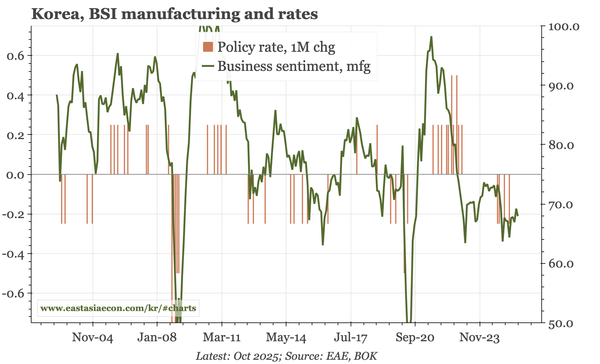

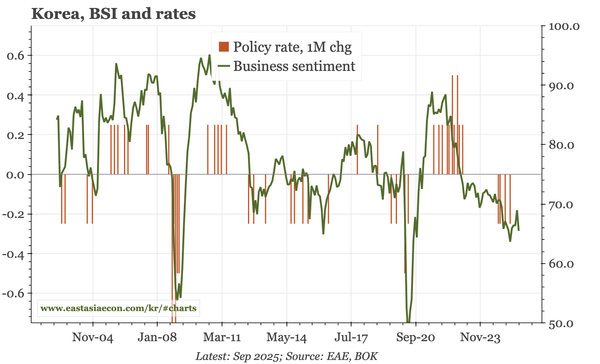

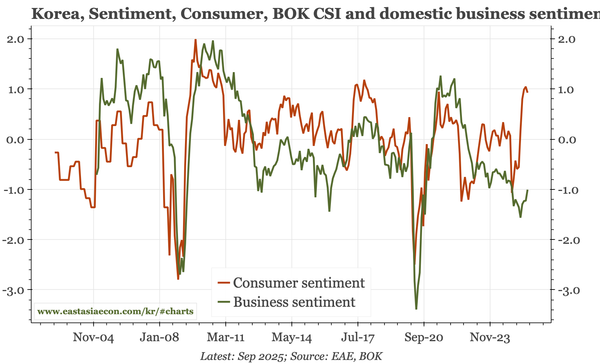

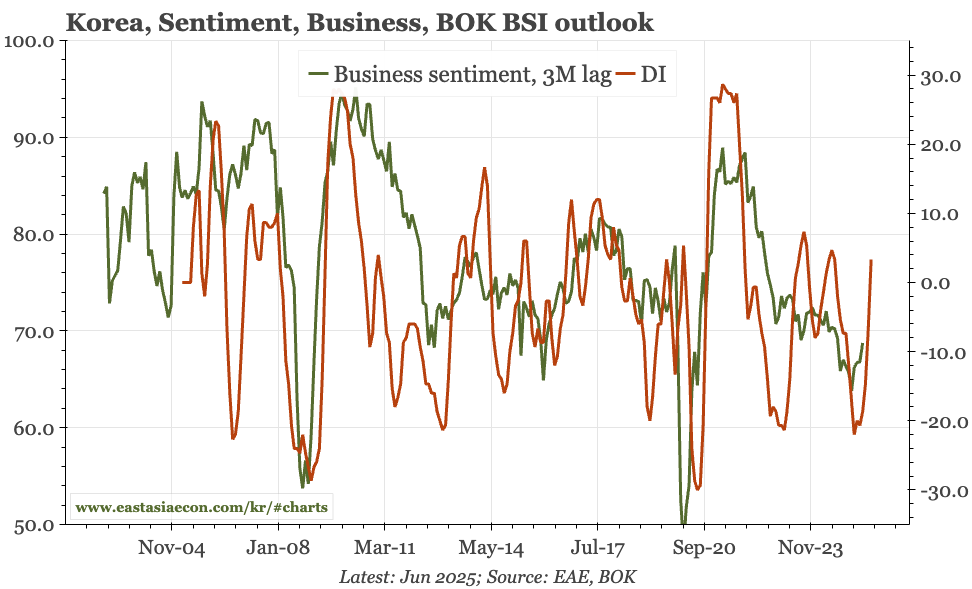

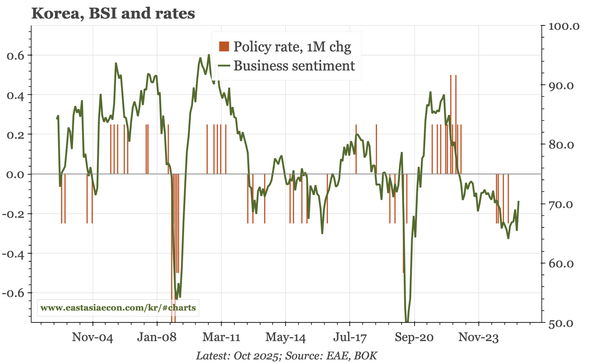

Korea – business sentiment turning

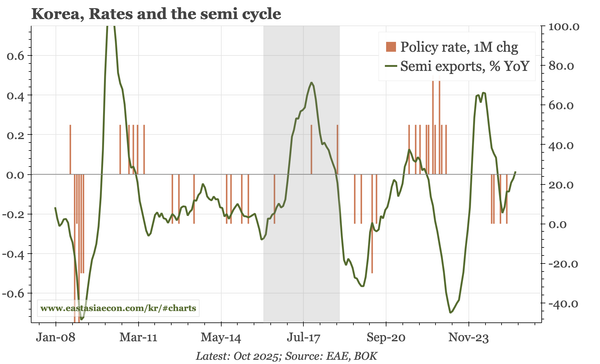

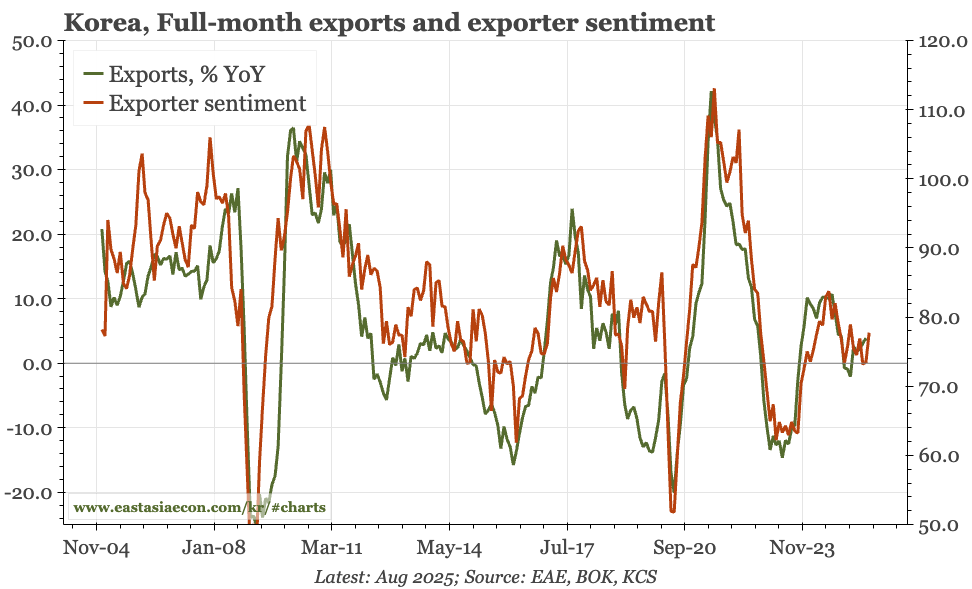

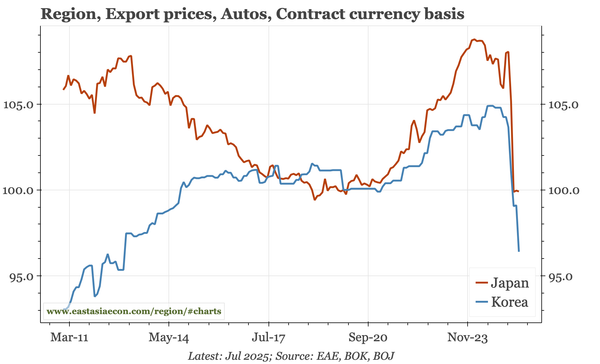

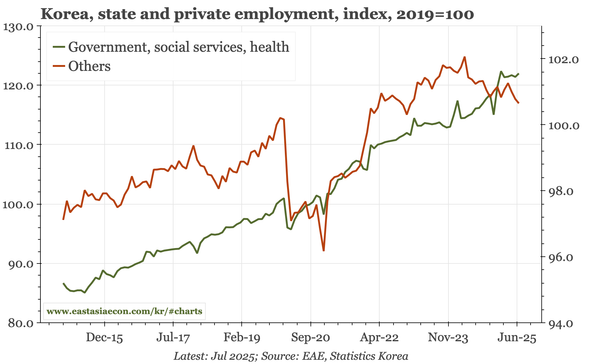

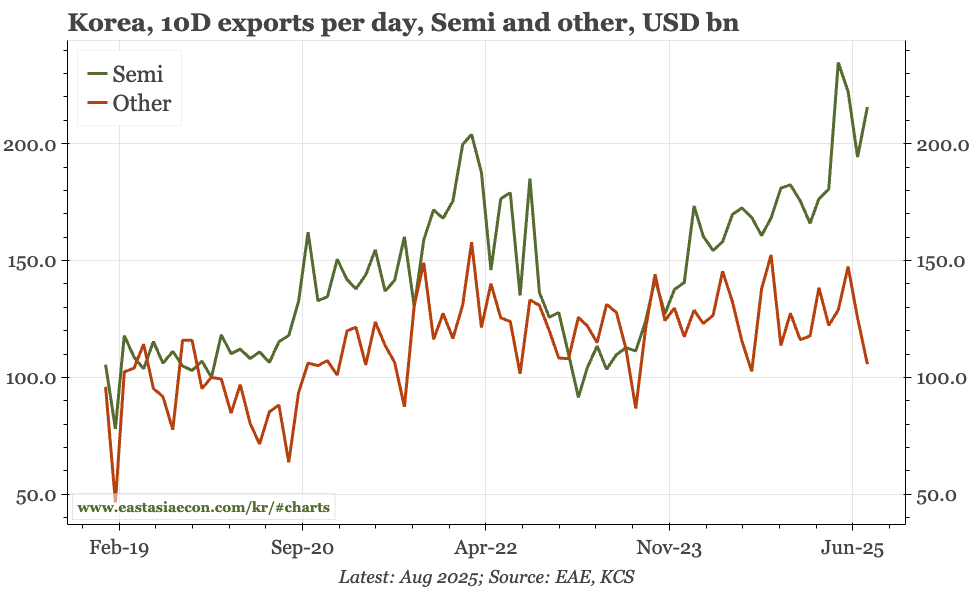

After last month's puzzling fall, business sentiment bounced in October. With the diffusion across sectors still rising, it seems reasonable to expect a further rise in sentiment towards neutral. But there still are headwinds to recovery: construction and real estate, exports, and the labour market.