China – some nominal momentum

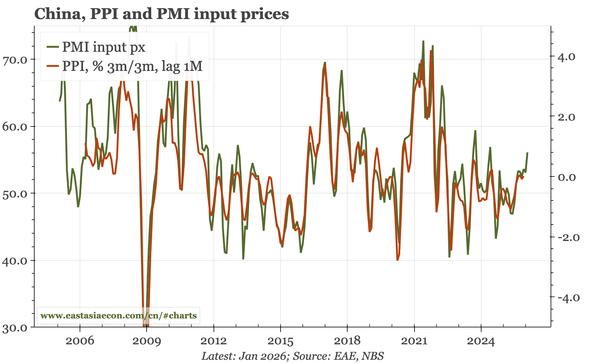

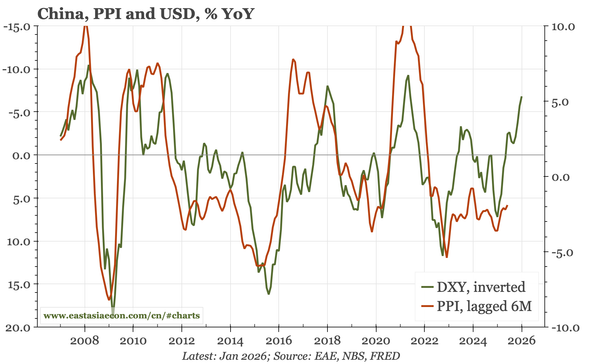

Today's official PMIs were below 50. That shows the domestic economy is weak – though the data were likely pulled down by the coming holiday. More interesting was the further rise in prices in manufacturing. That change relates to USD/global prices, but does suggest an upturn in nominal momentum.

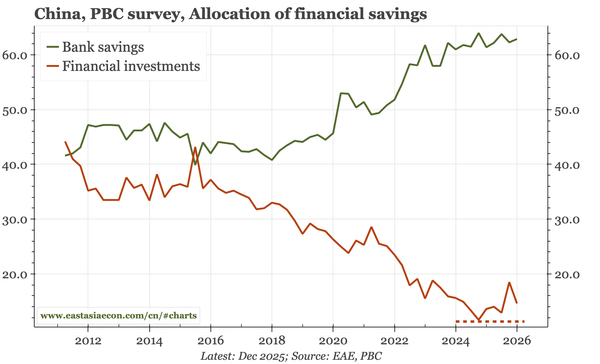

China – the end of the flight to safety

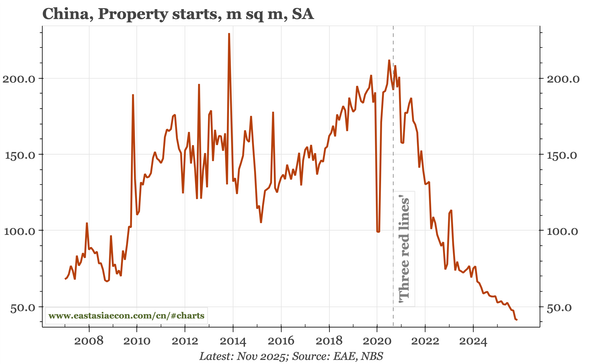

Like the actual monthly deposit data, Friday's PBC Q425 depositor survey shows a slowing of the flood of household savings into the safety of bank deposits. The structural deflation pressure caused by the collapse of real estate activity and the chaos of the covid lockdowns is beginning to ease.

China – nominal pick-up

Most important for markets is today's Q4 data is the pick-up in the deflator and nominal GDP, which external trends suggest can run further. In terms of the details, the data show two big discrepancies: collapsing FAI v industrial stability, and falling retail sales v rising consumption share of GDP

China – domestic so-so, external go-go

Some of the signs of domestic stabilisation I'd been tracking in 2025 faded into year-end. However, they didn't disappear entirely. China is also starting to benefit from the global tailwinds of weaker USD and rising commodity prices, creating upside risks for China's nominal cycle.

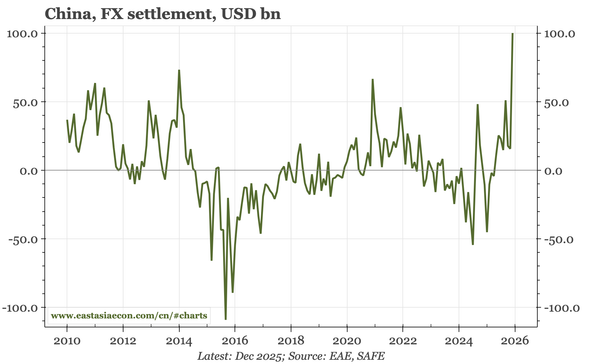

China – foreign flows stronger than domestic

China's release today of December data for money, credit and fx settlement tell three stories: domestic savings outflows have lost momentum, credit ex-government is looking a bit stronger, and capital inflows are really picking up. If right, the last dynamic is the most important for markets.

China – inflation up, for now

The second-derivative improvement in inflation is continuing, and should be seen in a better deflator when the Q4 GDP data are released later this month. However, there's not yet enough to think the trend can persist beyond Q126. One factor that could derail the improvement would be a stronger CNY.

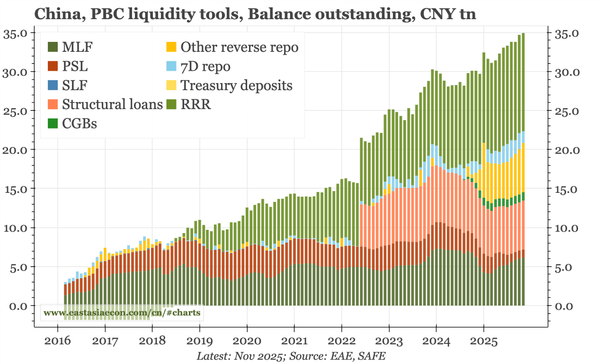

China – three positive monetary dynamics

Real economy developments still look negative for inflation. That the deflator nonetheless looks to be turning can be partly attributed to local food prices and global commodity prices. However, I think monetary factors are also playing a role, with three dynamics in particular worth highlighting.