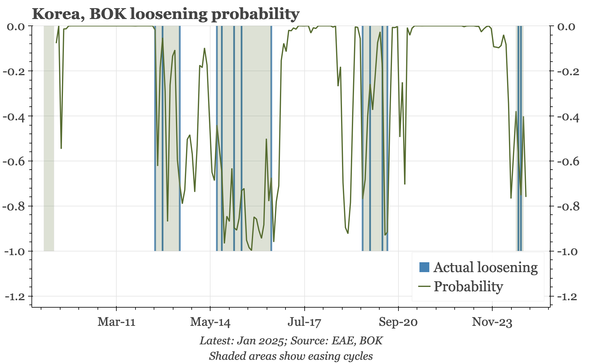

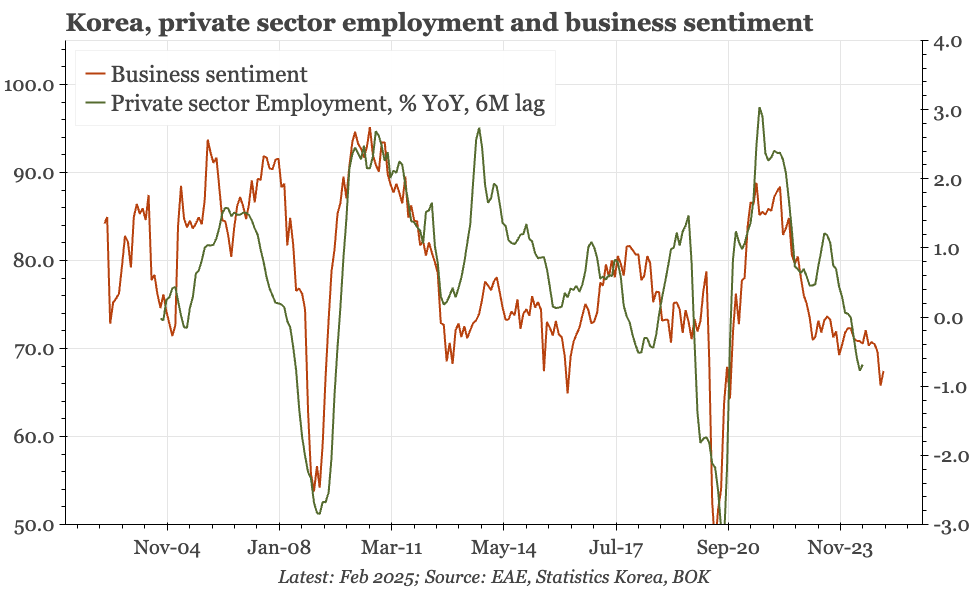

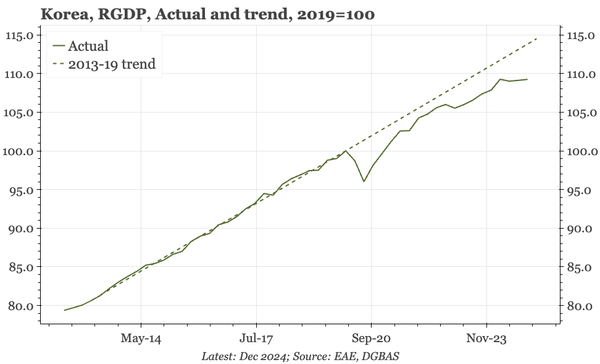

Korea – still in a cutting cycle

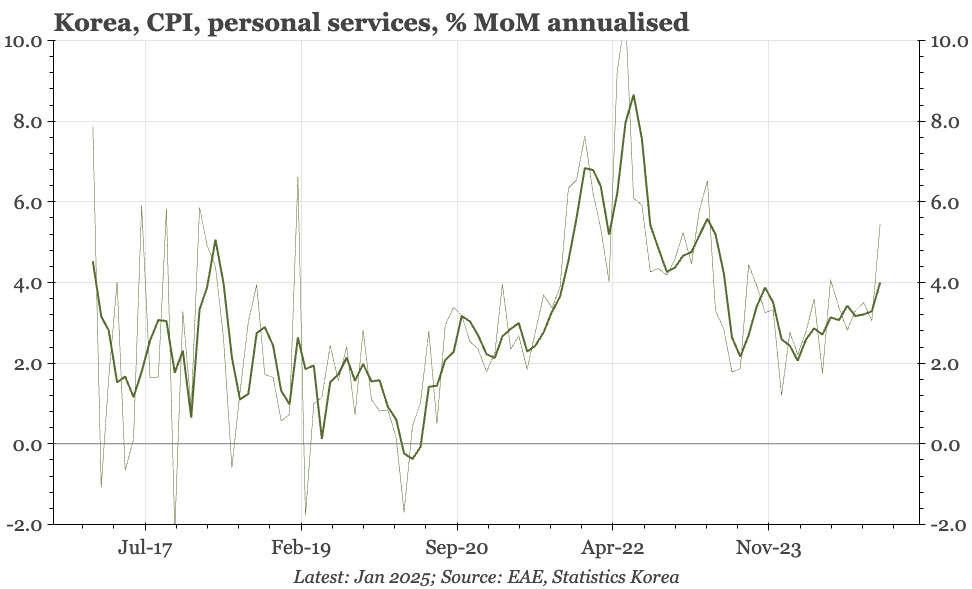

As it did in January, a BOK cut next week seems likely. Of course, the bank didn't cut in January, so this forecast risks whiplash. But to turn market pricing, the bank would need to indicate an end to loosening, which is unlikely unless it highlights household debt or services inflation.

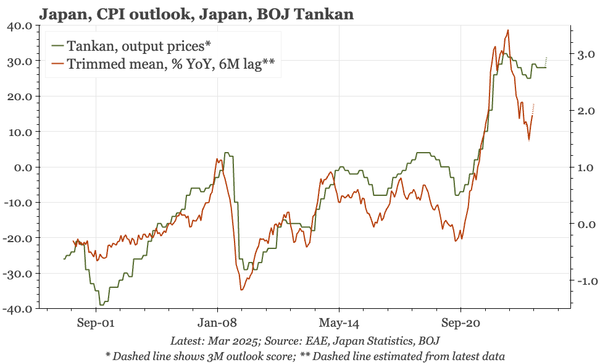

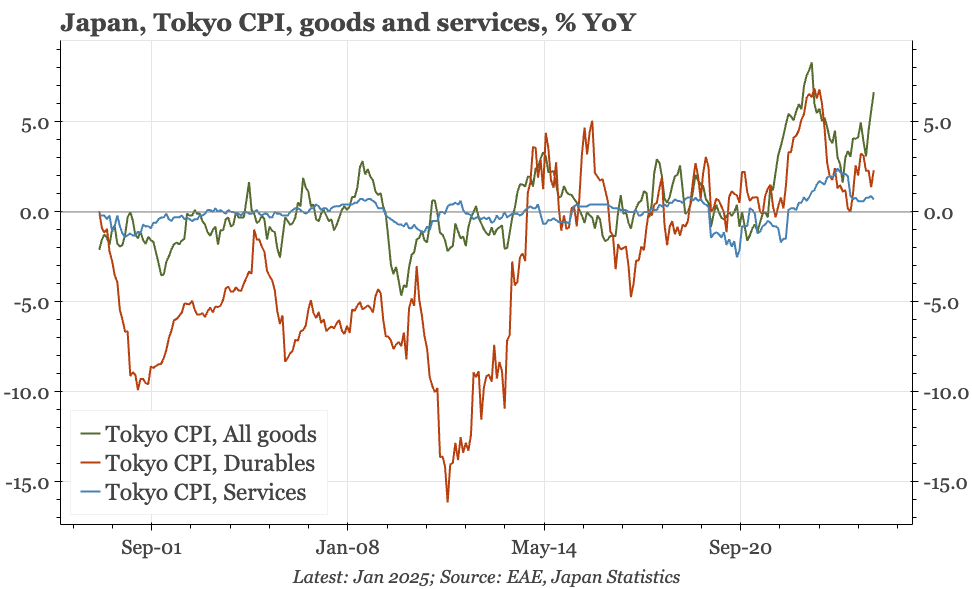

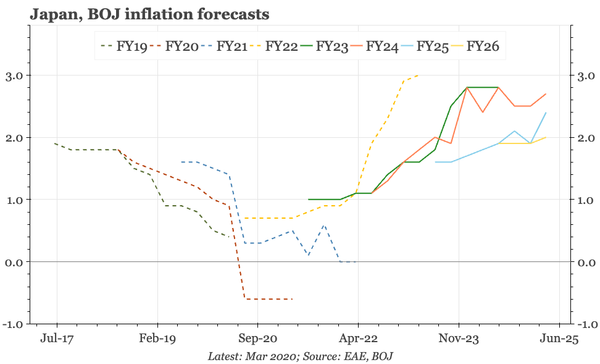

Japan – inflation pain

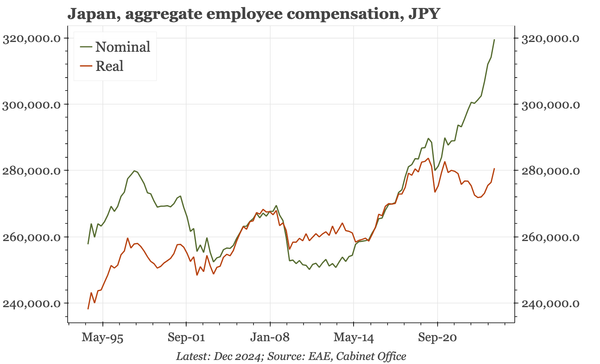

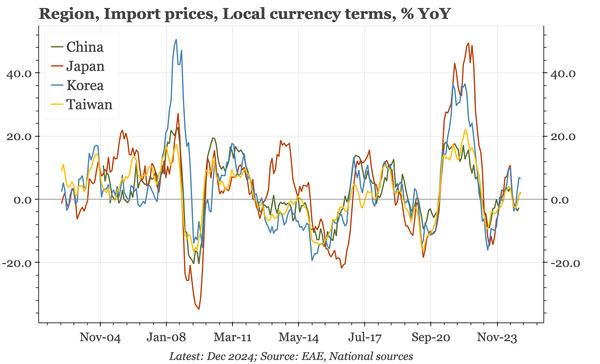

The fundamental inflation story of labour market tightness and wage hikes was seen in today's firm services PMI. But both the PMI and CPI today suggest that dynamic has again been overtaken by prices driven by supply shortages, a phenomenon that is clearly bad for real incomes and so consumption.

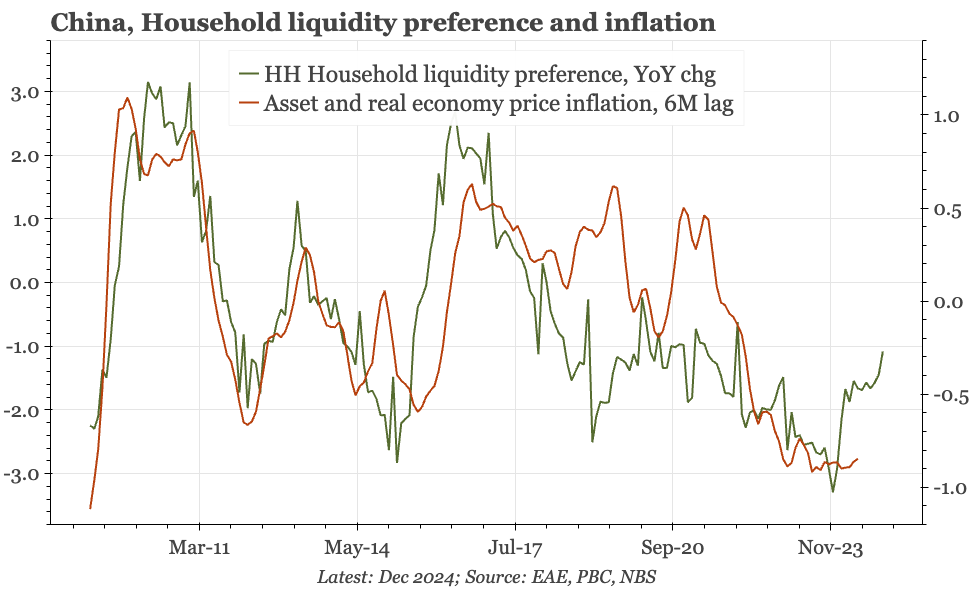

China – credit mixed, and need more evidence of deposit turn

Gone are the days when the monetary data can make a big difference to the market mood. Today's release doesn't turn back the clock: the headline is a bit stronger, but mortgage lending wasn't, and there are distortions from Chinese New Year and definition changes.

Korea – employment improves, but only in the public sector

The rebound in headline employment in January wasn't broad, with jobs in the private sector remaining weak. With no reversal in the sharp rise in the participation rate of recent years, and the number of part-time jobs still rising, the labour market is likely less tight than headline data suggest.

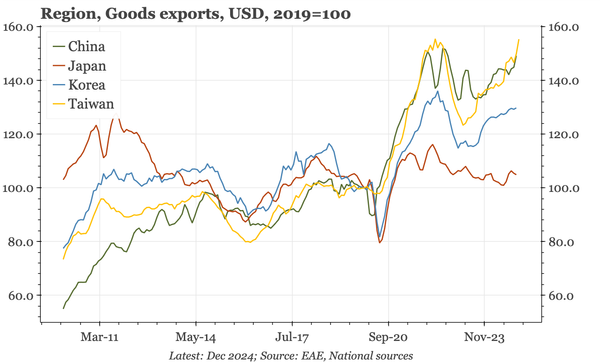

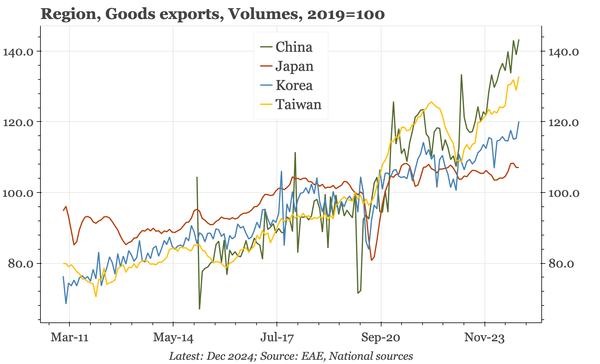

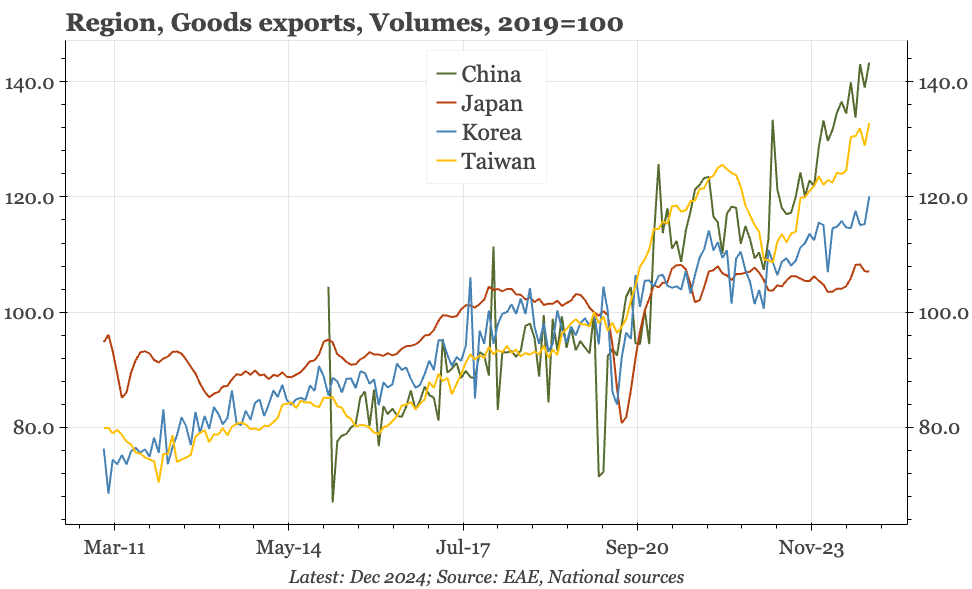

Region – export trends and market implications

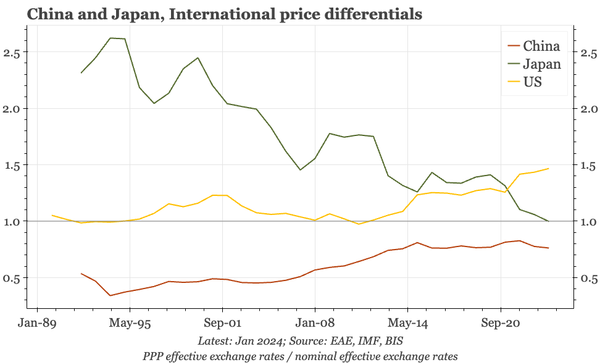

In LCU terms, there's little to choose between exports in the different economies. But in volumes, China and Taiwan are very strong, and Korea and Japan clearly lagging. This should have implications for CNY, TWD and KRW. For Japan, the significance is for macro if USDJPY turns.

Region – Asia's dramatic demographics

A longer video discussing demographics, the area where Asia is most clearly leading the world. The changes in the population will clearly matter for economies, but Japan's experience shows the macro implications aren't necessarily what might be expected.

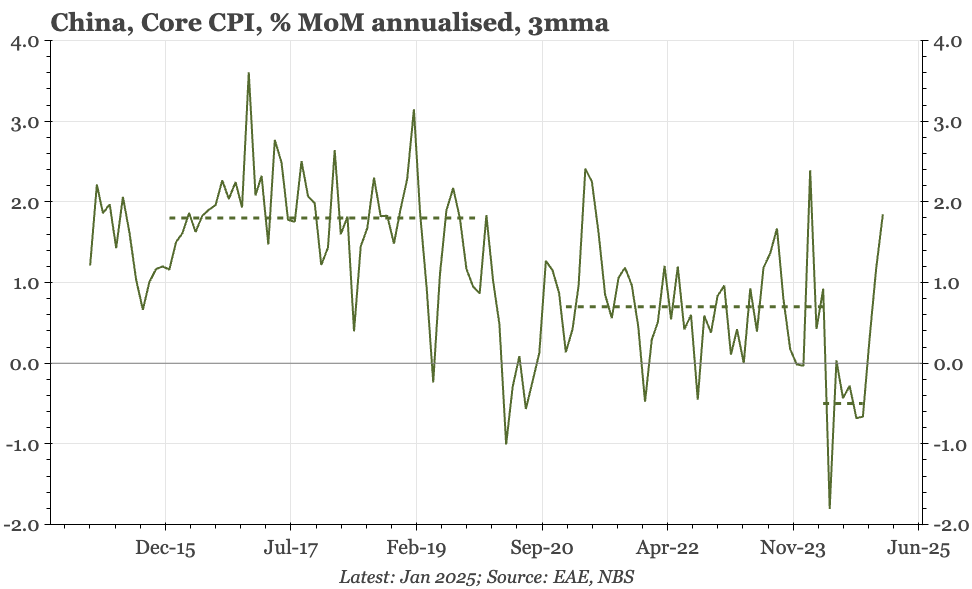

China – core CPI back up to +2%

January core CPI picked up. That doesn't look like a Chinese New Year effect, and comes after Q4 when prices were already looking firmer. This dosn't mean inflation, but if core, which has underperformed other price indicators, is now catching up, it would mean China isn't in underlying deflation.

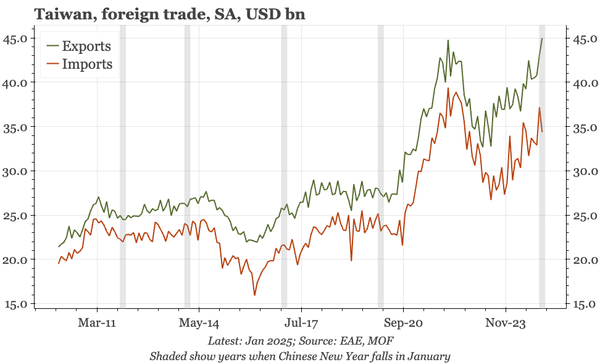

Taiwan – LNY explains higher CPI, but not stronger exports

The spike in inflation seen in January isn't unexpected given consumer spending on the back of this year's early Chinese New Year. The strength of exports can't be explained away in the same way, and suggests Taiwan's relative outperformance is continuing.

Japan – the hawkish case

Naoki Tamura is a relative hawk at the BOJ. While that doesn't make him mainstream, his speech today is still worth reading, because it is direct and well-reasoned, and because an upside surprise in inflation and rates is a very reasonable scenario for 2025.

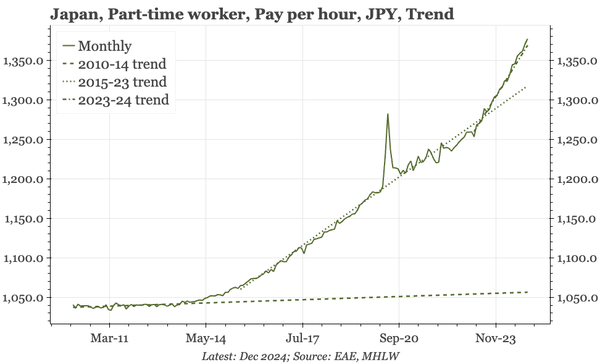

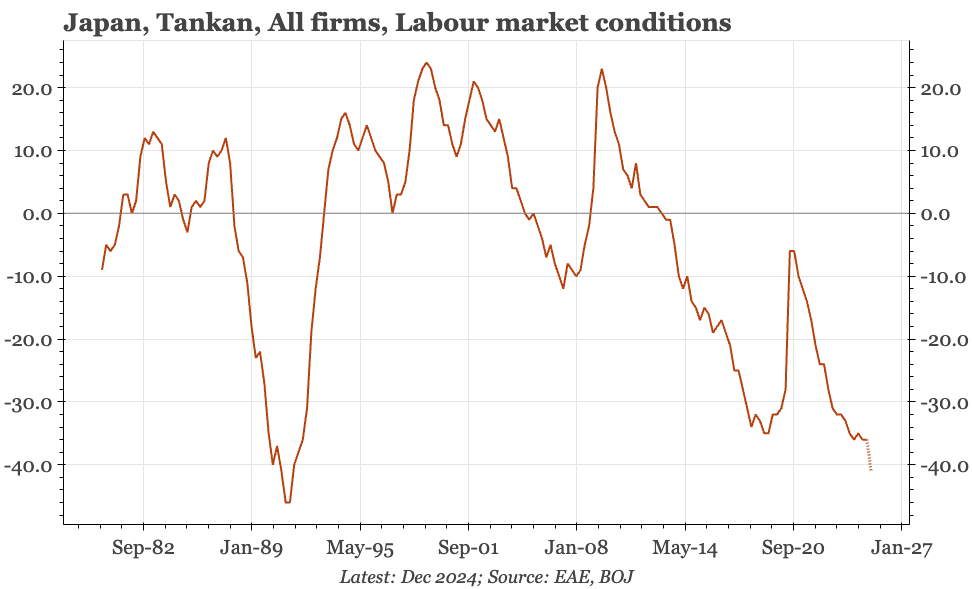

Japan -part-time wage growth at 4.6%

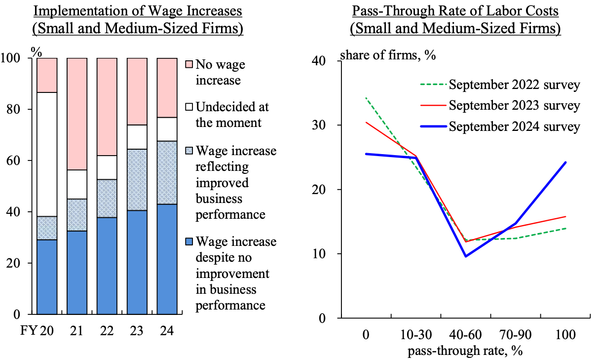

Full-time worker wage growth remains stable at a bit under 3%. Further acceleration is likely, though not much: this year's shunto will probably moderate from 2024. Part-time worker wage growth is though continuing to rise, consistent with the BOJ's view of a tight labour market.

Korea – core inflation up again, but growth fears dominate

Data today show the rise in underlying inflation that has been underway for almost a year continuing. But yesterday's minutes of the last BOK meeting show that notwithstanding the rise in $KRW, weak growth rather than rising inflation remains the much bigger concern.

Japan – still not the right inflation

Ideally, the BOJ wants the participation rate to peak, higher wages to make consumers more positive, and both demand-pull and supply-push to drive inflation. Instead, consumption is sluggish as rising goods price inflation outpaces wages, with the part rate continuing to rise.

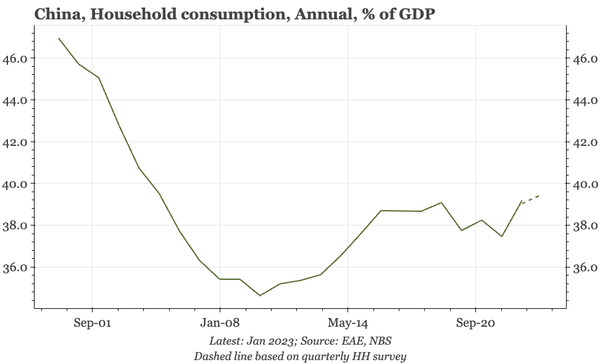

China – on a Japanification scorecard, only getting 30%

With the BOJ's review of post-1990s Japan, we have an inventory for Japanification. Using this to assess China today, what stands out is not the similarities, but the differences. All told, on my scoring China isn't graduating to Japanification, achieving a mark of only 30%.

Japan – doubling down on labour shortages

The main change the BOJ made to its description of the outlook on Friday was the mention of a "growing sense of labour shortage". The special analytical boxes in the full outlook report, released today, give a lot more colour on why the BOJ made that adjustment.

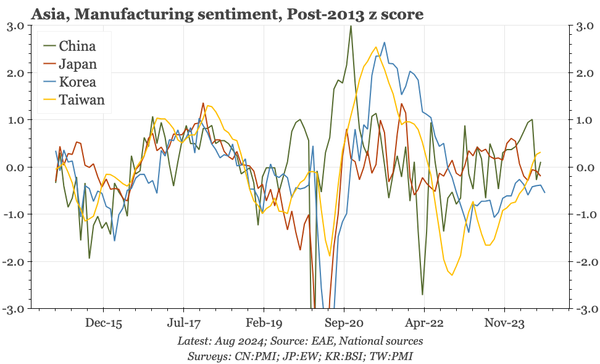

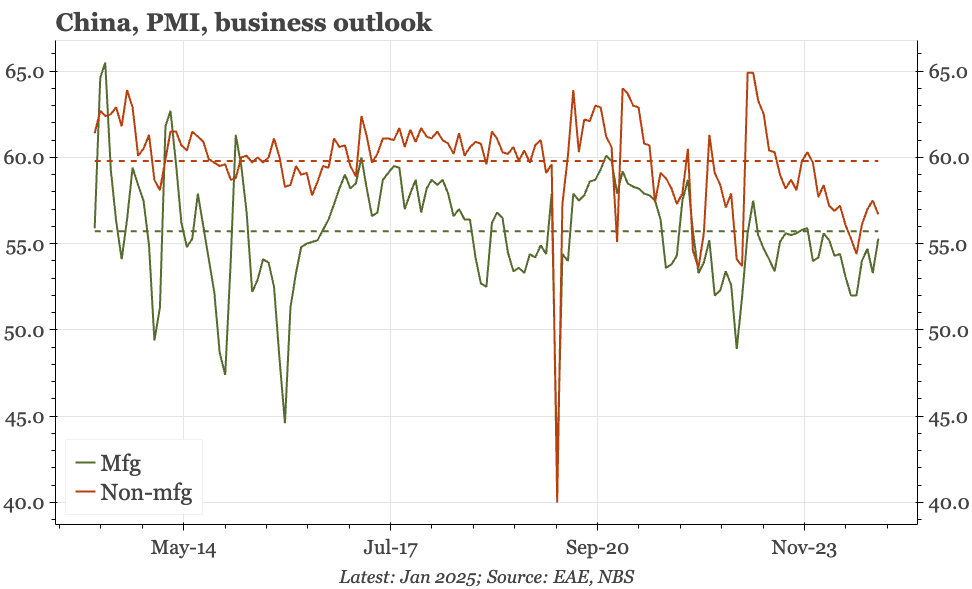

China – not very informative

Data today don't help in understanding the cycle. PMI headlines softened, but that isn't unusual when Chinese New Year falls in January. The details didn't drop in the same way, but also don't look strong. Separate data for industrial profits did improve, but that isn't a reliable data series.

Taiwan – investment for now, but exports matter more

Despite a surge in capex, GDP growth slowed in Q424 to 1.8% YoY, the lowest since September 2023. 2025 as a whole should be better, with modest growth in exports and private consumption. The upside risk is wage growth feeding into stronger consumption. Downside comes from the Trump tariff threat.

Japan – on the way (again) to 1%

The highlight of today's BOJ meeting, apart from the hike, was the increased confidence around the labour market. That, and the firmness of the dataflow, strongly suggest the bank continues to hike. It doesn't feel aggressive to think of 1% by year-end. Ueda's press conference will give more colour.

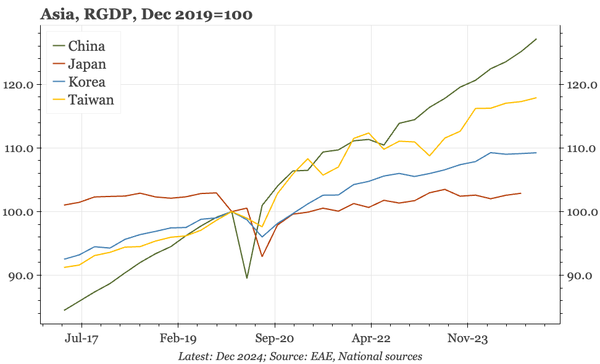

Korea – weak in Q1, worse in Q1

Today's GDP release shows Korea's economy only grew in Q124. After that, activity stagnated. Q125 is likely to be worse, given the collapse of domestic confidence after the martial law fiasco, a deterioration confirmed by the BOK's confidence surveys that were also released the last couple of days.