Korea – export floor?

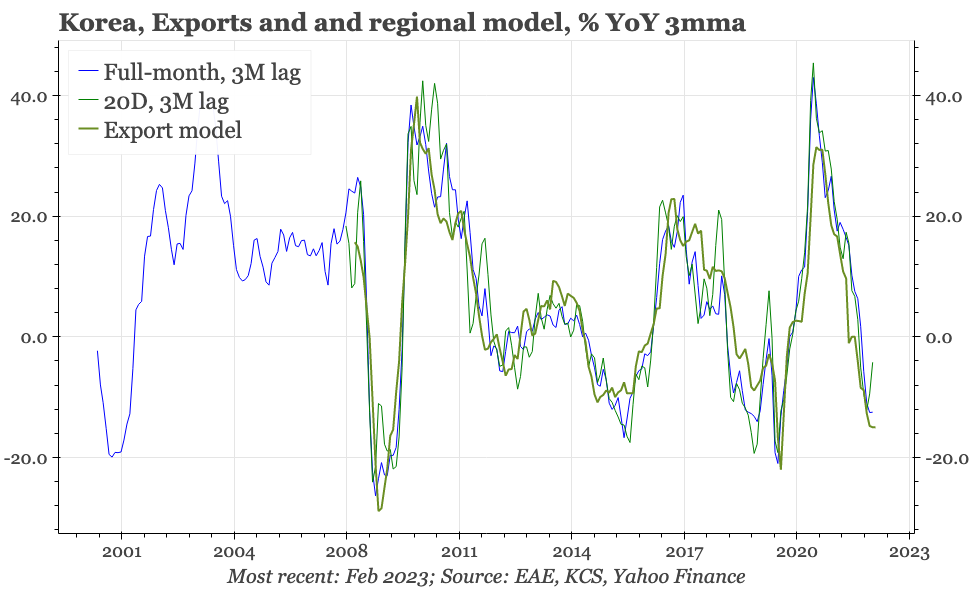

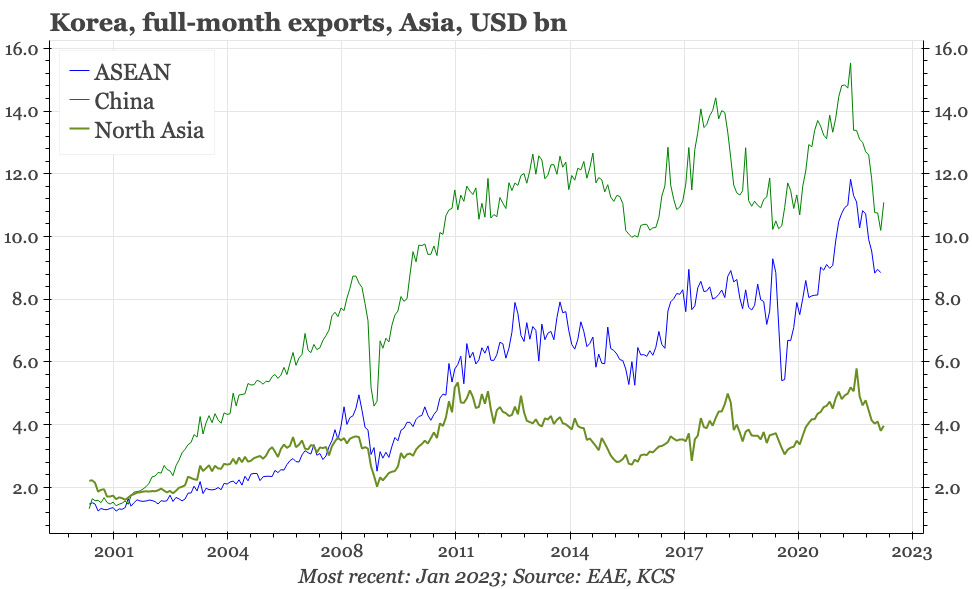

Korean exports continue to fall, but there are sighs that a short-term floor might be near. The driver of that is recovery in China, which is happening when exports to DM have yet to decline.

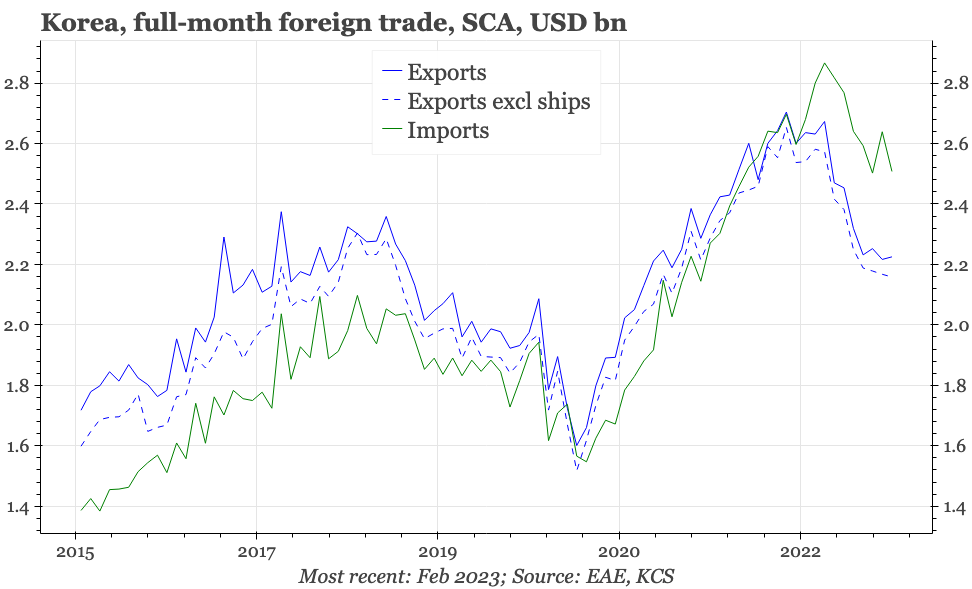

Korean full-month February foreign trade

Korean exports continue to fall. However, the rate of decline has clearly decelerated, which fits with some of the leading indicators suggesting that the cycle might soon find a short-term floor.

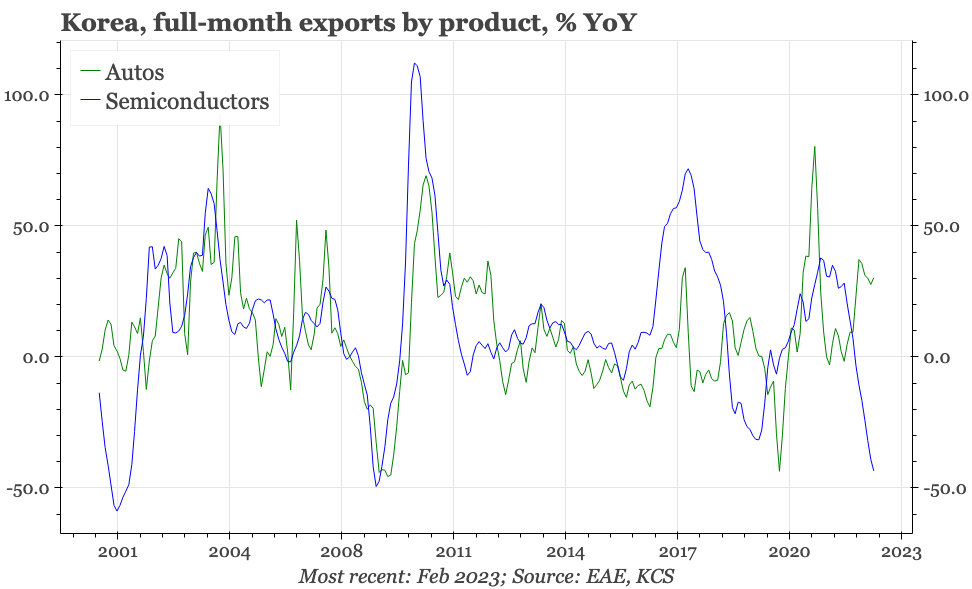

This improvement would be driven by two dynamics. First, in terms of markets, there are finally signs of exports to China recovering. That's happening at the same time as shipments to DM have yet to fall. Indeed, sales to the US rose in February to get back close to the record high. Second, from a product perspective, while exports of semiconductors continue to fall, car shipments have been picking up. This differentiation is unusual, given the semi and auto demand tends to move together.

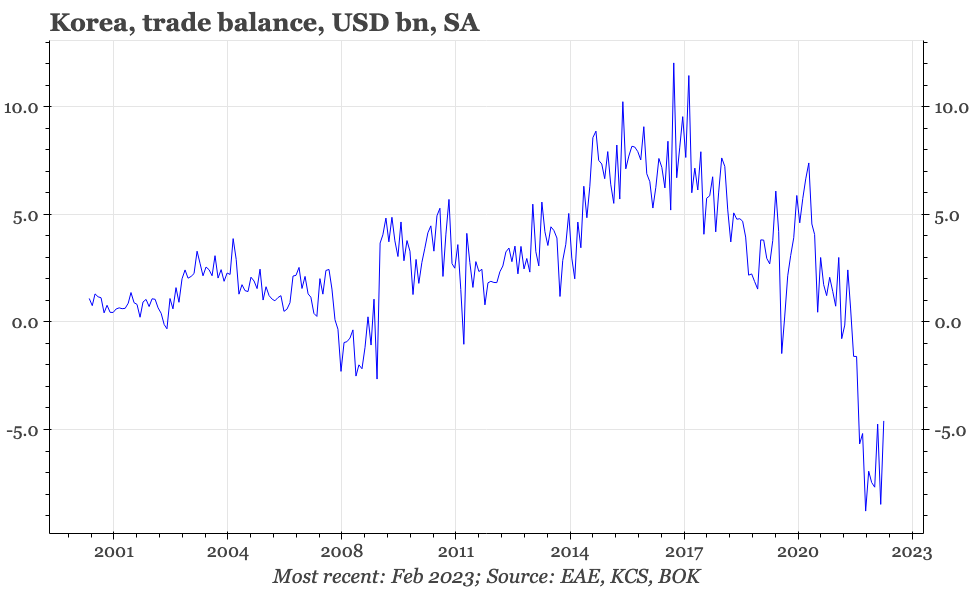

Imports fell in February, but are still roughly at the same level of December 2022. The size of the import bill, combined with the strength of exports, continues to put pressure on the trade balance, which remains in deficit.

A bottoming out – let alone an improvement – in the export cycle would be an important development for macro in Korea, and thus for the BOK. To get a real turn though, there needs to be a decent turnaround in China, while exports to the US and EU continue to hold up. DM demand has been much more resilient than we would have expected, though presumably, that can't be sustained indefinitely.