Japan – BOJ cautious on exports, confident on wages

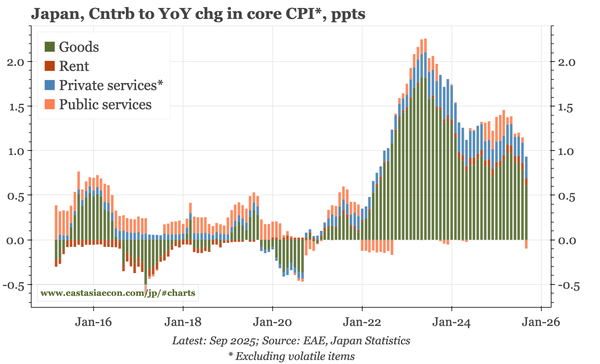

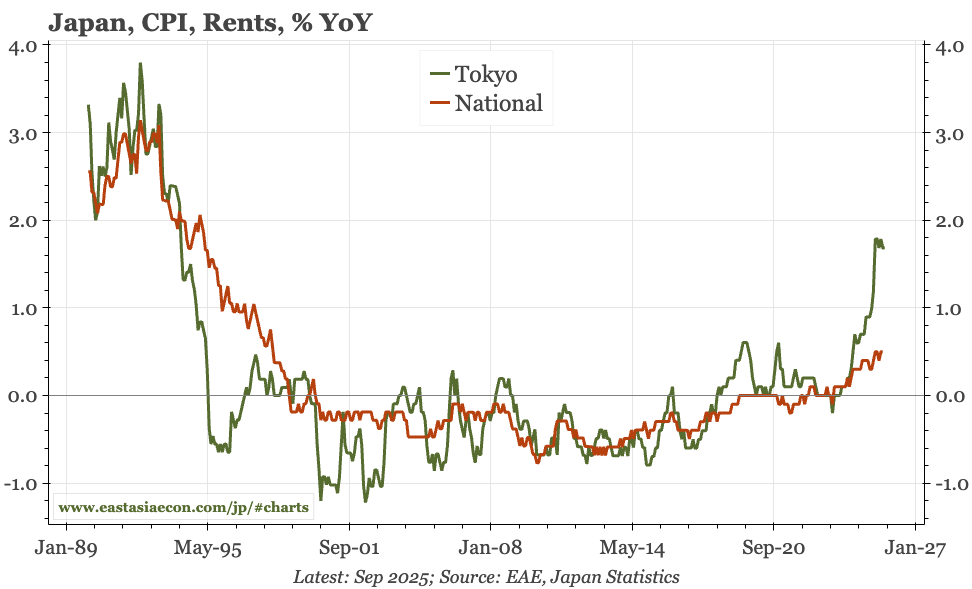

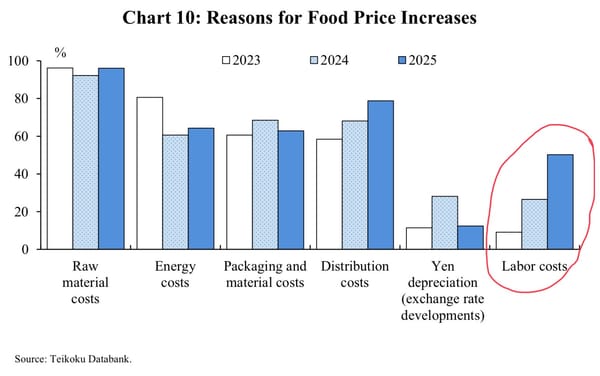

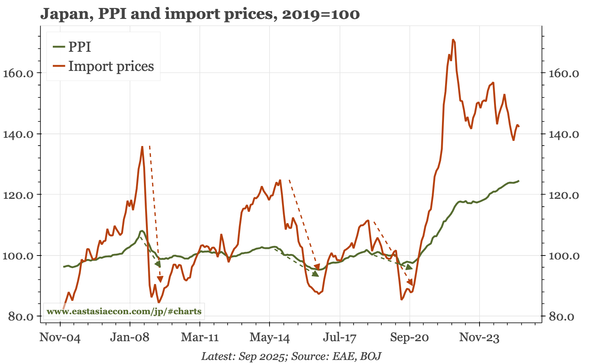

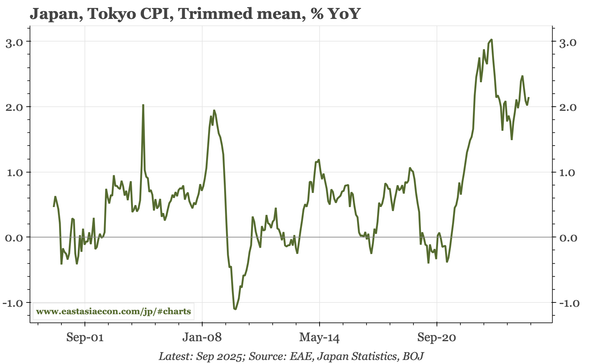

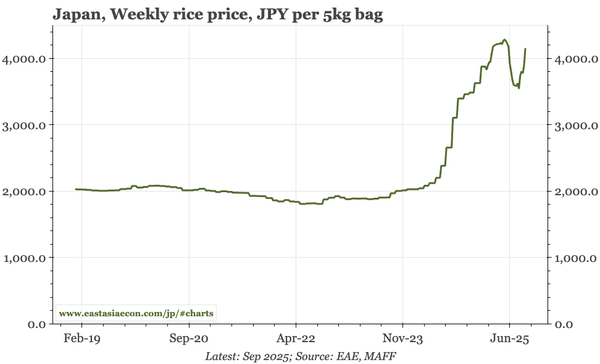

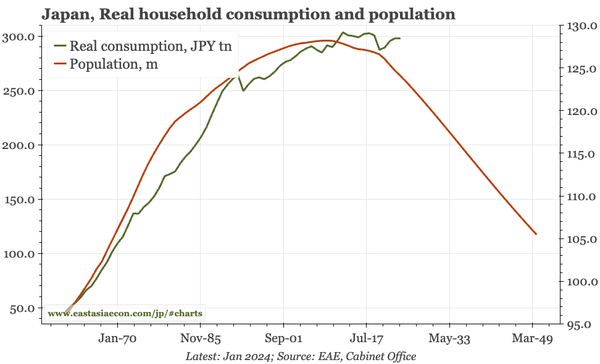

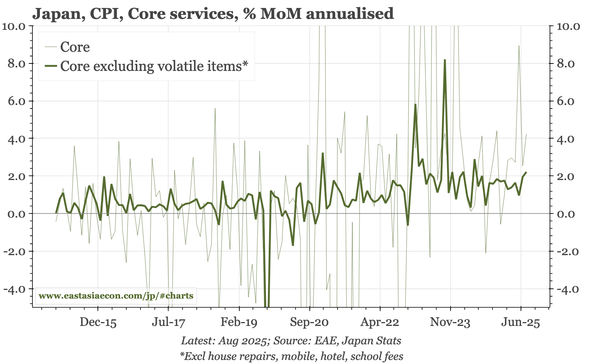

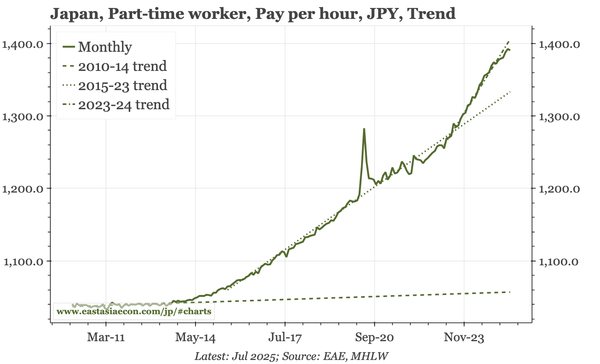

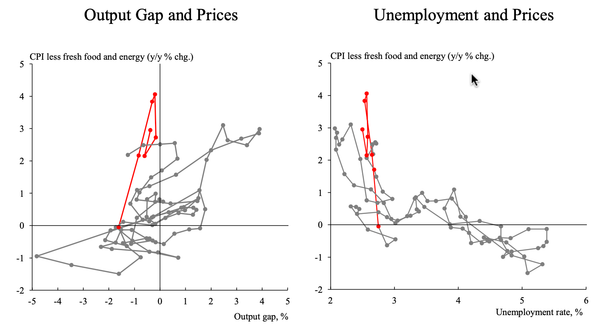

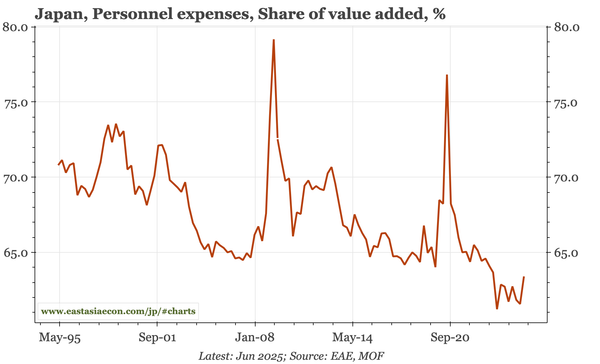

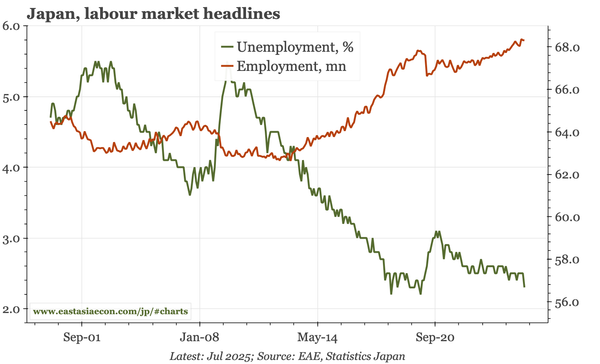

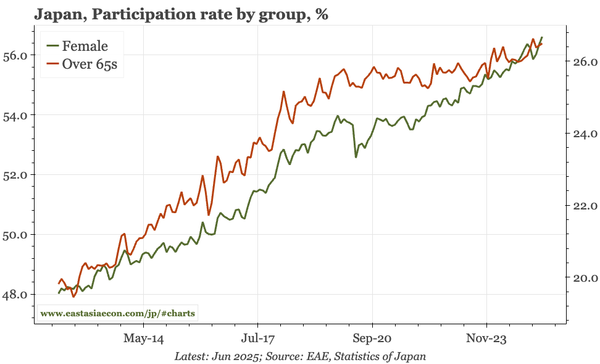

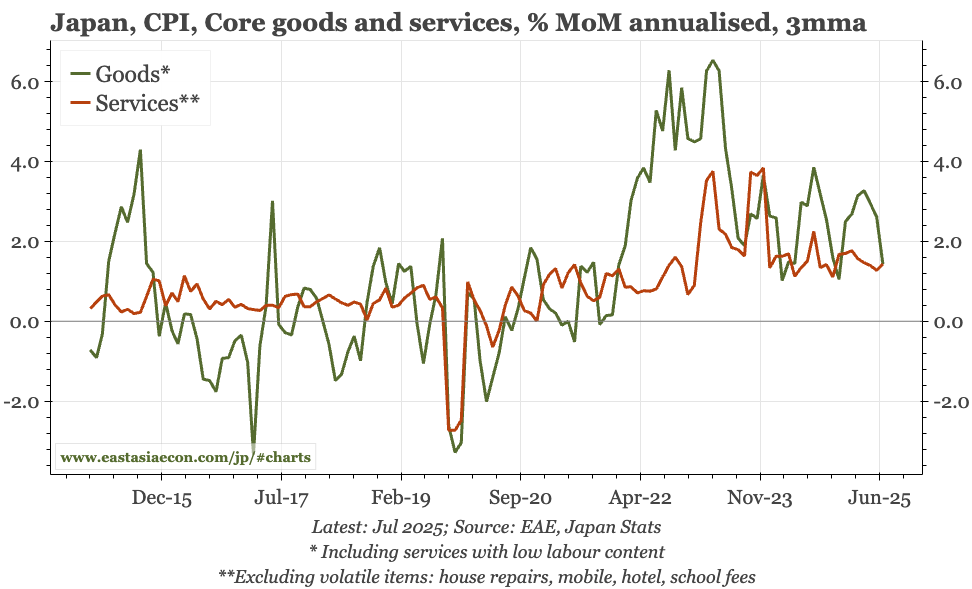

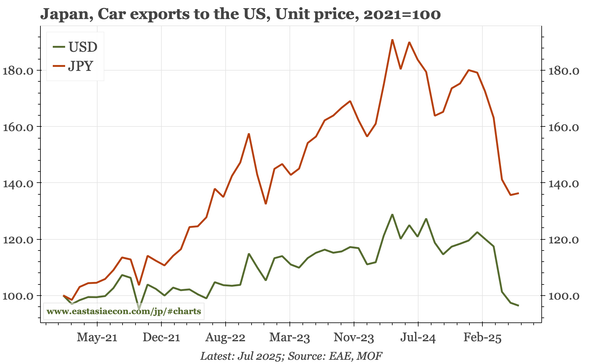

Today there were the usual month-end data releases of retail sales, the labour market, and construction, as well as Tokyo October CPI. More interesting was the BOJ's full outlook report, analysing exports, capex resilience, food prices and consumption, as well as wages and prices.