Last week, next week

A summary of what happened on East Asia Econ last week, and what to look for in the next seven days.

This is what happened on East Asia Econ this week.

Thematic

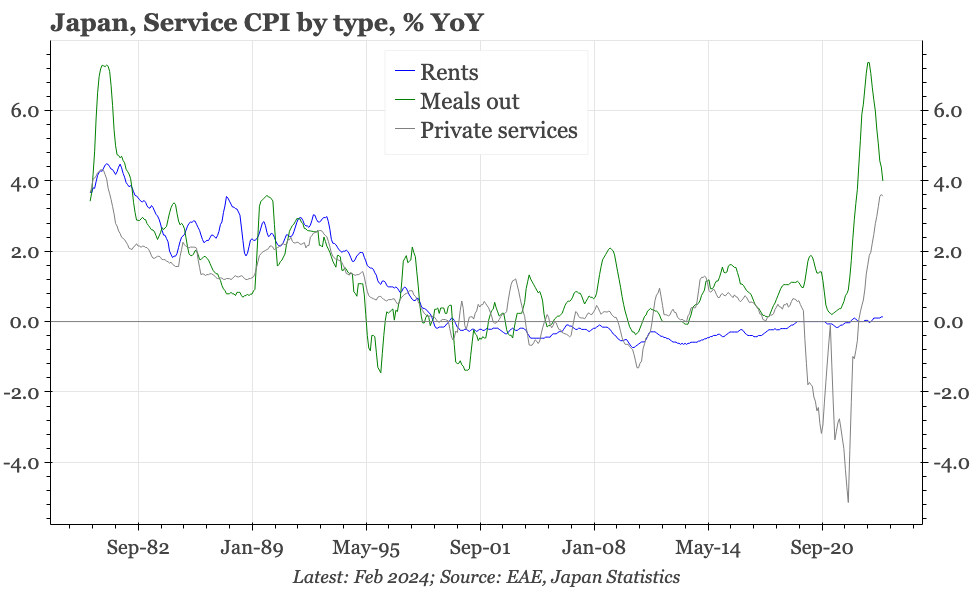

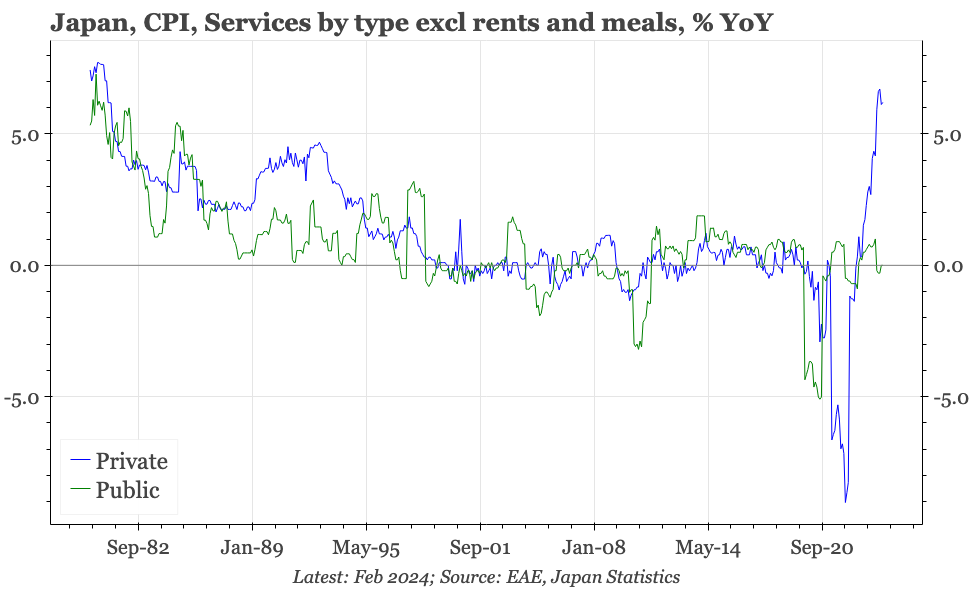

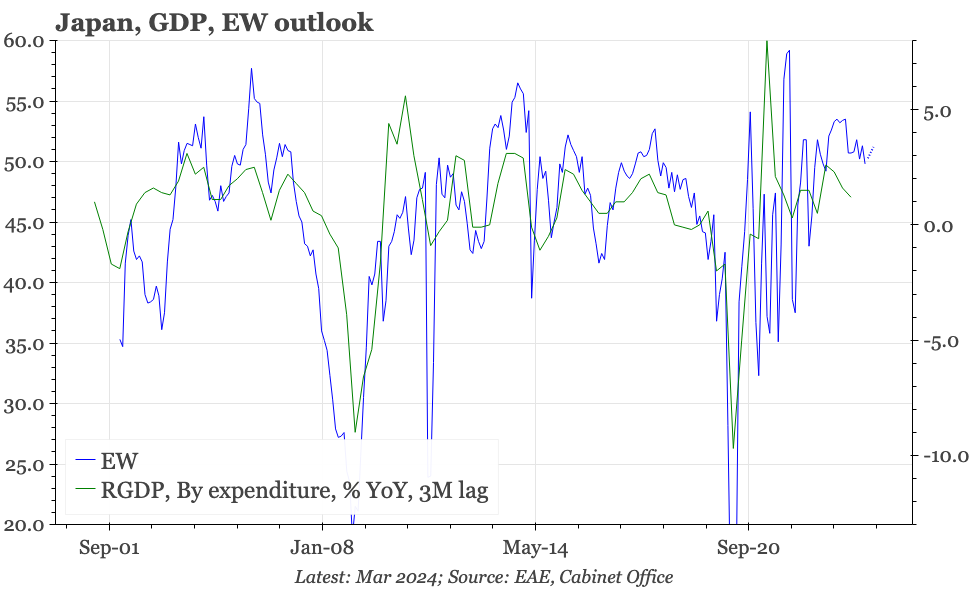

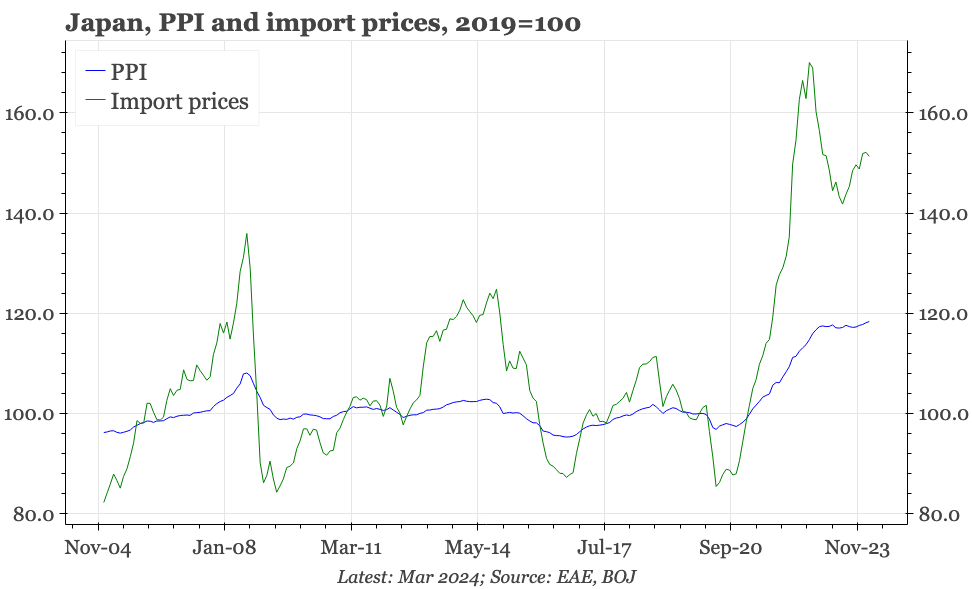

Japan – the trouble with services prices. We take a detailed look at services prices, which account for 50% of the CPI basket, and need to continue to rise if inflation is to be sustained.

Cycle

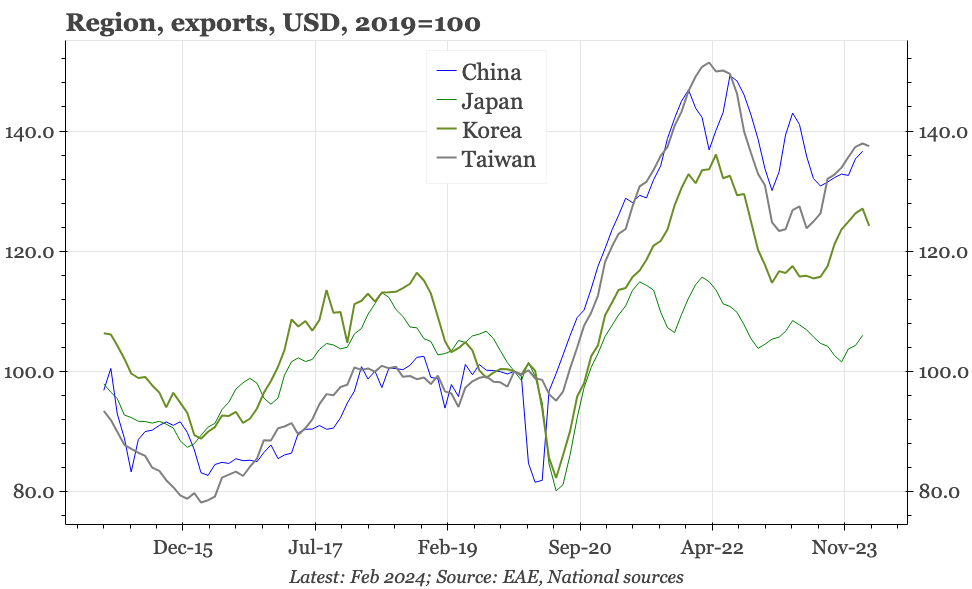

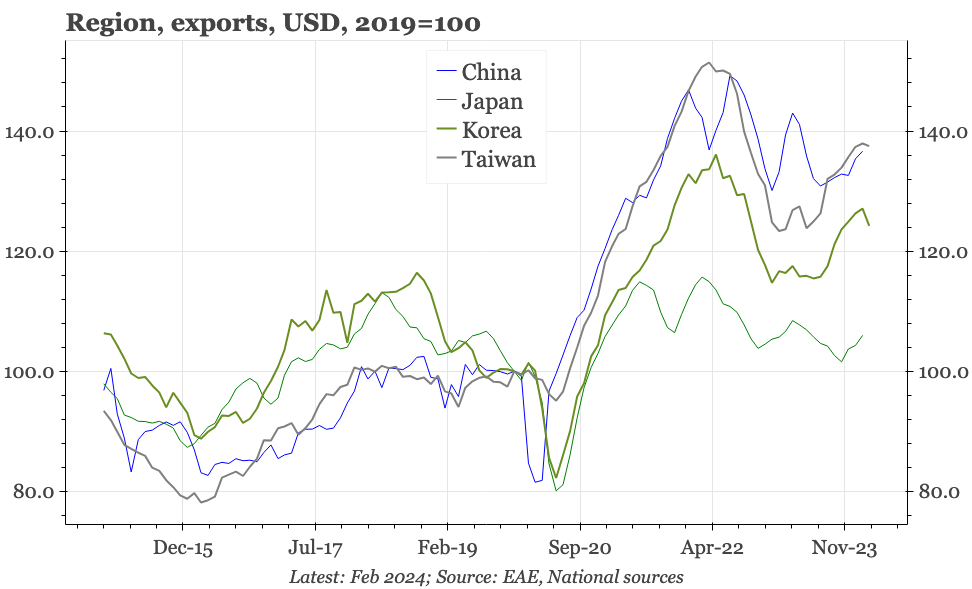

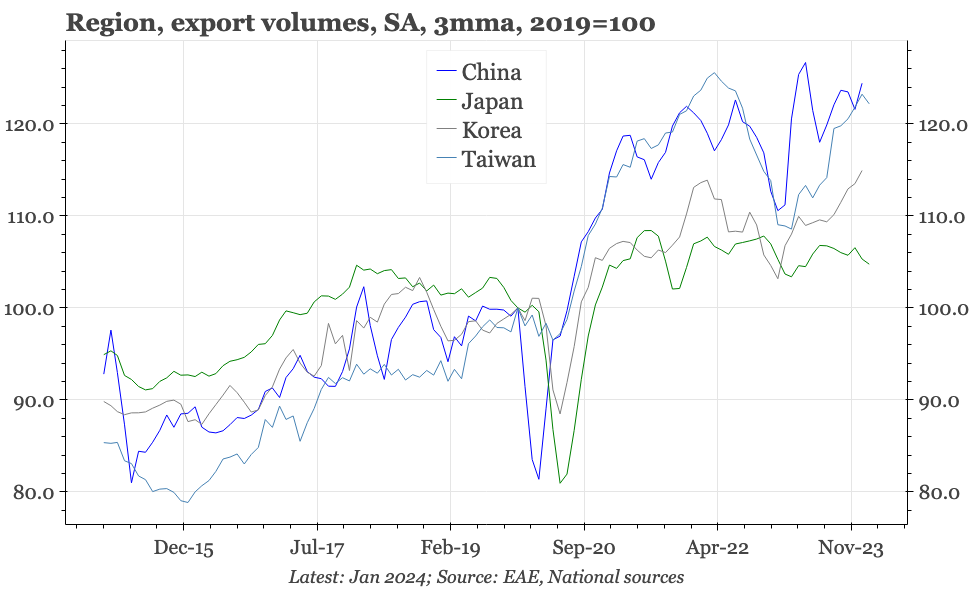

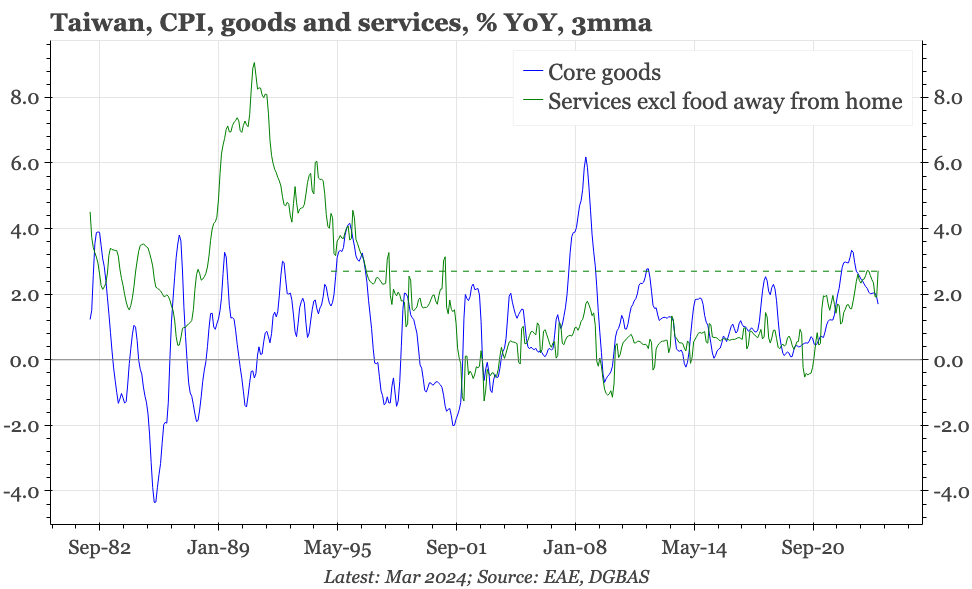

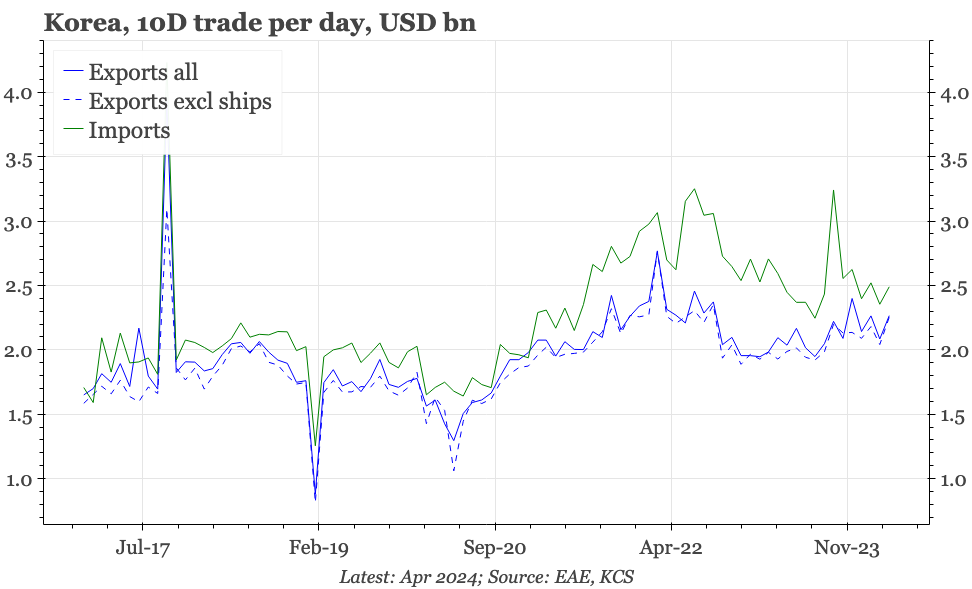

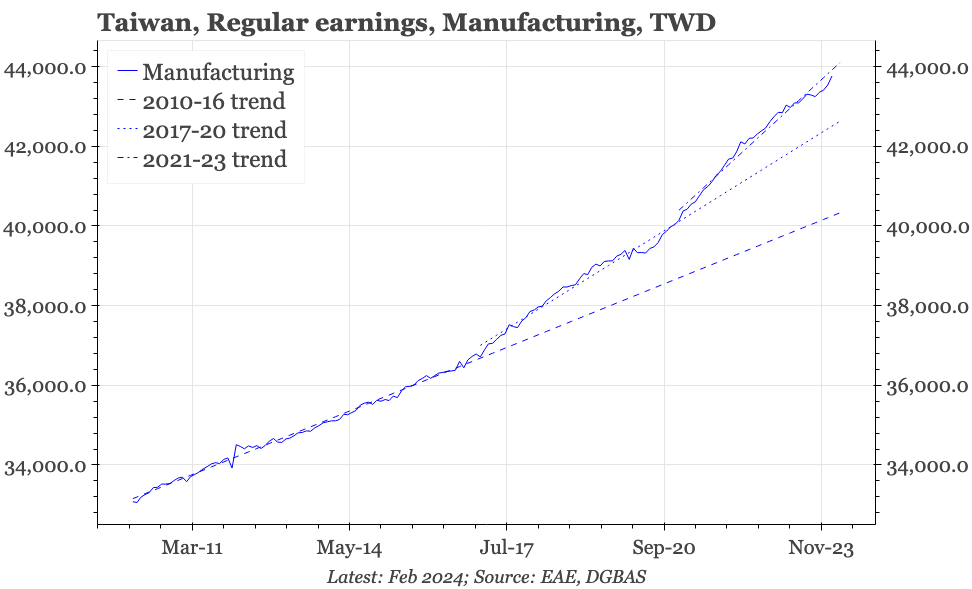

Cycle update – export recovery still mixed. The export cycle is recovering, but more in volume than value terms, and in Taiwan and China than Korea. This won't remove worries about weak consumption in Korea and China. But it likely is sufficient to keep Taiwan's economy tight, and the CBC will likely be hiking again if exports rise more.

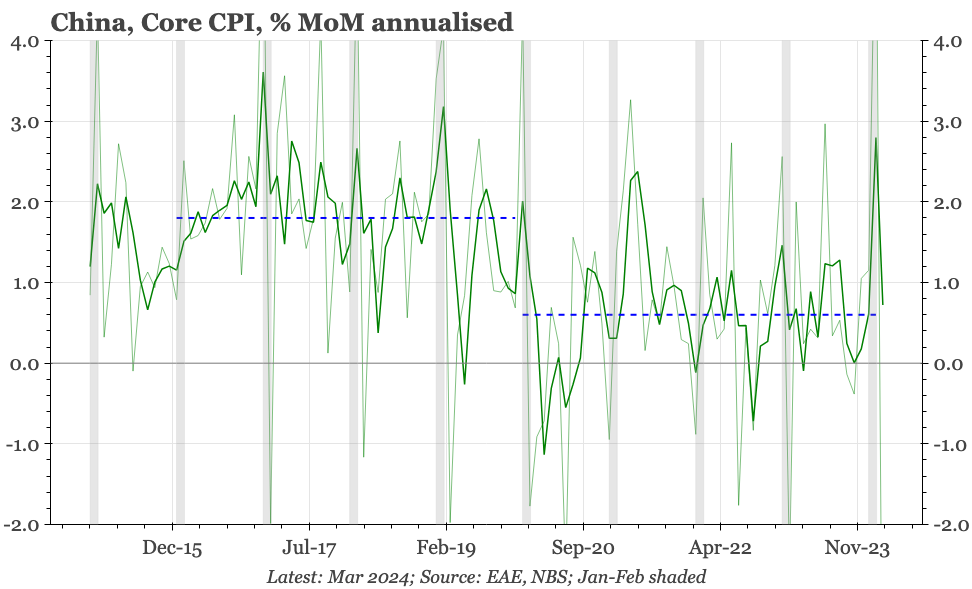

Cycle update – inflation trends unchanged. Price trends in China remain range bound, with PPI falling at a 2.5%-3% YoY rate, and CPI fluctuating around 0.7%. Narrow leading indicators for inflation suggest some strengthening from here, but a real change in inflation dynamics needs a change in China's overall macro dynamics.

Cycle update – strong exports, weak imports. We think today's export data were strong, reaching an all-time high in CNY terms. If there was weakness, it was in imports. The result, obviously, is a renewed widening of the trade surplus.

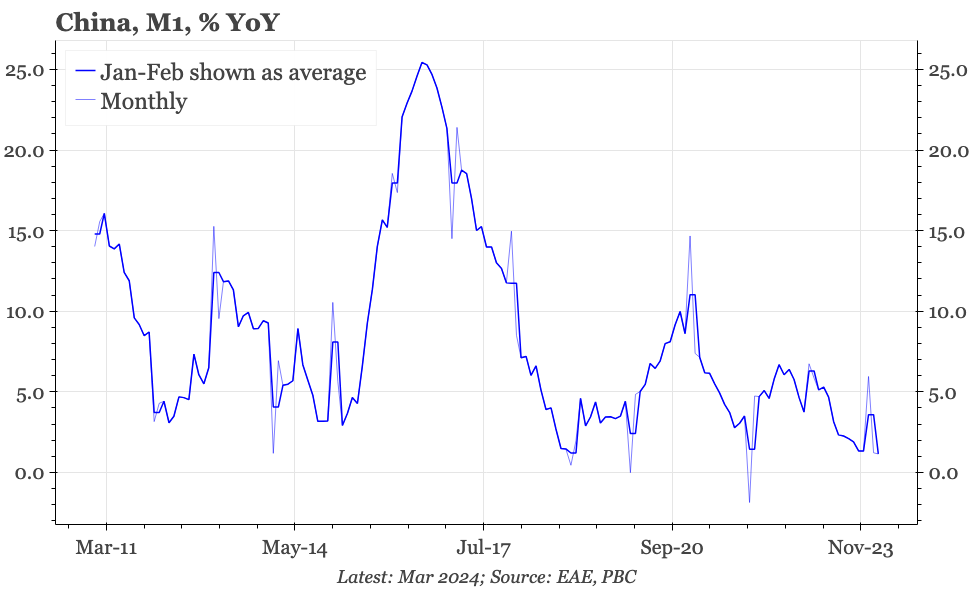

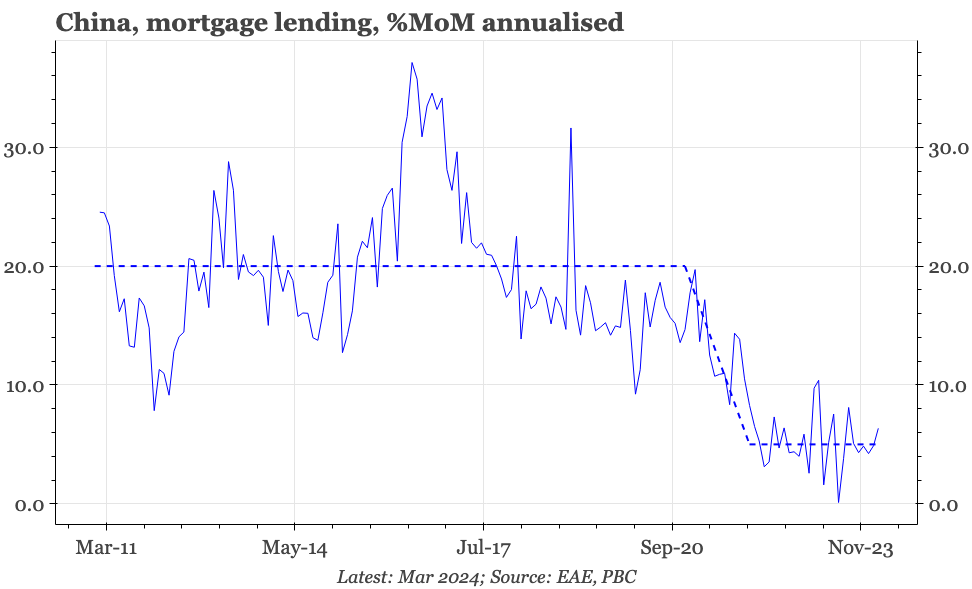

Cycle update – the end of the credit cycle? China's monthly monetary release doesn't seem nearly as important as it once did, because a lot of the major indicators are rangebound. The one indicator that looked a bit different last month was M1, but that rebound fully reversed in March back down to just 1.1% YoY.

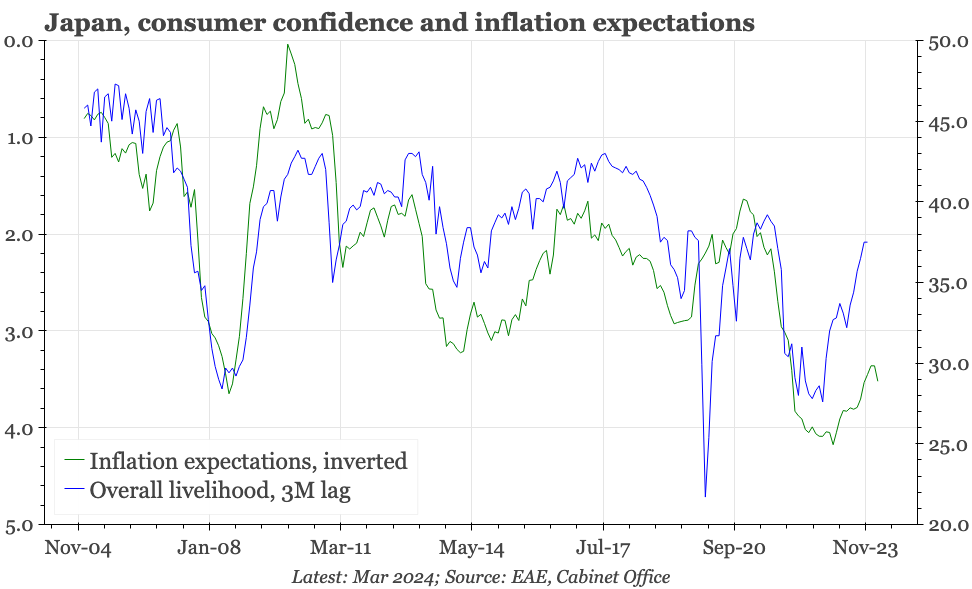

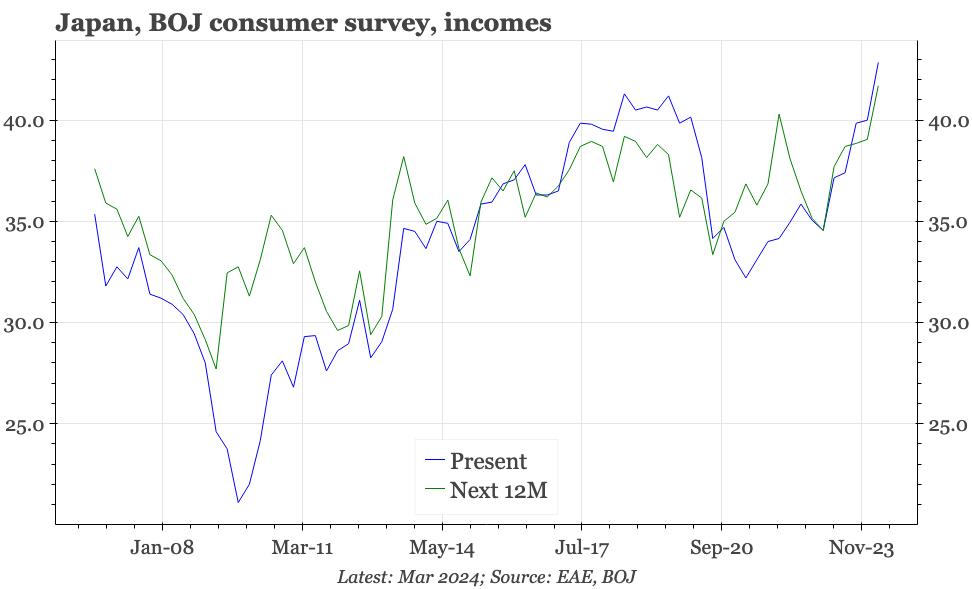

Cycle update – consumer confidence stronger. Consumer confidence for March gives reasons to think that stronger consumption will drive continued economic recovery in 2024.

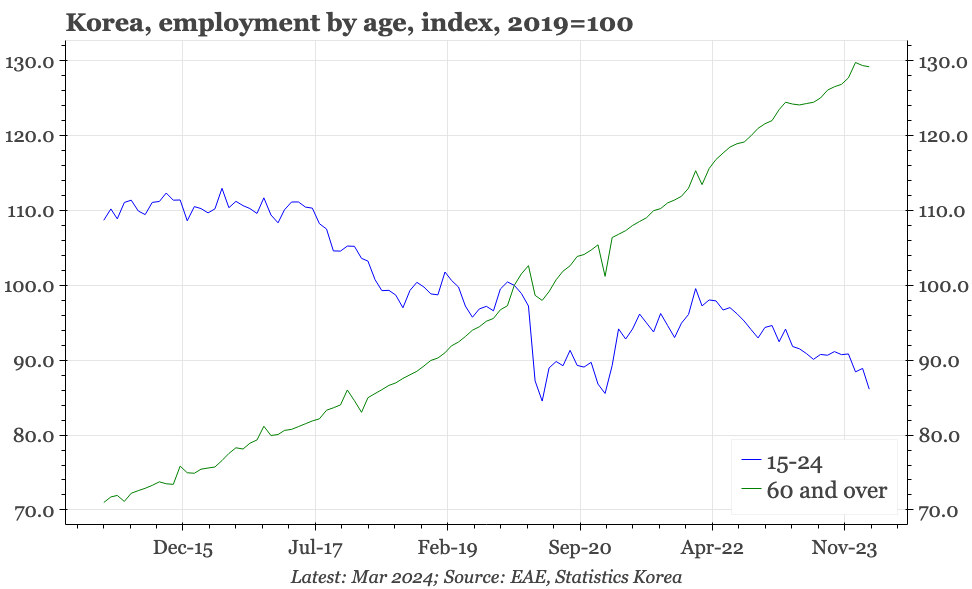

Cycle update – a weakening hold. With headline CPI still above target and the US-Korean yield gap widening, we don't think the BOK is ready to cut yet. However, the weakness of economic activity and the softening of core inflation raise the likelihood of a dissenting vote.

Cycle update – buying a bit more time. The BOK today sounded confident that core is coming down, but argued that headline is more uncertain. Of course, these two measures are different, but the distinction still feels disingenuous, and gives the impression that the bank is just trying to buy a bit more time.

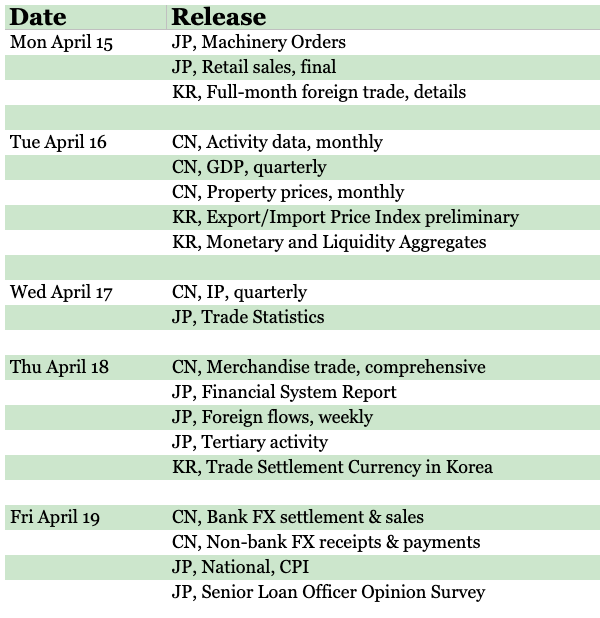

The data highlight of the next few days is the Q1 GDP release for China on Tuesday. Given data for the first couple of months, as well as the PMI and exports for March, that should be relatively strong. But with inflation so low, growth in nominal terms will have remained weak. Japan releases national CPI data for February on Friday, the same day the BOJ releases the SLO survey. On Wednesday, there's also trade data.