China – where we're at

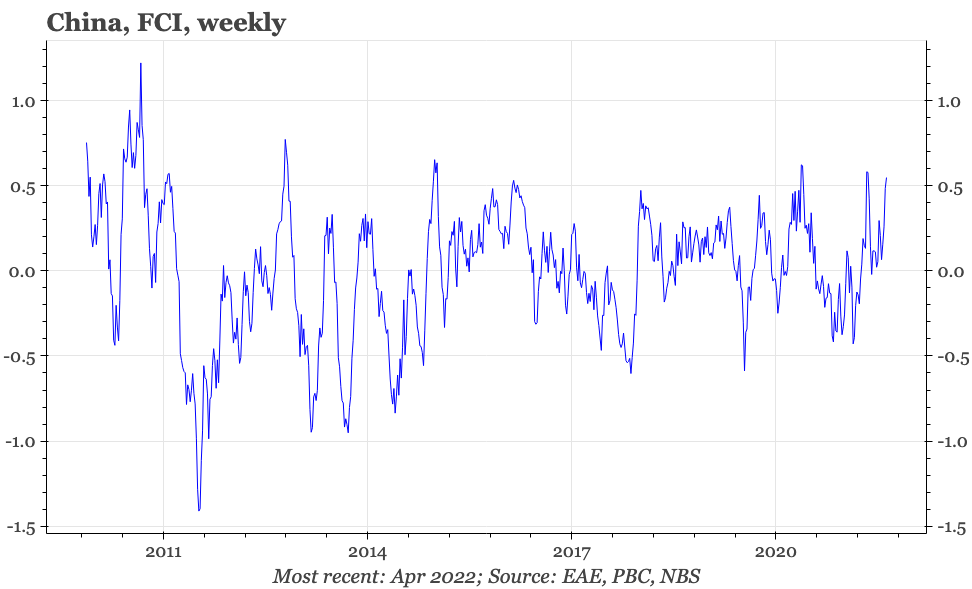

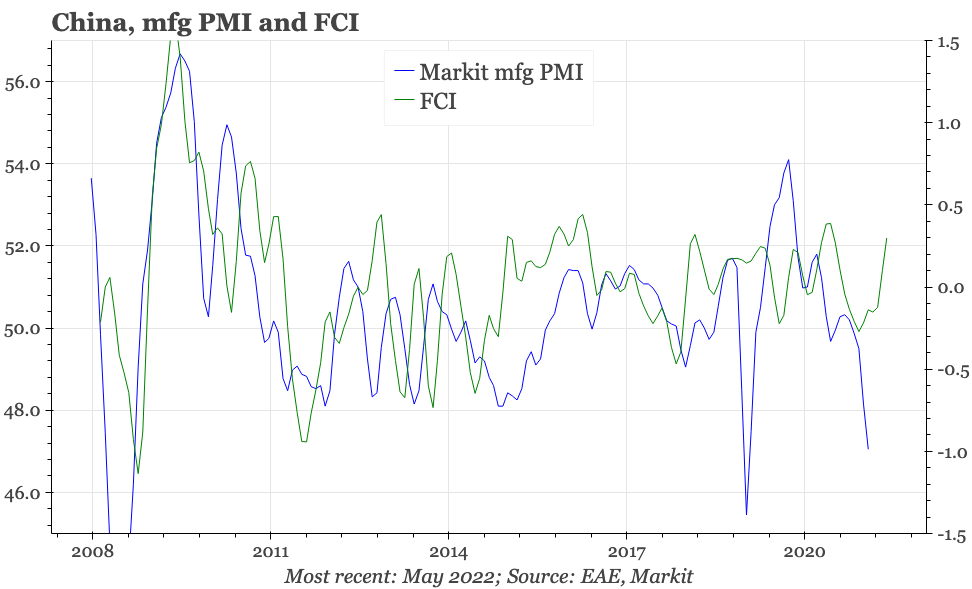

There's been more policy loosening, but it remains incremental. Upside risks to activity do exist as FCI continues to lift, but it is difficult as yet to get too excited about the outlook.

The Covid-19 situation is generally improving, with total reported cases falling to 86 yesterday, down from 122 the week before. Beijing continues to relax restrictions, with dine-in service at restaurants re-commencing from June 6th, and there are signs of overall activity levels rising. But it remains a slow process. There's also some underlying nervousness about a return of Covid-19 – though given the government's zero covid stance, there now always will be – with 3 cases in the community in Shanghai yesterday.

The economy also has quite the hole to climb out of. The Caixin services PMI for May, released today, did improve from April, but at 41.1, suggests overall activity contracted sharply for the second consecutive month. That survey was conducted before Shanghai's official re-opening on June 1st. Since then, activity has risen, but passenger numbers on the metro on Thursday last week were still just 30% of average levels in 2021. The 12M outlook score in today's PMI did come in above 50, so there's some optimism about recovery continuing. But that optimism is mild: according to Markit, the 12M outlook score remaining below the long-term average.

Any recovery in activity last week might have been dulled by the holiday on Friday for the Dragon Boat Festival. At a headline level, the fall over the long weekend in domestic tourist numbers and spending compared with 2021 wasn't too dramatic, at -10.7% YoY and -12.2% respectively. But domestic travel has been depressed ever since the Covid-19 pandemic first emerged. It is quite remarkable that tourist spending this year was just 65% of the 2019 level.

The authorities continue to be active in trying to bolster the recovery. The State Council on May 31st announced a basket of 33 measures, in six groups: fiscal; monetary; “stabilising investment and encouraging consumption”; food and energy security; supply chains; and people's basic livelihood. There also continue to be more PBC releases than normal, with the latest being the transcript of a press conference to add more flesh to the bones of the State Council's financial policies. The Sate Council has also sought to create a bit more space for economic recovery by outlawing nine types of Covid-19 prevention measures that it considers to be overkill. The first in the list being it is “not permitted casually to expand exit restrictions from medium- and high-risk areas to other regions”.

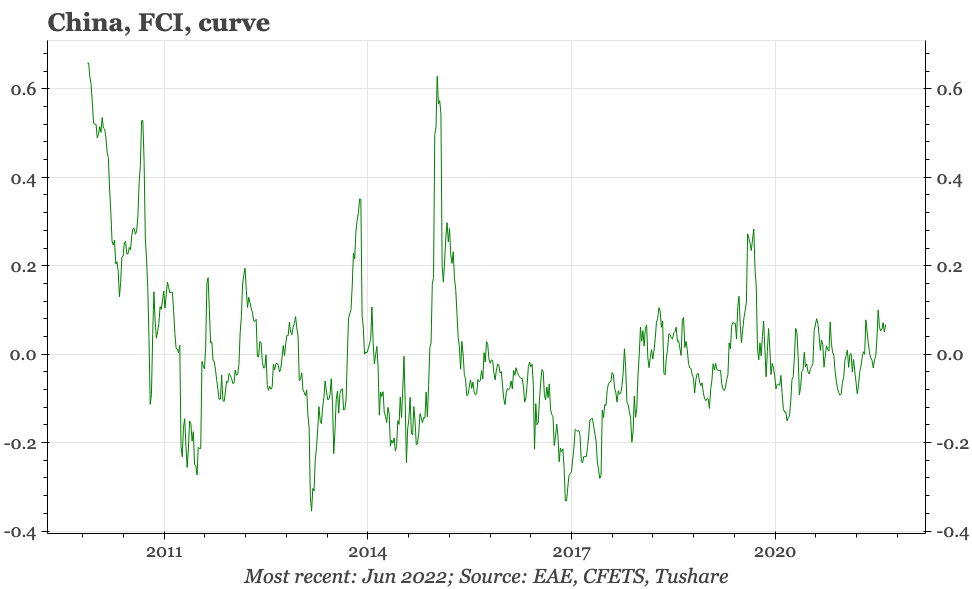

But while they've been busy, all this action hasn't created much excitement. Equities are rising modestly, and the curve is a bit steeper, but there's nothing like the moves in fixed income seen at the end of the Wuhan lockdown. Market sentiment seems underwhelmed.

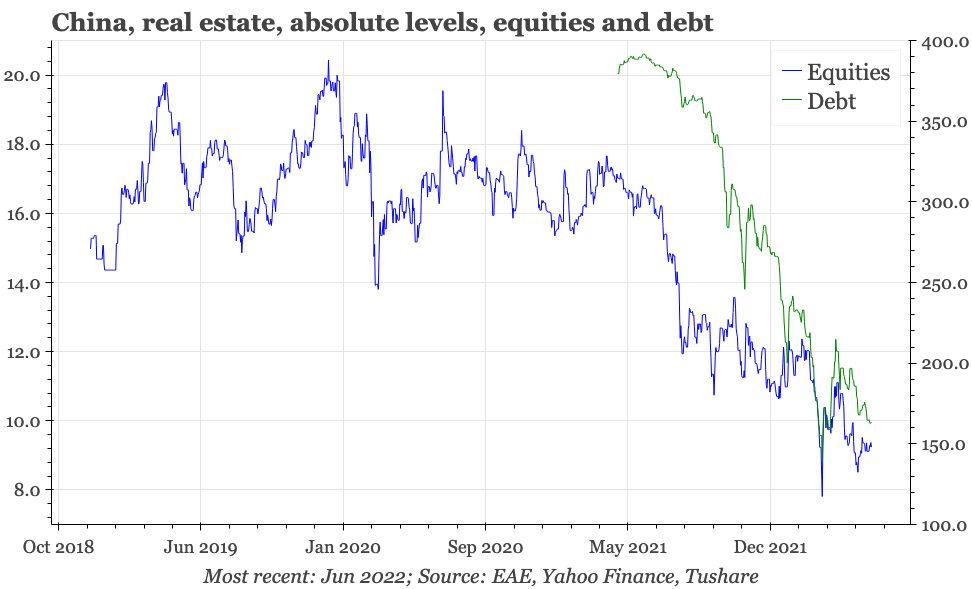

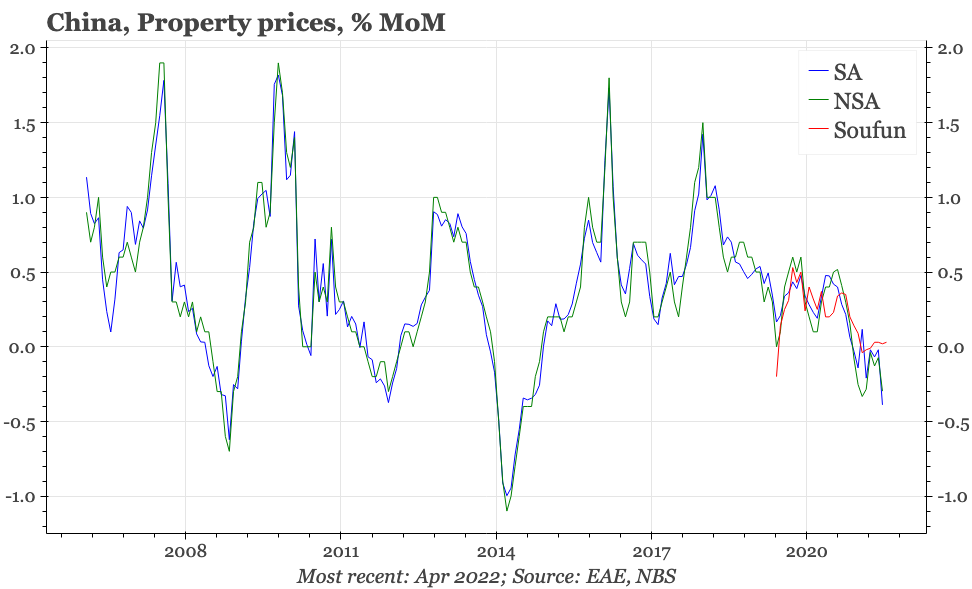

This sense of disappointment feels reasonable. Some measures had been pre-announced: for example, the MOF had already indicated that this year's local government special bond quota would be completed by August. Others lack specificity. The PBC continues to say it will implement the government's plan of “stabilising land prices, house prices and expectations”, but hasn't offered any new details – though data from CREIS do suggest property prices managed to eke out another small gain in May. Related to that is a third deficiency: policy remains incremental. It is good news for activity that the scale of tax cuts for businesses is being expanded, but there's no big new initiatives. In particular, direct, large-scale help for household incomes hasn't come onto the agenda, and there's no indication in public discussion that this will change.

If the authorities continue to succeed in achieving zero covid, and thereby avoid new lockdowns, then there's probably been enough policy announced to ensure the economy can at least climb some way out of its current deep hole. And perhaps there is some upside risk, if property prices normalise to the current low level of mortgage rates, and last week's renewed loosening in Financial Conditions Index can be sustained.

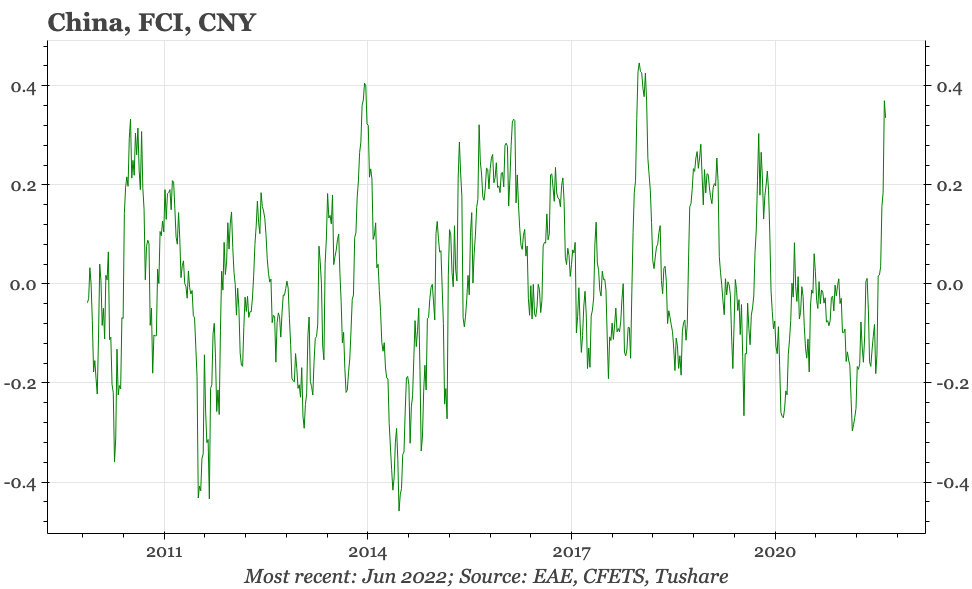

But the loosening of FCI is now being driven primarily by the weakening of the CNY. That is a helpful development for the cycle, but is perhaps not as powerful for the domestic activity as shifts in the curve or equities would be. Moreover, without the authorities being more aggressive in boosting household incomes, the heavy lifting of recovery needs to be done by the old economy. The ongoing financial weakness of homebuilders – at least as indicated by debt and equities – doesn't suggest the old economy is in a good position to pick up the slack.