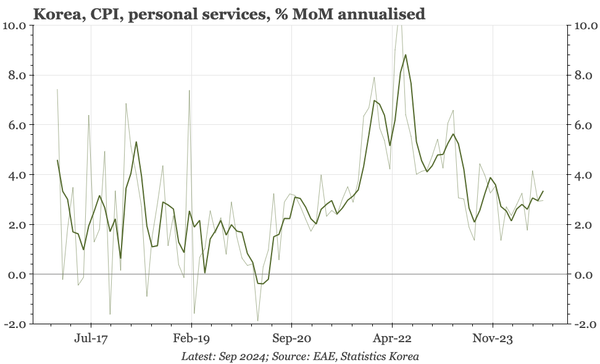

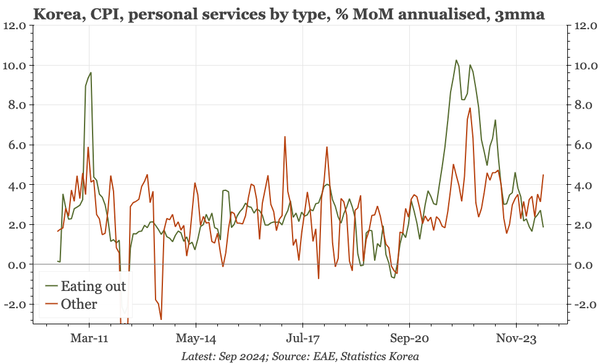

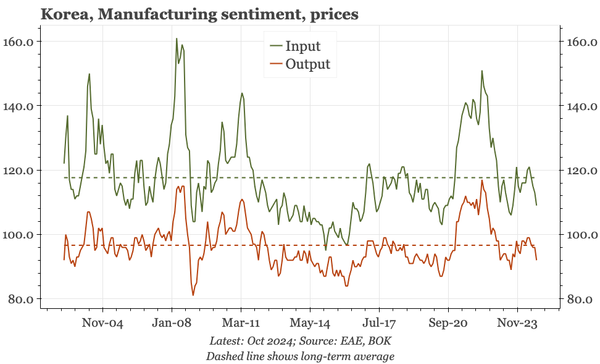

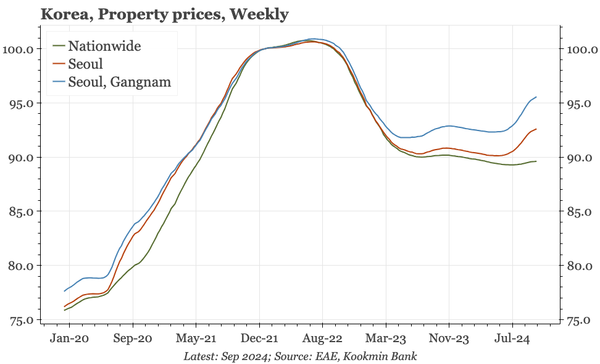

Korea – right, for some of the wrong reasons

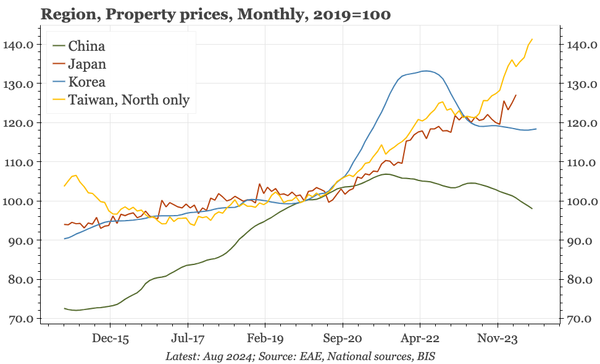

As expected, the BOK's cut on Friday was hawkish. However, while I thought the bank would express some concern about services inflation, its only worry seems to be that lower rates will give a new boost to real estate. If housing is calm, the consensus will thus expect rates to fall further.