Japan – waiting for hospitality

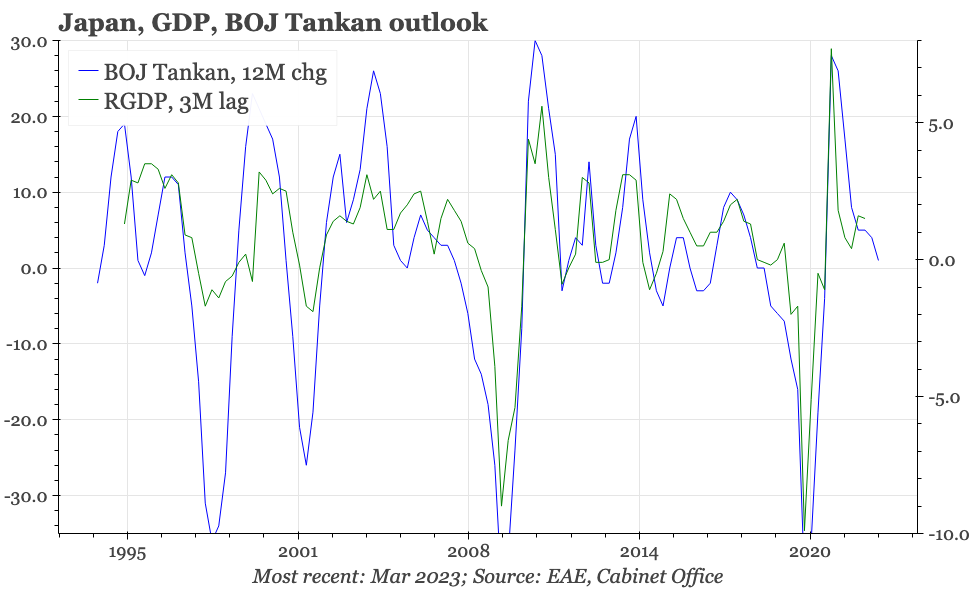

The Tankan points to GDP growth remaining tepid. It does, however, confirm other data showing services price inflation is beginning to emerge. That seems likely to at least persist as Asia opens up after covid, challenging BOJ claims that inflation in Japan is all about energy prices.

Q4 BOJ Tankan

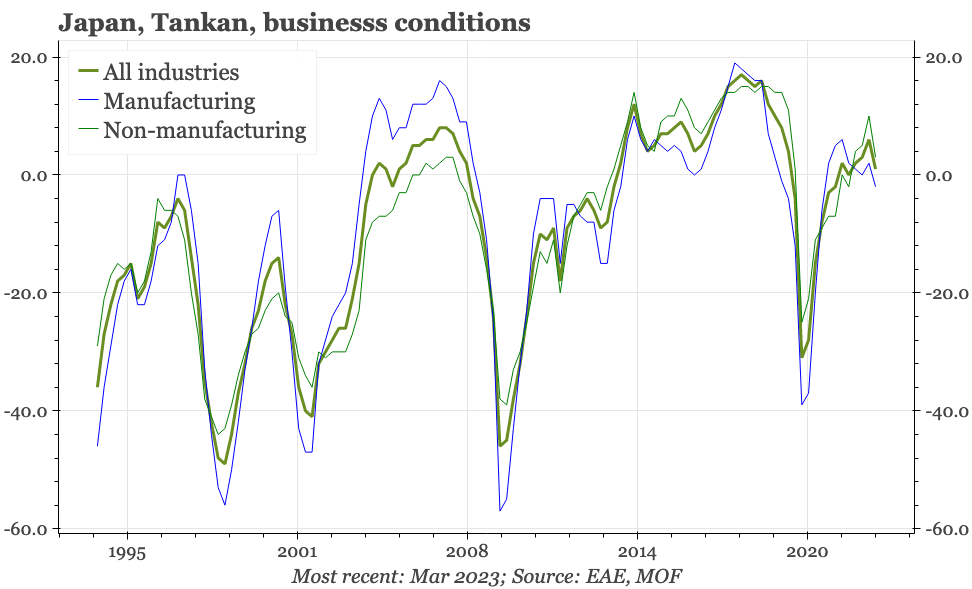

It is disappointing that the BOJ's Tankan survey for Q422 points to economic growth slowing, even though the pace of recovery out of the pandemic has already been tepid. In the Tankan, the weakest part of the economy is manufacturing, which isn't surprising. Manufacturing was by contrast the strongest sector of the economy during covid, but the global goods cycle is now clearly slowing. November trade data released today showed Japan's exports flat-lining, while leading indicators are clearly pointing down.

However, while manufacturing is the weakest sector, the Tankan also showed sentiment in non-manufacturing declining from last quarter. That is even more disappointing than the decline in manufacturing confidence. Services demand has been depressed in the last couple of years, both by covid itself, and the various measures used to suppress the virus. Looking at that alone, and it would have seemed reasonable to expect an ongoing lift in the services sector.

The reason this hasn't happened is that the easing of the covid hit for Japanese consumers has been offset by a sharp rise in inflation, an increase that has outpaced the rise in wages. The resultant squeeze in living standards has caused a collapse in consumer confidence, and so prevented the realisation of the growth dividend that should have been delivered by the easing of the domestic covid crisis.

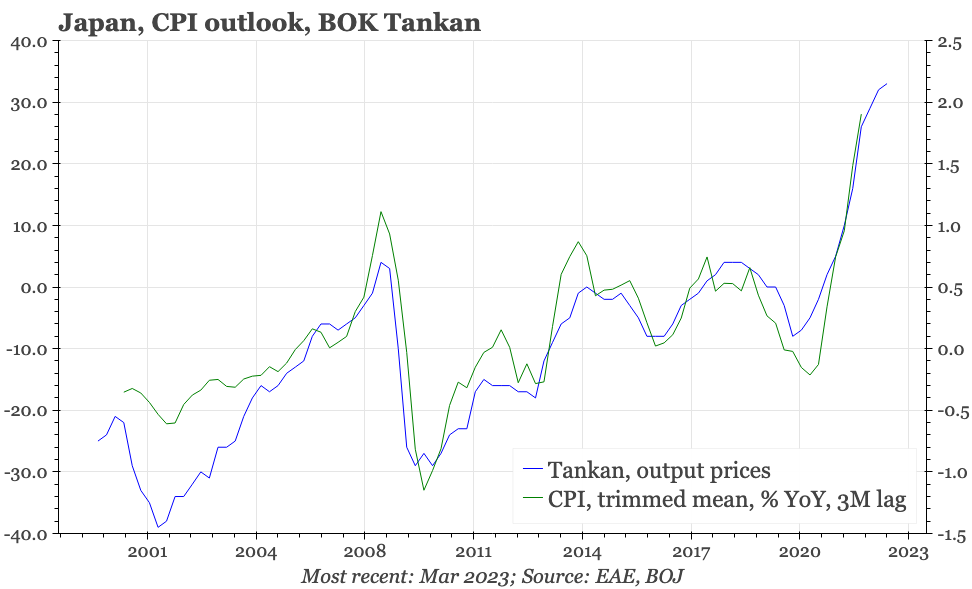

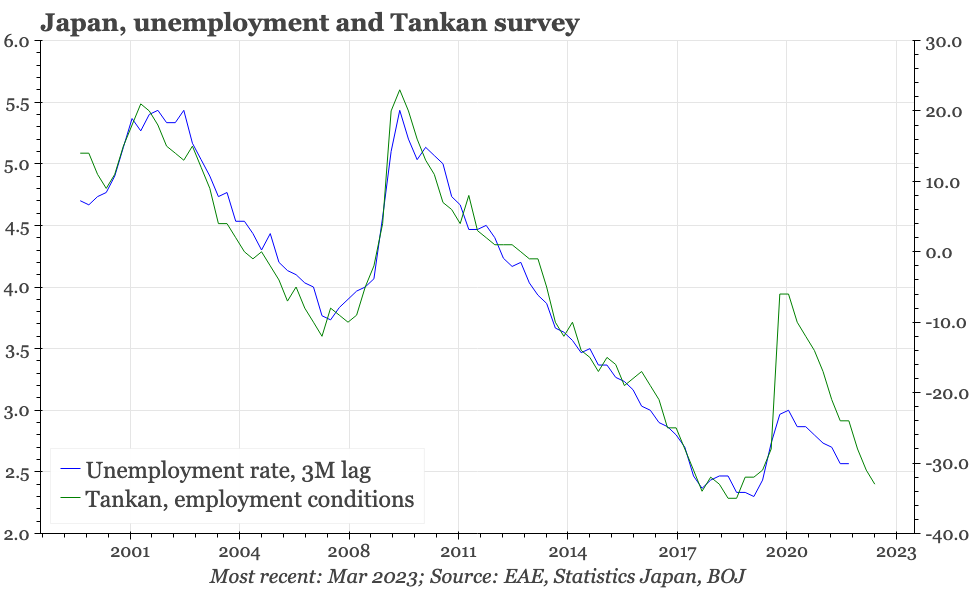

The Tankan does at least suggest that the fall in real living standards should be starting to stall. Overall output prices did rise again this quarter, but a bit less quickly, which is consistent with other indicators pointing to a deceleration in imported commodity price inflation. The Tankan also pointed to a further tightening of the labour market, which should provide some support to nominal wage growth in the coming months.

These are welcome developments, but at least as signalled by this quarter's Tankan, the changes don't look powerful enough to really move the macro needle. While the pace of acceleration is easing, output prices in the Tankan are still pointing to inflation rising a bit further. Meanwhile, the tightening of the labour market is in line with other leading indicators pointing to unemployment falling a little more, but not back to the pre-pandemic lows. If that is right, then it seems unlikely wage growth accelerates much further.

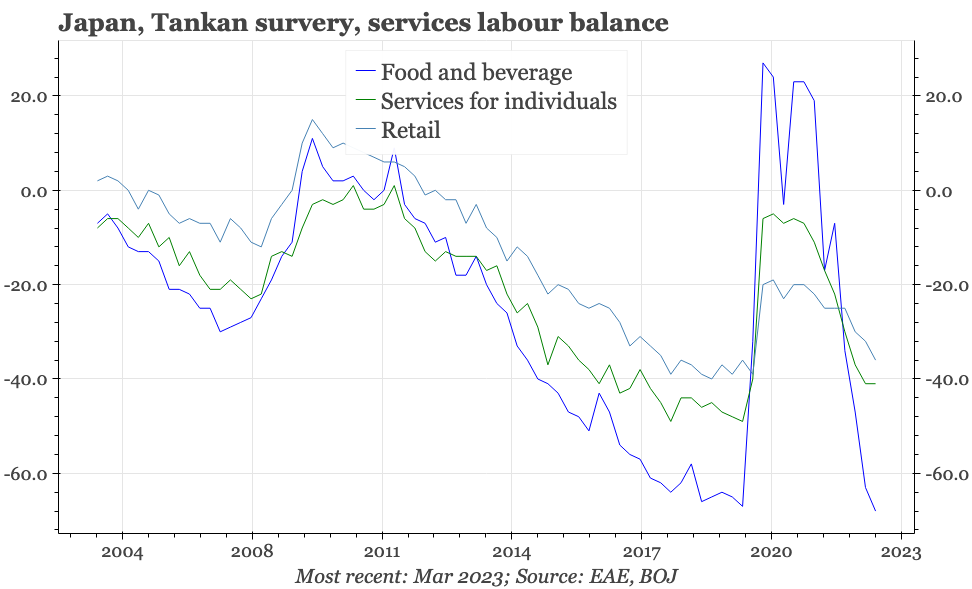

Of course, it is only really now that Asia is opening up after covid. Japan's own border was effectively closed until quite recently, and it is only in the last couple of weeks that the potential for a resumption of international tourist flows in and out of China – which, pre-pandemic, was Japan's biggest source of tourists – has emerged. This quarter's Tankan wouldn't have captured the impact of the changes that will result from Beijing's sharp shift on covid.

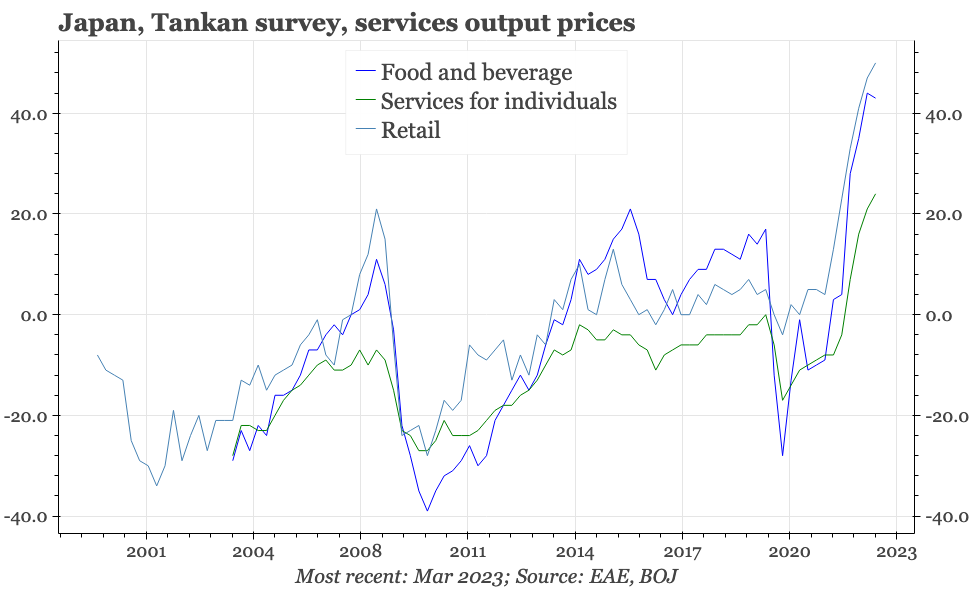

This is important because even without an extra impetus, hospitality service output price inflation as reported in the Tankan is quite strong. In addition, the reported demand:supply balance in some parts 0f the hospitality sector are already tighter than any in any other industry. Moreover, for all the BOJ's claims that the rise in CPI inflation has been driven by import prices alone, there has been a sharp acceleration in private sector services inflation.

We have waiting empty-handed for a normalisation of consumer demand for a few months already, do it probably isn't right to get too excited about that now finally occurring. Private services inflation also only has a 10% or so weighting in the overall CPI, so prices in the sector would have to rise dramatically indeed to lift the economy-wide rate of inflation. However, with the labour balance already tight and prices already rising, there is the potential for a further rise in services inflation. That in turn would make it more difficult for the BOJ to argue that inflation is just about energy prices.