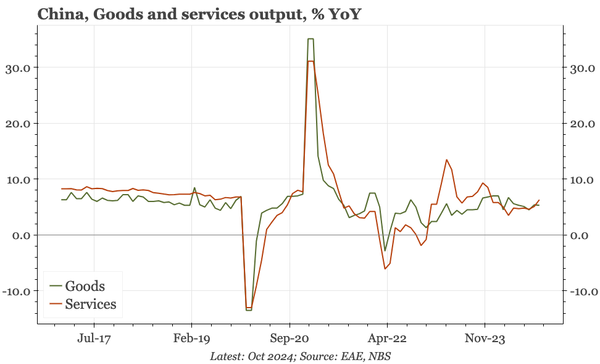

China – services output up, but not much else

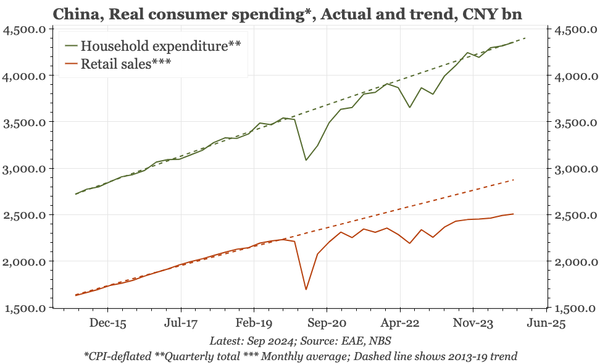

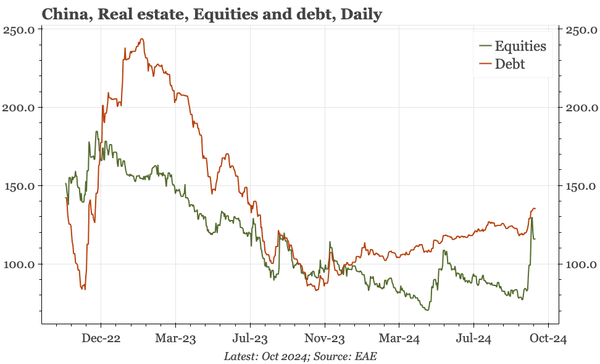

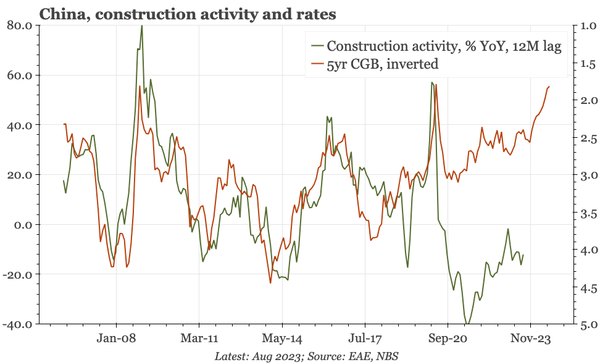

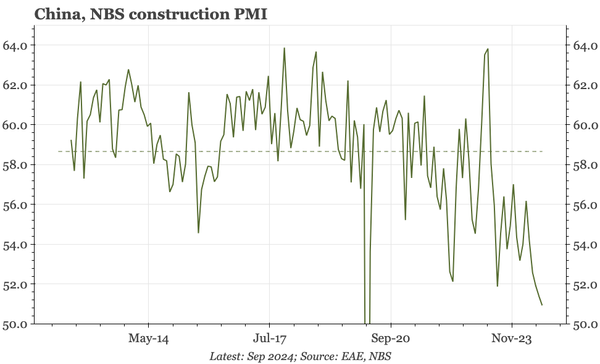

With a bounce in reported retail sales, it looks like economic growth in October got back to the government's 5% growth target. Overall, though, the tone of the data was rather mixed, with real estate activity in particular still extremely weak.