Korea – August business sentiment

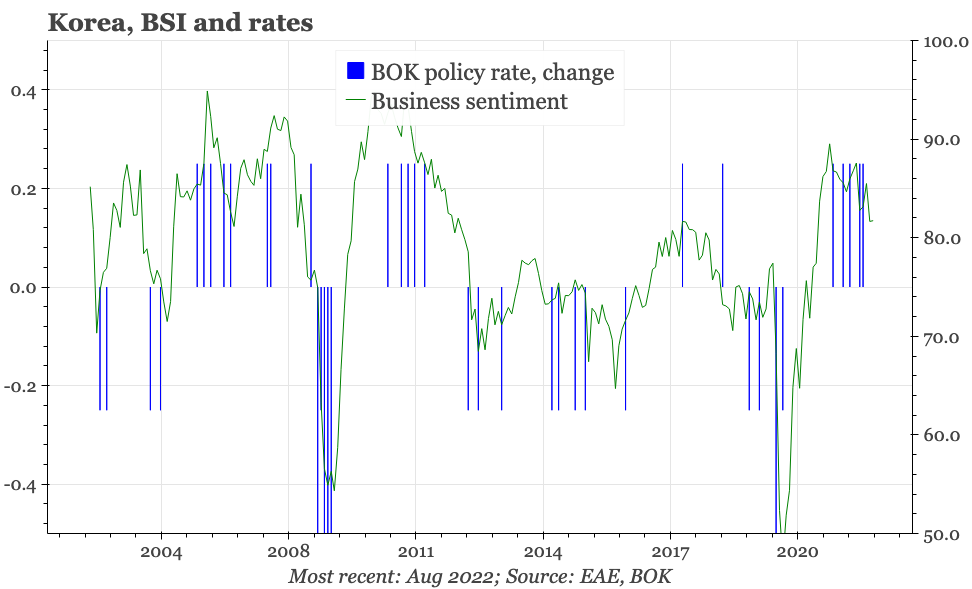

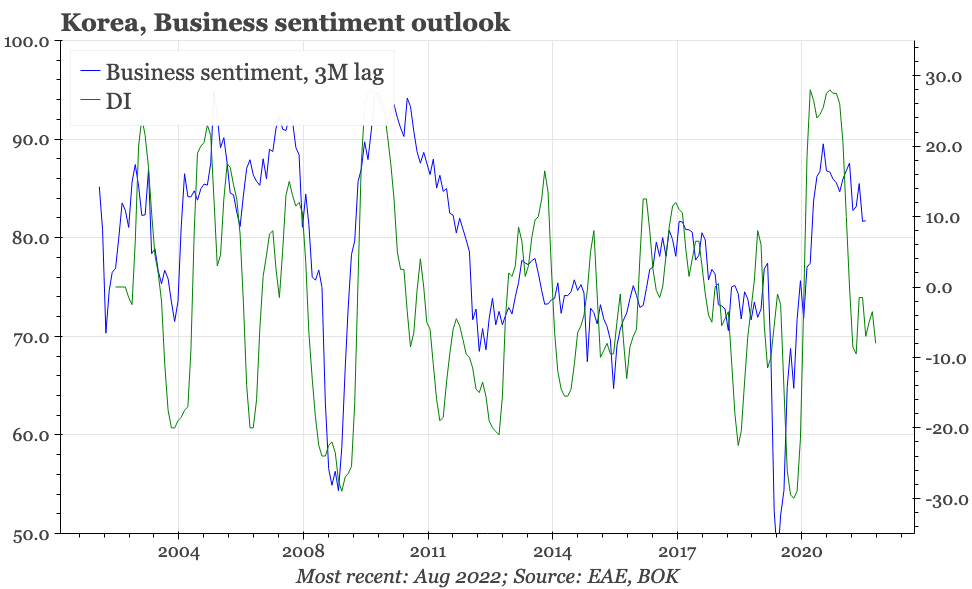

Business sentiment and price indicators remain at high levels. That justifies more BOK tightening in the short term. But there are some signs of change ahead, with exporter sentiment clearly down from the peaks, and inflation leads also falling.

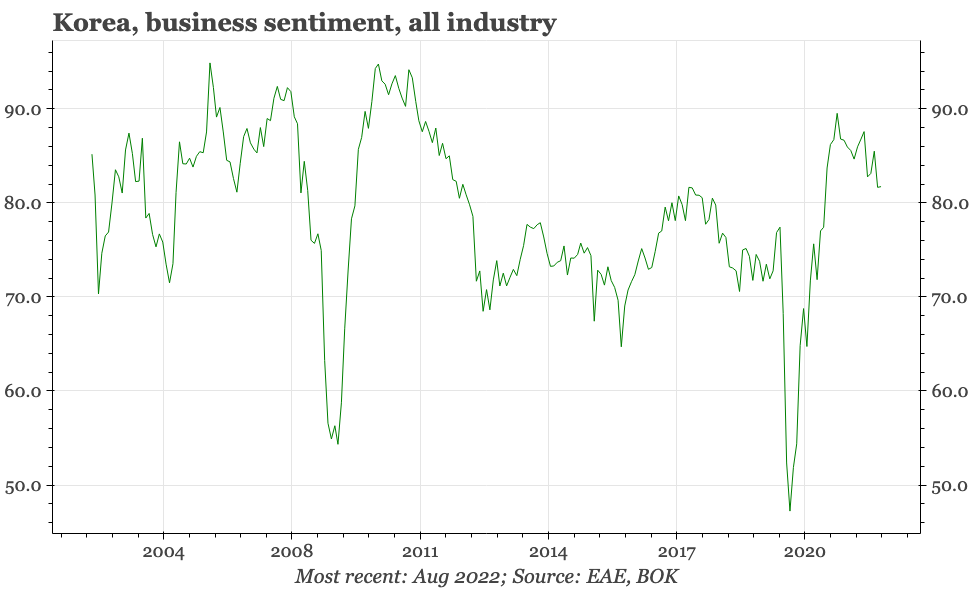

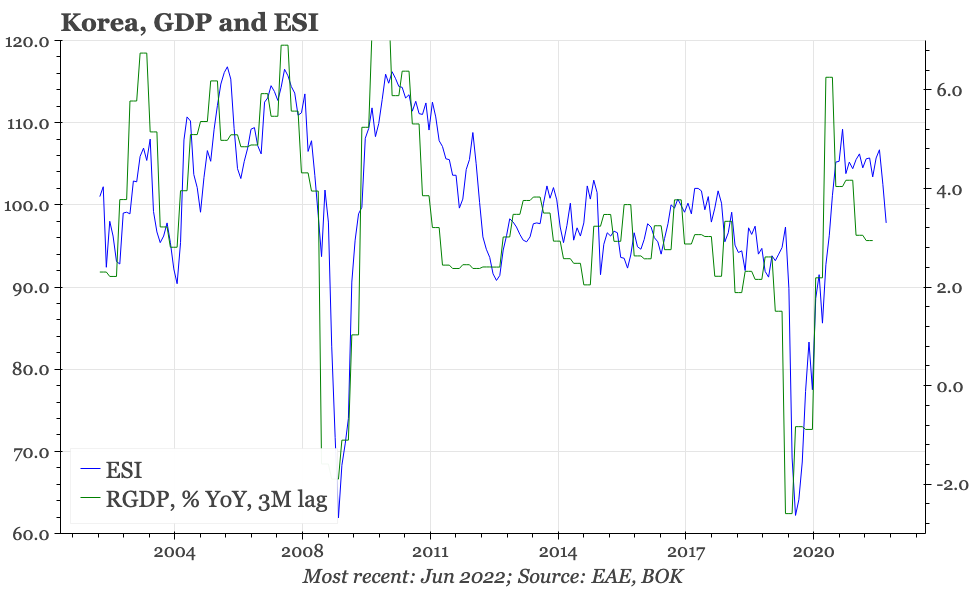

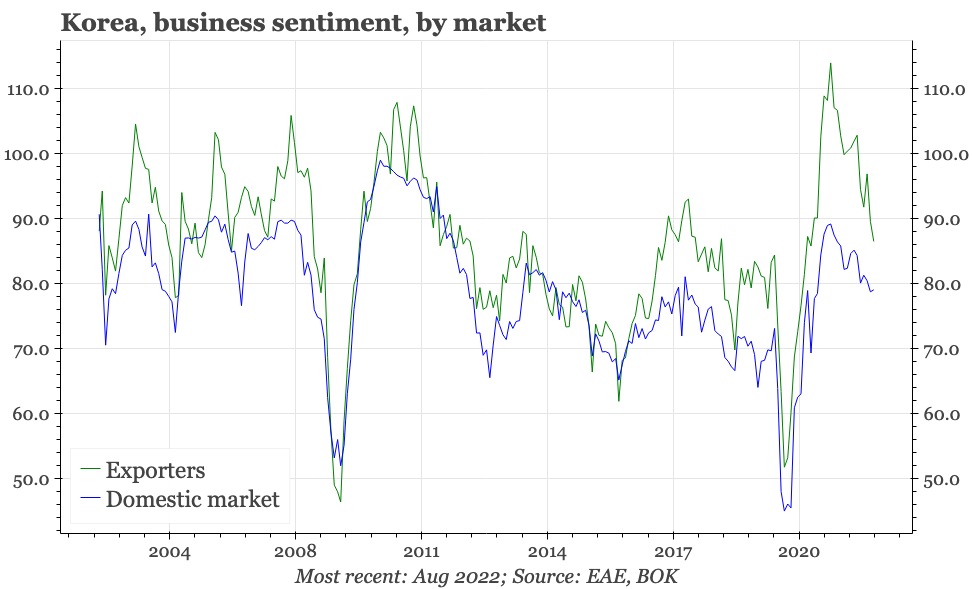

Sentiment in the monthly BOK business confidence survey remained elevated, and suggests the cycle alone – and so not even including the surging inflation – is strong enough to warrant further BOK hikes.

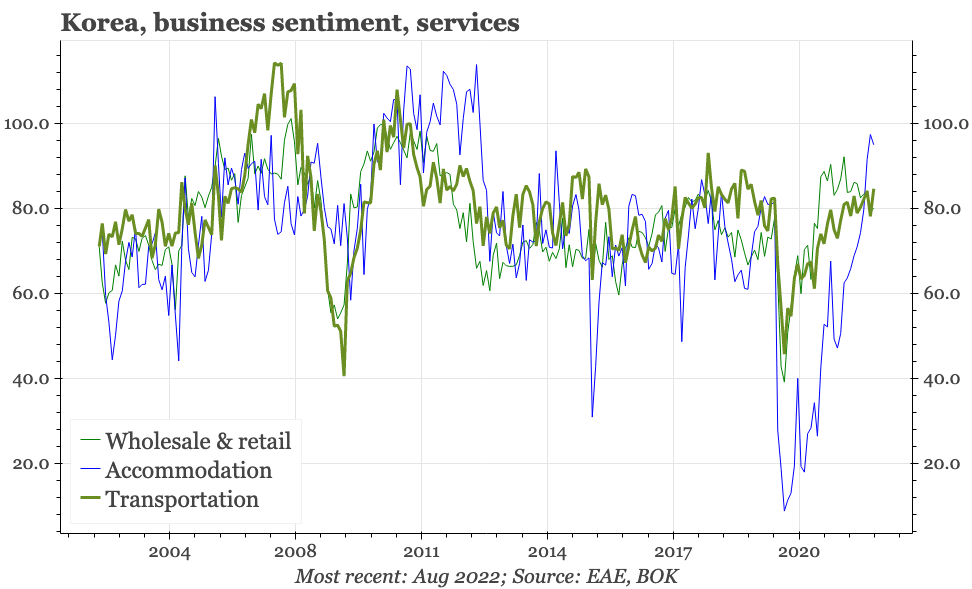

Sentiment among manufacturers and exports does continue to soften, a signal that exports will likely be declining in the following months. For the moment, that trend is being offset by some resilience in non-manufacturing sentiment, boosted by demand pent-up during the covid troubles of the last couple of years. Confidence through August in today's survey for accommodation did fall a bit, which likely shows the beginnings of exhaustion in this trend, though it is also true that covid cases in Korea are rising again.

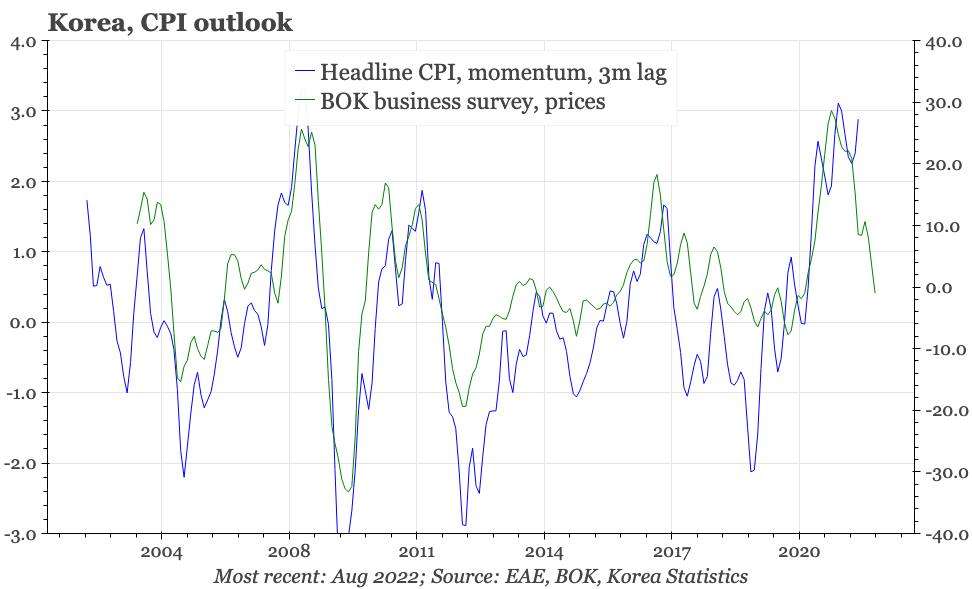

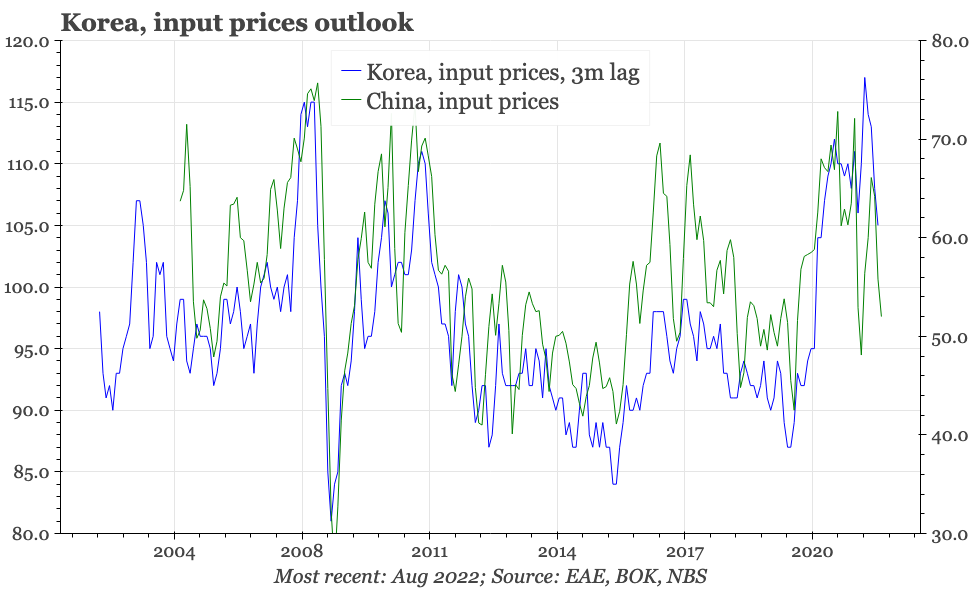

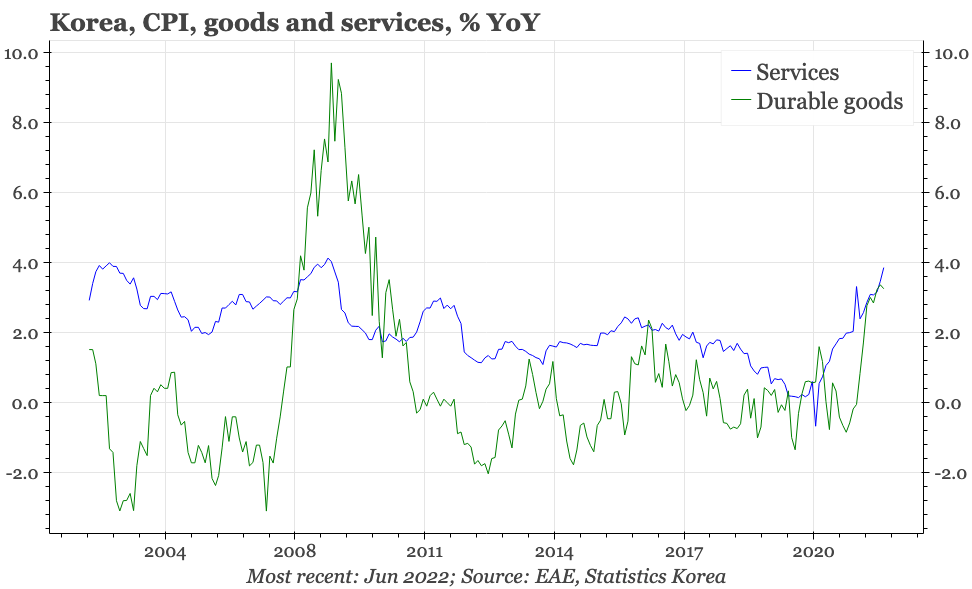

Today's survey did show a fall in both output and input prices. That indicates that inflation momentum should decline quite sharply in the rest of the year particularly as the leads for input prices suggest further downside ahead. That said, this is only true for the YoY change in inflation – the falls aren't yet big enough to show that inflation itself is about to decline a lot. Moreover, the business survey only measures prices in manufacturing, and so probably is better at detecting changes in goods and global prices rather than the services and domestic prices which have also been boosting Korean inflation.