China – where we're at

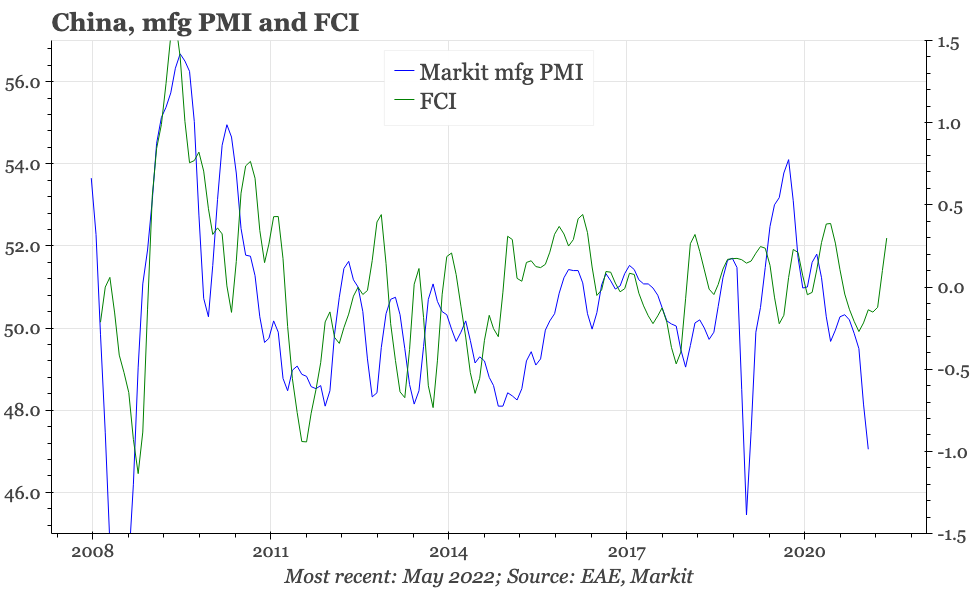

Our FCI remains accommodative. That, depressed activity, the fall in covid cases and a corporate sector that is somewhat of an even keel should ensure modest recovery. However, without a clearer policy push from the government, a real surge in growth in 2H feels unlikely.

Covid-19 numbers have come down again, with official data showing only 23 new domestic infections nationwide yesterday. That's promoting more relaxation of restrictions, with Beijing allowing students back to school, and some further afield localities even easing-off on mass testing. Not all the nervousness has gone away; as long as zero covid remains the aim, it never will. After finding around 10 cases in a couple of days, Shenzhen's Futian district imposed a partial lockdown this last weekend.

Still, as the covid situation has become more manageable, so the government's attitude towards other issues is returning to normal. In particular, it has become yet clearer that the government hasn't given up on growth. In particular, for the first time since Shanghai entered a lockdown, Xi Jinping himself has talked about this year's growth target, saying:

We will step up macroeconomic policy adjustment, and adopt more forceful measures to deliver the economic and social development goals for the whole year and minimize the impact of COVID-19

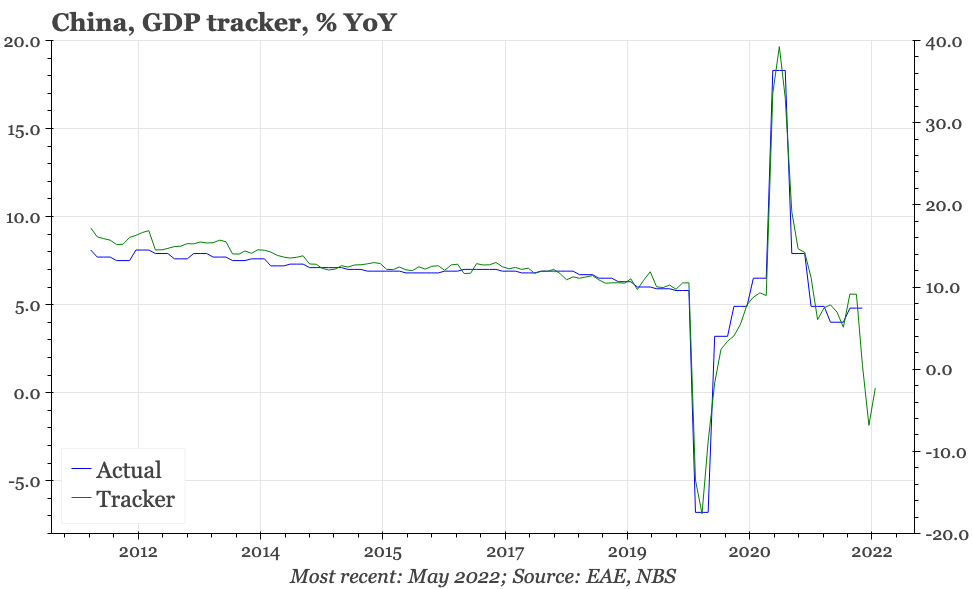

Given that a lot has happened in the months since, it may be worth remembering that the over-arching economic development goal that was set back in December 2021 was achieving GDP growth of 5.5%. Official data showing the economy grew by 4.8% YoY in Q122, up from 4% in Q421, already attracted a lot of scepticism. If government statistics show anything near 5% growth in Q2, the reaction is likely to be even more incredulous.

As covid numbers – and government restrictions – have receded, there have been increasing signs of activity improving. As one illustration of that, metro passengers numbers in Beijing and Shanghai are now back up to around half peak levels. But that doesn't undo the damage done in April-May, a hit that was very clear in the normal nationwide macro indicators for the first couple of months of the quarter. Our rough tracker suggests the economy contracted around 1% YoY in April-May.

In terms of the reported Q2 GDP numbers, the one obvious source of upside risk is the unknown, but likely big (and fungible) government expenditure on the covid prevention measures of the last couple of months. That could make a difference to official GDP data, though it clearly hasn't helped to make the economy feel particularly good. On its own, it also doesn't offer the prospect of any growth achieved in Q2 being sustained.

The government has been talking up infrastructure investment, so that might provide a boost to growth from here. There's also, finally, some signs of life in the other big driver of construction activity in China, with property transactions reportedly turning up. That is an important development, given the historical importance of real estate in the economy. However, that upturn in end-user demand is recent, and it hasn't done much to relieve the crisis that's been enveloping the suppliers of property. Homebuilder equities have bounced a bit in recent days, but debt has been trading back near the all-time lows.

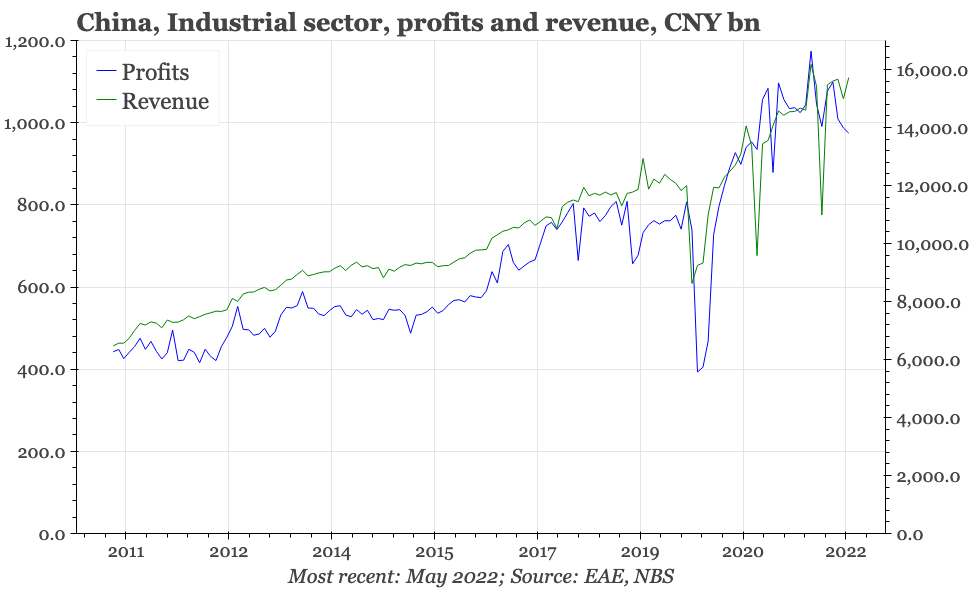

Outside property, industrial enterprises overall do seem to be in a reasonable state of health. According to data released today, profits in May did contract by around -7% YoY. But that fall partly reflects the high base from last year, when profits were growing at high double-digit rates. The absolute level of profits in the last three months has fallen, but remains quite high relative to history. Moreover, the rising trend in revenue after the first covid lockdowns of early 2020 still looks to be in place.

These profits data aren't comprehensive, measuring only the finances of larger, industrial firms. As a result, they exclude service-oriented and SMEs, precisely the sort of firms that have been hardest hit by the covid lockdowns. The upcoming CKGSB survey for June will provide some update of how these enterprises have been faring.

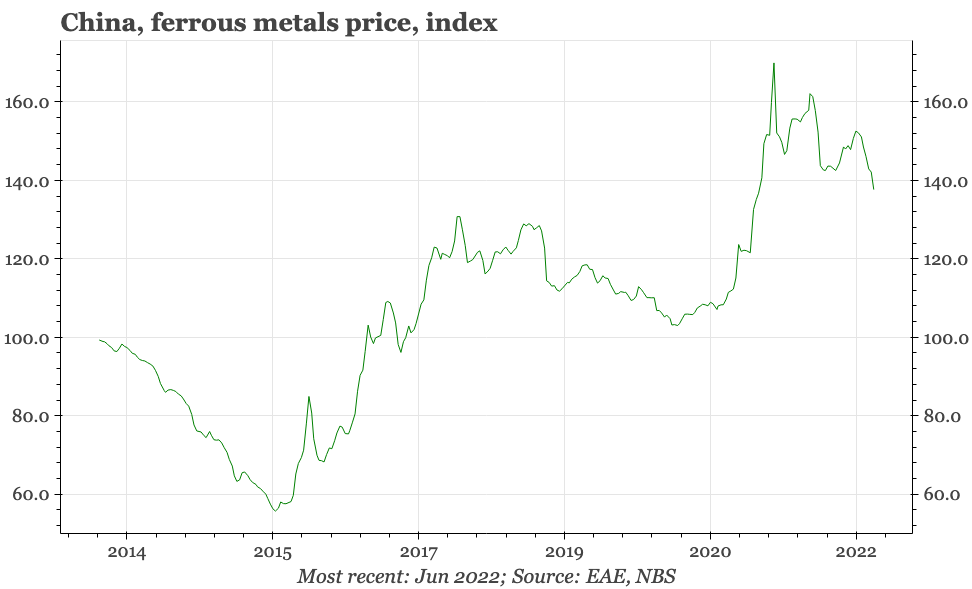

As for the bigger firms, the firmness of revenue has been helped by the big increase in producer prices of recent months. That has been a global phenomenon, but at least in China, there are signs that the rise has started to recede, with the latest update of the NBS's 10-day industrial prices data showing falls in all sectors outside of energy.

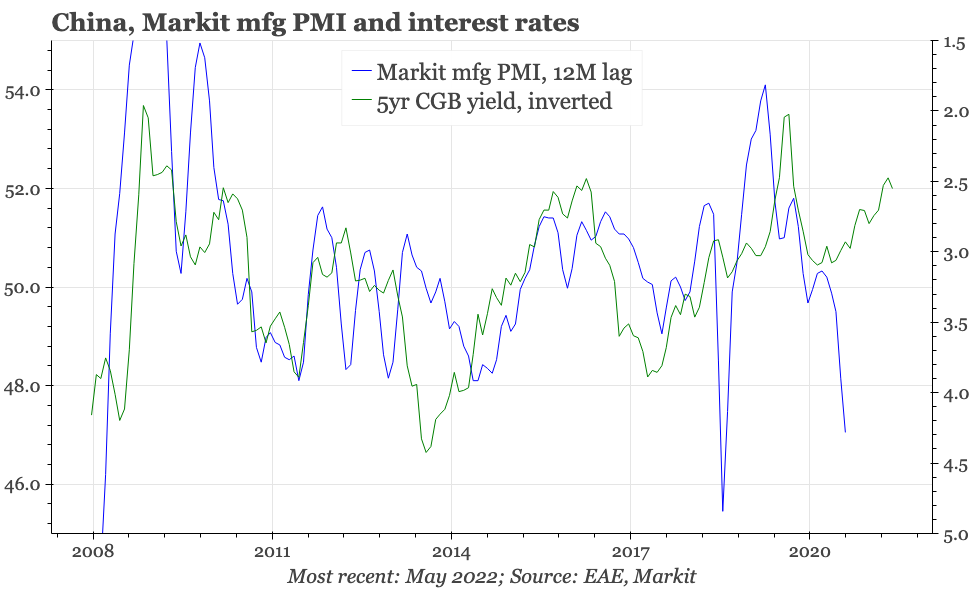

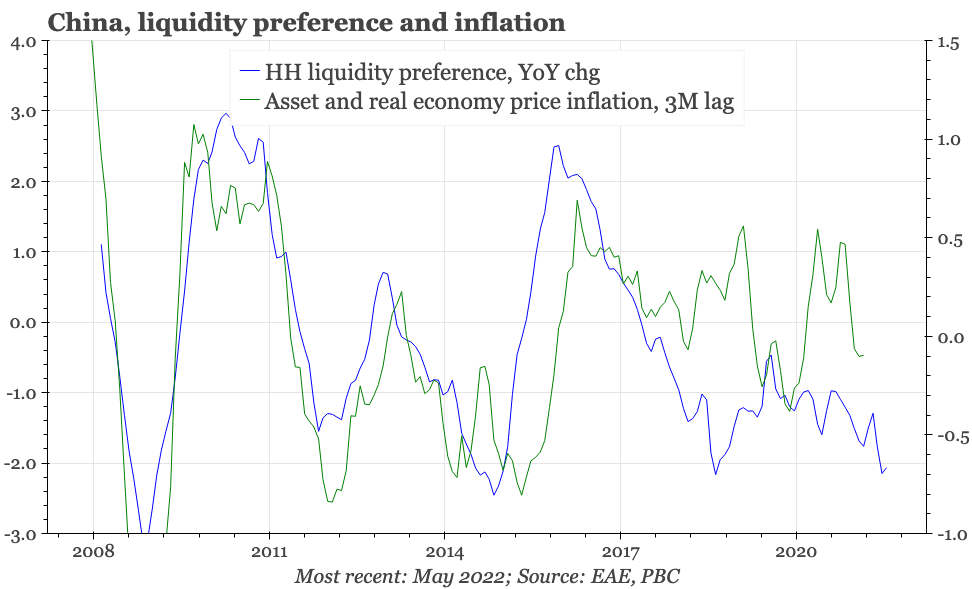

The turn in prices doesn't suggest that demand has been particularly strong in China coming out of the lockdowns. And if that is right, then it suggests that the government isn't on track to meet Xi Jinping's social and economic development goals. Perhaps we are going to see the “more forceful measures” that Xi promises would be forthcoming. With industrial prices easing and no sign of the sort of rise in household liquidity preference that would boost overall inflation, it doesn't like inflation is a barrier to more stimulus.

Overall, our financial conditions index continues to look accommodative. Given that and the low level of activity, the easing of the covid crisis and a corporate sector that has been on somewhat of an even keel, there is enough in place to support modest economic recovery. However, without a clearer policy push from the government, it still feels like a real surge in growth in 2H is a tail risk rather than base case.