Japan – June CPI

June CPI was still quite strong. But there aren't signs of a transition from goods to services price inflation. Without that shift occurring, the BOJ has justification for arguing that inflation isn't broad-based, and thus that policy doesn't need to change.

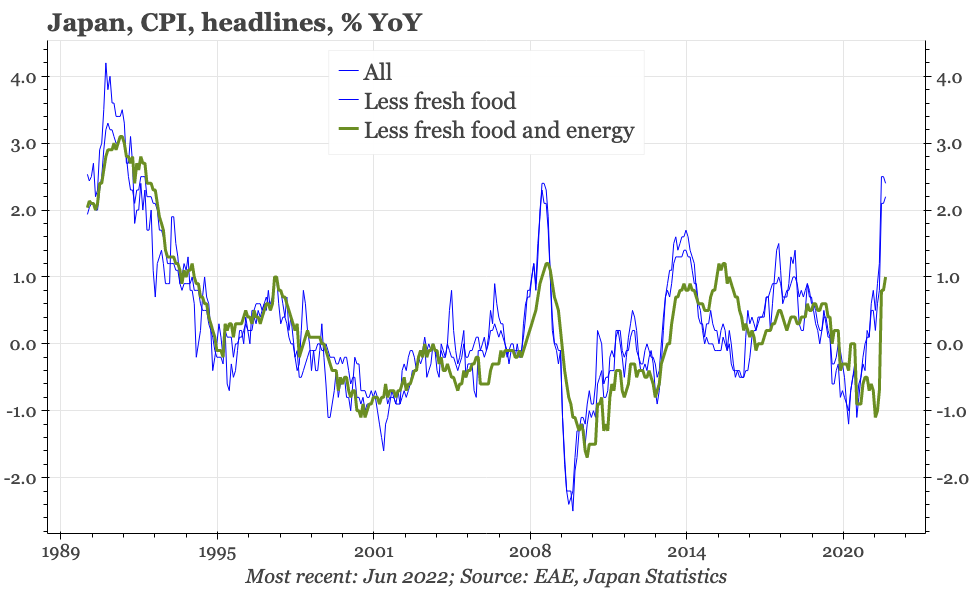

Headline CPI inflation was a little slower in June, easing back from 2.4% YOY to 2.3%. CPI excluding fresh food and energy rose again to 1% YoY, the fastest since early 2016. However, the level of core CPI was unchanged in June from May.

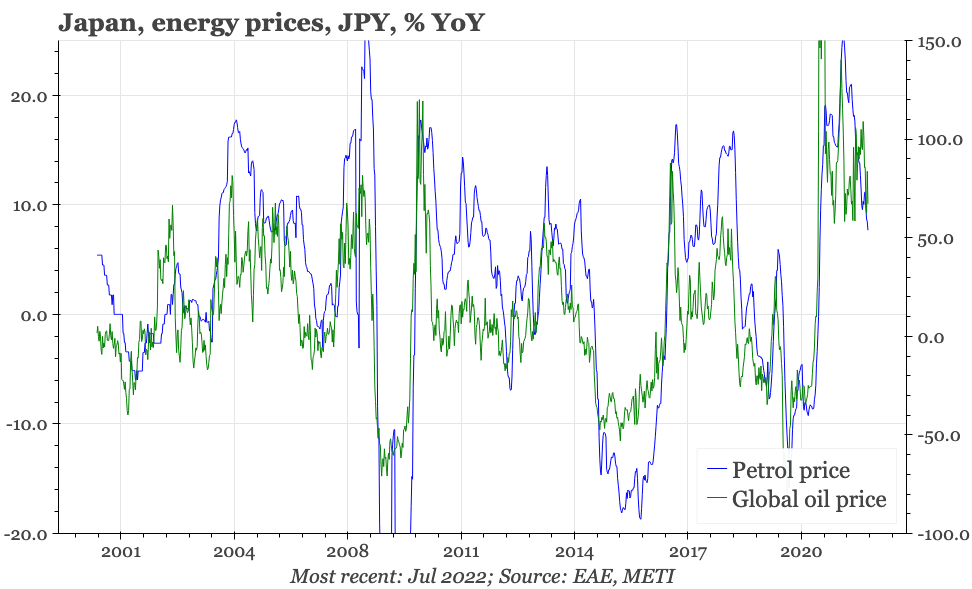

The cause of the slowdown in headline was, predictably enough, softer goods price inflation. Even in JPY terms, there's been some slowing of oil price inflation, which has continued through July.

Services price inflation was unchanged in June for the third consecutive month at -0.3% YoY. That seems a bit stable to be reading too much from, and services prices have been particularly vulnerable to policy distortions in recent years. However, with global commodity prices softening, any rise in domestic inflation from current rates will need to be driven by local services prices. Moreover, with the BOJ yesterday again reiterating that it is willing to look through what it views as the current narrow rise in CPI, a transition to services price inflation is one of the triggers needed to shift monetary policy.

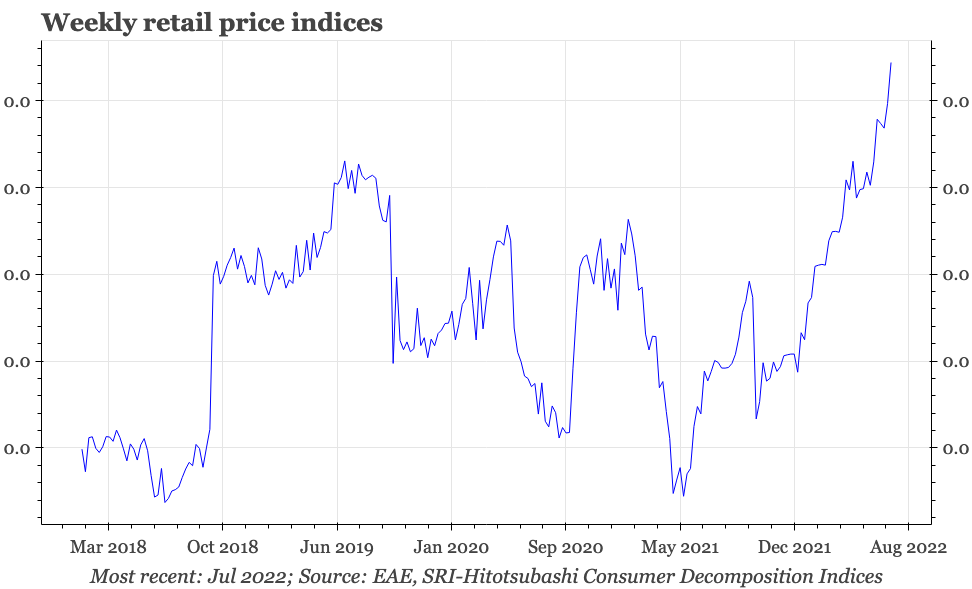

It doesn't feel that the labour market is tight enough or aggregate demand yet sufficiently firm to drive this broadening out of inflation. That said, the weekly retail series compiled by Hitotsubashi University points to price inflation remaining relatively strong at least through early July. That combination of indicators suggests that inflation is remaining at around the current relatively- but not super-high level. There will be more information next week with release of the BOJ's measure of trimmed inflation for June, and July Tokyo CPI.