China – activity deteriorating again

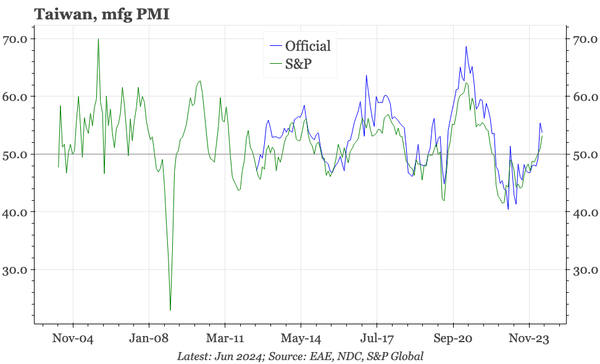

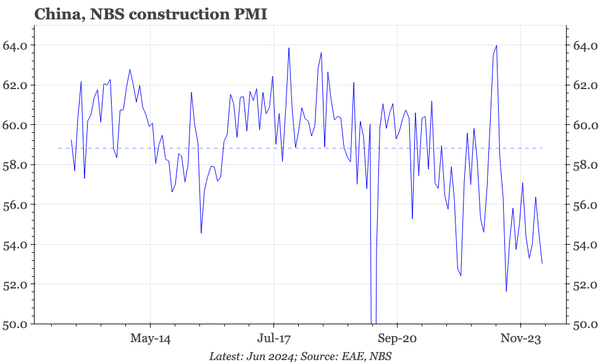

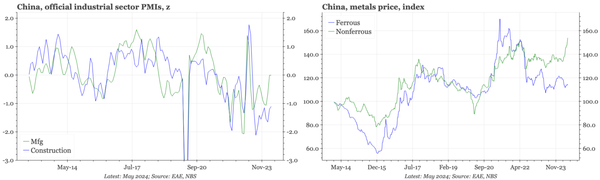

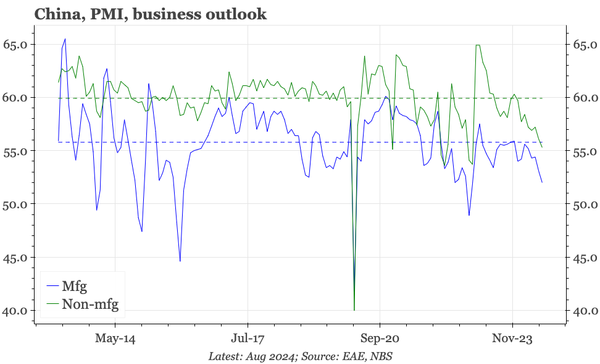

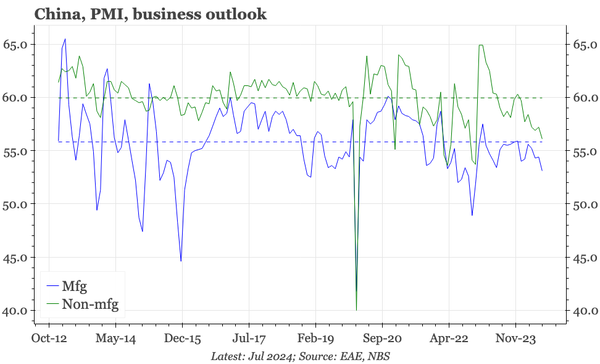

The PMI for mfg fell further in August, and while for non-mfg it ticked up, the details across the surveys were soft. The drops in input prices and jobs were particularly noticeable. Maybe the Caixin PMI sends a different message, but today's data show a cycle that is starting to deteriorate again.

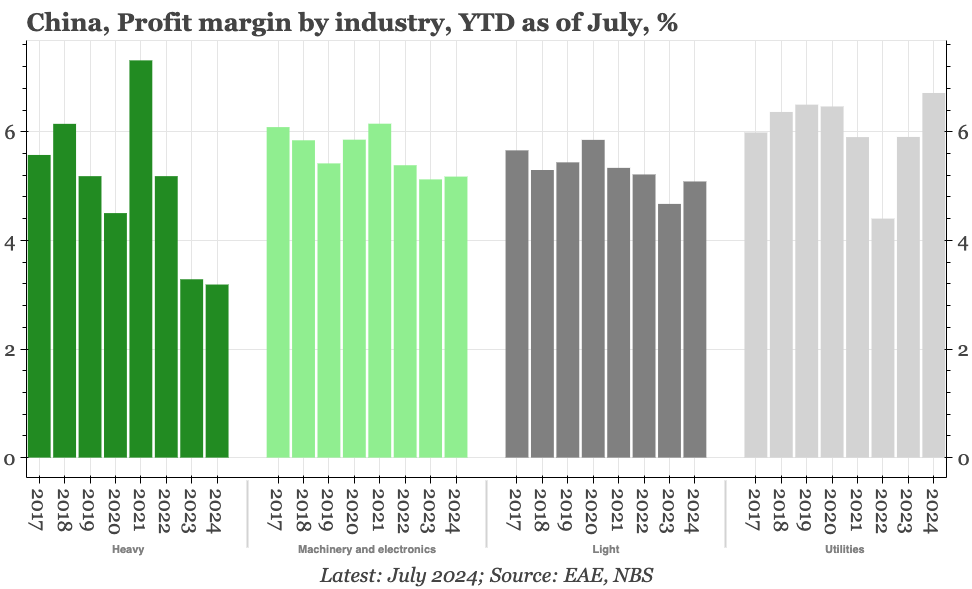

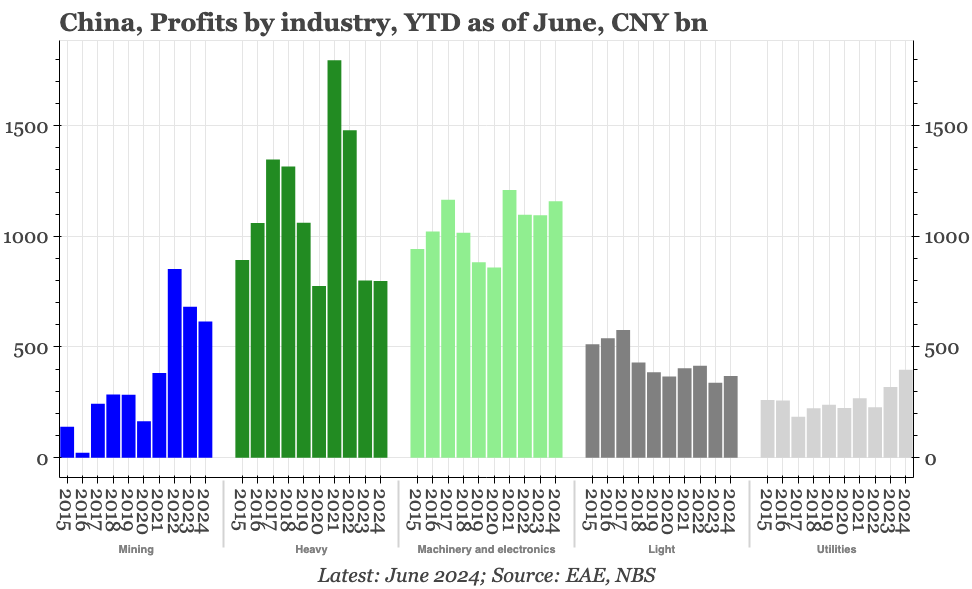

China – heavy industry still the big drag

Yesterday, officials claimed high-tech industry contributed 60% of the aggregate rise in industrial earnings through July. That's partly because profitability in heavy industry is so poor. Even then, overall profits still only rose 4%. New sectors still aren't strong enough to really lift the whole.

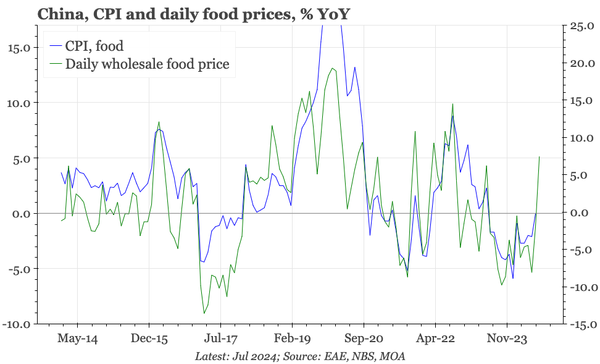

China – inflation up, but only food

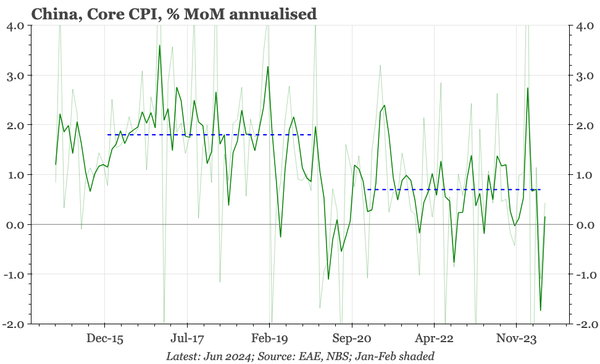

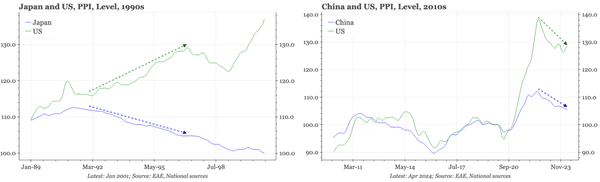

Just as inflation concerns ease elsewhere, there's an acceleration in China. Food prices have risen 7% YoY in August, the biggest rise in more than 2 years. However, while that complicates the deflation narrative, it isn't enough to change it, given a renewed fallback in PPI and weak M1.

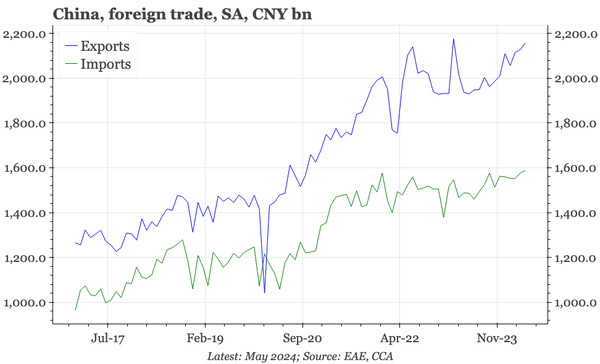

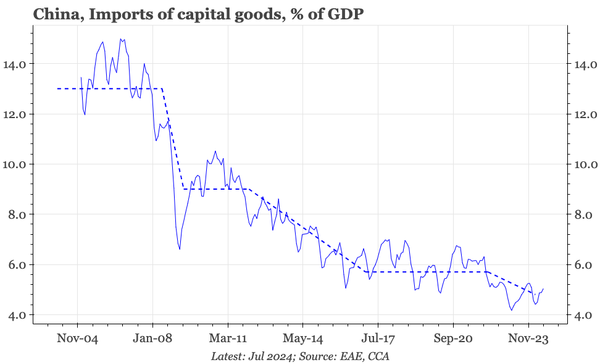

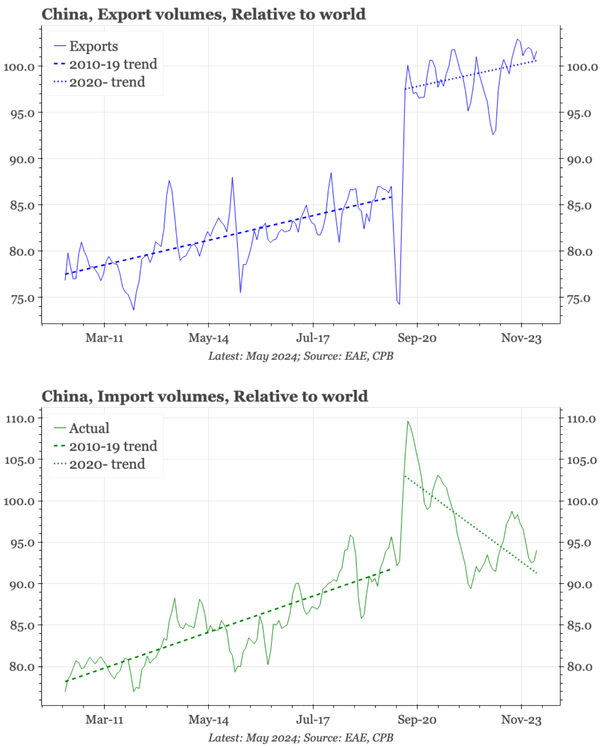

China – the big shift is imports

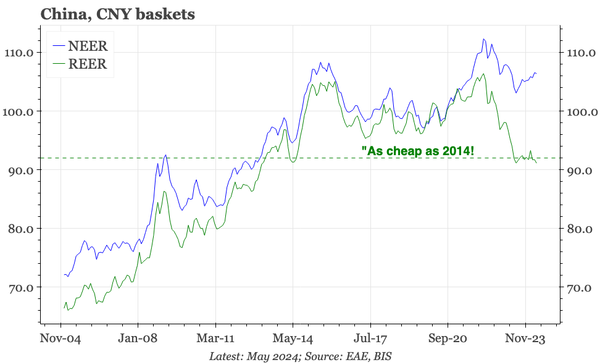

A chart-heavy note looking at some of the broader trends in China's foreign trade. Exports have been reasonably strong, but no more robust than they were before covid. The bigger change is in imports, which are weak, a trend that protectionism elsewhere will do nothing to resolve.

China – what's with manufacturers going broke?

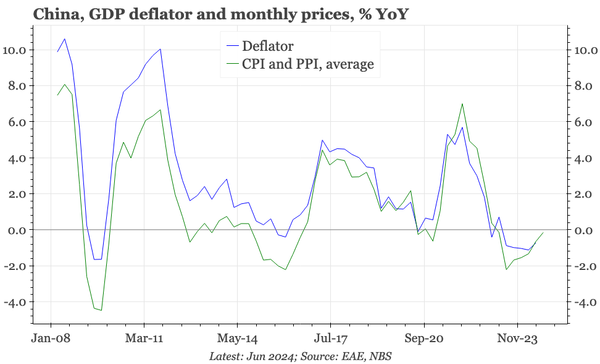

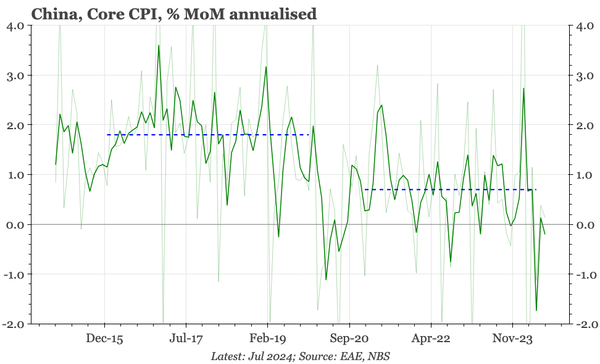

Rather than industrial policy, the better explanation for weak corporate finances is deficient domestic demand. Related to that, the biggest shifts since covid haven't been in export growth or PPI, but in imports and core CPI. Macro policy doesn't suggest this weakness is set to change.

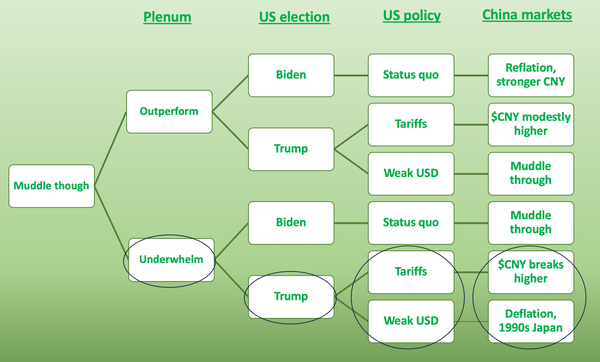

China – still muddling through

We can't see anything in today's data to shift market sentiment. Property remains in a deep slump, and retail sales are weak. But that's not new, and with some of the pressure coming off the CNY, Beijing will probably think its muddle through approach of incremental easing will continue to work.

China – perhaps a positive deflator in Q3

Today's property prices were very weak again, and that is important. But in the real economy, the deflator might still turn positive this quarter, because of the recent stabilisation of PPI, and the weather- and pork-propelled rise in food prices.

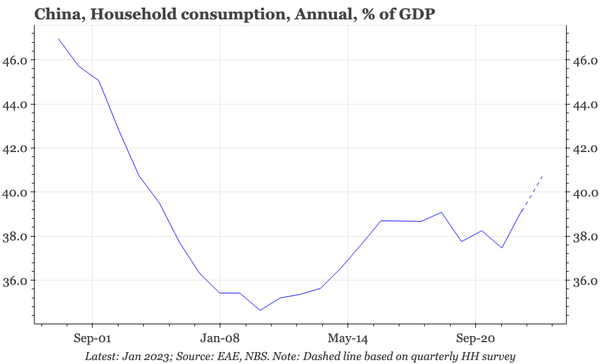

China – still the new normal

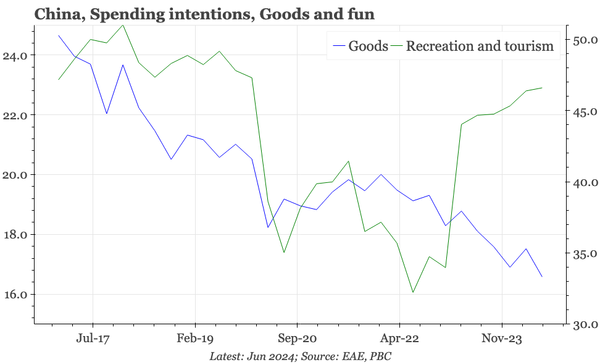

The PBC's Q2 survey shows consumption not especially weak, with the real post-20 changes in household behaviour being a shift from spending on goods to services, and from saving as property and riskier investments back to banks. The corporate survey wasn't bad either, but loan demand fell sharply.

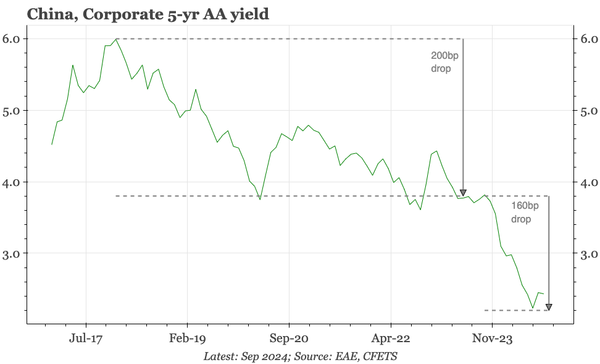

China – core CPI deflation again

The July price data offer more evidence that the food price cycle has turned. With less PPI deflation too, it is likely that headline CPI gets a bit of a lift. But core CPI inflation in July was once again very weak, which is enough of a reason to assume that the PBC will continue to cut rates.

China – imports more interesting than exports

July exports fell, but it is premature to call the start of a downturn. That's partly because of market share gains. These are solid, though not impressive enough to validate over-capacity. In terms of structure, the much bigger shift is in imports, which have completely over-turned pre-20 trends.

China – no cycle momentum

Our China cycle framework is that the muddle through of the last 18M is running out of road. The July PMIs look consistent with that, with weakness in pricing, jobs and confidence. The one remaining contrary indicator is the S&P mfg PMI, which has been strong, and for July will be released tomorrow.

China – deposits not as bearish as loans

Even allowing for a change in credit intensity, June headline credit and money data are bearish. The one positive trend is data through May showing household demand deposits no longer falling so quickly. That shift continuing would help sustain China's macro muddle through.