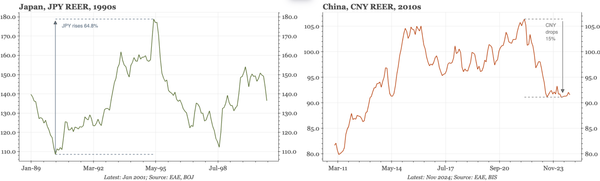

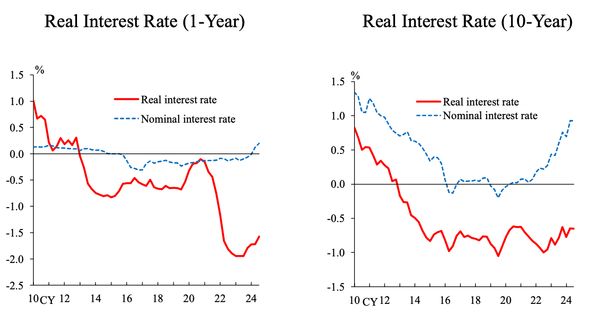

China – are low rates and a weak CNY really to be feared?

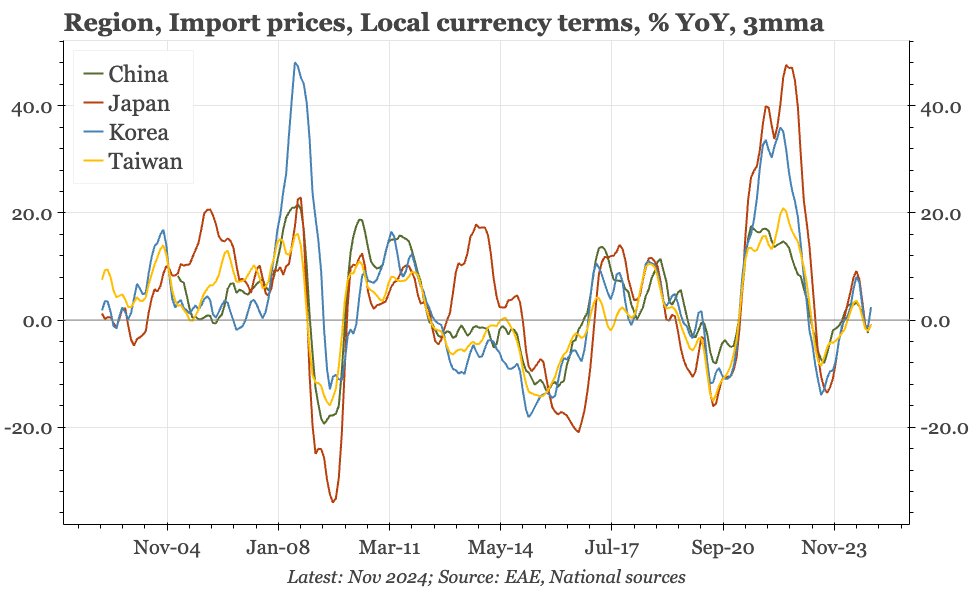

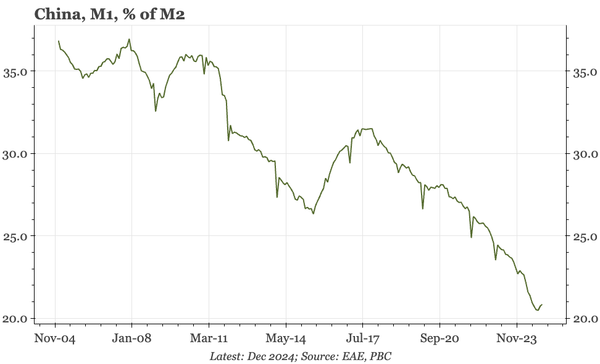

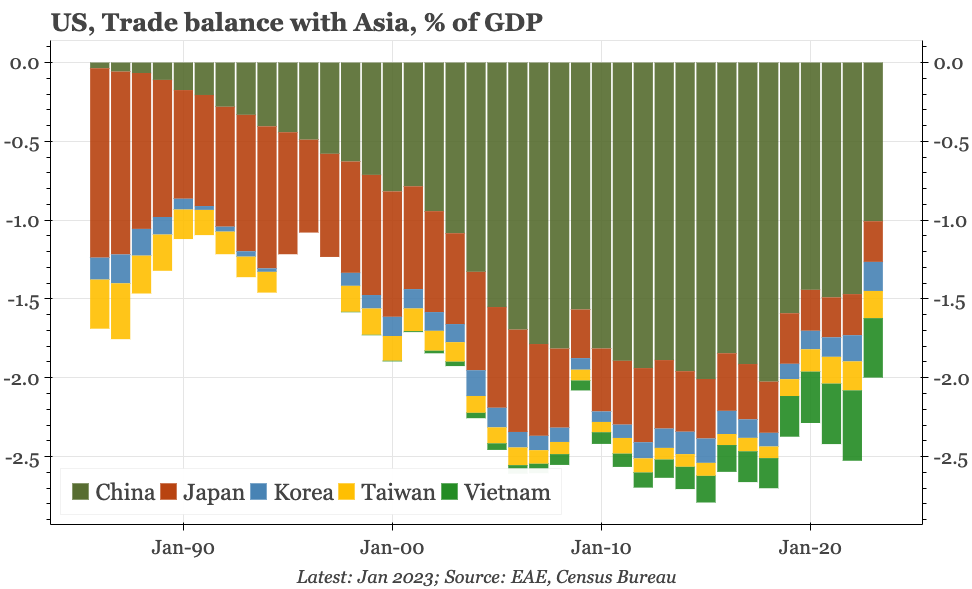

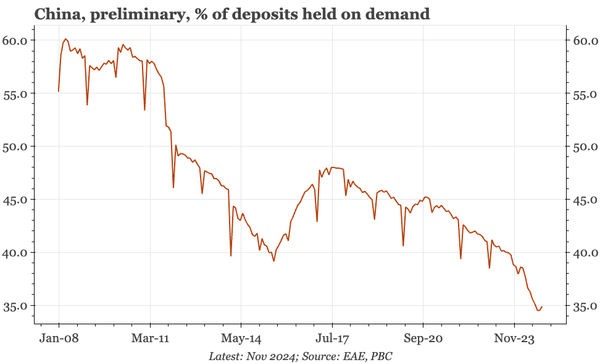

Falling rates and a weakening CNY are causing concern, but I don't think they should be. If CNY weakening was pushing up onshore rates, that would be different. But $CNY rising while rates fall suggests a loosening. That doesn't ensure an economic turnaround, but it is better than a tightening.

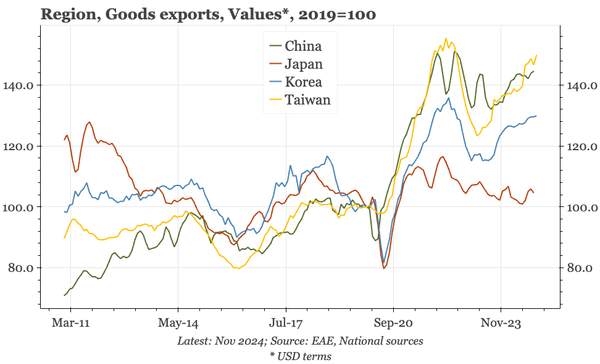

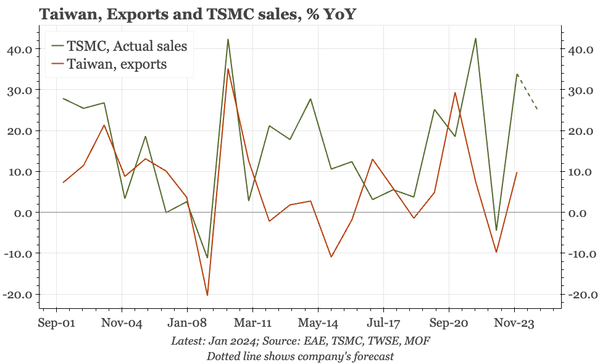

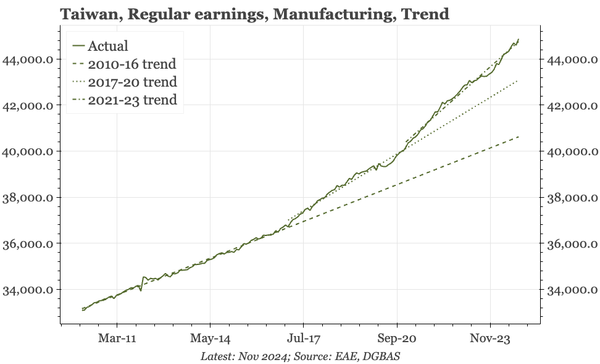

Taiwan – TSMC continuing to support the cycle

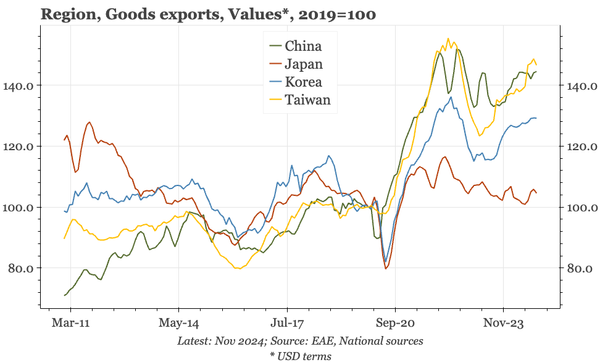

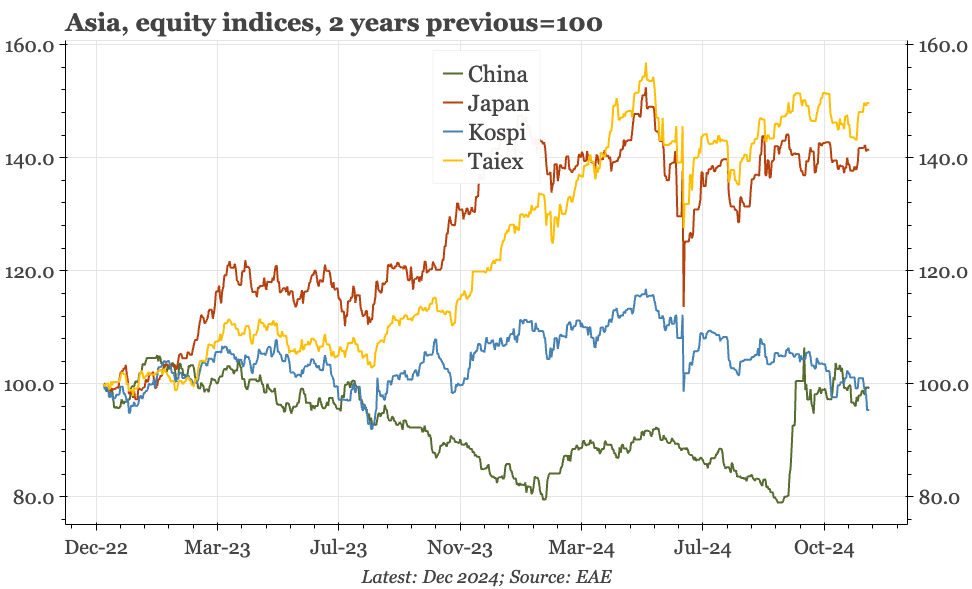

Already Taiwan's dominant firm, strong 2024 results mean TSMC has now doubled in size just since 2021. The firm remaining bullish for 2025 is this a reason to be optimistic about Taiwan's exports, but also to think the domestic cycle can warm up further. The contrast with Korea is huge.

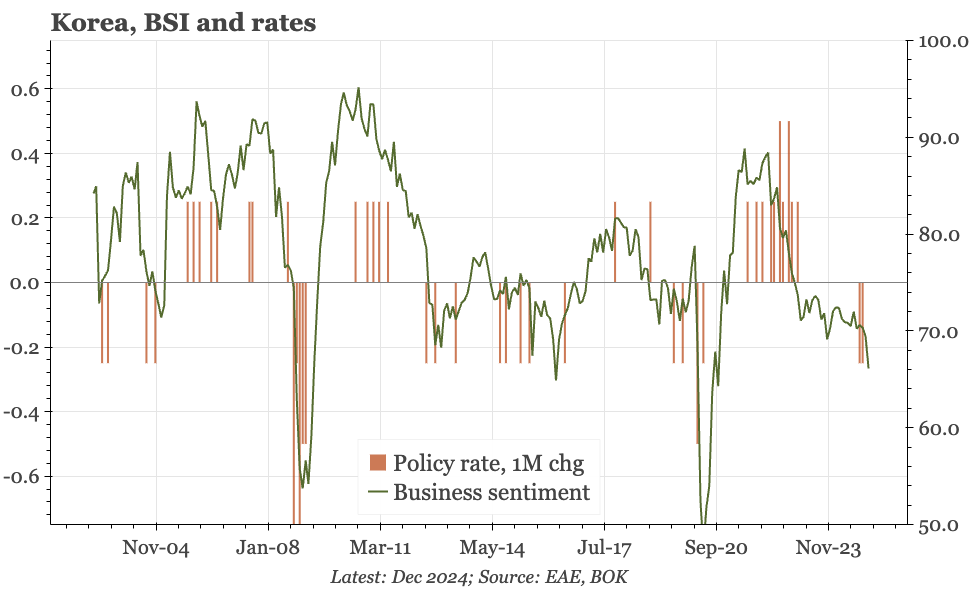

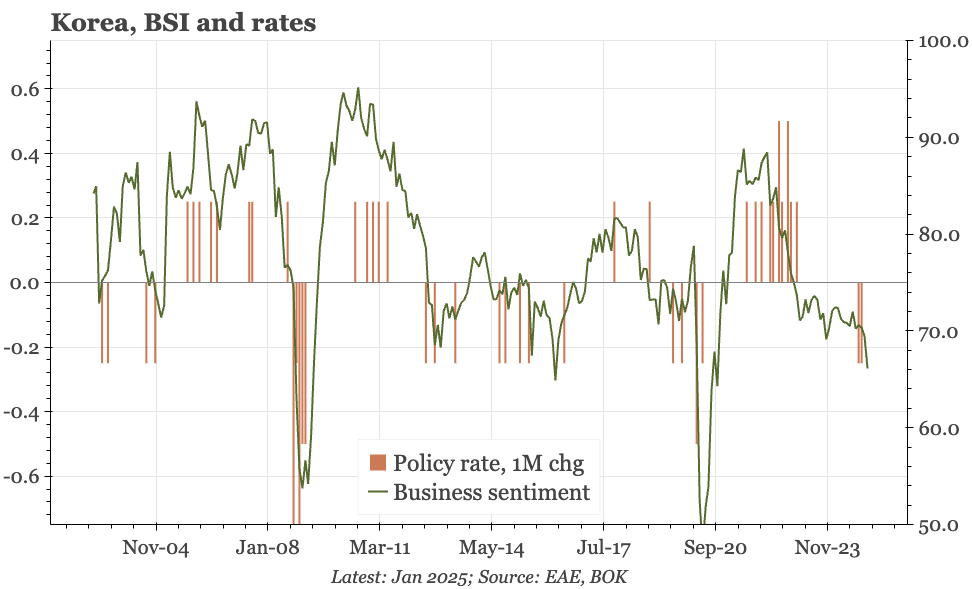

Korea – doveish hold

Contrary to my thinking, the bank didn't cut today. The reasoning – KRW weakness and political uncertainty – wasn't a shock. However, the tone of the meeting was very doveish, with the bank talking about "intensified" downside risks to growth. Korea really looks very different to Japan and Taiwan.

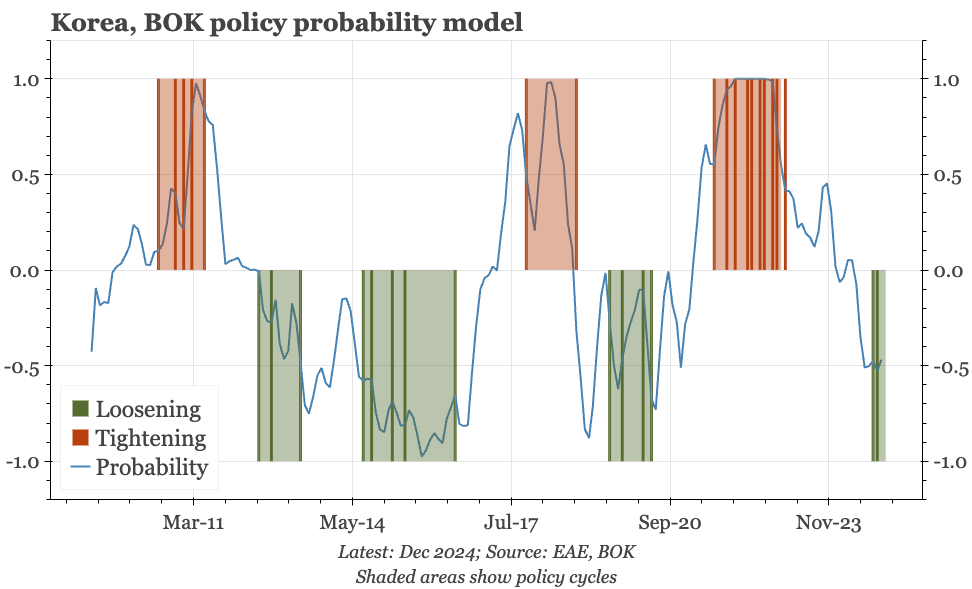

Korea – re-quantifying the BOK's reaction function

I've revised my model for the BOK's reaction function. That suggests the probability of loosening tomorrow is about the same as the Q4 meetings when rates were cut. Considerations for later in the year are yesterday's SLO survey warning of a rebound in housing, and firm services CPI.

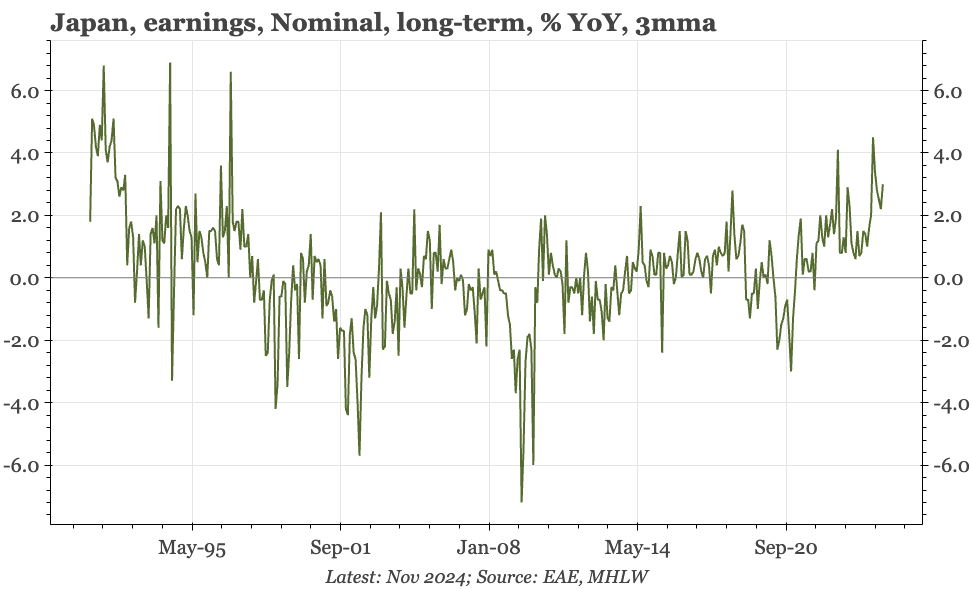

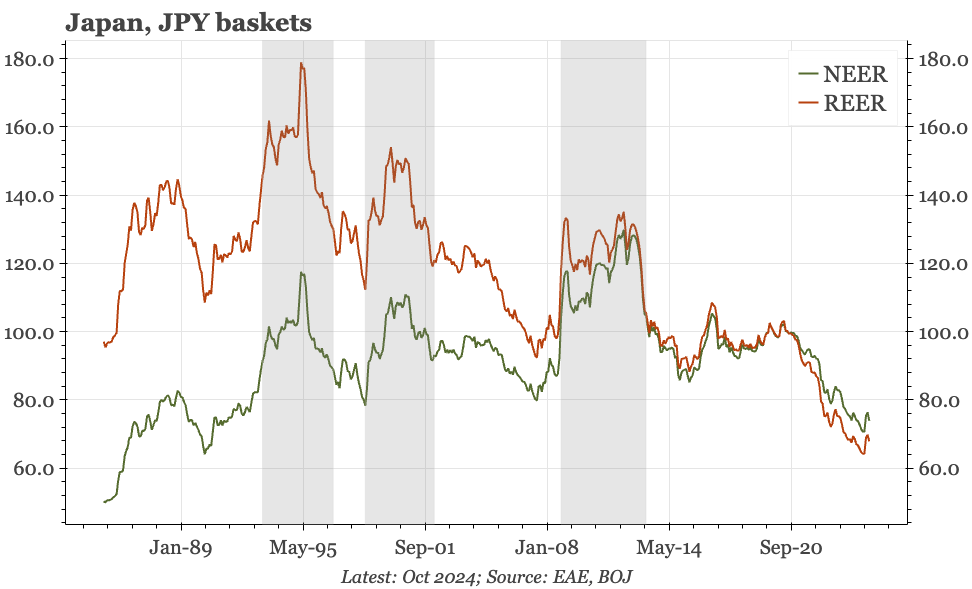

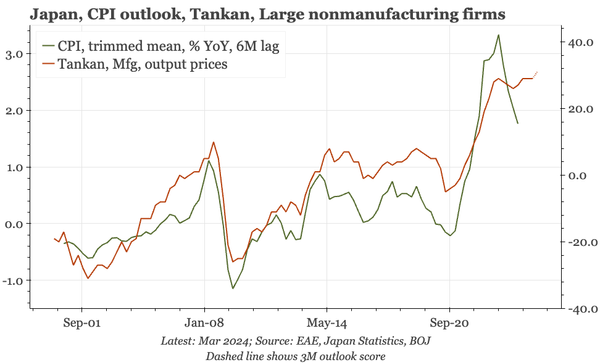

Japan – a step closer

Deputy governor Himino today downplayed the risks from the US that were the BOJ's focus in 2H24. He mentioned plenty of caveats too, not least being that speeches shouldn't be read as telegraphing any MPC outcome. But it feels like the BOJ is getting closer to hiking again.

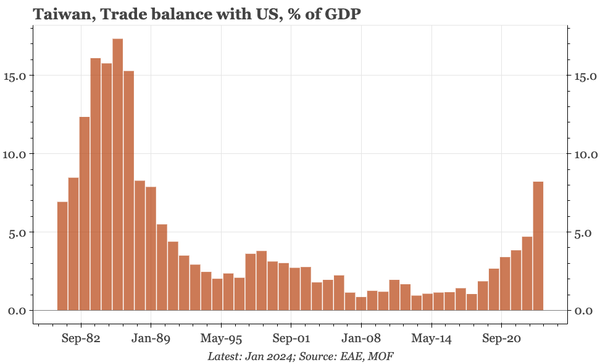

Taiwan – peaking, but not yet slowing

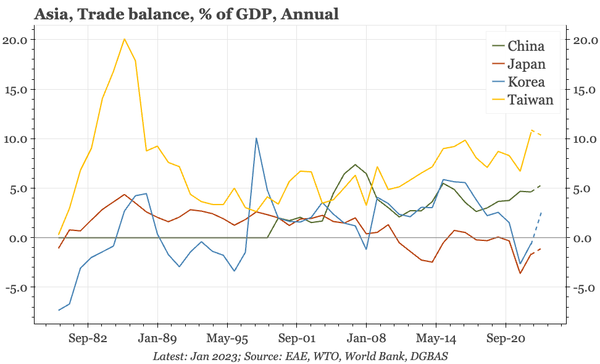

Taiwan has the strongest cyclical picture in the region. It isn't gaining further momentum, so rate hikes aren't likely, but nor are cuts. The other big factor is Trump. He won't like either Taiwan's massive trade surplus, or its modest military spending.

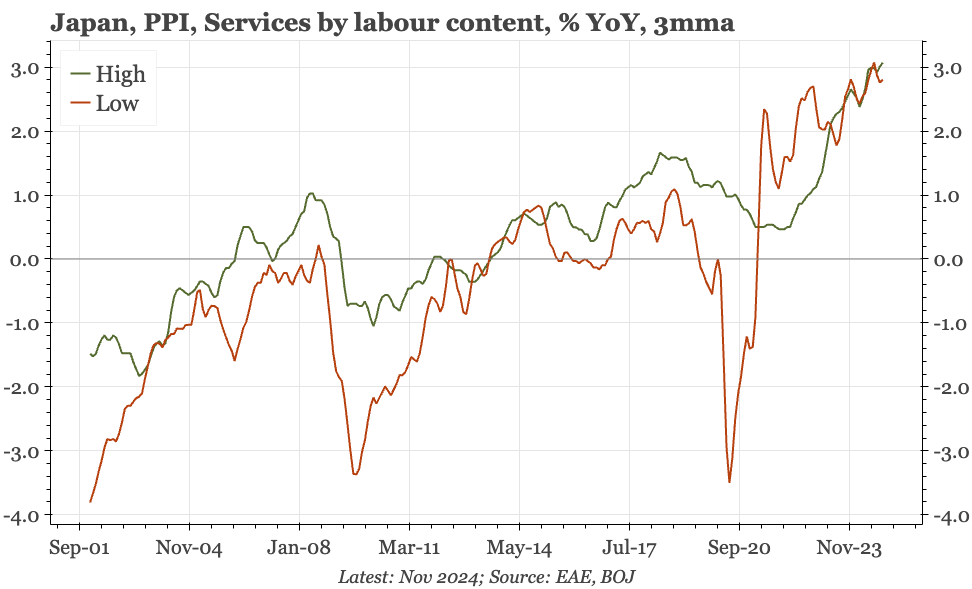

Japan – more incrementally positive wage indicators

Today's labour market indicators – official wage data for November, and the Q1 regional report from the BOJ – don't suggest that momentum is picking up sharply. But they do indicate that the labour market is tight, and wage growth continuing to trend up.

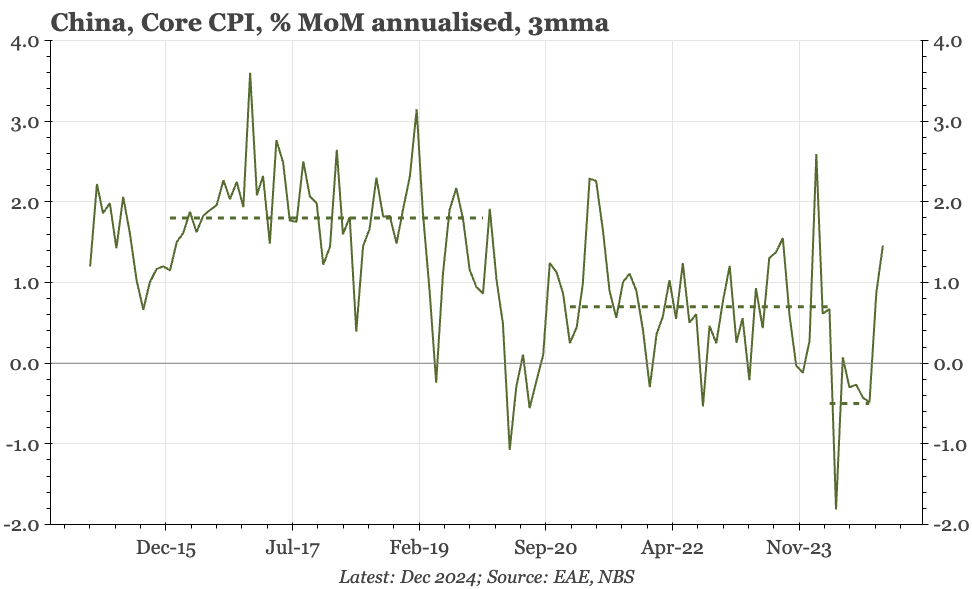

China – core CPI back to +1%

After being -ve for most of 2024, core CPI saar rose in Q4. That seems unlikely to sustain, given the 2024 policy boost is fading. However, that core has picked up is at odds with the consensus interpretation of today's data, while being in line with the relative stability of PMI output prices.

Korea – another step lower

Recent data and the minutes of the November BOK meeting offer a good opportunity to look at Korea in light of the latest bout of political turmoil. The conclusion: a weak cycle is getting weaker, and so exchange rate depreciation is unlikely to stop the BOK cutting further.

Japan – what breaks the range?

After a couple of weeks travelling there, and recent data and policy releases, it is clear that Japan's cycle and inflation stories are intact. That makes a Q1 BOJ hike likely, but on its own, that won't mean much for $JPY. More interesting is to ask what might get the bank to move more quickly.

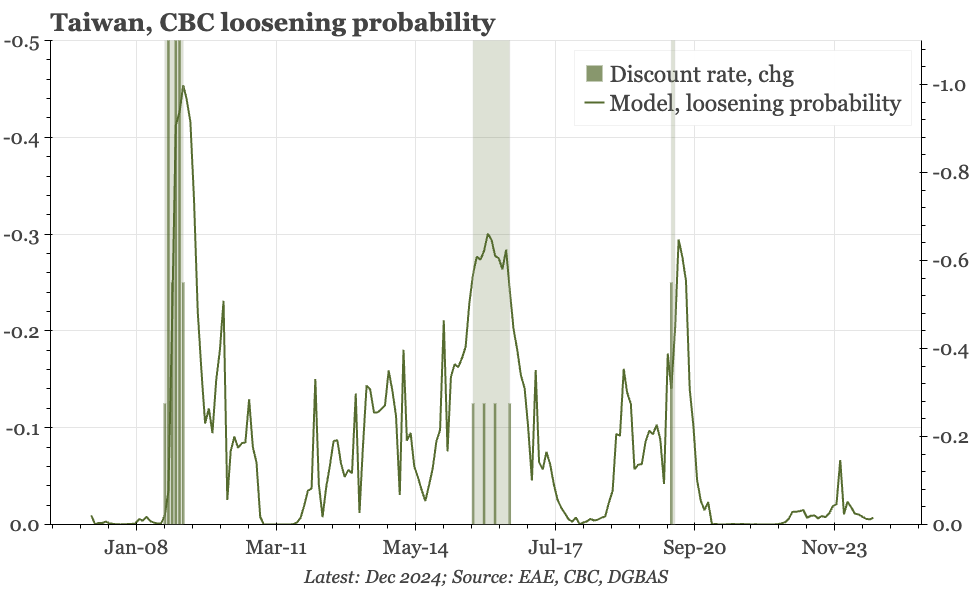

Taiwan – firmly on hold

The CBC kept policy unchanged yesterday, and won't be in a rush to move in 2025. Growth will be slower, but the bank isn't particularly worried about either exports, or domestic demand. Optimism about consumption is partly because of expected wage hikes, which in turn will support inflation.

Japan – BOJ still not moving

There was a dissenting proposal to hike today, and while the majority voted to stay on hold, Ueda suggested more clarity on wages would clear the way for rates to go up. That makes the early January meeting of BOJ regional managers important, though for the JPY, that's quite a while to wait.

Region – Back to the Future: East Asia and Trump 2.0

The film Back to the Future came out in 1985, and with inflation in Japan, deflation in China, and big external surpluses once again, there are all sorts of regional economic themes that have echoes of then. Here's a podcast in which I discuss the implications, with links to the underlying research.

Taiwan – how to dispose of USD100bn?

There's rarely much interest in Taiwan macro. But 2025 could be different: with post-2020 domestic economic lift-off, and the return of Trump, the circumstances that have kept the TWD undervalued for 20 years might be changing. This is a detailed chart pack looking at the issues involved.

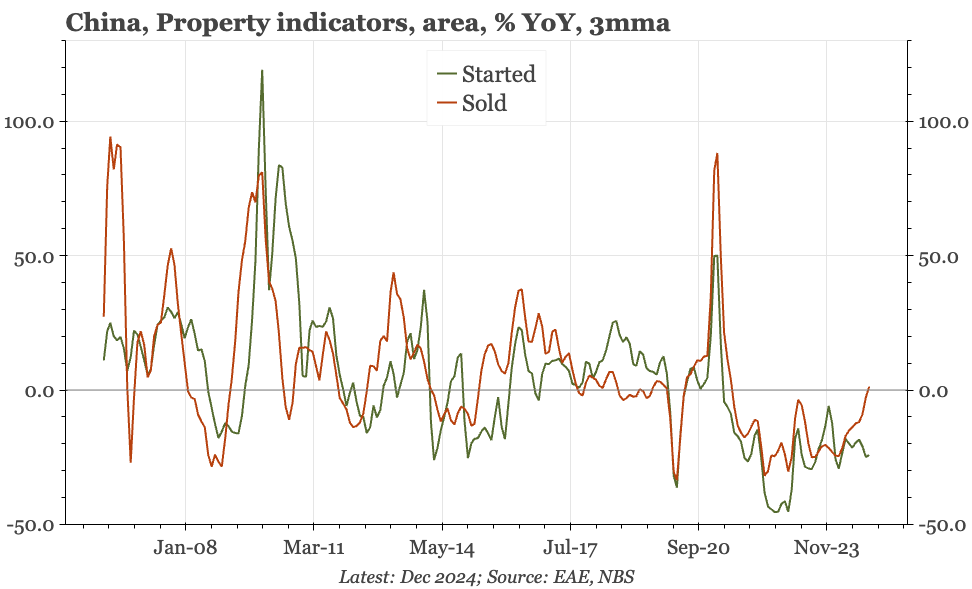

China – neither better nor worse

An easing of home price deflation and the decline in narrow money growth keep alive an upside scenario where individual investors buy into the idea that policy is putting a floor under growth. But the continued fall in property sales and weakening of credit dhow any turnaround is tentative at best.

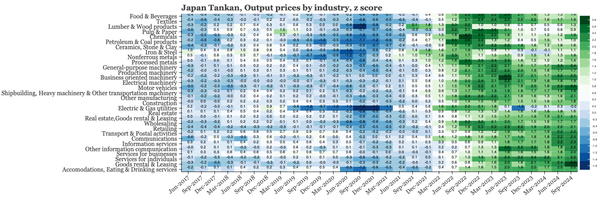

Japan – still warming up

The BOJ releases its quarterly Tankan survey in two parts. The summary was published Friday, and today's full release confirms the story: the forecast scores point to a labour market that is still tightening, and output price pressure that is continuing to build.

Japan – another very solid Tankan

The Q4 Tankan shows business sentiment firm, the labour market still very tight, and pricing intentions rising. A few months ago, this sort of picture would have made it easy to think of an imminent rate hike. However, the faltering of the BOJ's message since make it hard now to have conviction.