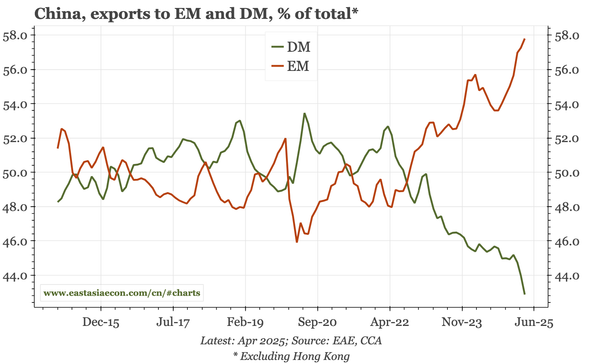

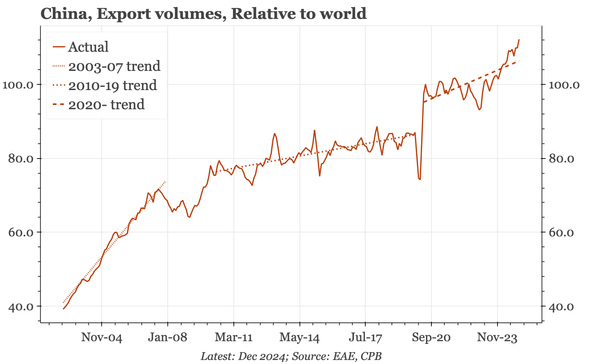

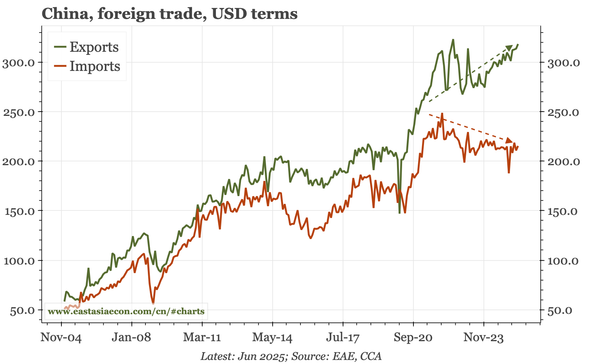

China – exports up again

There aren't signs – yet – of China's export juggernaut hitting a wall. The big fall in US exports eased in June, allowing overall exports to continue to creep up, reaching a new post-2022 high. Imports, meanwhile, continue to flat-line, so the trade surplus remains large.