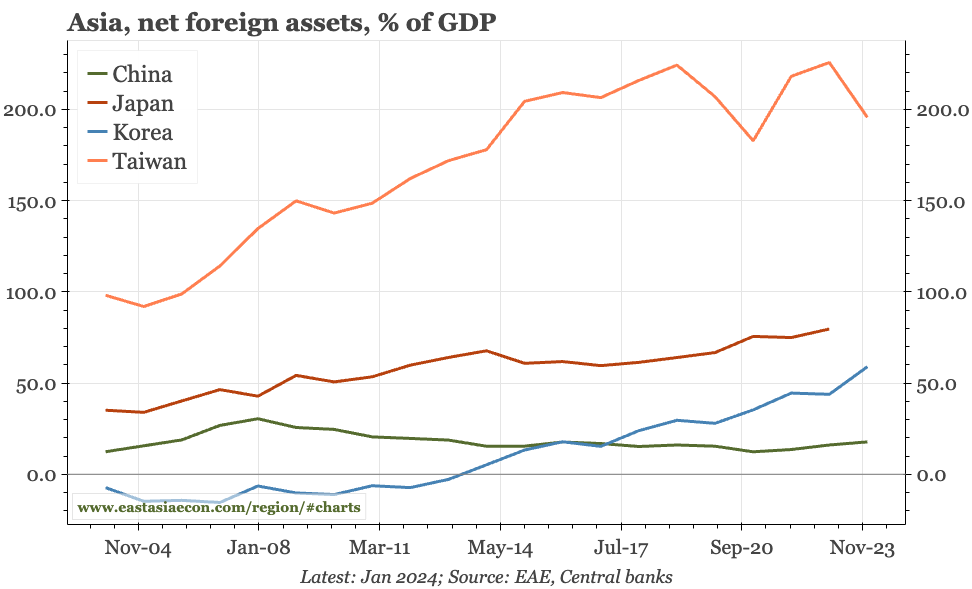

Taiwan – tech boosting NIIP, but not the TWD

Data today show Taiwan's NIIP surplus dropped a little in 2023, but remained extremely large. Those assets have been accumulated via strong exports, 60% of which are now "high-technology". And yet, the TWD through April weakened, with one measure of the REER no higher than 2001.

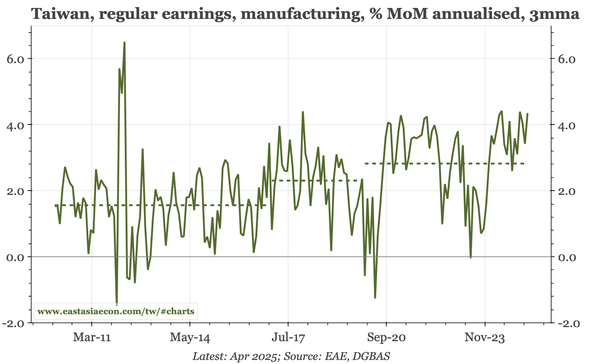

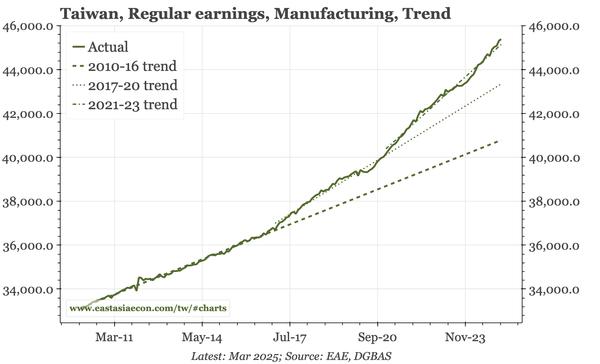

Taiwan – wage growth remains strong

Relative to history, Taiwan's wage growth remains strong. As would be expected, that's being led by manufacturing, though services wages have been firm too. For now, the downside for rates remains a structural appreciation of the TWD, not a problem with the cycle.

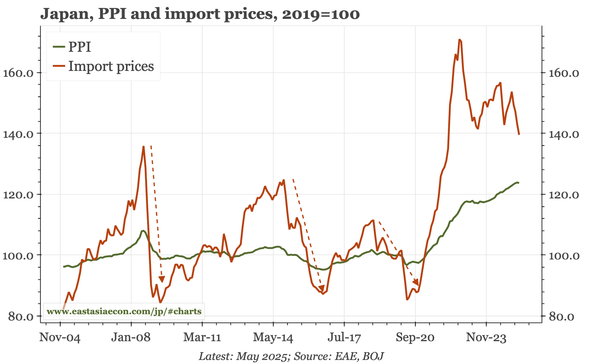

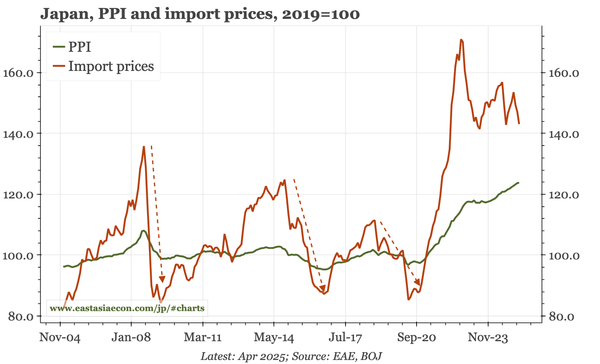

Japan – PPI starting to decline

PPI inflation eased in May, falling to 3.2% YoY, down from the recent peak earlier this year of more than 4%. The ongoing decline in JPY-denominated commodity prices shows this process has further to go, but feed-through into PPI will likely be dampened as importers try to restore profit margins.

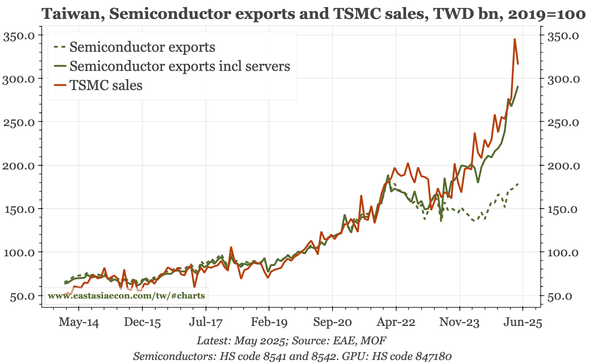

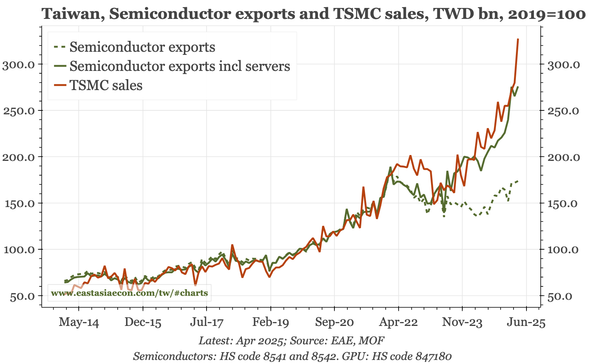

Taiwan – TSMC still leading the way

May was a bit softer for TSMC, but sales are still 26% higher than at the beginning of the year. That matters a lot for the overall economy, given that semiconductors are about 50% of exports, and outside of semi, exports aren't growing much, if at all.

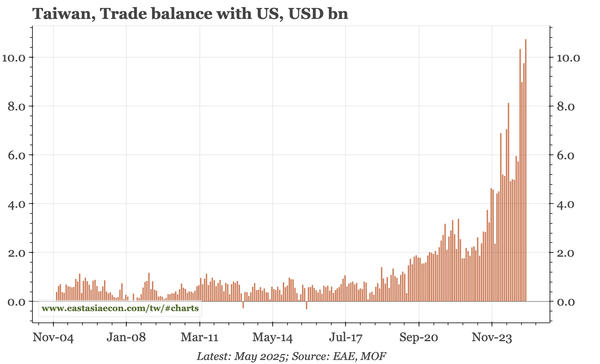

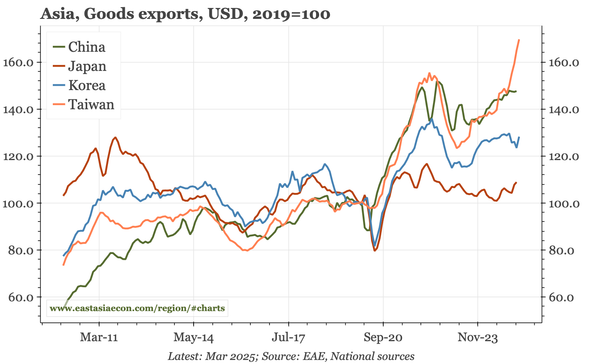

Taiwan – exports still going straight up

The sharp reversal in exports expected by the government isn't showing up yet. Shipments rose strongly again in May, and are now 17% higher than in December. With imports weaker last month, the trade surplus increased to near 20% of GDP, a new multi-decade high. The biggest driver remains the US.

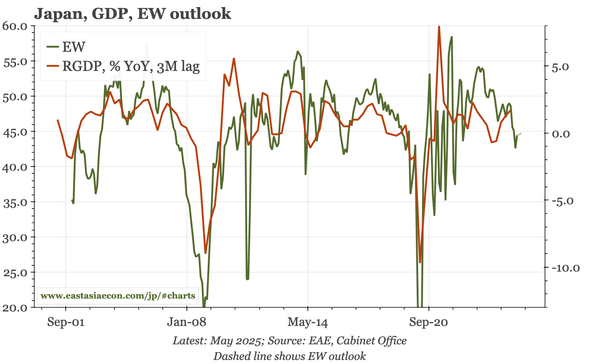

Japan – sentiment back to average

Sentiment in the Economy Watchers survey still points to slower GDP growth in 2H25. However, it now isn't particularly weak, improving in May back to the long-term average of the survey. That's probably not enough for the BOJ, but likely would be if Japan can now land a trade deal with the US.

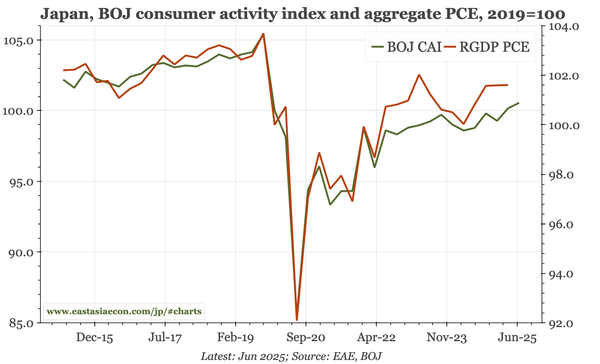

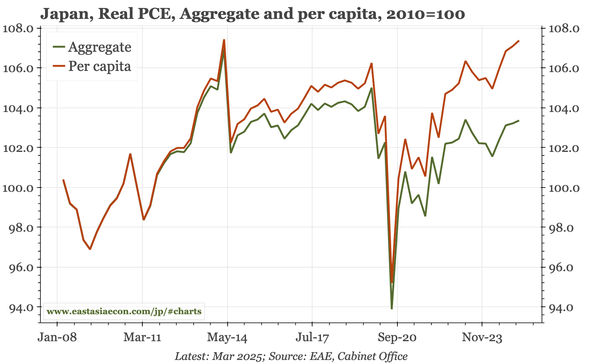

Japan – PCE revised up for Q1

In the second release of Q1 GDP, consumption was revised higher. In aggregate terms, there's still no convincing trend up, but the per capita level of spending is now as high as the previous record peak in 2014. The revision boosted GDP to flat QoQ, even though capex was revised down.

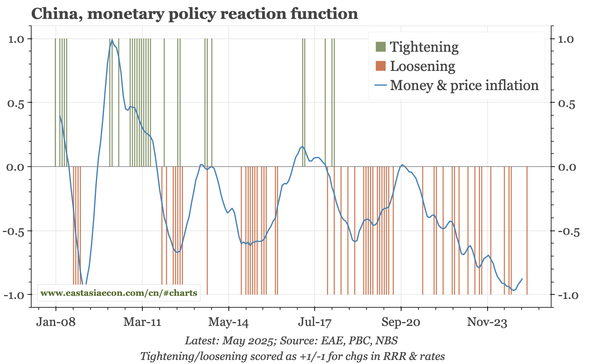

China - sluggish activity, weakening prices

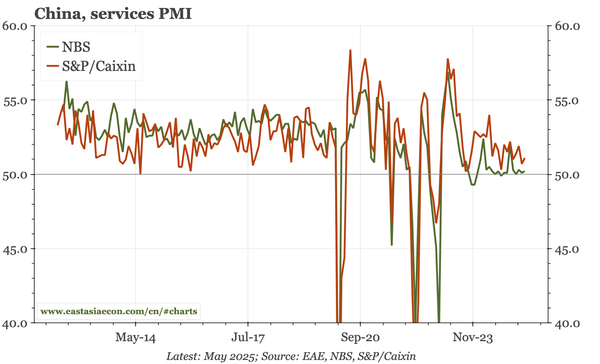

The S&P PMIs indicate slower growth in May, with the mfg PMI dropping sharply, and today's services PMI sluggish. Both also suggest more deflation. In today's survey, input prices ticked up, but selling prices were pushed down by "greater competition for new work and promotional activities".

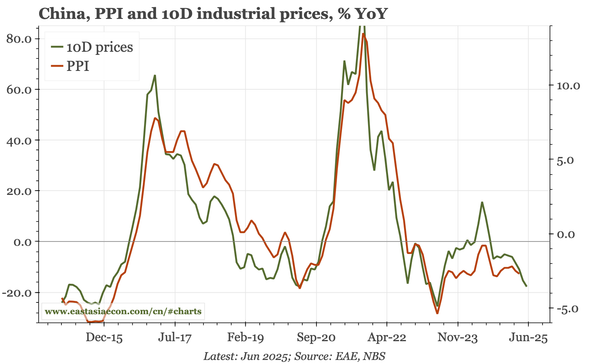

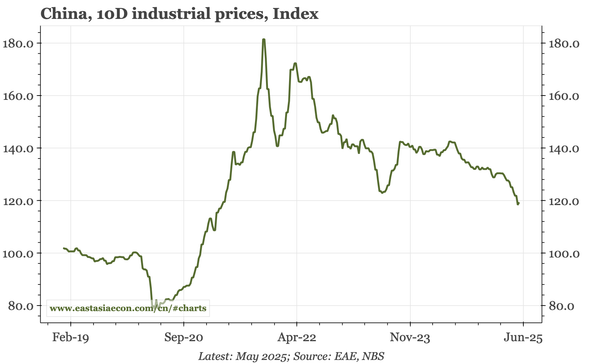

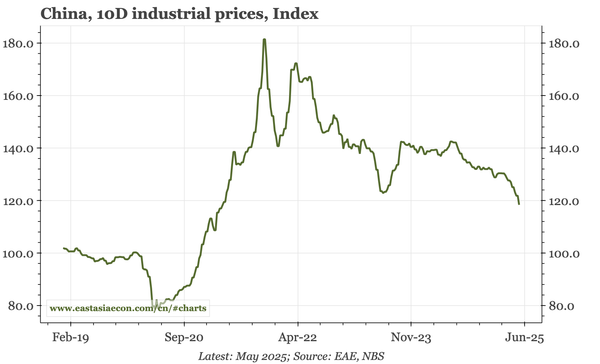

China – faster PPI deflation

High-frequency data continue to point to a faster rate of deflation in China in recent weeks. One reason is lower energy prices, which should bring some economic relief to downstream firms, but building materials and steel prices are also falling. Cyclical momentum the economy remains very weak.

China – sharp fall in Caixin PMI

Rather than getting the tariff-reprieve boost seen in the official PMI, and other PMIs across the region, the S&P PMI fell to 48.3 in May, the lowest since September 2022. Export orders dropped to the lowest since July 2023. That fed into weaker staffing and continued falls in prices.

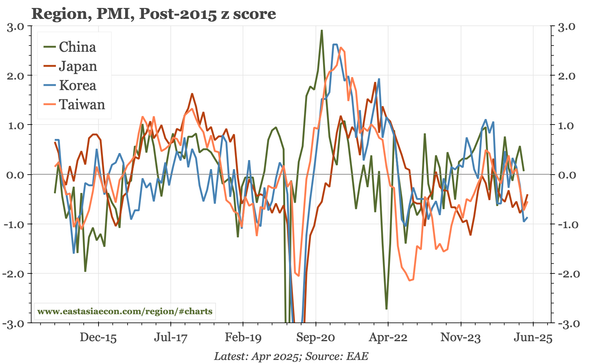

Region – PMIs stabilise in May

The Liberation Day tariffs caused the PMIs to fall sharply in April. Postponement of the tariffs triggered a recovery in May. But the bounce in the headlines was mild, and Korea, where according to S&P "new orders fell at the...strongest rate in almost a decade", continues to lag.

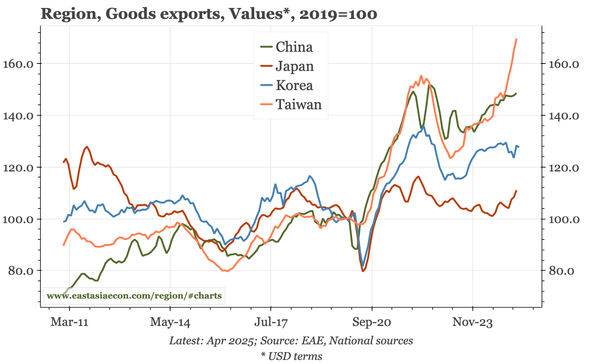

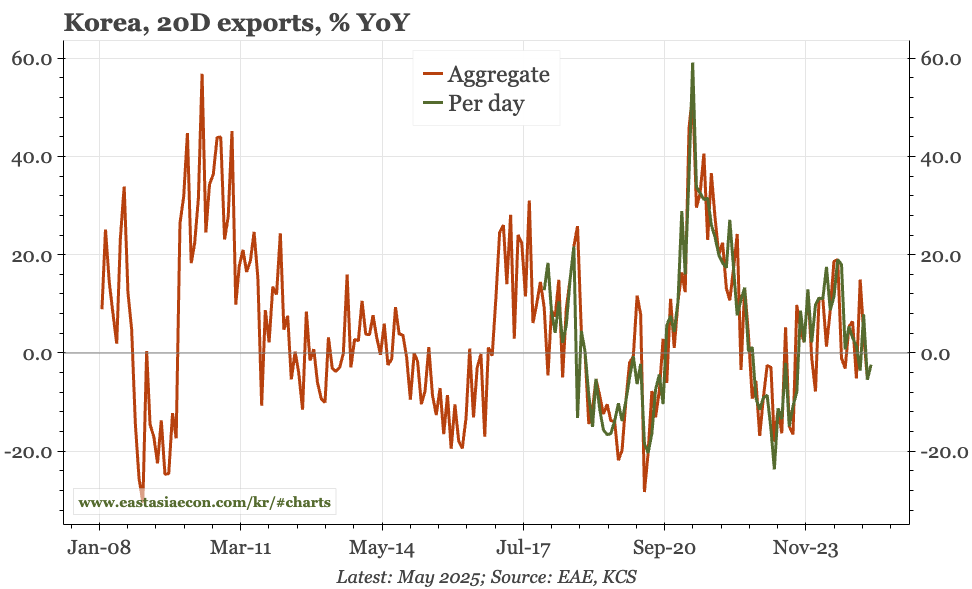

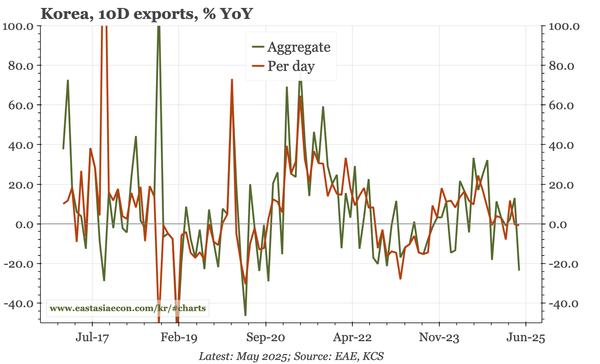

Korea – exports still underperforming

Even with a rebound in semi exports, overall Korean exports continue to go sideways. As a result, the underperformance relative to the rest of the region of the last 6M continues. This presidential election won't affect that, though it should bring stronger fiscal policy, boosting domestic demand.

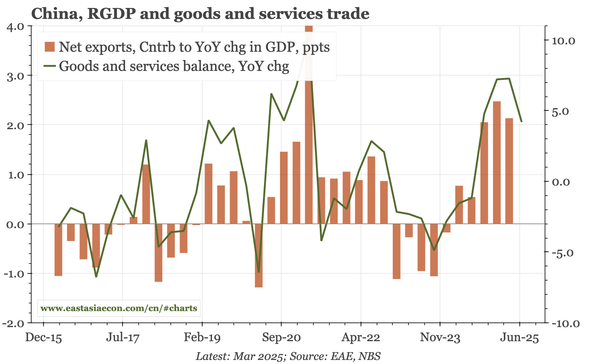

China – net export contribution falling in Q2

We don't get many expenditure inputs to estimate components of GDP each quarter. One of the few that is available is net exports, which can be proxied by the change in the monthly balance in goods and services trade. Data today show that remains high, but is now falling YoY, and will dampen Q2 GDP.

Japan – mild bounce in consumer confidence

After falling sharply in recent months, there was a modest bounce in consumer confidence in May. The consumer mood may have been given a boost by politicians focusing more on the cost of living crisis. But that crisis remained clear in today's survey, with inflation expectations remaining elevated.

China – accelerating deflation

The recent renewed decline in upstream prices is partly about energy, and so will provide some help to manufacturers. However, in a sign of the continued weakness of construction, building material prices have also dropped, and the acceleration in PPI deflation is rarely a good sign for the cycle.

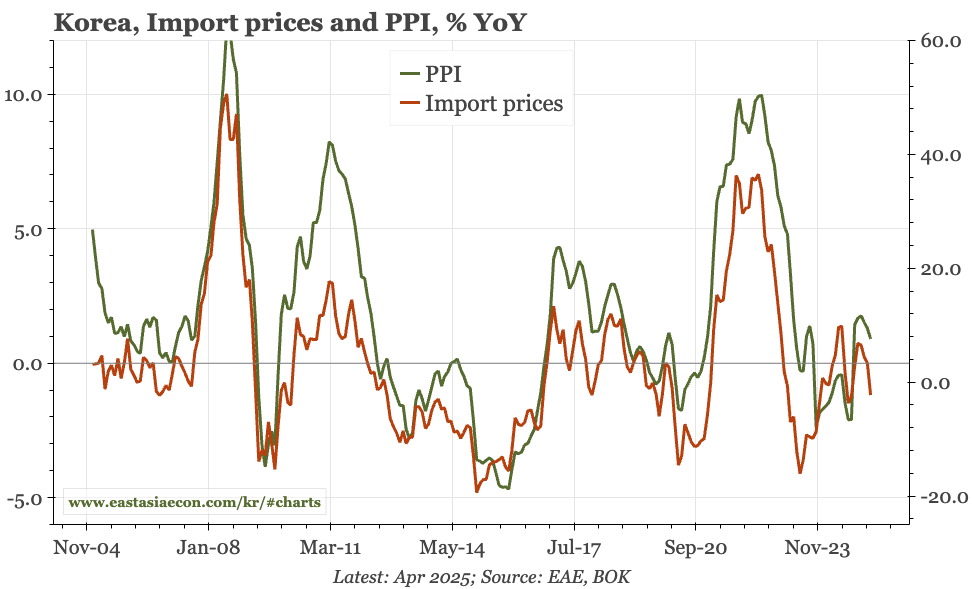

Korea – PPI following import prices lower

Today's data show that, unlike Japan, Korean PPI is following import prices lower. Unsurprisingly, the big moves in the PPI April report were in energy prices, which fell 7.9% YoY. With the KRW also strengthening, the BOK from here should be able to focus even more on the weakness in growth.

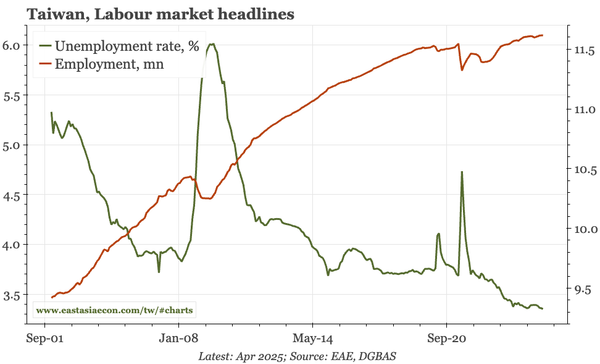

Taiwan – labour market still tight

After a tick-up in mid-2024, unemployment is back at 3.4%, the lowest in 25 years. In Korea, low UE is offset by big supply-side shifts as the participation rate rises. That isn't happening in Taiwan, so the labour market really is tight, with the big risk being tariffs cause export recession.

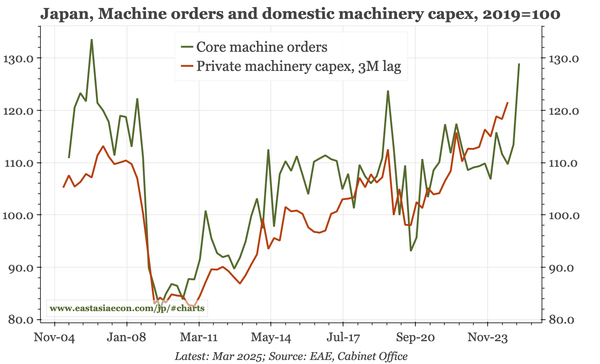

Japan – strong orders, weak sentiment

March machine orders surged, which could be tariff-related, but the strength was in domestic not foreign orders. Anyway, it seems unlikely to last, with today's flash May PMI repeating the downbeat message of the EW, with business confidence "the second-lowest recorded" since 2020.

Korea – no tariff shock yet

After adjusting for days worked, Korea's exports in the first 20 days of May fell YoY for the second consecutive month. But this isn't a tariff shock: in level terms, exports peaked back in mid-2024. If anything, May was a bit stronger, led by a rebound in semiconductor shipments.

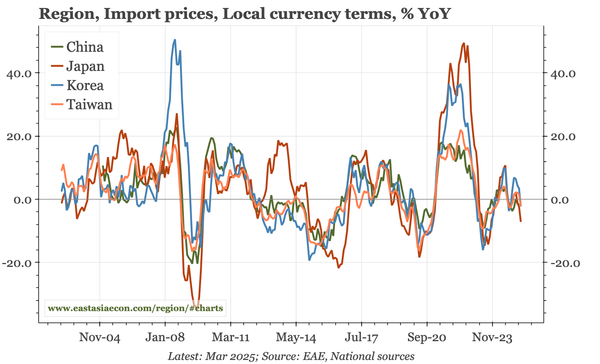

Region - uniform falls in import prices, but inflation diverging

YoY import prices are falling everywhere. The implications are mixed. It is contributing to a drop in PPI inflation in Korea, but an intensification of deflation in China. In Japan, meanwhile, PPI inflation remains elevated, supported by the cumulative rise in import prices of recent years.

China – faster PPI deflation

Optimistically, you could argue that the sharper drop in upstream prices though May is driven by the falling global oil price, a decline that is good news for China. But the details show the prices of other products are dropping too, and the upshot will be a yet faster pace of PPI deflation.

Japan – import prices versus PPI

The gap between PPI and import prices is a useful way of thinking about inflation and the BOJ. Usually, the gap is closed as import prices are cut by a combination of global recession and JPY strength. If neither happens, PPI inflation isn't likely to recede, and BOJ hikes will remain on the table.

Taiwan – manufacturing lifts overall wage growth

A key component of the structural shift in the economy is rising wages. That continued in March, with signs of another acceleration in manufacturing wage growth on the back of strong exports. As a result, overall wage growth is once again over 3%, as quick as during the recovery out of covid.

Korea – exports not collapsing, but still weak

The sharp drop in exports in the first 10 days of May doesn't show tariffs are having an impact. Rather, the decline was because of a fall in the number of working days. But the data do show that Korea's export cycle remains weak, with shipments in level terms treading water for a year.

Taiwan – can exports be stronger still?

Data released yesterday showed April as being another boom month for Taiwan exports. TSMC's sales today suggest exports might be stronger still, with TSMC's revenue rising even more quickly than in the 2020-21 post-covid recovery. That's remarkable, even allowing for front-loading.

Taiwan – another export surge

A lot of market discussion in recent days has centred on hedging by the lifers. The central bank, however, has argued that the move in the TWD was driven by exporters. That is believable: exports grew remarkably strongly in 2020-22, and have done so again through April this year.

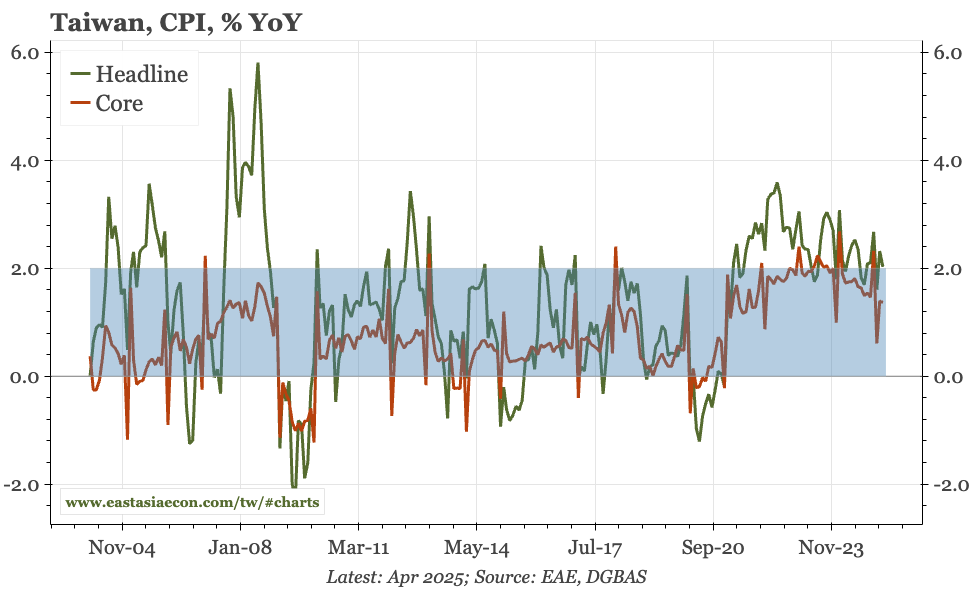

Taiwan – inflation continuing to slow

My framework for Taiwan and the TWD is a structural economic recovery driving a normalisation of inflation after the near deflation of the 20 years before 2020. That remains the theme, but there is now a clear cyclical slowing of CPI. That will intensify if tariffs trigger an export recession.

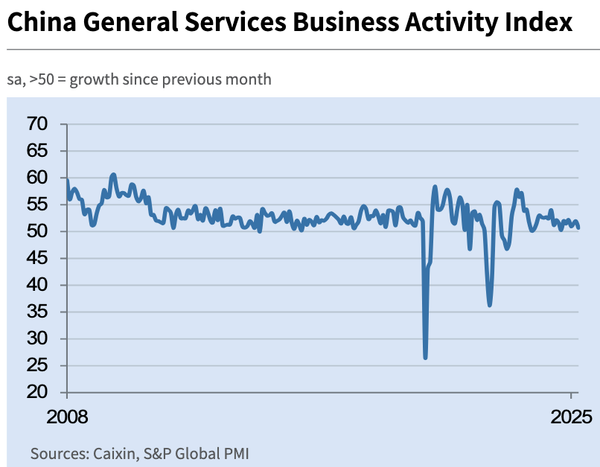

China – service business confidence near all-time lows

Politically, China might well be prepared for the trade war. But I remain sceptical that is true economically. The headline of today's Caixin services PMI was soft, and the commentary noted confidence falling "to the second-lowest level recorded since data collection began in November 2005".