Korea – cycle worsening, rates to fall

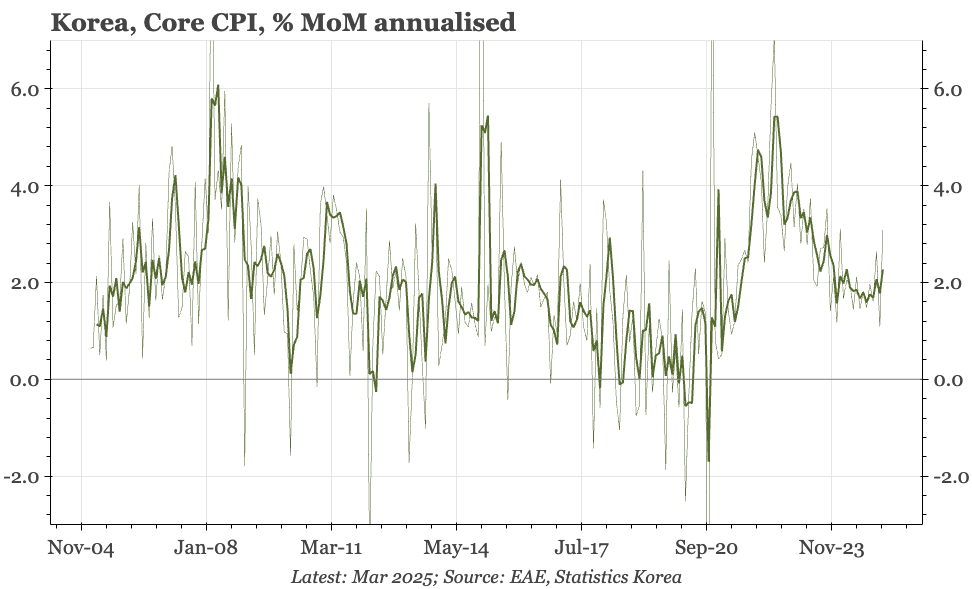

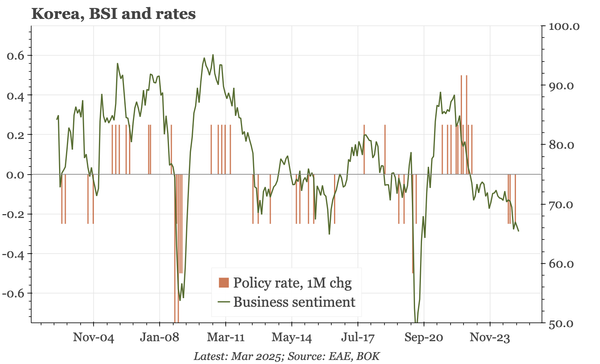

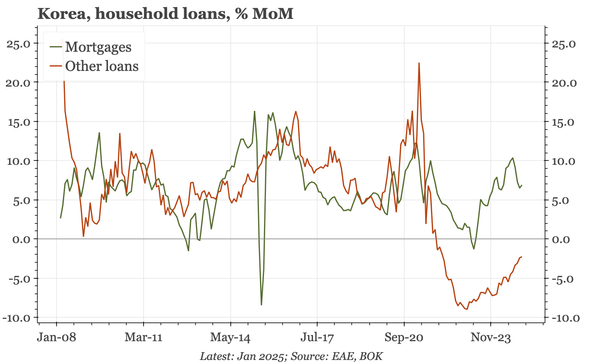

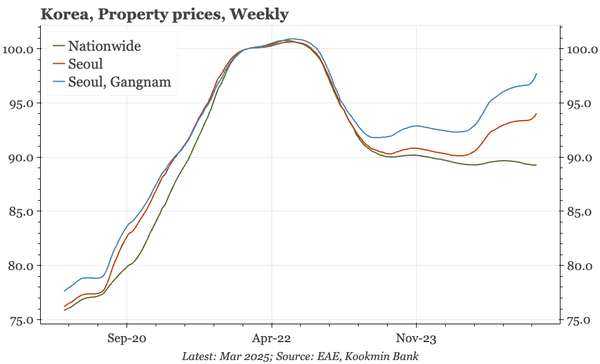

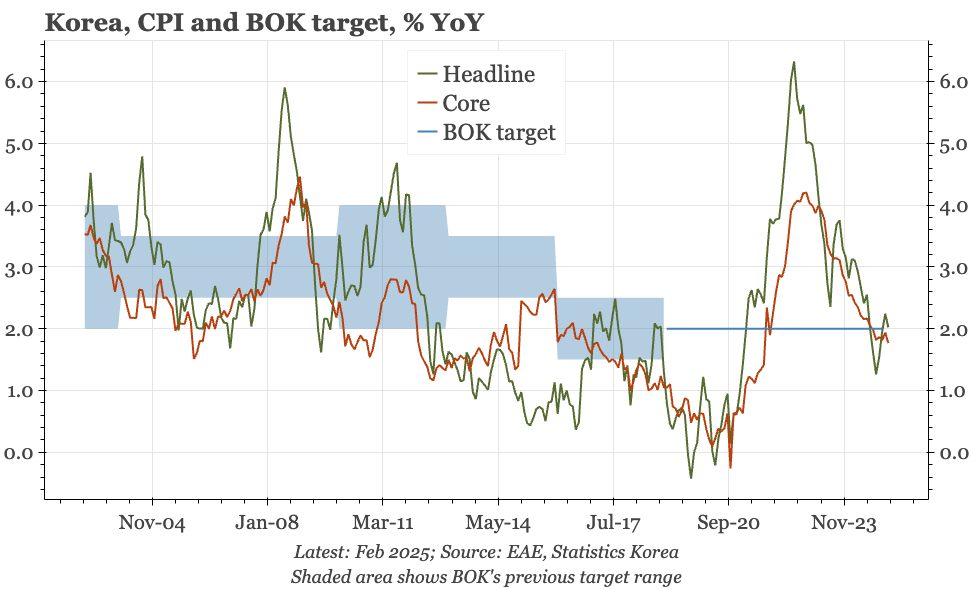

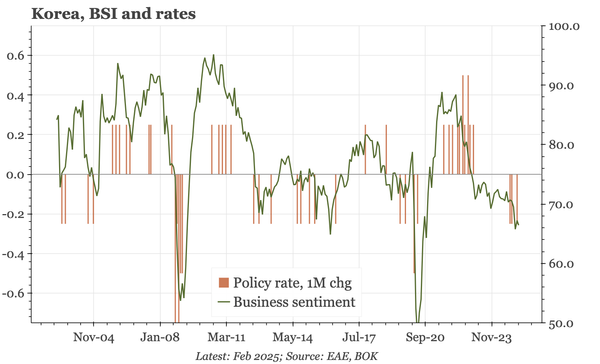

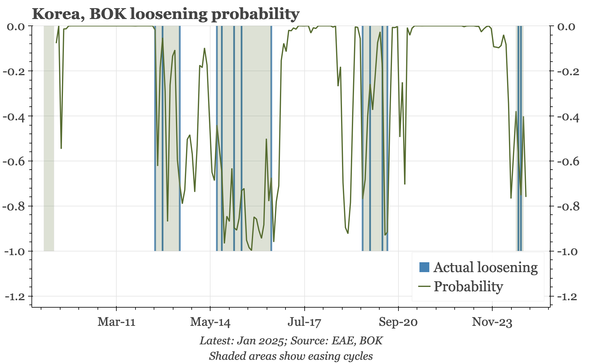

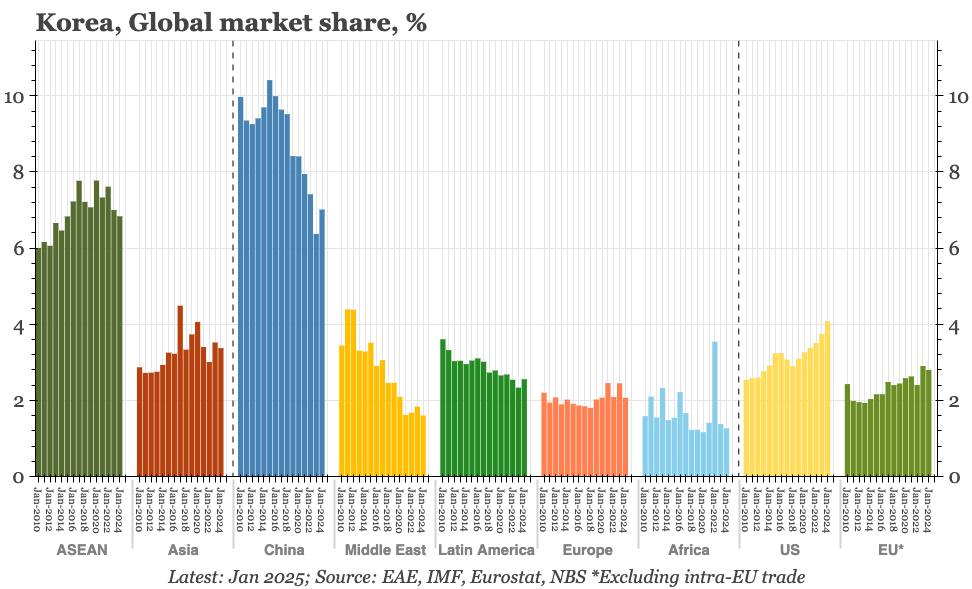

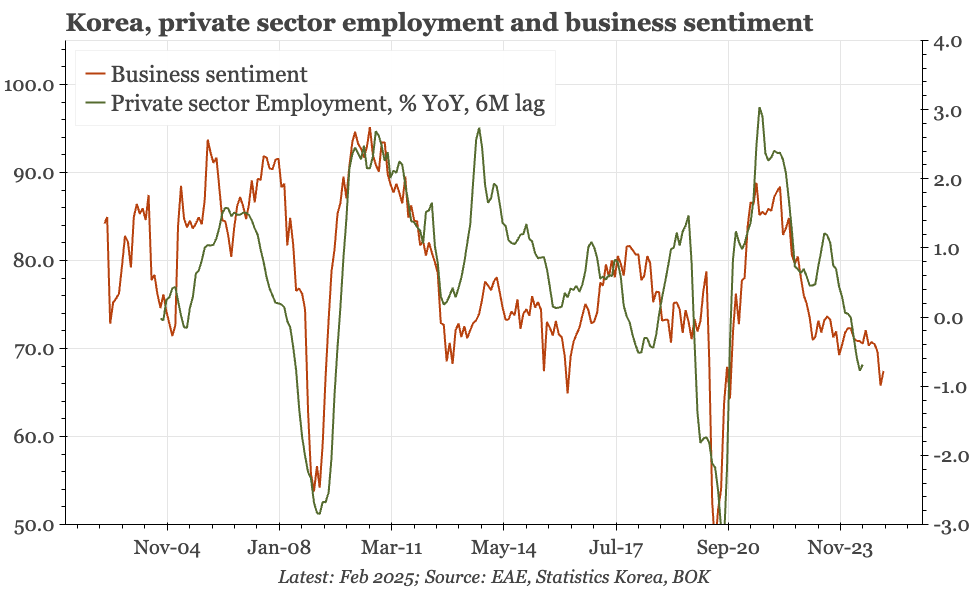

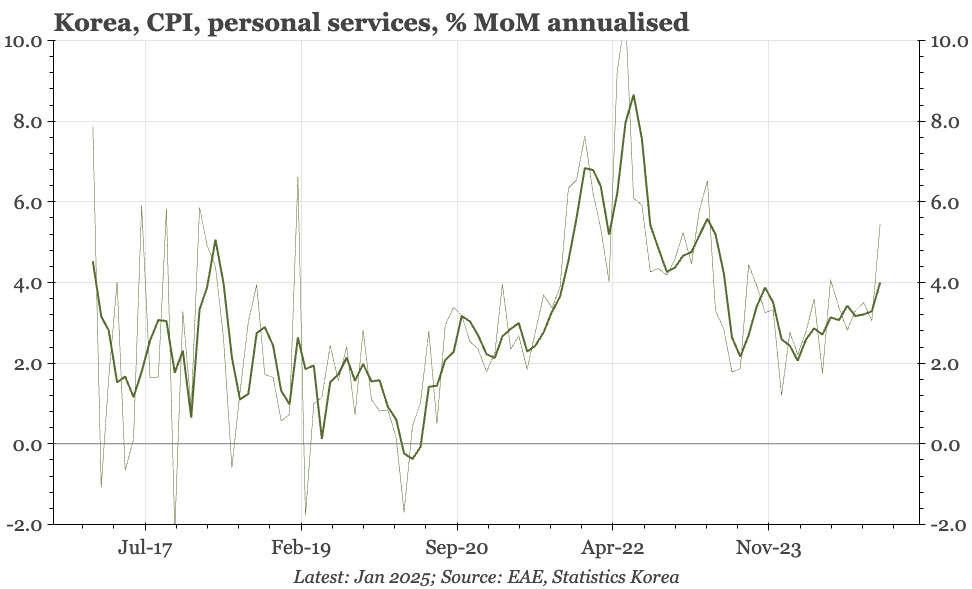

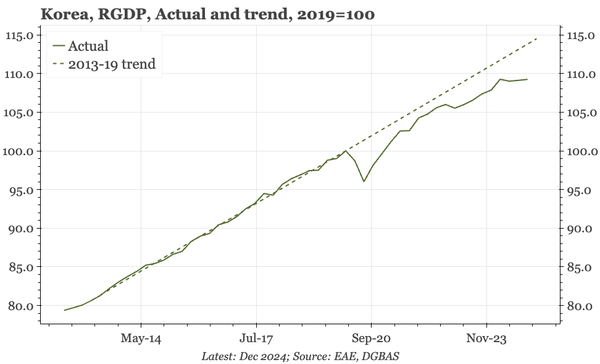

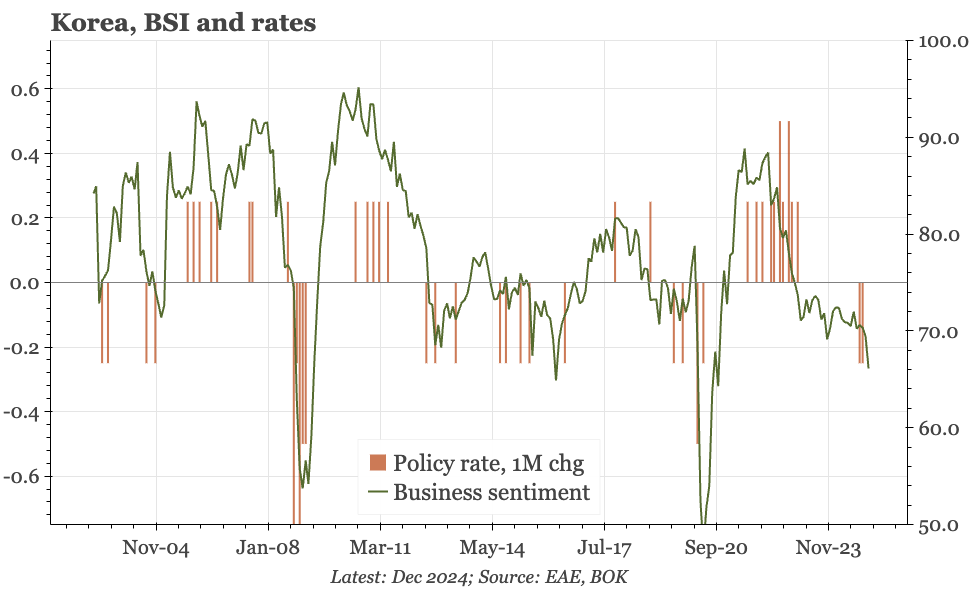

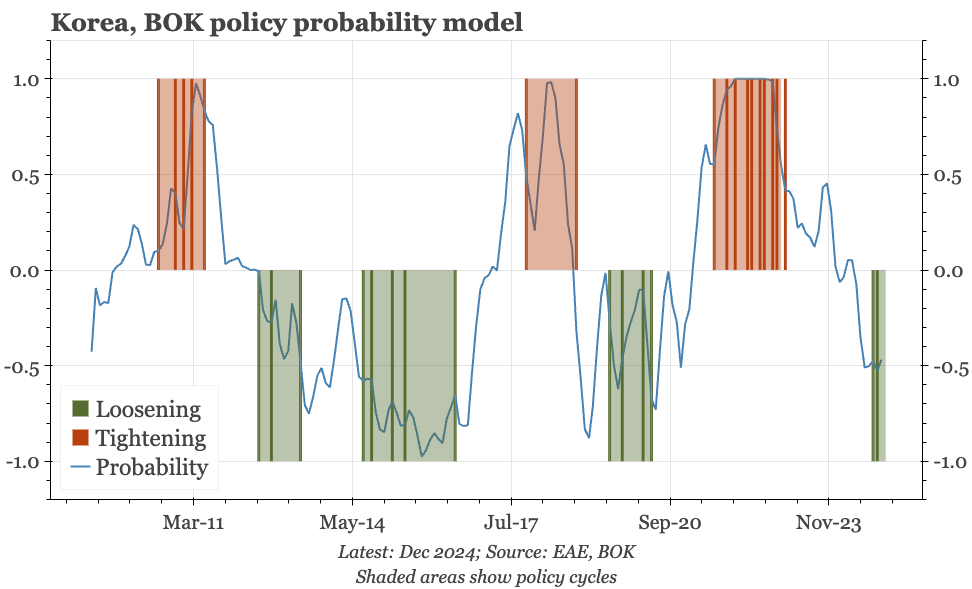

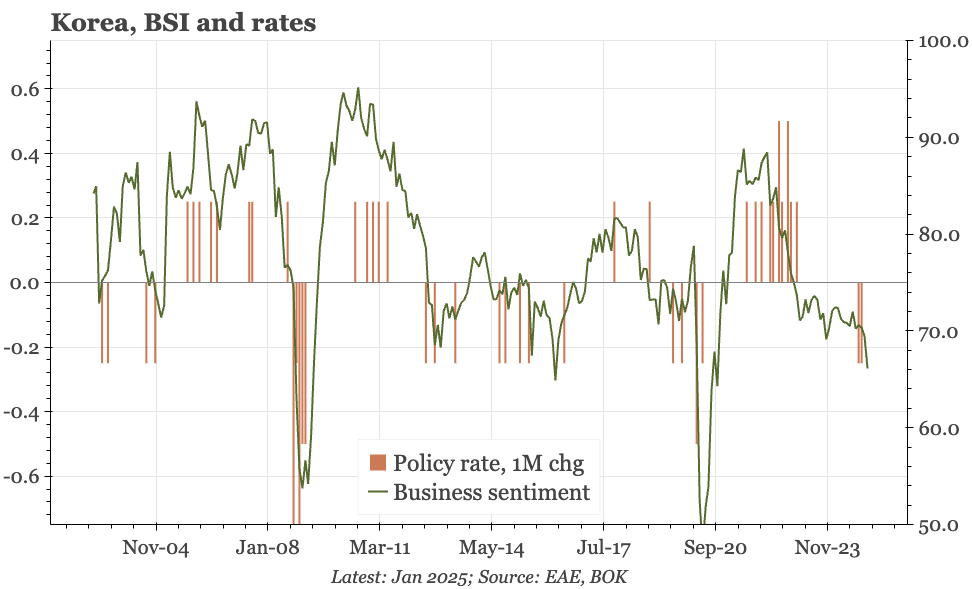

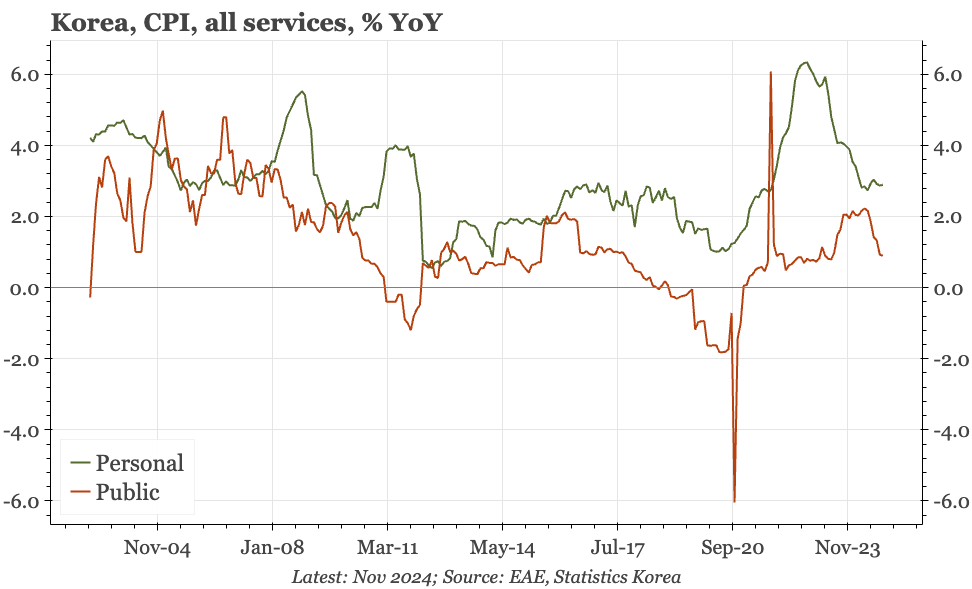

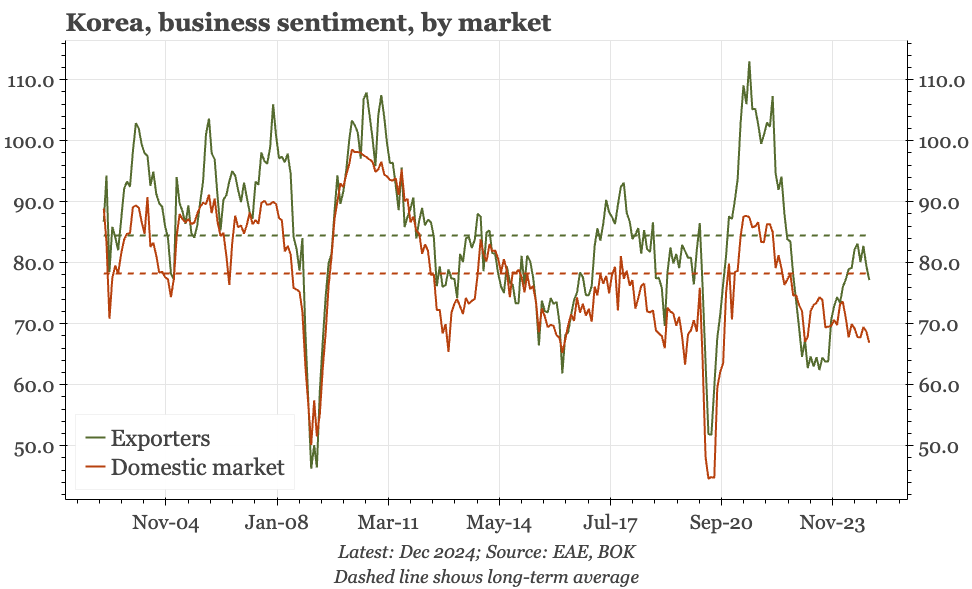

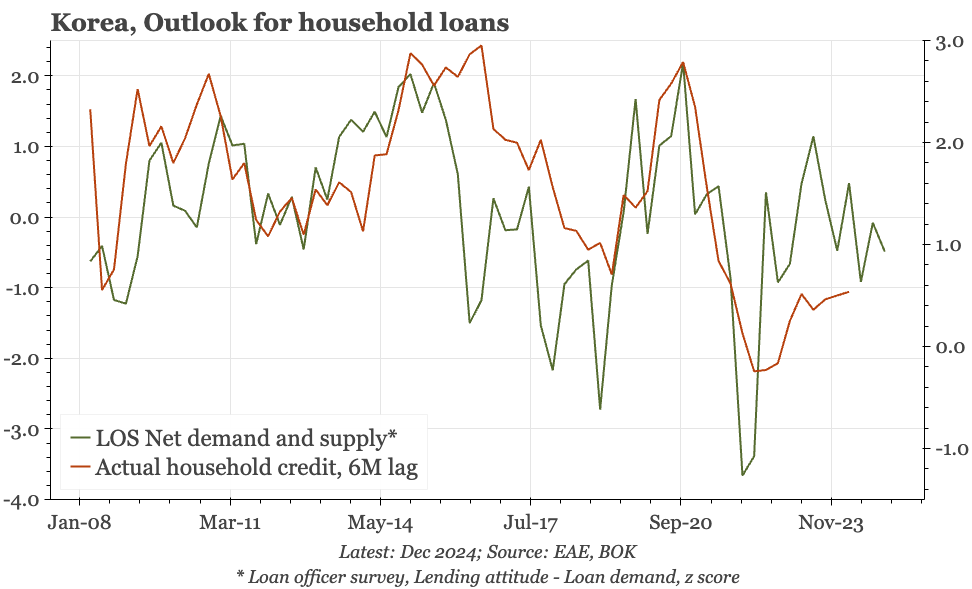

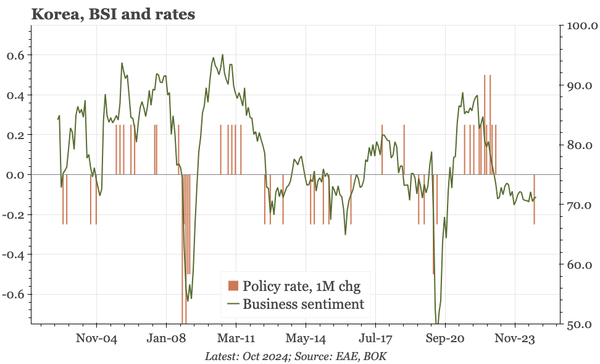

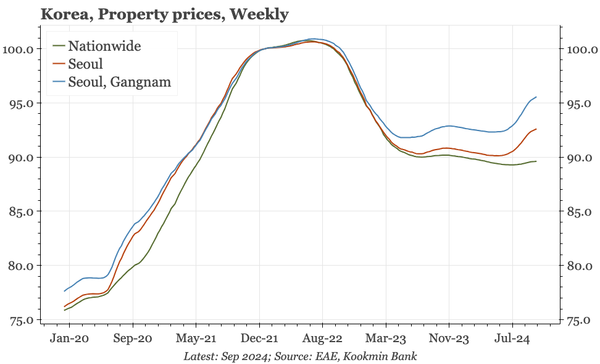

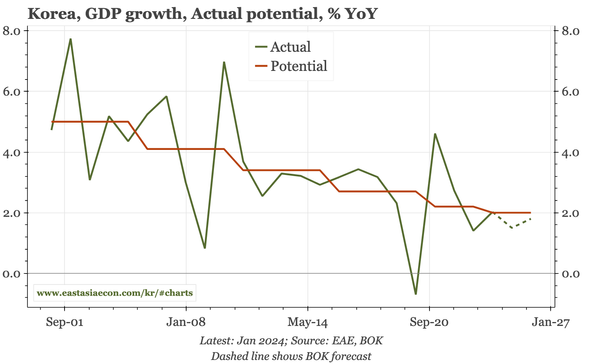

The economic environment for Korea is about as bad as it can get. Despite the short-term rebound in house prices, that suggests more rate cuts, starting at this week's meeting, that will ultimately take the policy rate below neutral. The one caveat I have is the stickiness of services inflation.