The China Diviner

Reading the western media, and it seems the strongest market in China right now is for doom and gloom. Which is striking, as the short-term cycle is likely close to a trough, while there are reasons to think the longer-term outlook isn't as bad as the spate of the-end-is-nigh headlines suggests.

Peak pessimism

Reading the western media, and it seems the strongest market in China right now is for doom and gloom. “Pessimism engulfs the Chinese economy as foreign investment fades” says the Financial Times. The Economist, which last week proclaimed that “Foreign investors are fleeing China”, has as this week's lead “China's slowdown: the trouble with Xi's new economic model”.

It is of course absolutely true that the last few months have been a bad time for equity investors and the macroeconomy. A regulatory crackdown has driven tech company stocks down by 50%, and the sector is now reporting mass lay-offs. A separate policy squeeze on homebuilders has caused both property equities and construction activity to collapse. And all that before the renewed outbreak of Covid-19, the lengthy and disruptive lockdown of Shanghai, and renewed plummeting of the Chinese PMIs.

Before the virus first emerged in 2020, it was almost impossible to imagine China's GDP contracting in YoY terms. Now the country is facing the second such episode in just over two years. It would be surprising if all this hadn't created some tensions among policymakers in Beijing. And policy paralysis and political infighting have become the latest element in the China crash narrative. Talk of a policy rift between President Xi Jinping and Premier Li Keqiang has quickly solidified from vague sense into accepted wisdom. There's even been talk of Li taking over from Xi, perhaps as punishment for the troubles of the last few months, or maybe because the core leader is suffering from a brain aneurysm.

Needless to say, The China Diviner isn't the right place to be finding reliable updates on Xi Jinping's health. Nor will we be the ones to be getting a scoop about any a palace coup. But while these reports may end up being true, they also look like a tempting end-point for a China-is-in-trouble narrative. And yet, just a few months ago, and it didn't seem China was in trouble; indeed, while it now appears policymakers in Beijing can't do anything right, little more than a year ago and there weren't many reports of them doing much wrong. They swiftly controlled the first Covid-19 outbreak with few people dying; the economy recovered more quickly than most observers had expected and without the considerable stimulus that has now contributed to inflation elsewhere; and back then The Economist was leading with headlines like “Xi's new economy: don't underestimate it”.

Of course, things do change, and as they do, observers can and should shift their views. The tech and property crackdowns of 2021 were certainly new, significant developments that add to our understanding of Xi Jinping's China. Still, it is also true that sentiment tends to move in waves rather than towards an end-point.

Perhaps it will be different this time, but to get a better sense of whether it will be, it is necessary to work out how much trouble China is in. In attempting to do this, it is useful to differentiate between the short-term, cyclical direction of the economy and the long-term, structural trajectory. In terms of the cycle, you don't need to be too much of a China bull to think the economy is likely close to the trough. As for the structure, there are certainly things to worry about. But there are also clear reasons to be more optimistic than the end-is-nigh headlines suggest.

Short-term cycle

While we might not be certain about much regarding politics in China, we do know the government's number one goal right now is to drive Covid-19 numbers back towards zero. It is this drive that has caused economic activity to collapse in the last couple of months. The situation in Shanghai has improved, but while case numbers in Beijing continue to be below 100, they aren't low enough to be able to call the all-clear. Even if the city of Beijing avoids a big outbreak and returns to normality, as long as the CCP remains committed to zero covid – and that seems likely to remain the policy, at least through 2022 – so the economy will remain at risk from new lockdowns.

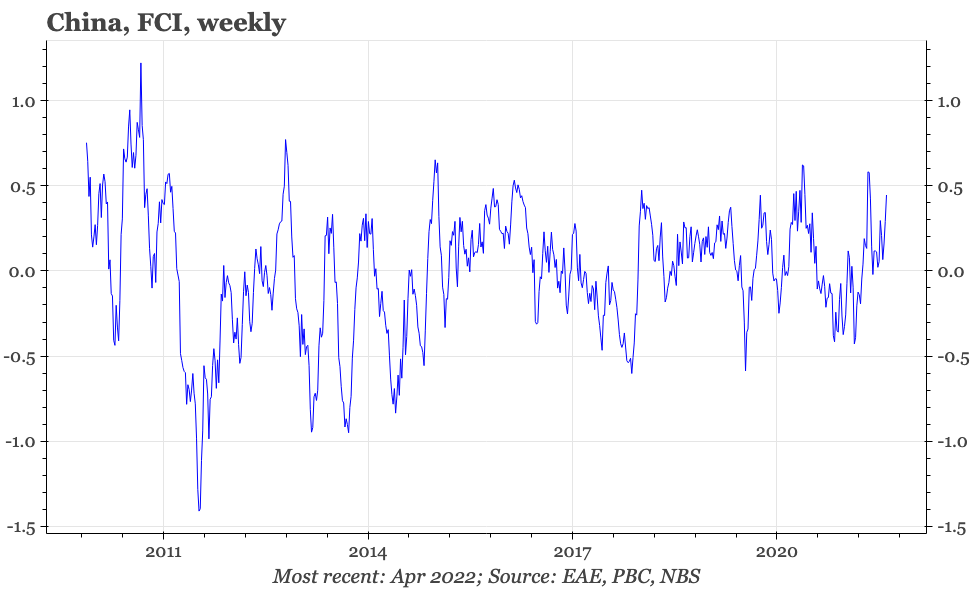

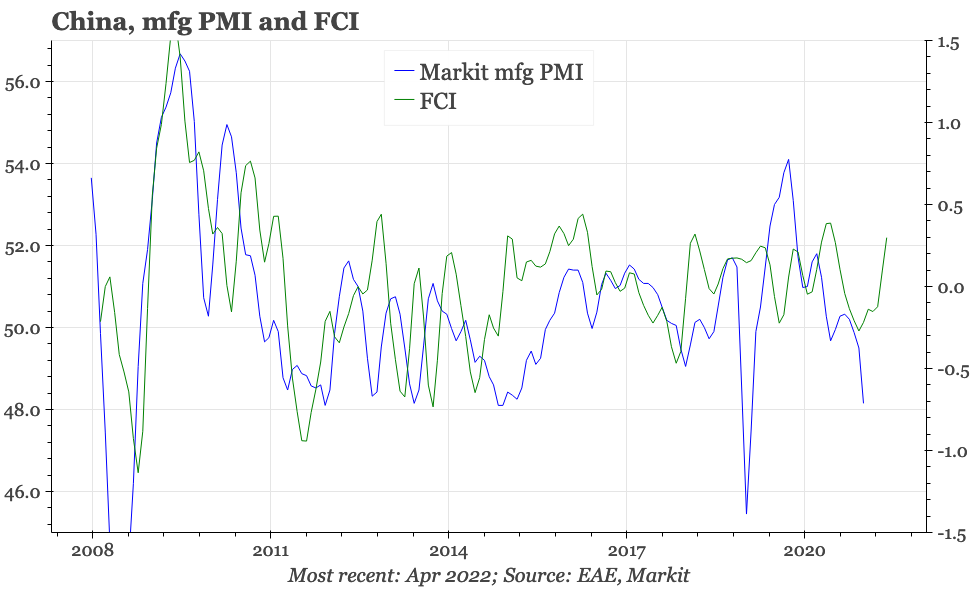

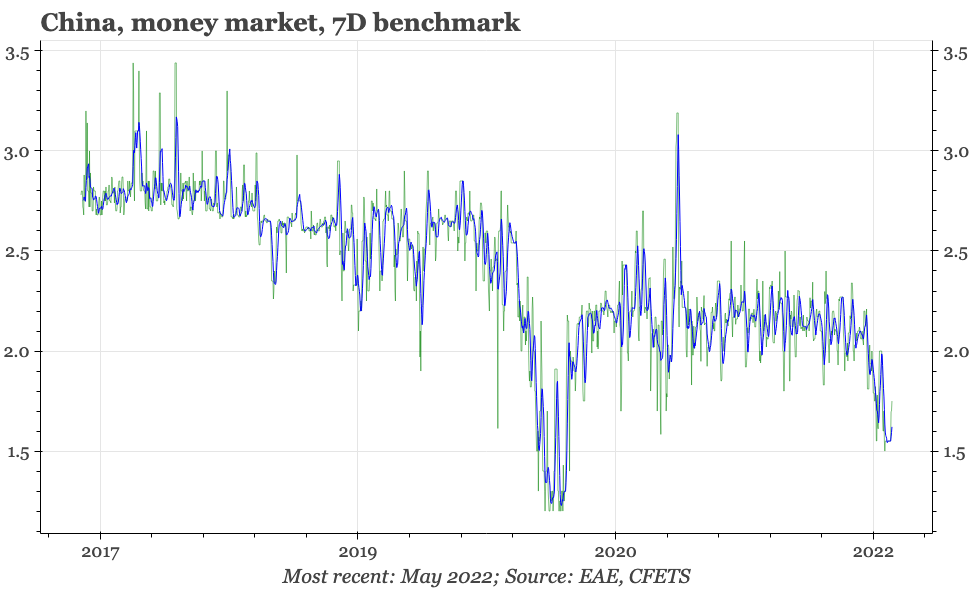

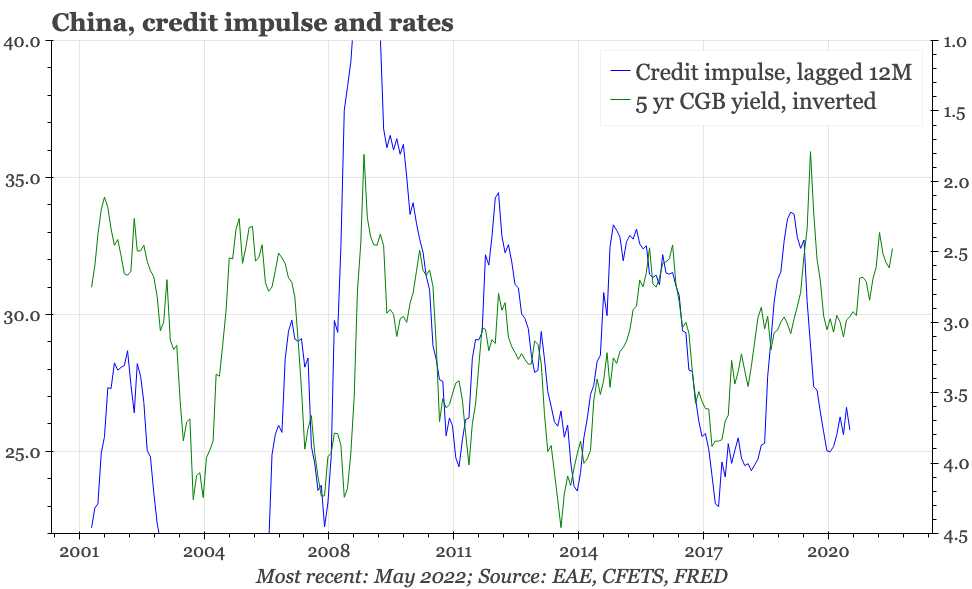

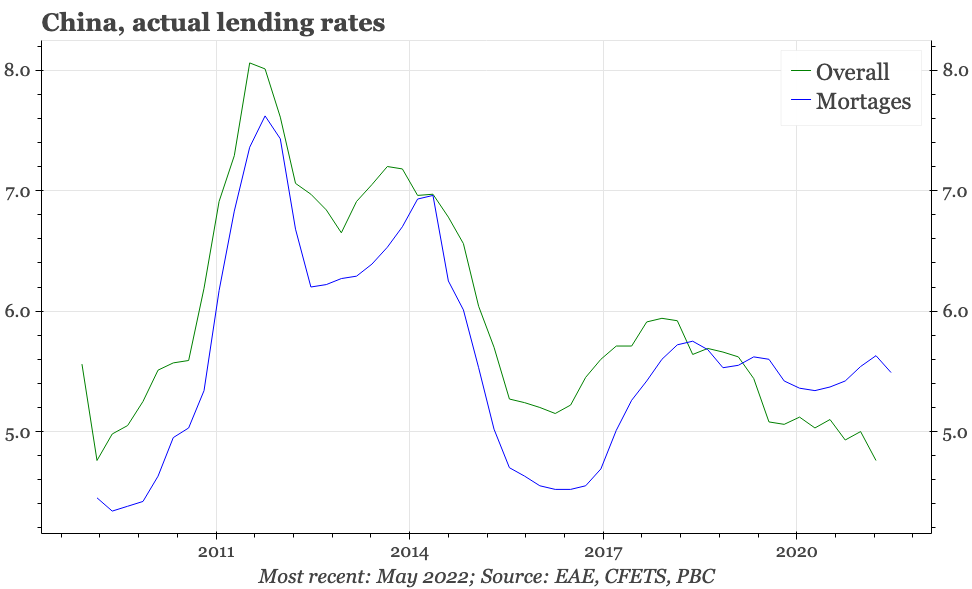

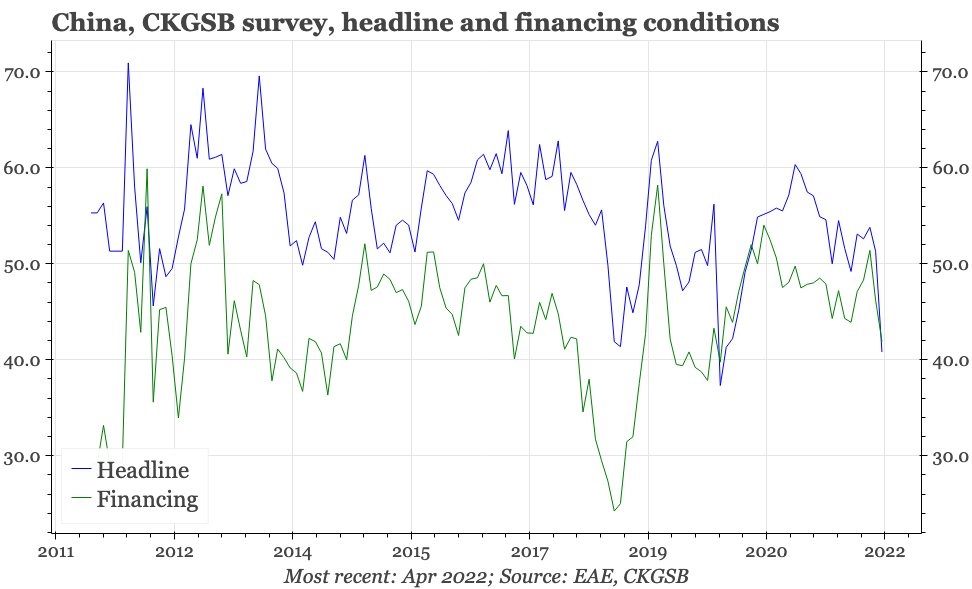

That said, if and when there is a break from Covid-19, conditions are shaping up for recovery. Our Financial Conditions Index is looser than normal, and is consistent with the PMI being above 50 (and also suggests that for all the real challenges China faces, they are some way from coalescing into a domestic financial crisis). The authorities have been cautious on headline easing, but they have moved behind-the-scenes, allowing the 7-day repo rate to fall below 2% for only the third time in history. The credit impulse has been recovering. Finally, macro policy for the property market has eased for the first time in this cycle, with the authorities moving twice within just a few days to cut mortgage rates.

To be clear, this doesn't look at all like China in 2008 – or the advanced economies in 2020. If perhaps not quite an open consensus, there are certainly many economists in China who view the 2008 stimulus as a mistake, with policymakers struggling ever since with the hangover of debt that was created. Chastened by this experience, Chinese officials have been openly critical of the aggressive stimulus used by the advanced economies to escape the Covid-19 recessions.

Given this backdrop, it would be surprising if Beijing was now throwing caution to the wind and loosening on every front to escape its own covid-driven downturn. Instead, the policy response looks similar to China's own play book used two years ago. Headwinds are stronger this time, with property weaker coming into the downturn, and exports likely giving less support coming out of it than was the case two years ago. Given this, policy needs to do more. However, if lockdowns end, then likely there's been enough done to fuel a bounce in activity in 2H22.

This isn't a particularly big call. Clearly, the lockdowns have depressed activity, so there will be an automatic bounce if and when the restrictions end. More interesting perhaps is whether there's also room for some optimism about the longer-term outlook. As for the cycle, the gloom around the structural trajectory for China also can't be dismissed: Xi Jinping has tightened and centralised political control and decision-making; since 2021 in particular it has felt that the authorities have prioritised national security concerns over economic ones; and all this has created a sense that the pragmatic approach to economic policy that was a critical part of China's economic emergence over the last forty years has been replaced by an attachment to ideology.

Long-term trajectory

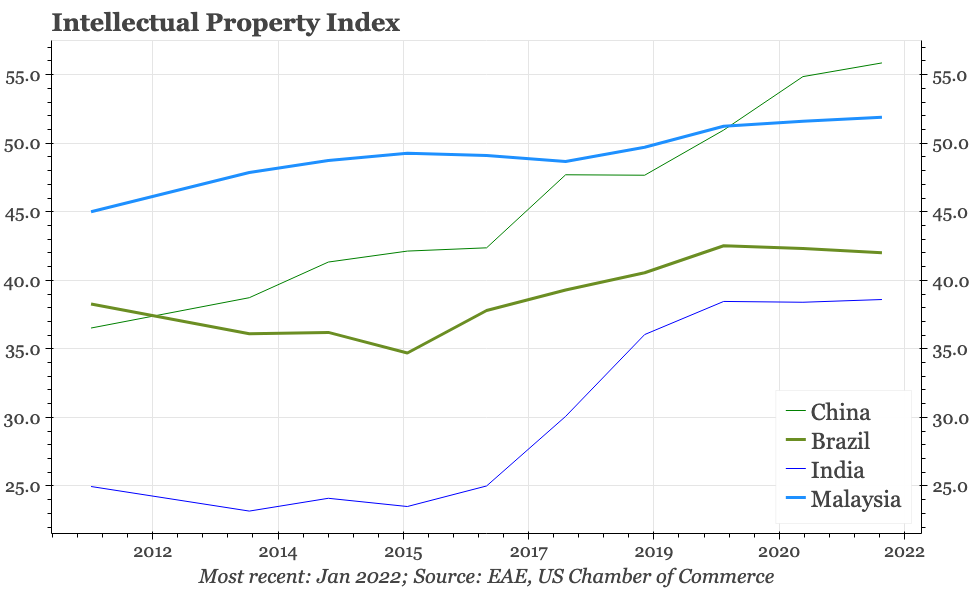

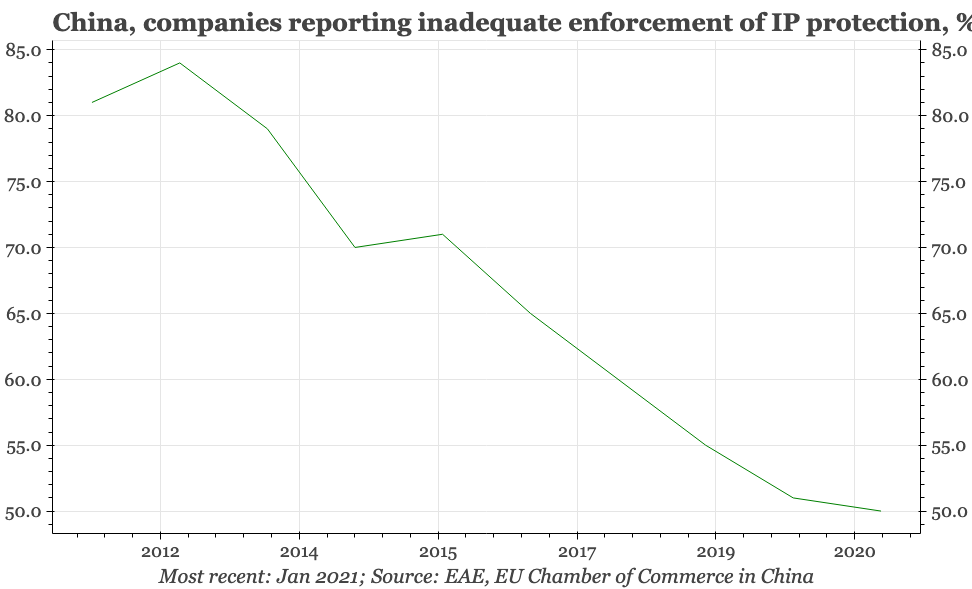

These concerns are real and important. But in thinking about the longer-term outlook, it is essential to give due weight to the other side of the ledger, where there is evidence of “reform”. As an example, one of the big complaints of foreign firms has been China's inadequate protection of Intellectual Property. Addressing this issue was, formally at least, a key driver of the tariffs the Trump administration imposed on China. Those tariffs haven't changed, but China's protection for Intellectual Property Rights has. The US Chamber of Commerce's IP Index shows that China's Intellectual Property Rights environment has improved more quickly than that in any other major economy in the last ten years. The European Chamber of Commerce in China's annual member survey provides on-the-ground backing for that finding, with the proportion of companies reporting that IPR enforcement is “adequate” or better rising from under 20% to 50% between 2012 and 2021.

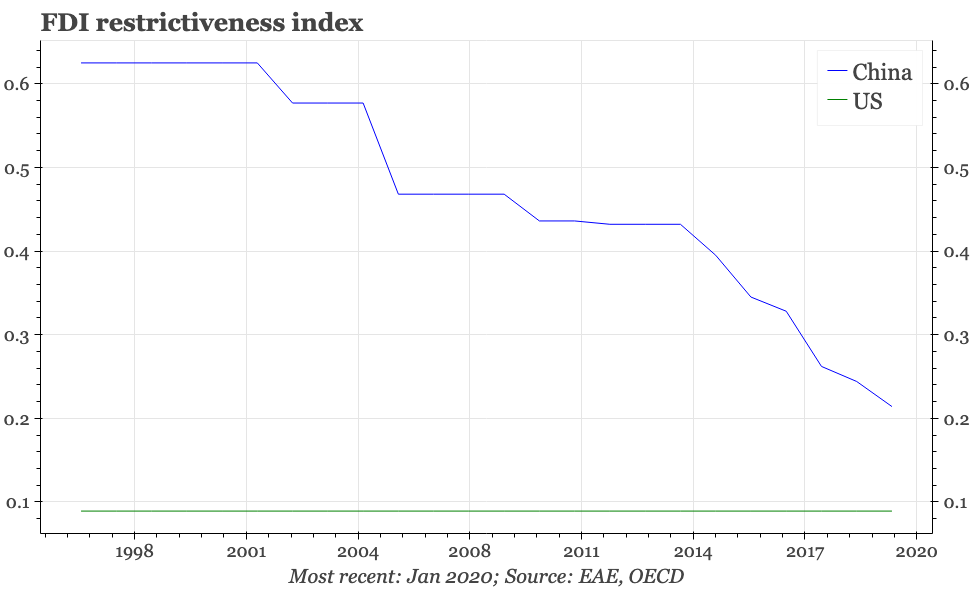

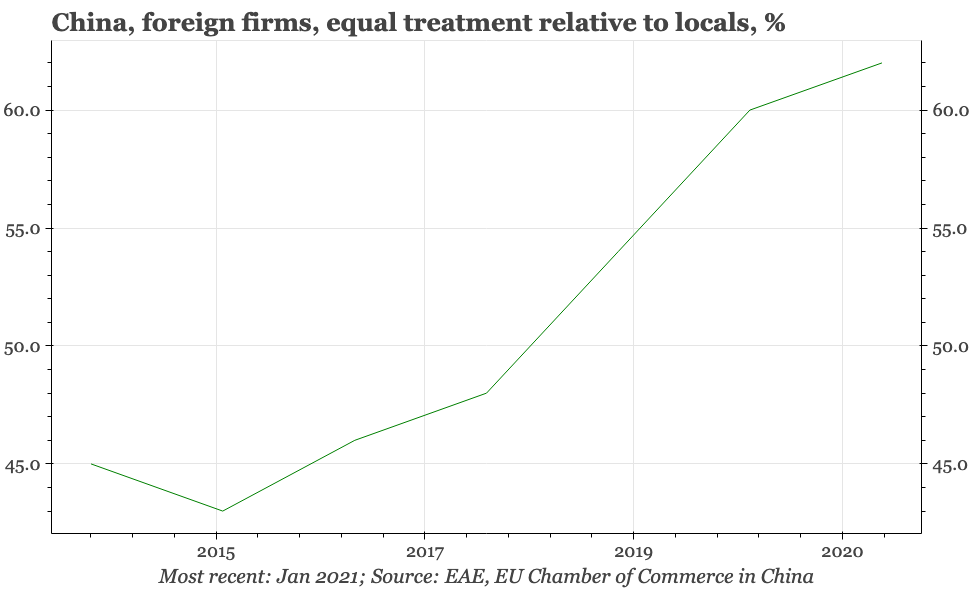

That is part of a general, albeit gradual, improvement in the overall business environment for foreign firms in the country. The OECD's FDI Regulatory Restrictiveness Index for China has consistently fallen through the last few years, with improvements made in almost all sectors. The index shows some sectors of the economy, especially media, remaining highly restricted. Most opening has occurred in industries like electricity distribution, as well as finance and insurance. Again, the EU Chamber's survey results provide a check on these results, with most companies responding to its 2021 survey reported receiving equal or better treatment than local firms. Actual investment data also show the change. Financial sector inbound FDI has roughly doubled since 2017. Aggregate foreign buying in China's debt and equity markets averaged USD52bn a year in 2012-16, but USD171bn in 2017-21.

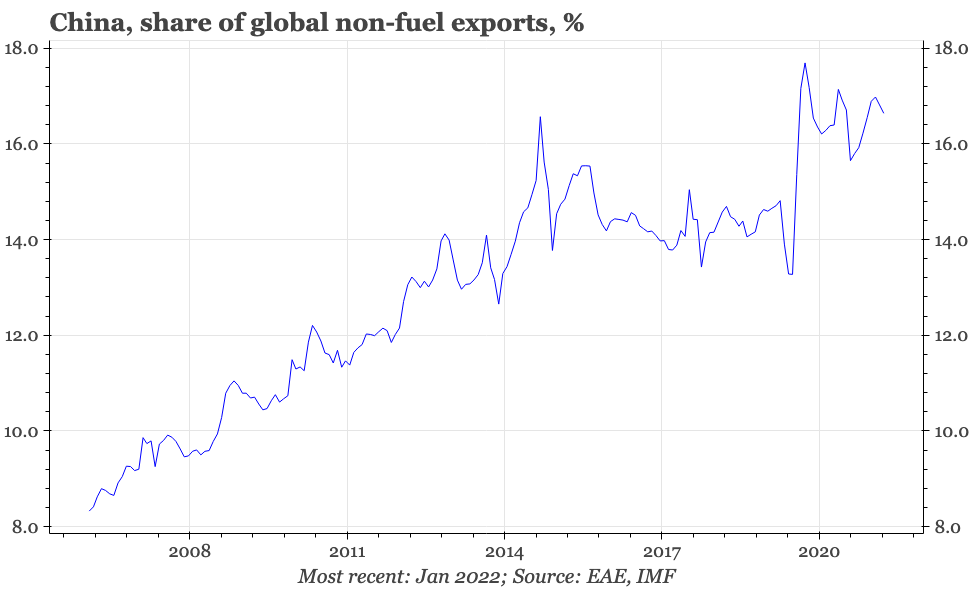

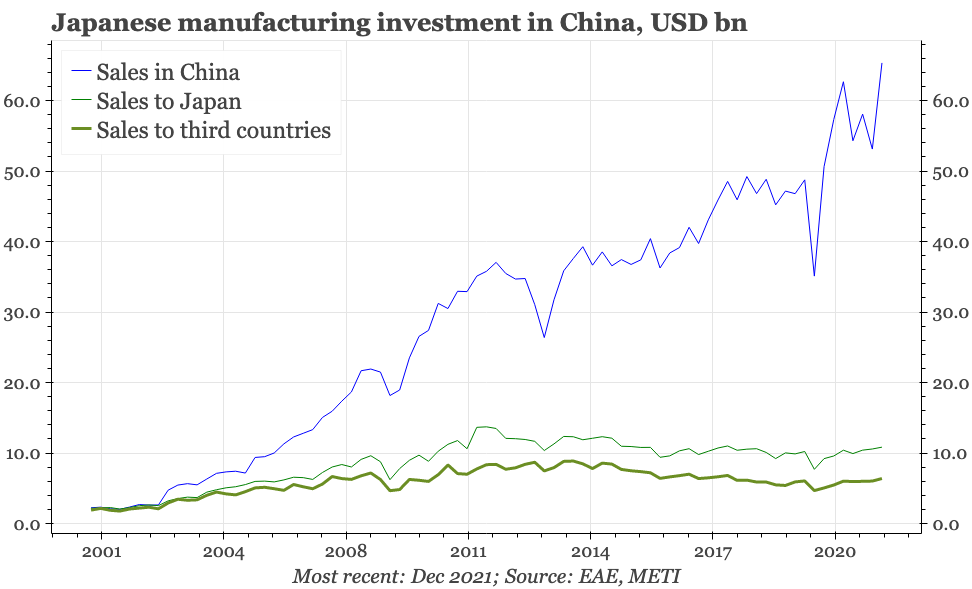

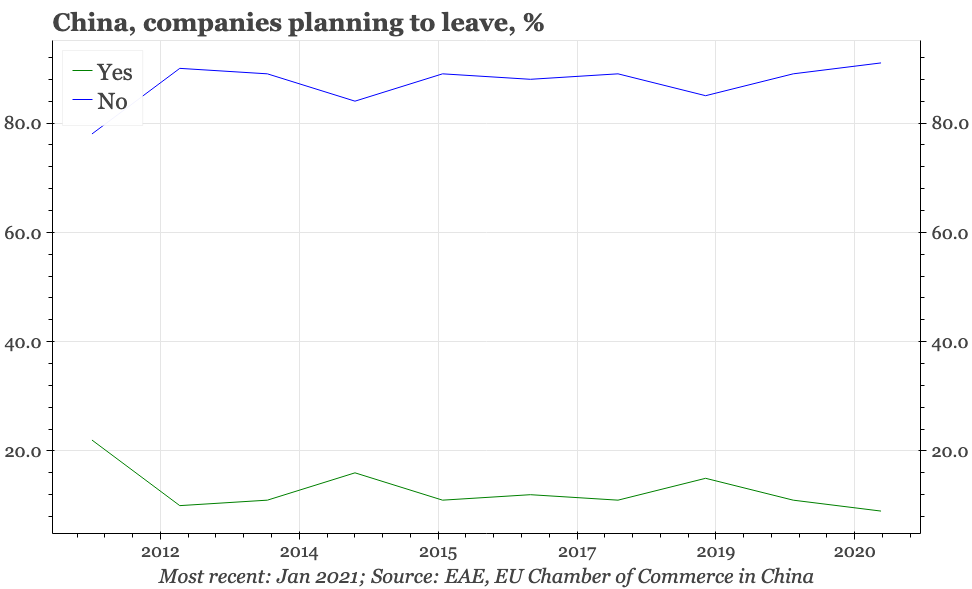

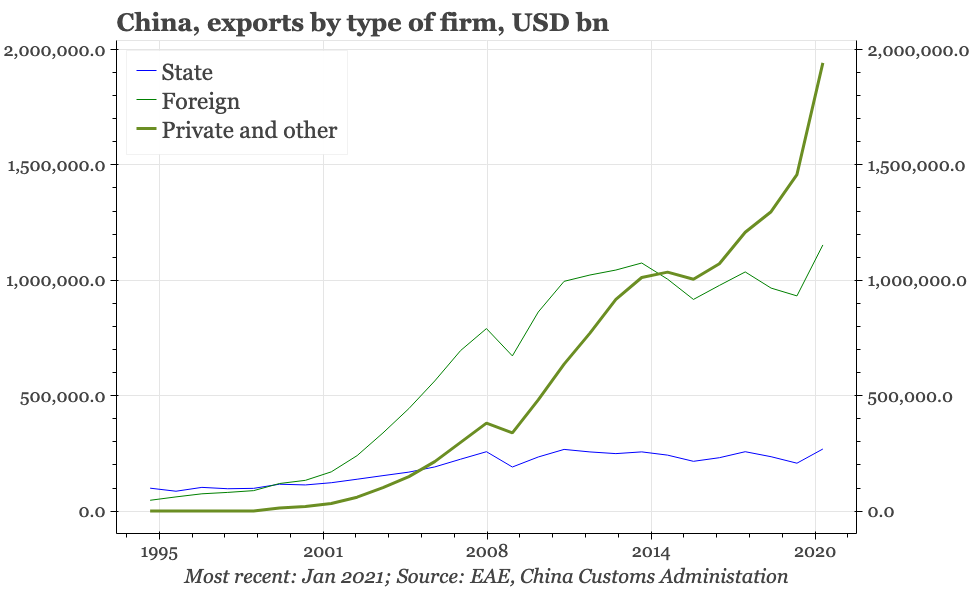

At the same time, all the concern in recent years about onshoring doesn't seem to have come to much yet. The proof of that isn't the more than 80% of foreign firms in the EU Chamber survey saying they plan to stay in the country: there has been a big change in foreign involvement in China, with fewer companies investing in manufacturing-for-export and more targeting the country's domestic market. But the limited extent of onshoring is clear in trade data. Far from declining, China's share of global exports has taken a new step-up since the covid pandemic hit the world. With the share of China's exports made by foreign firms shrinking, this suggests that the competitiveness of China's private firms – for it is these rather than state-owned firms that are doing the exporting – is rising.

Historically, it has been easier for Chinese private firms to access global markets than sell domestically. However, the environment for local private firms at home also looks to be improving. Unfortunately, in even discussing this, it is impossible to escape from the global politics that now seems to permeate discussion of almost any aspect of China. One indicator of the domestic improvement had been the World Bank's “Doing Business” survey, but this whole initiative has now been cancelled, amid concerns that certain countries, including China, were exerting influence to inflate their scores.

That is an unhelpful development, and certainly takes the shine off the sharp rise in China's Doing Business global ranking from 91st in 2013 to 31st in 2020. But that doesn't mean the direction of change shown by the survey isn't real. Promoting reforms consistent with the Doing Business framework has been one part of a general push to improve the business environment for smaller firms in China, an initiative particularly associated with premier Li Keqiang. At the same time, the government overall has put a policy priority on channelling money away from speculative investments to the “real economy”, and reducing the cost and improving the availability of finance to smaller firms.

In a recent speech, the premier laid out several examples of the changes that have been made. There's been the implementation of negative list systems for approving market entry; more than 1,000 approval processes have been eliminated or decentralised; 90% of government services are now available online; and the time needed to transfer money from the central government to local regions has fallen from 120 days to 7.

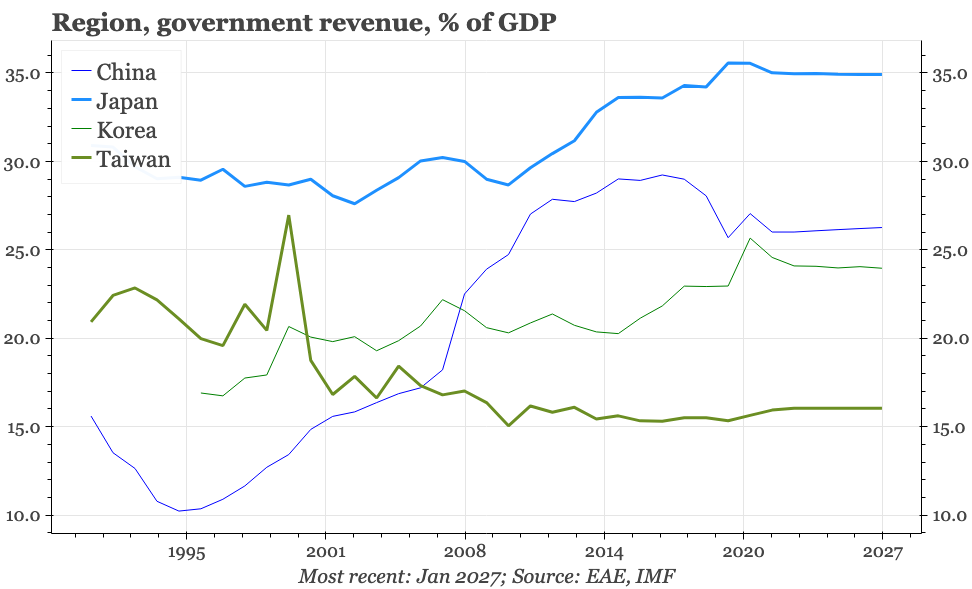

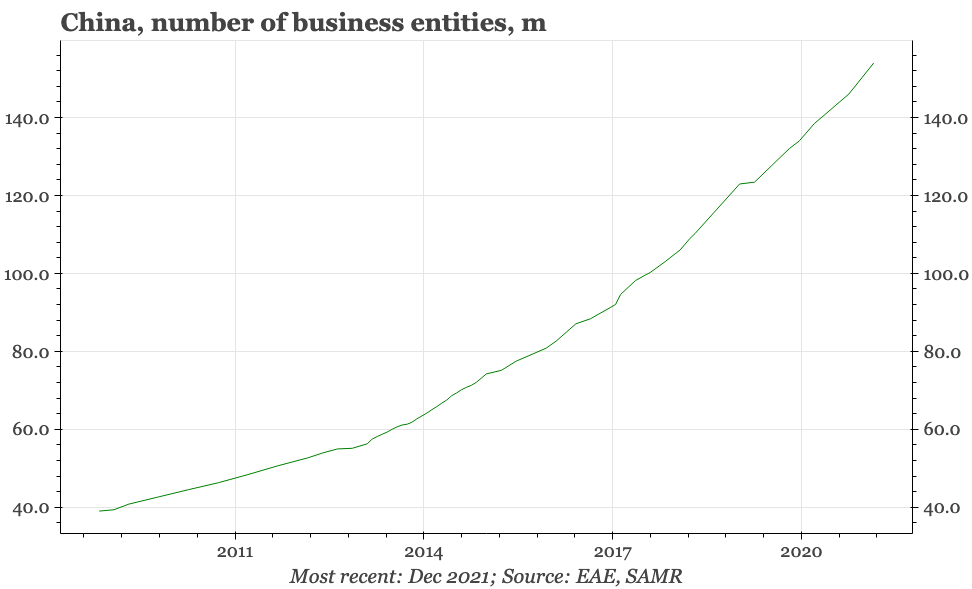

Finding evidence to back up all these claims isn't easy, although they are consistent with the direction of change suggested by the Doing Business Survey. But we can quantify some other business environment reforms. The premier's claim that that his administration has cut taxes and fees by CNY8.6trn during the 13th five-year plan goes some way to explain the fall in government revenue from over 29% of GDP in 2017 to 26% shown in IMF data. The PBC says that overall interest rates have fallen from 5.9% in 2018 to 4.8% now, while lending to small and micro firms has tripled since 2016. In an indicator of the improved availability of capital for SMEs, there is tentative evidence from the Cheng Kong Graduate School of Business's entrepreneur survey that financing conditions for smaller firms has become less structurally tight. Data from the State Administration for Market Regulation backs up Li Keqiang's claim that the number of businesses in China has more than doubled in the last ten years.

Expecting a change in sentiment

None of this is to argue that China is absolutely on a positive trajectory. In terms of boosting the short term economic cycle, there does seem to be a real difficulty in reaching consensus about how and to what extent policy should be used. Li Keqiang and others are clearly worried about growth, with the premier reasonably warning that the economy is facing difficulties that in “some respects are more serious than in 2020”. But there hasn't been a huge amount of follow-through. Policymakers appear hamstrung. As a rule-of-thumb, they share a deep-seated belief that stimulus should be routed via investment and corporates rather than consumption and households. At the same time, however, they worry that another wave of investment would add to the debt the economy is already burdened with as a result of the 2008 stimulus.

In terms of the long-term trends, the improvement in the environment for foreign businesses has only been incremental. Perhaps reflecting that, the multi-year and substantial fall in inbound FDI relative to GDP might have bottomed out, but it hasn't rebounded very much. The picture doesn't change much if we include portfolio inflows enabled by the opening up of the financial sector.

The premier's efforts to reform the business environment for smaller firms is admirable, and over the long term might well help improve the efficiency of the economy. But his apparent hope for a form of trickle-down economics, that a vibrant corporate sector would support employment and thus household incomes, isn't yet showing up in the data. Instead, given the weakness in consumer confidence since the first covid shock in 2020, there is an increasing risk that the virus has delivered a permanent negative shock to the household sector.

Of course then, there are things to worry about. At a minimum, the government has made it clear that there can't be a better cyclical story until covid is firmly under control, and I doubt there can be a better structural trajectory without real policy support for the household sector. Still, it is true that sentiment usually goes in cycles, and that as much optimism in 2020 was overdone, likely so is today's pessimism. If and when the short-term cycle improves, then it isn't far-fetched to think that sentiment towards China's structural trajectory could also shift. As an illustration, it was only two years ago that The Economist was arguing that Xi's economic model could “propel growth for years”.