activity. Statistics from the non-official China Index Academy (CIH), suggesting property prices rose MoM for the third consecutive time in April, don't on their own do much to tackle this scepticism, because: local government measures to stabilise the market are likely affecting measured prices; the change in CIH prices seems amazingly small (a 0.02% rise in April); and - for what its worth, given the magnitudes of the shifts - the momentum of change is now down, with the change in April coming after rises of 0.03% in both February and March.

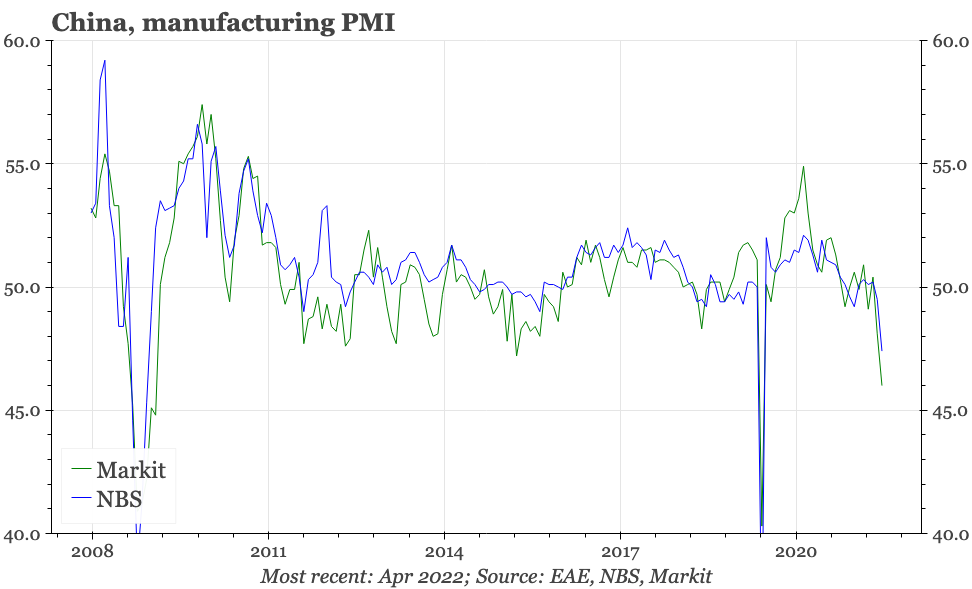

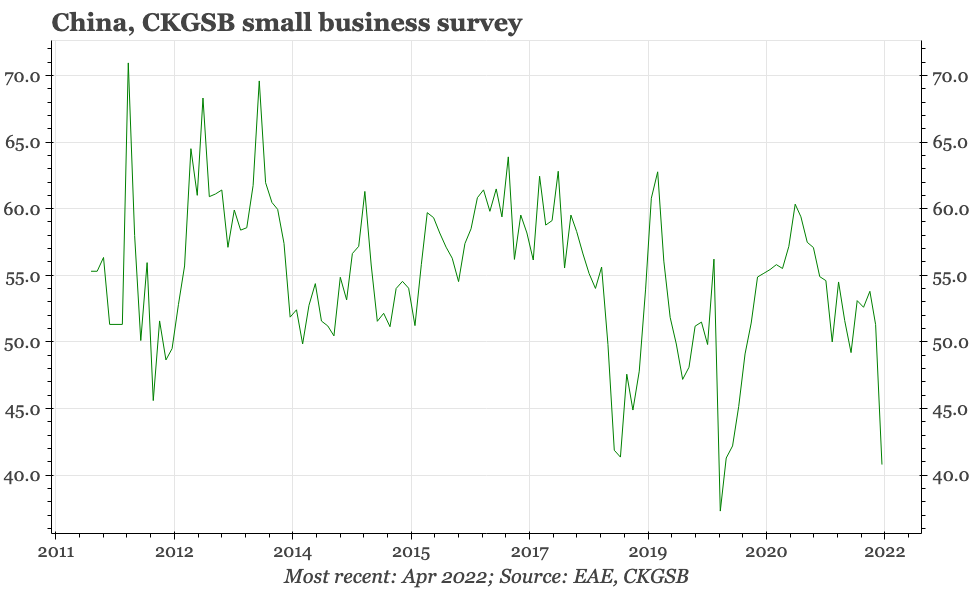

There is of course a good reason for property momentum to be fading: the covid crisis. In all likelihood, the restrictions the government is rolling out to try to get back to zero covid mean that GDP is once again contracting. That's the message even of official data, given the weakness of both the manufacturing and non-manufacturing PMIs from the National Bureau of Statistics in April. The Caixin manufacturing PMI also fell again in April, as did the all-economy survey of smaller firms from the Cheung Kong Graduate School of Business.

Without covid actually getting back to zero, the threat will remain of the sort of lockdowns that have been seen in Shanghai, and thus the damage inflicted on the national economy in the last few weeks persisting. On this front, the news of recent days is mixed at best. The overall incidence of covid in Shanghai continues to fall, but the city continues to find new cases in people outside of quarantine, which is a problem economically because achievement of "zero covid in the community" is a key government criteria for broadly relaxing the current restrictions across the city. In the rest of the country, there's been no rise in cases, and that includes Beijing. But the authorities in the capital continue to look worried, banning all in-house dining just before this most recent holiday began.