Japan – Taking stock

The post-covid recovery is still early, with domestic demand still weak. Full-time wage growth isn't changing much, but in July, part-time wages grew 4% YoY. That isn't enough when commodity price inflation is picking up, and means renewed pressure for JPY intervention.

Q2 GDP, July wages, August Economy Watchers

At a headline level, the first release of the Q2 GDP data had been eye-catching. Apart from the recovery after the first covid shock in Q320, the 12% annualised rise in nominal GDP initially announced for Q2 was by far the fastest recorded since at least 1994. However, real growth was inevitably weaker, and within that, all the growth came from net exports.

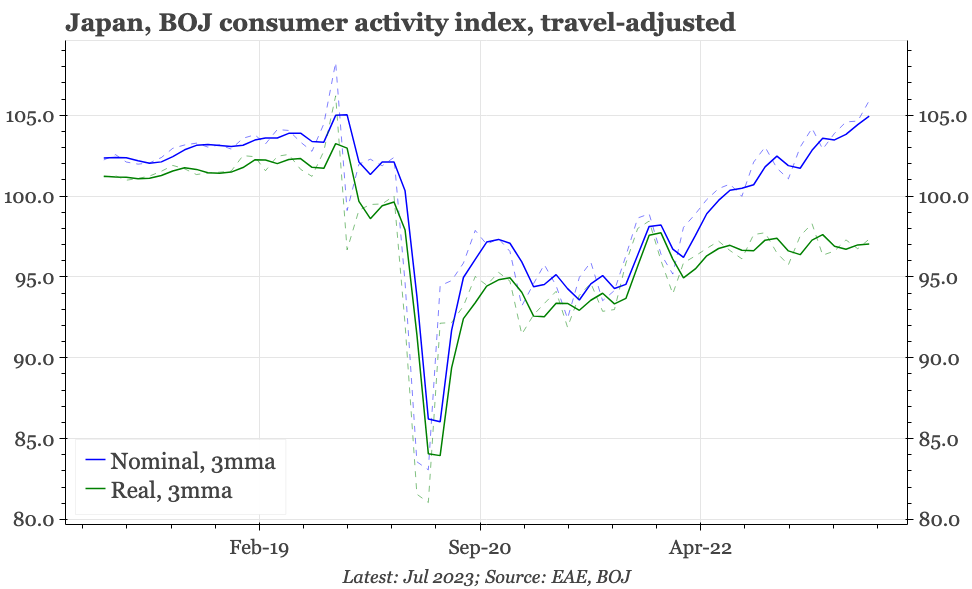

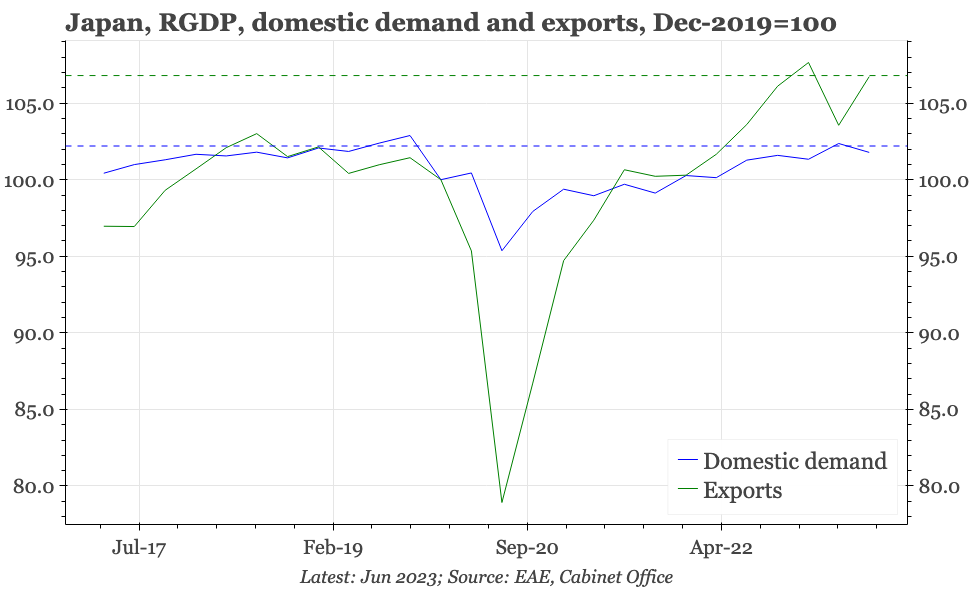

The message from the second cut of the data, released today, is if anything even softer, with both private consumption and particularly capex spending being revised down. Indicators through July don't suggest any rebound: this week's consumption activity indicator from the BOJ shows that consumer spending continues to grow at only a very mild rate. The overall economy is now bigger than before covid began, but only just, and domestic demand remains below the level reached at the end of 2019.

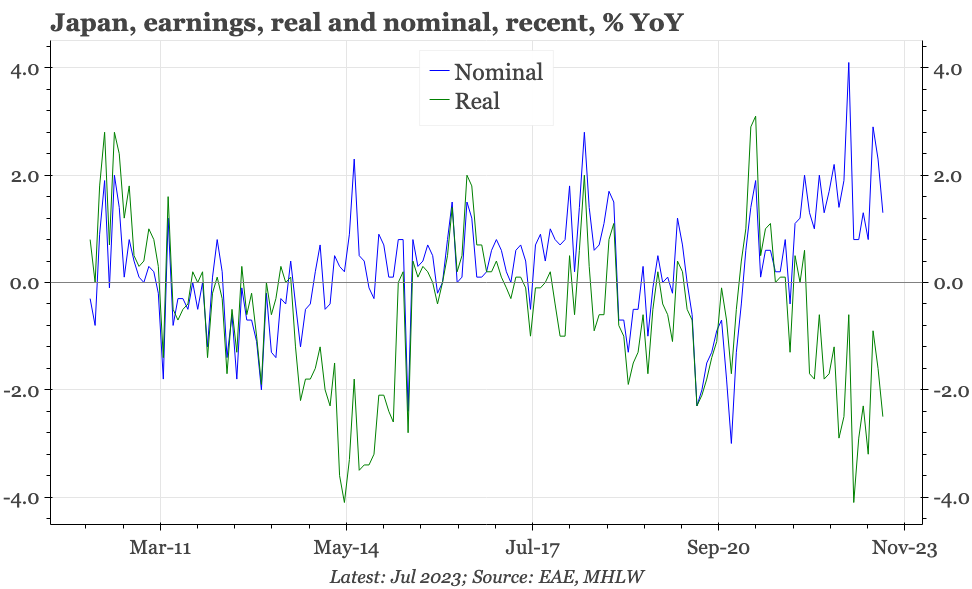

It perhaps isn't surprising that private consumption in particular remains weak, given the ongoing squeeze in real wages. Other data today showed that the decline continued in July, with overall real earnings falling by -2.5% YoY, dropping for the 16th consecutive month. Inflation remains relatively high, but growth in overall nominal earnings also eased back in July to just 1.3% YoY.

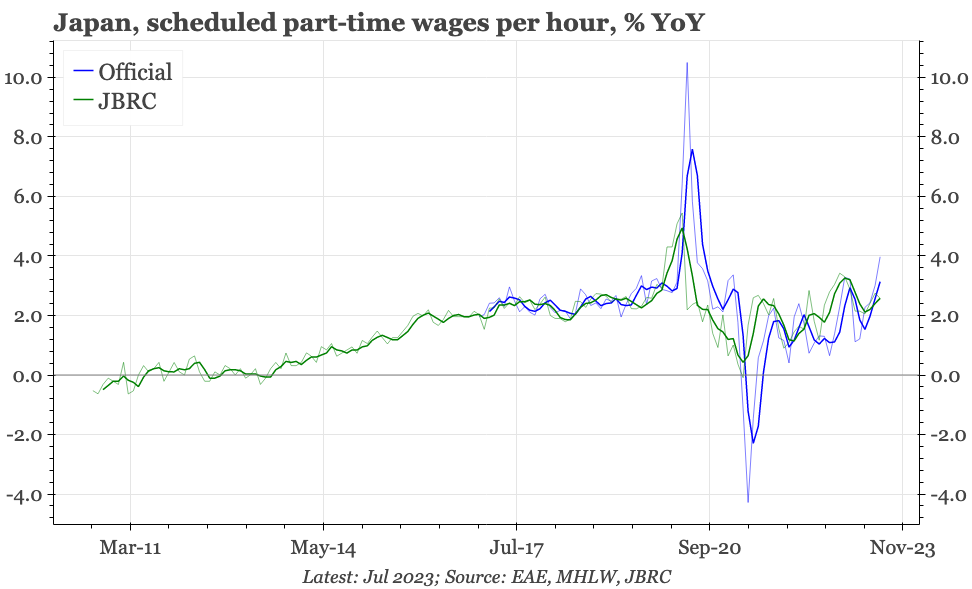

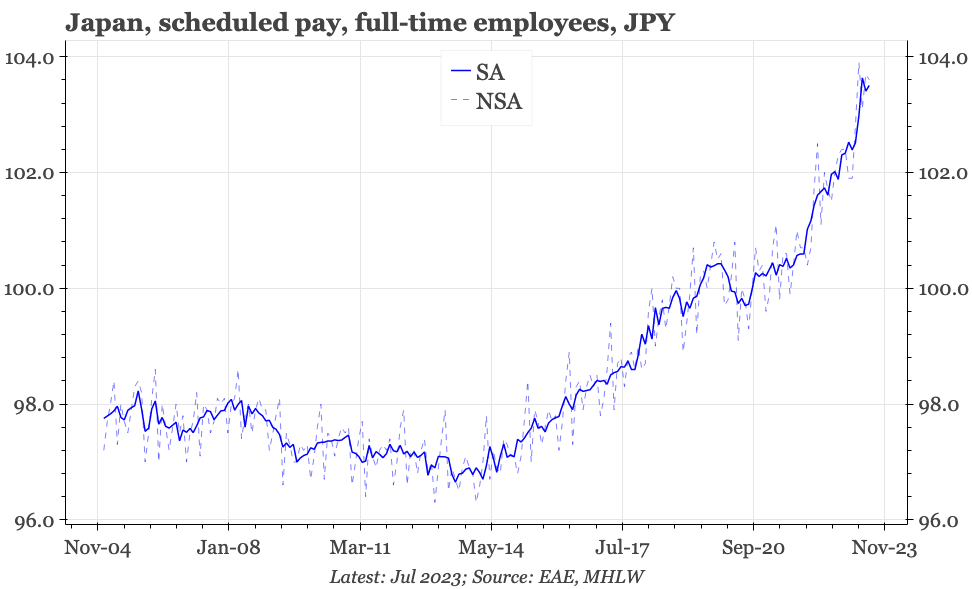

That was mainly because of bonuses, which tend to be noisy from month to month. Averaging out the last three months, and overall earnings continue to grow at around 2%. Full-time scheduled wage growth has slowed after the spurt between February and May. However, full-time employment has continued to tick up, which isn't insignificant given starting wages for these positions tend to be higher. At the same time, part-time hourly wage growth – which should better reflect underlying demand:supply conditions in the labour market – accelerated to 4% YoY in July, the highest since the pandemic began.

We've been arguing that the labour market isn't yet tight enough to drive the sort of reflation cycle that the BOJ wants. The acceleration in part-time wages might be an indication that another wave of tightening is now occurring, and that would fit with the bounce in consumer confidence, a development that has happened even though inflation expectations are high.

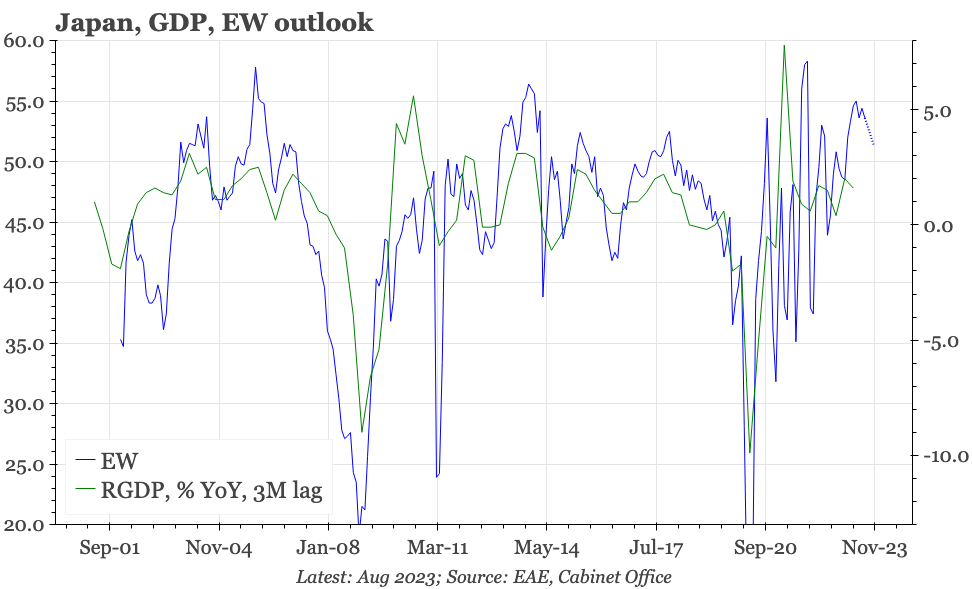

Despite the weaker GDP data, we'd think that a tightening of the labour market is what should be happening. There clearly has been an economic recovery this year, seen in the rise in business as well as consumer sentiment. Today's Economy Watchers survey was a bit softer, but continues to suggest the recovery in the economy still has room to run. The services PMI in July actually ticked up, and remains near the highs in the whole history of the series. The release of the series stated:

Long-term business expansion plans continued to support positive sentiment regarding the 12-month outlook for activity during August. The overall degree of optimism strengthened from July to extend the current period of business confidence to three years. Service providers also cited a sustained recovery from pandemic-related disruption alongside stronger demand for tourism and other customer-facing activities.

Overall, we would continue to think that the recovery in the economy is nearer the beginning than the end. That suggests that the BOJ won't be rushing to move rates further. The authorities, though, will be becoming more concerned about the continued weakness of the JPY, given that commodity prices have also risen again. The combination has lifted JPY gasoline prices by almost 10% since early June. If that trend continues to run without a further acceleration in nominal wages, the recent rise in consumer confidence will likely be fading once again. Given this, currency intervention is becoming more likely once again.