Japan – solid GDP

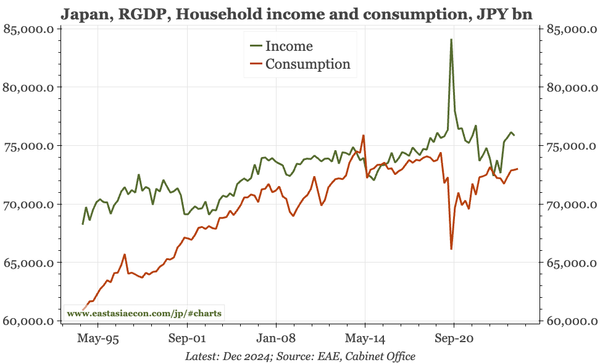

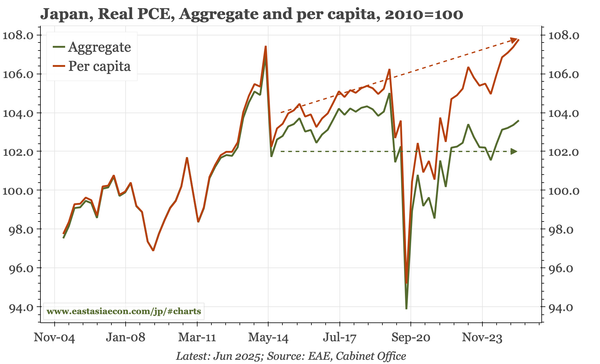

Q2 GDP wasn't particularly impressive at headline level, but the details were firmer, with both consumption and investment rising. The recovery in aggregate consumption does remain sluggish, but that is partly because of population loss. I estimate per capita consumption in Q2 reached a record high.