Japan - recent data

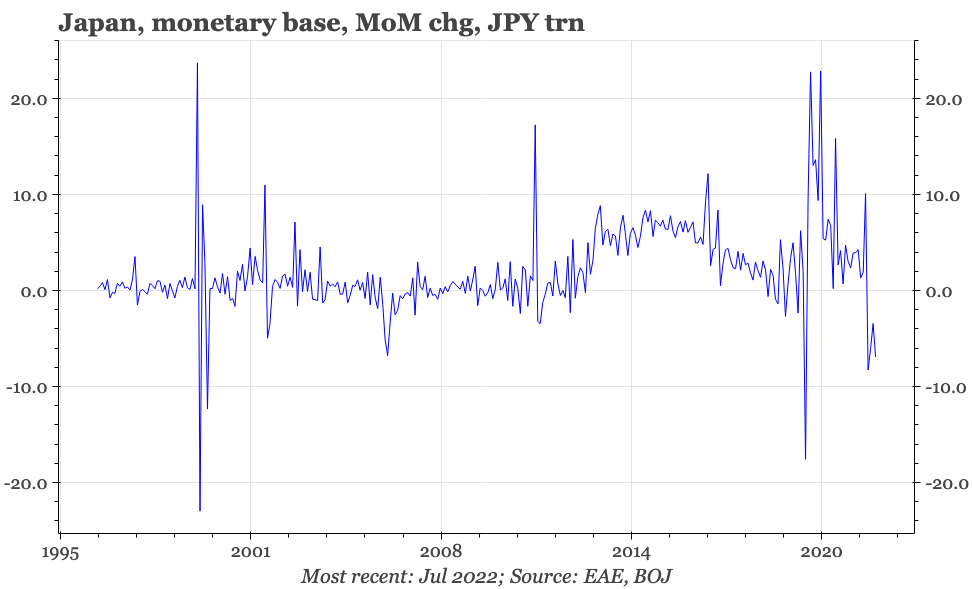

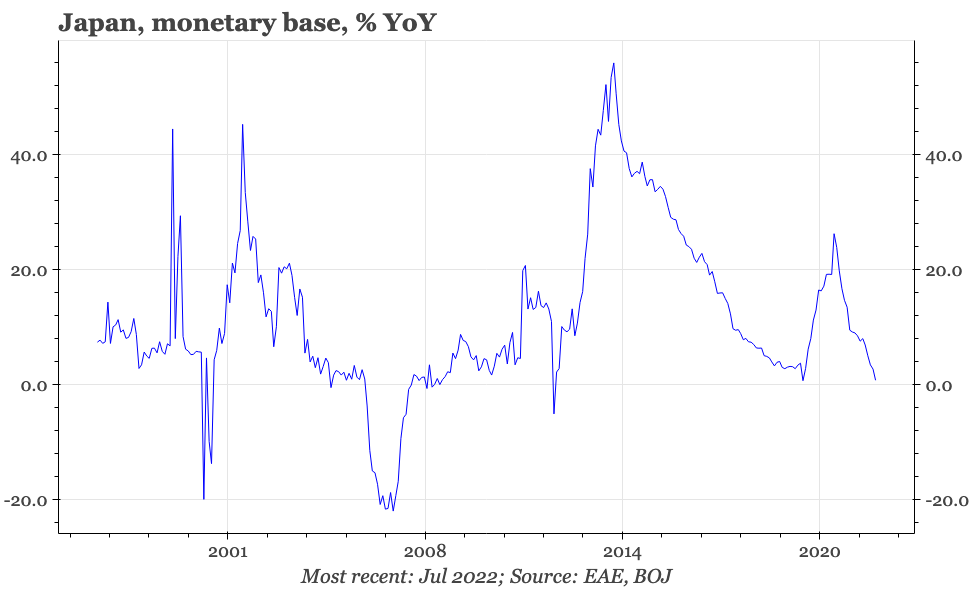

Q2 GDP shows economic recovery remains slow and uneven, with downside risks in early Q3. Capex is rising, but really only in nominal terms. Exports are going sideways, though there might be some upside risk from autos. Relatively high inflation will likely peak soon. The monetary base is shrinking.

Recent data show that the pace of economic recovery remains slow and uneven, with the short-term leads indicating the economy started to weaken again into Q3. Capex is rising, but really only in nominal terms. Exports are going sideways, with perhaps some upside risk from autos. Inflation is still relatively high, but will likely peak soon. The monetary base is shrinking.

GDP

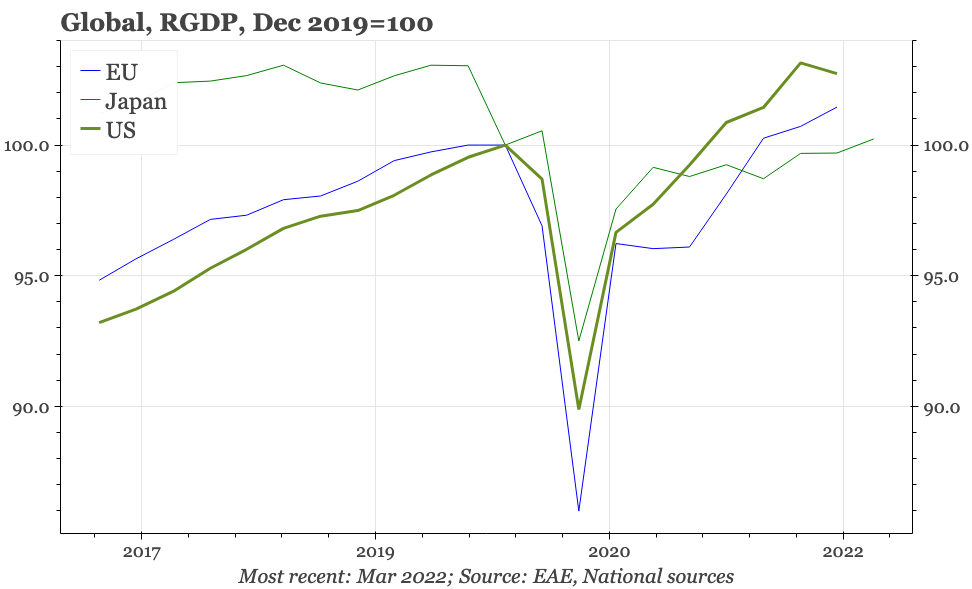

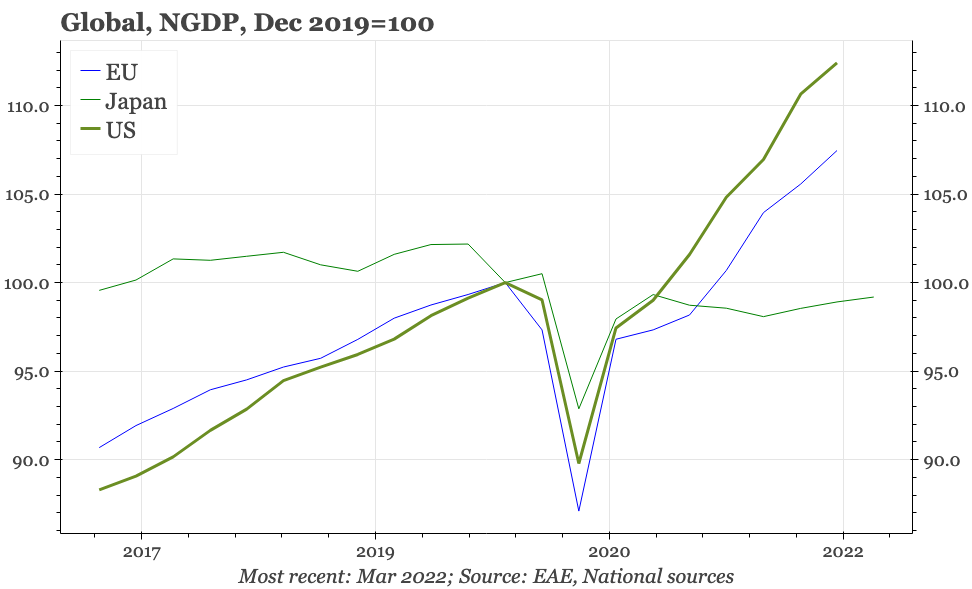

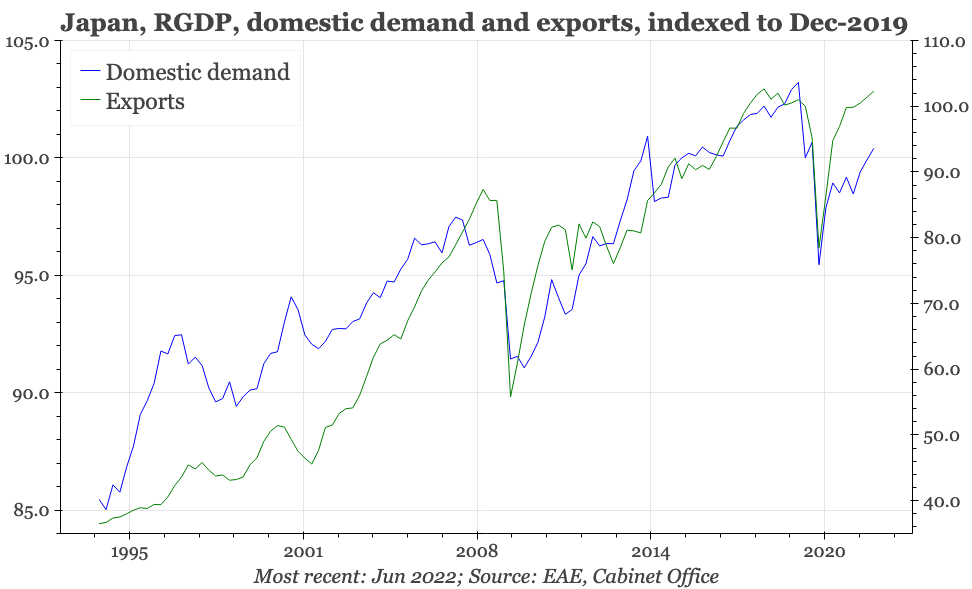

There is a recovery out of the Covid-19 recession, but the pace remains soft compared with the other advanced economies. That's true in real terms, but even more so when price changes are included.

The recovery that has occurred has been led by exports. Domestic demand has started to show stronger momentum in the last couple of quarters, driven by consumption. But consumer spending remains below pre-pandemic levels, whether looked at in terms of spending on goods, or services.

Consumption

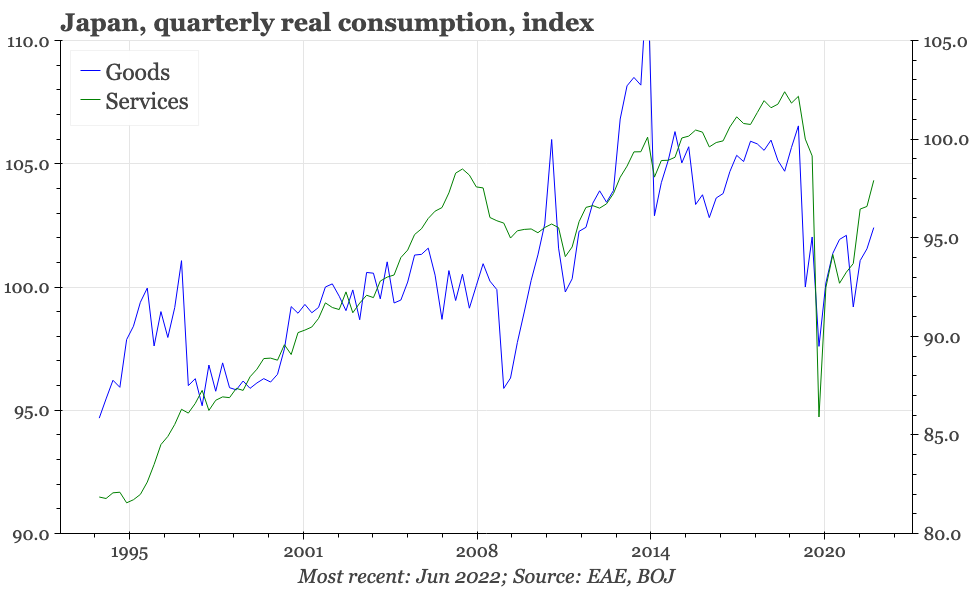

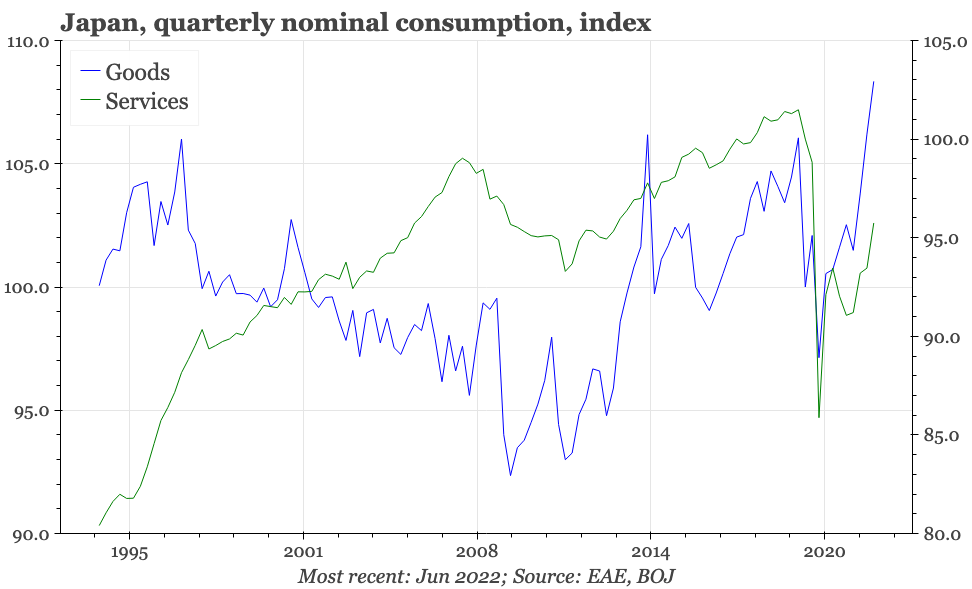

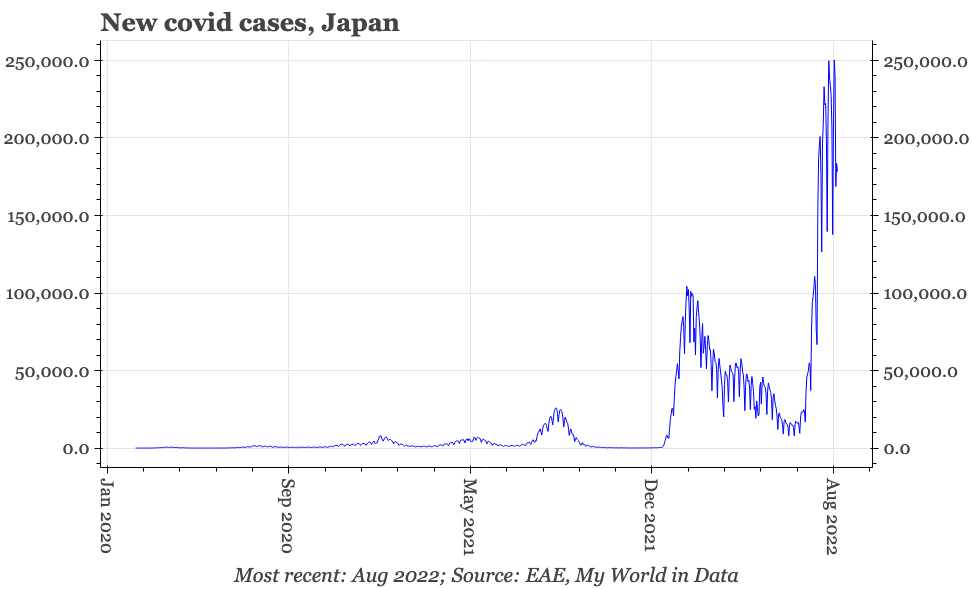

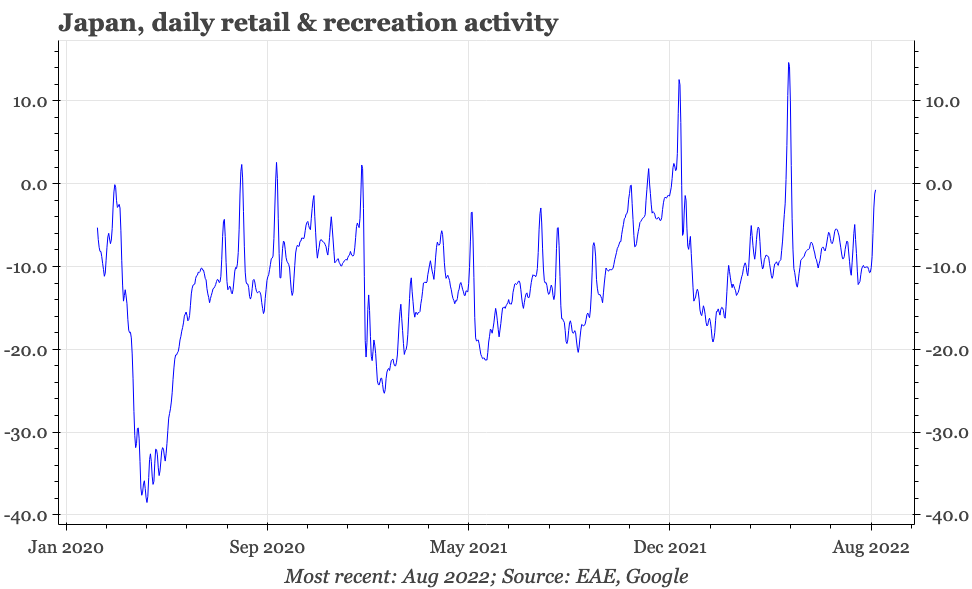

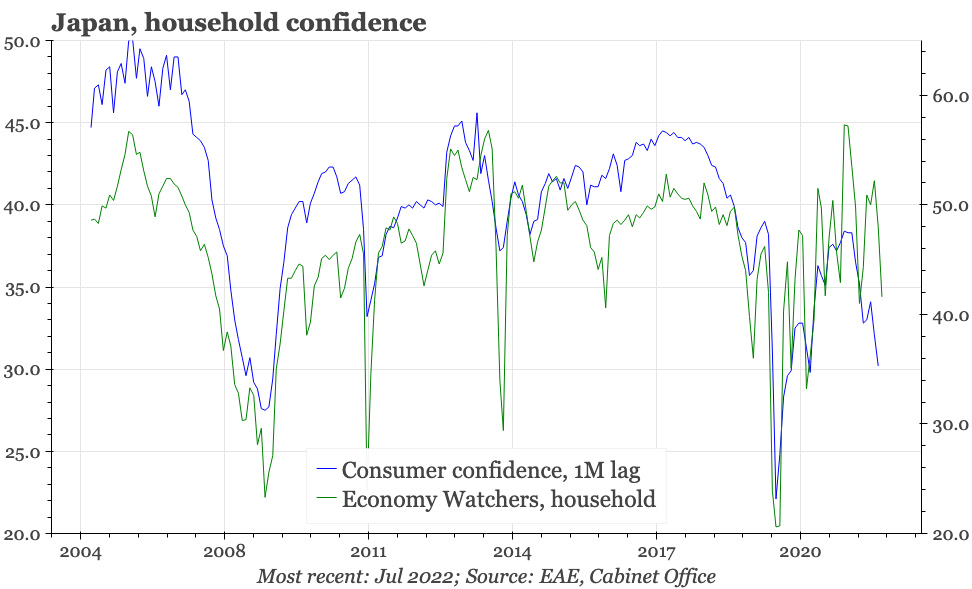

Each Covid-19 wave has had a big impact on Japanese consumption, so it isn't helpful for spending that case numbers are surging again. That though doesn't fully explain why consumer confidence remains weak, with the bigger drag being inflation.

The impact of the relatively rapid rate of rise in the CPI can be seen in the GDP breakdown, with goods consumption in nominal terms rising strongly, even though in real terms the level of spending remains soft. The Economy Watchers survey suggests consumer activity, and the economy in general, is weakening again into Q3.

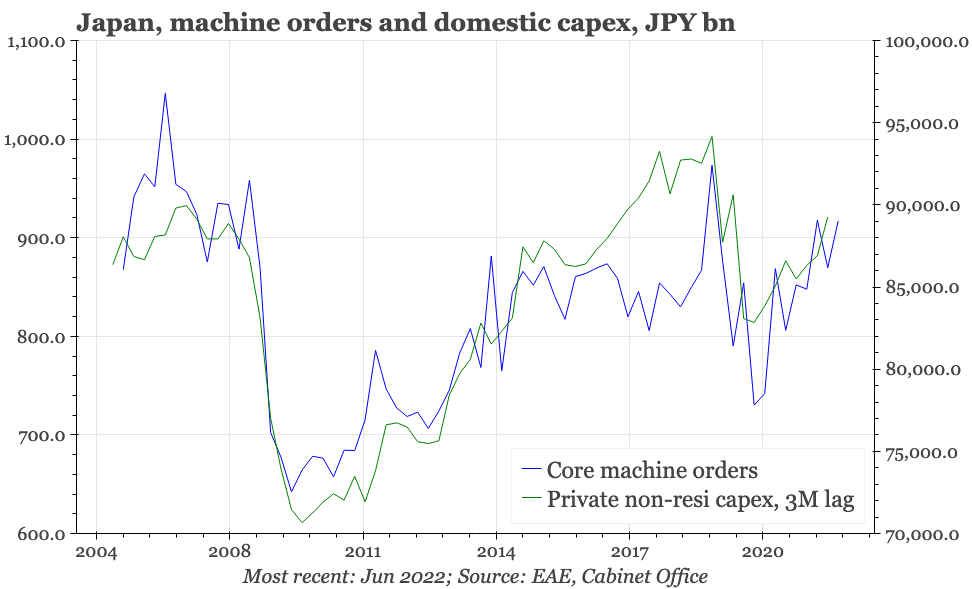

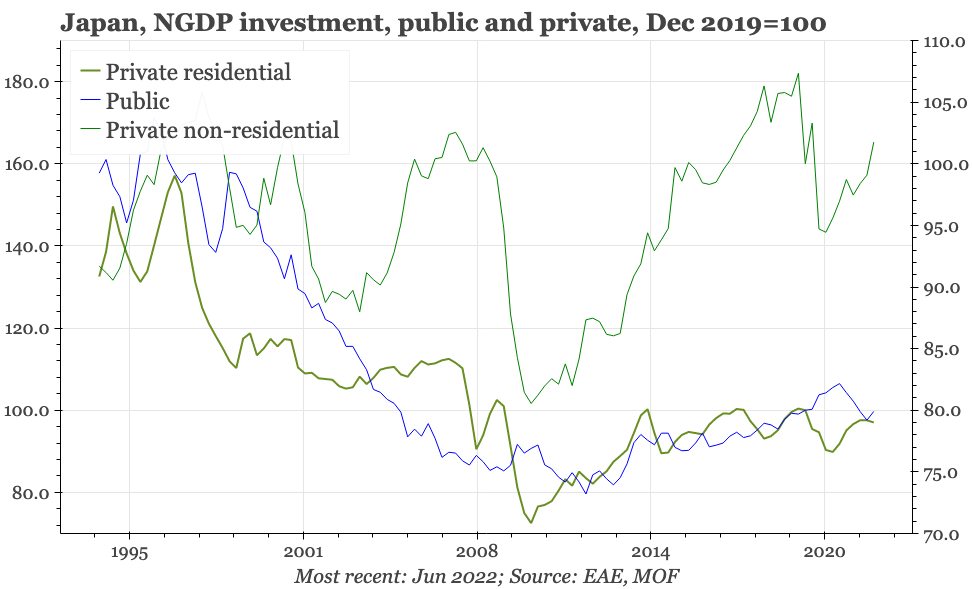

Machine orders

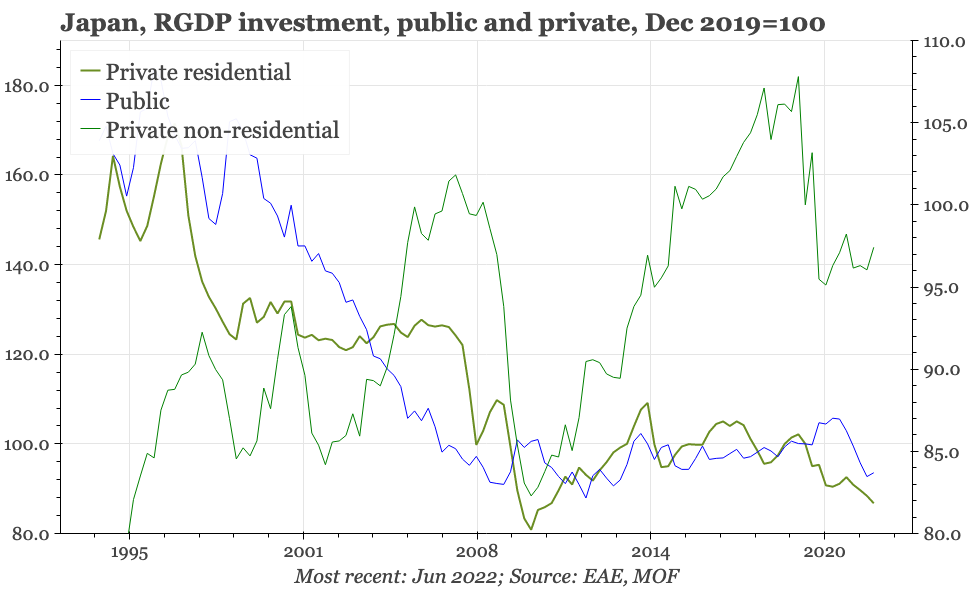

Machine orders though June point to the upturn in domestic capex spending continuing. That said, capex isn't as strong as headline data suggest. A rise is only visible in nominal terms; in real terms, capex is flat-lining overall, with a mild rise in private non-residential investment being offset by weaker out-turns for property construction and public works.

Foreign trade

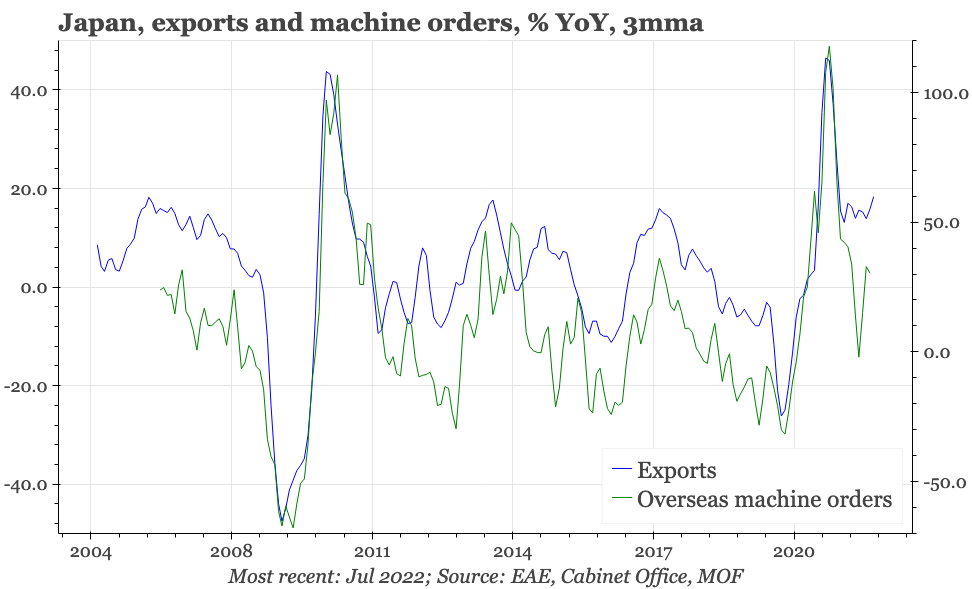

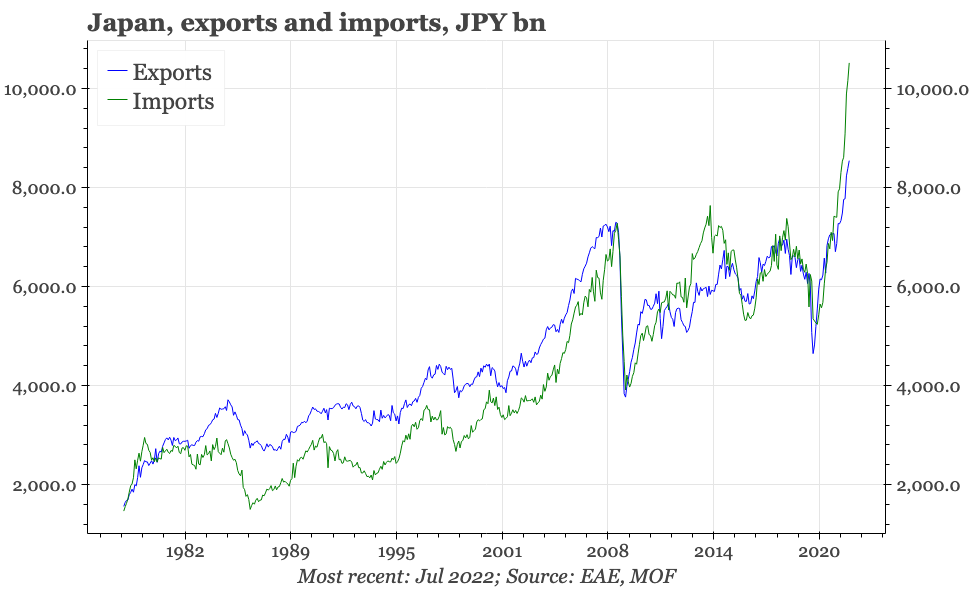

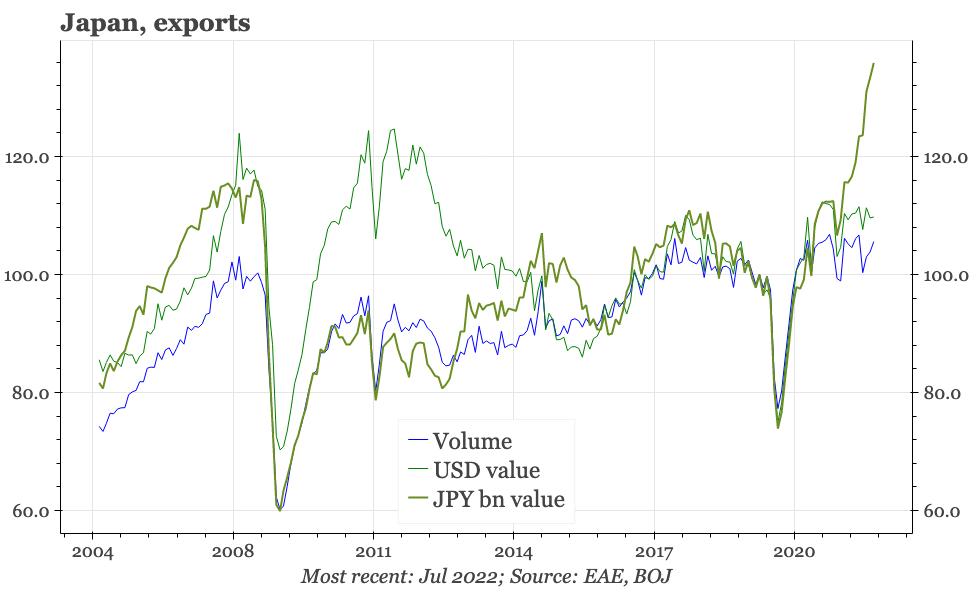

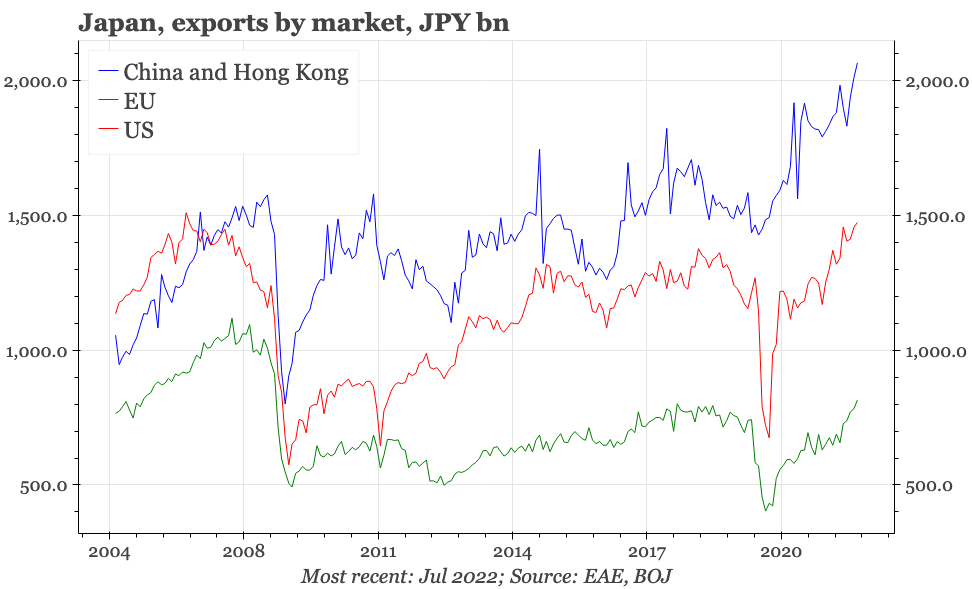

The surprise in machine orders in the last couple of months has been the rebound in orders coming from overseas. However, the relationship with actual exports hasn't been particularly close this year, which may reflect the big moves in the $JPY exchange rate. The depreciation has reversed a little in the last few weeks, but the prior extreme weakness in the currency was clearly seen in July foreign trade data, with both imports and exports surging in JPY terms.

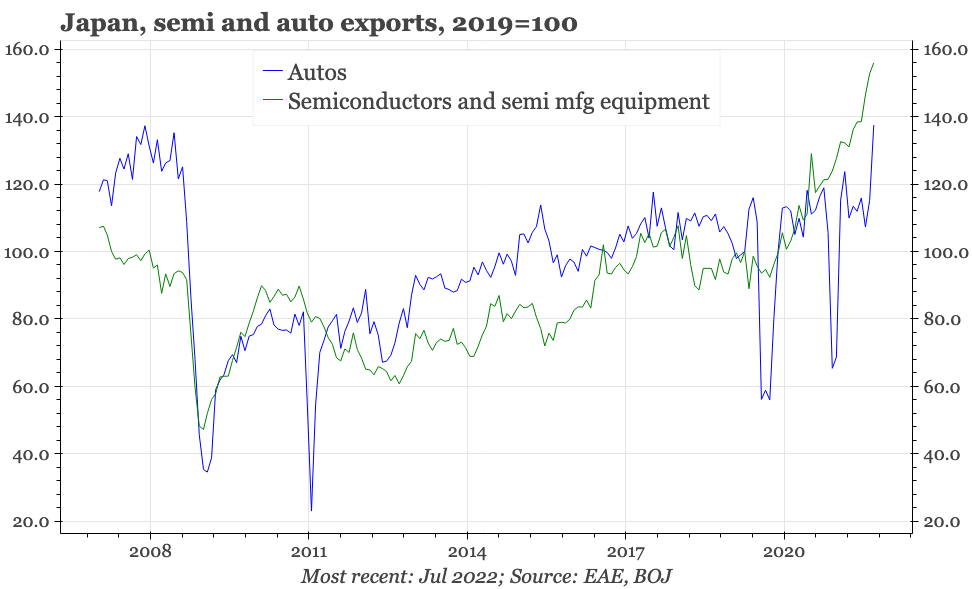

Export volumes have been range bound since early 2021. In the last couple of months, they have moved up to the top of the range. The detailed volume breakdown isn't available yet, but the value data suggest the rise in July was driven by stronger auto shipments.

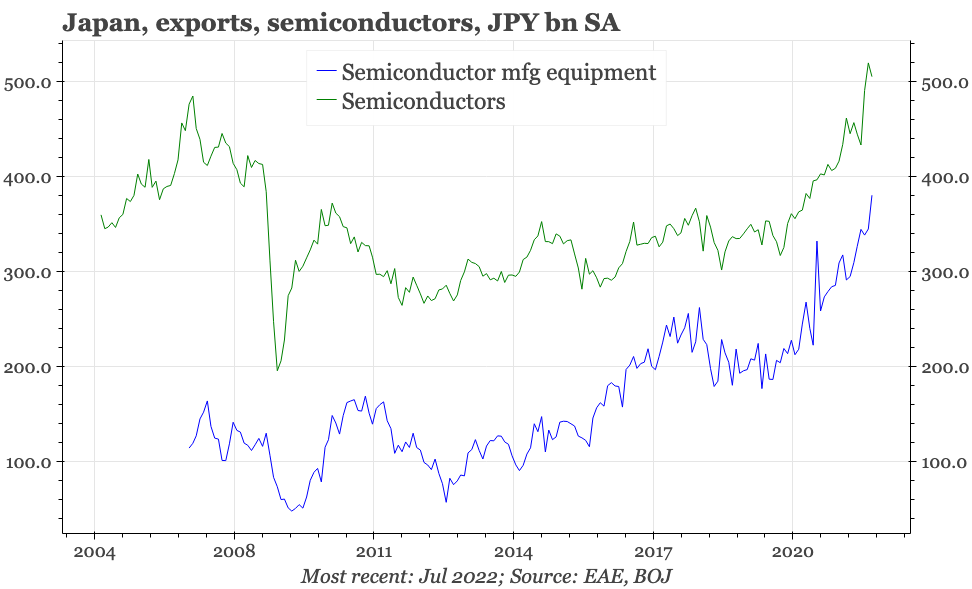

With Japan's tech exports benefiting from the strength in global demand that's lifted semiconductor exports across the region, the weakness in Japan's overall exports relative to the rest of Asia until now has been in large part because of the weakness in world auto trade. With the global tech cycle now seeming to be turning down, it would be particularly helpful for Japan if the auto cycle is now moving up.

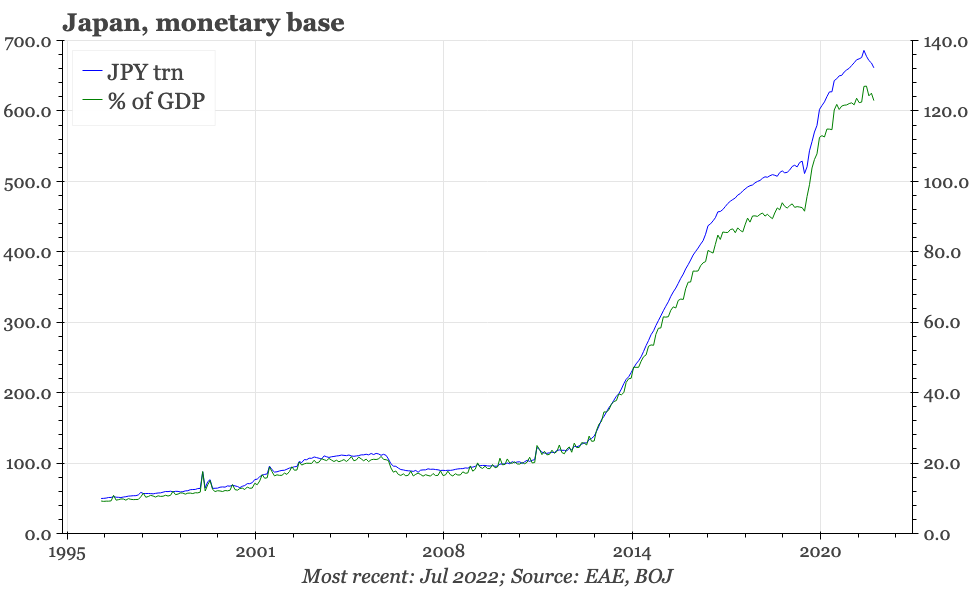

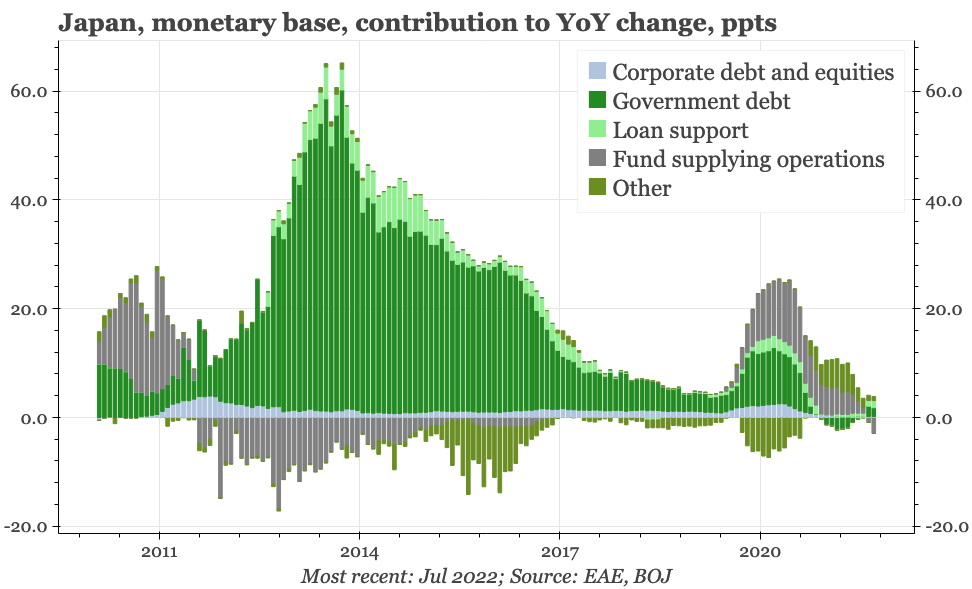

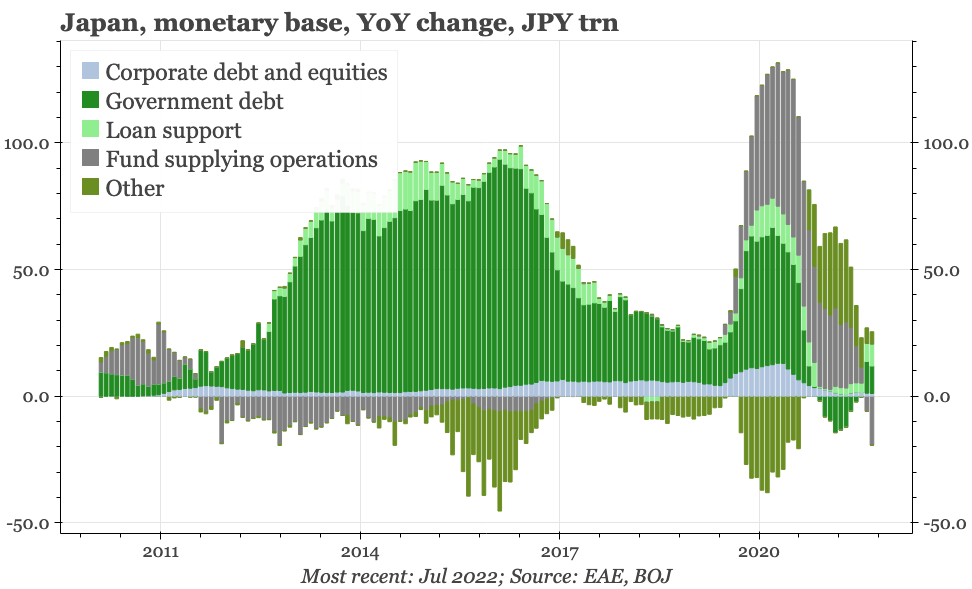

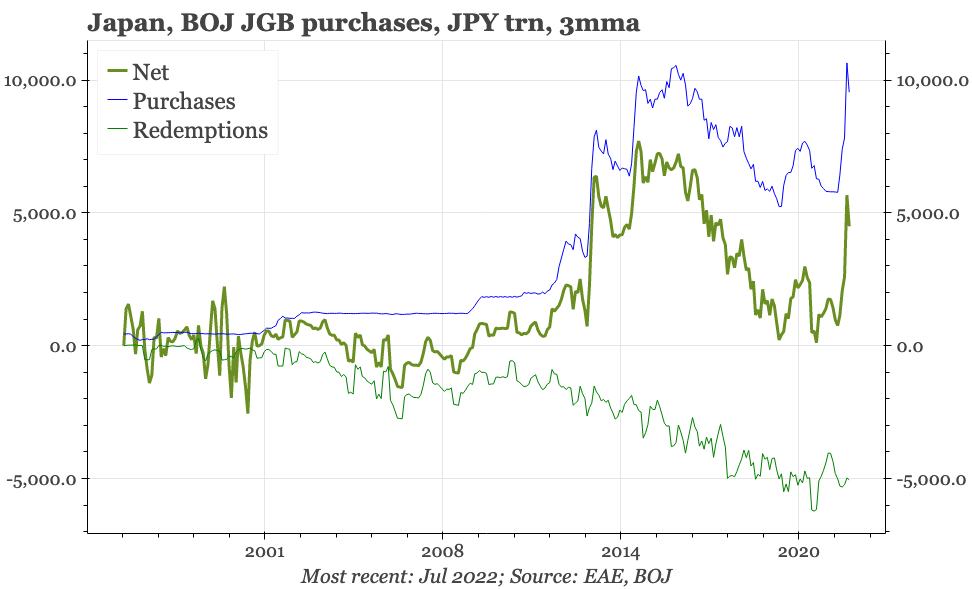

Monetary

Base money continued to contract in July. The BOJ wasn't pressured to buy JGBs at the same frenetic rate it did in June, and at the same time the Covid-19 loan support facilities continued to roll-off. Assuming US rates don't take a new step-up, then BOJ tapering will likely be the theme for the next few months.

Inflation

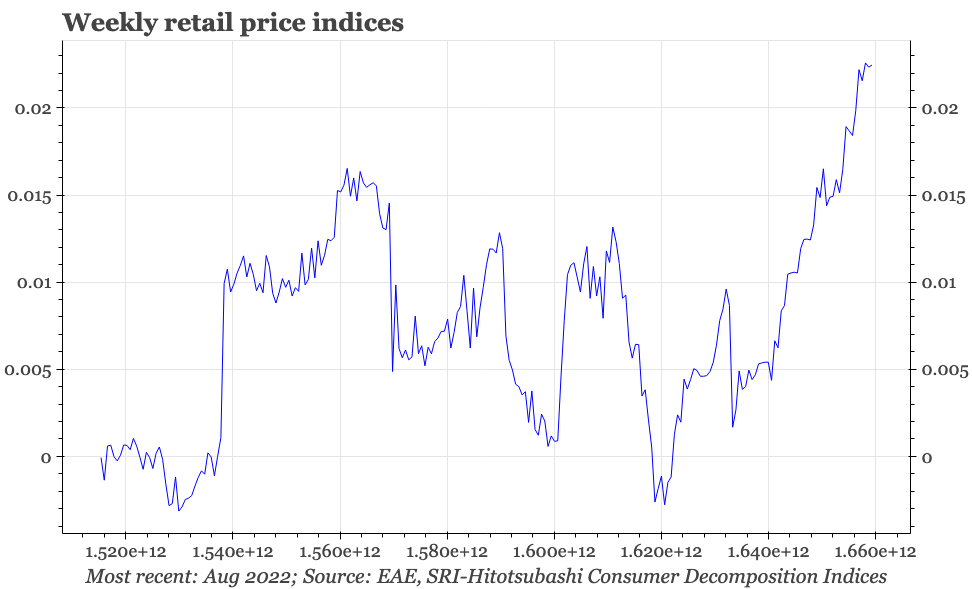

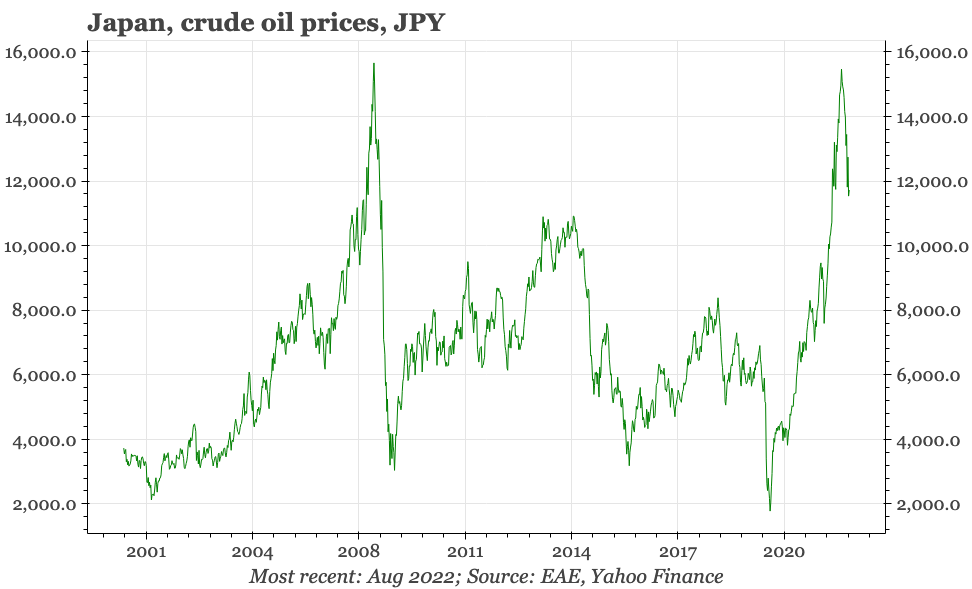

There's likely still some upside for headline inflation in the next couple of months, given the rise in overall import price inflation through July. But signs are again appearing that the peak is near. Crude oil prices in JPY terms are down around 25% from the highs of June, and Hitotsubashi University's weekly retail price inflation shows tentative signs of a peak.