China – May industrial profits

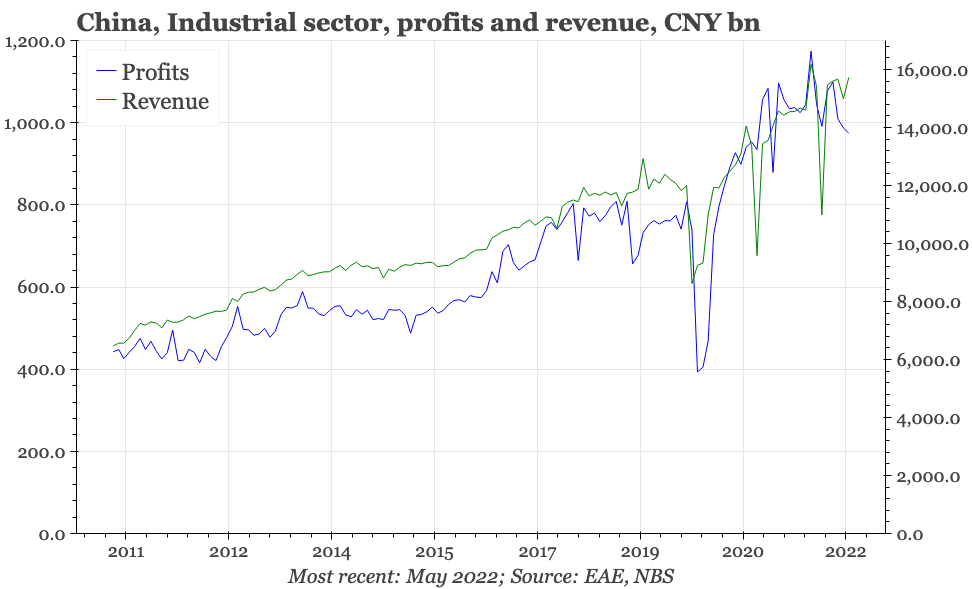

That industrial profits fell in May isn't a surprise. But the fall was fairly modest, and revenue remains on an upwards trend, with corporate earnings likely being helped by the strength of commodity prices in recent months.

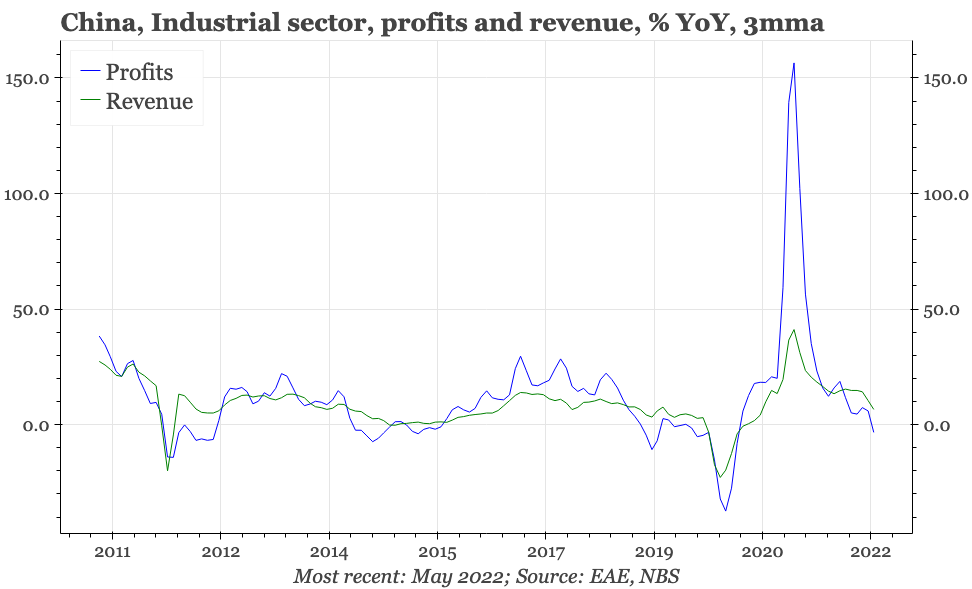

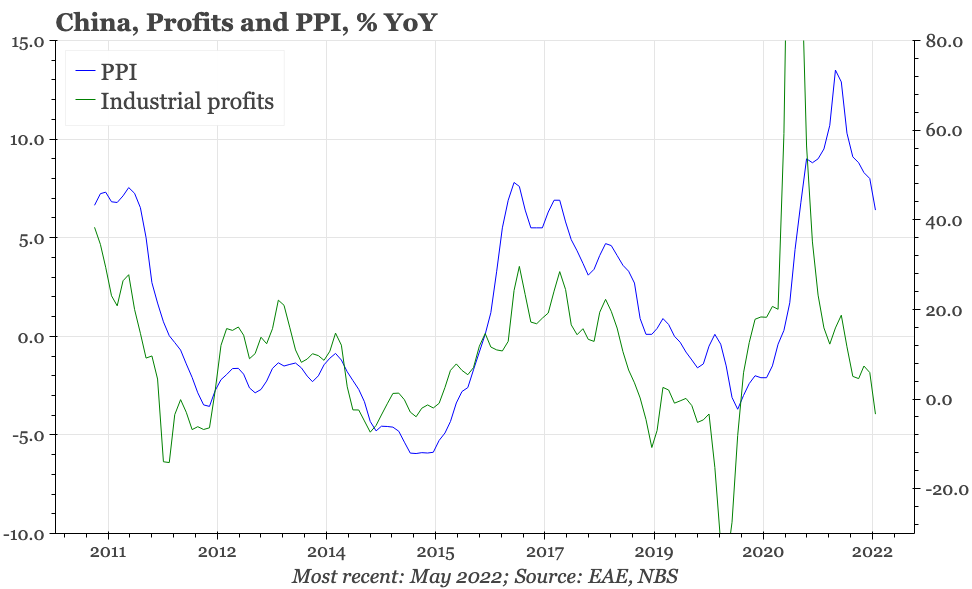

Industrial profits in May fell 7% YoY. Profits also declined MoM for the third consecutive time. For the YoY data, the fall can be partly explained by a high base of comparison – this time last year and profits were still rising at a high double-digit rate as the economy recovered out of the covid lockdowns of 2020. But of course, aggregate demand this year has also been weak, the result of the lockdowns and policy tightening in the property sector.

However, revenue remains firm, with the uptrend that started after the first outbreak a couple of years ago remaining in place. Revenue has probably been supported by the strength of commodity prices since 2020. At least in China, that strength now seems to be fading. But the impact of that on corporate revenue and profits will be offset to some extent if the domestic covid situation continues to improve, allowing a further easing of restrictions on economic activity.

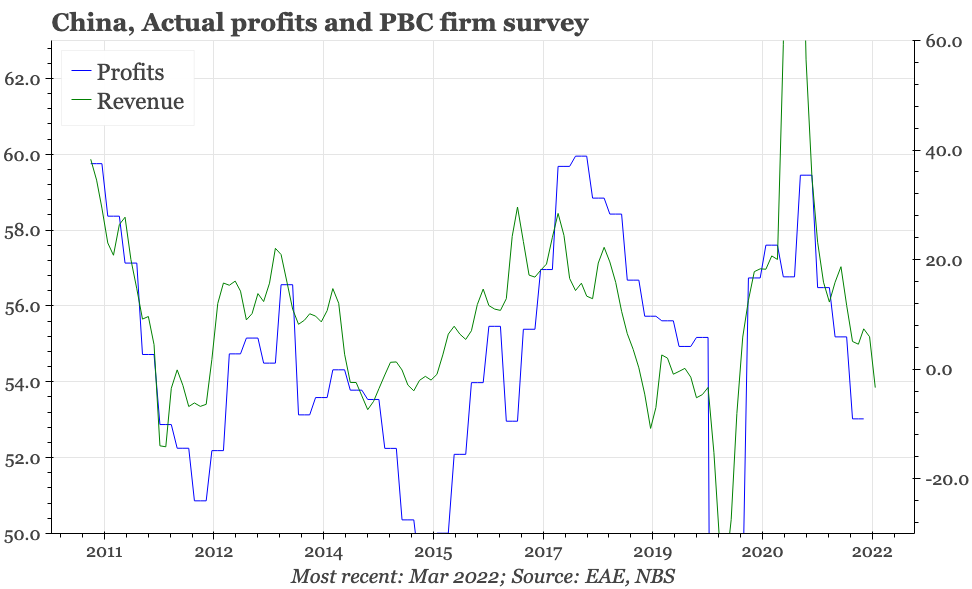

These profits data have three main drawbacks: their quality is rather poor; they measure the performance of larger firms; and they only cover firms in the industrial sector. As a result, these numbers don't capture trends among the small service-oriented SMEs that have hardest hit by the covid lockdowns.