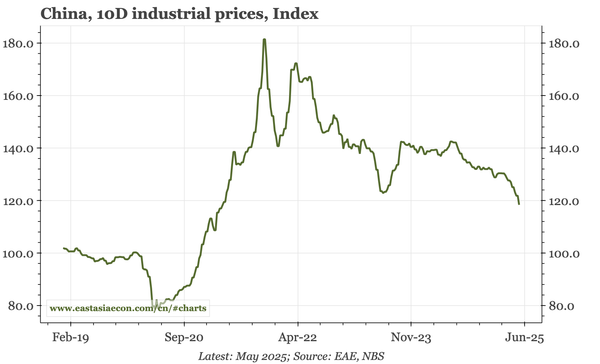

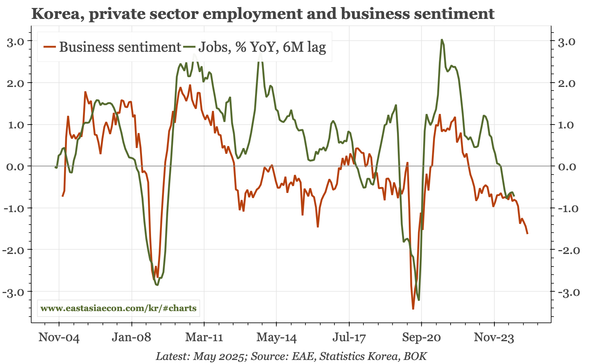

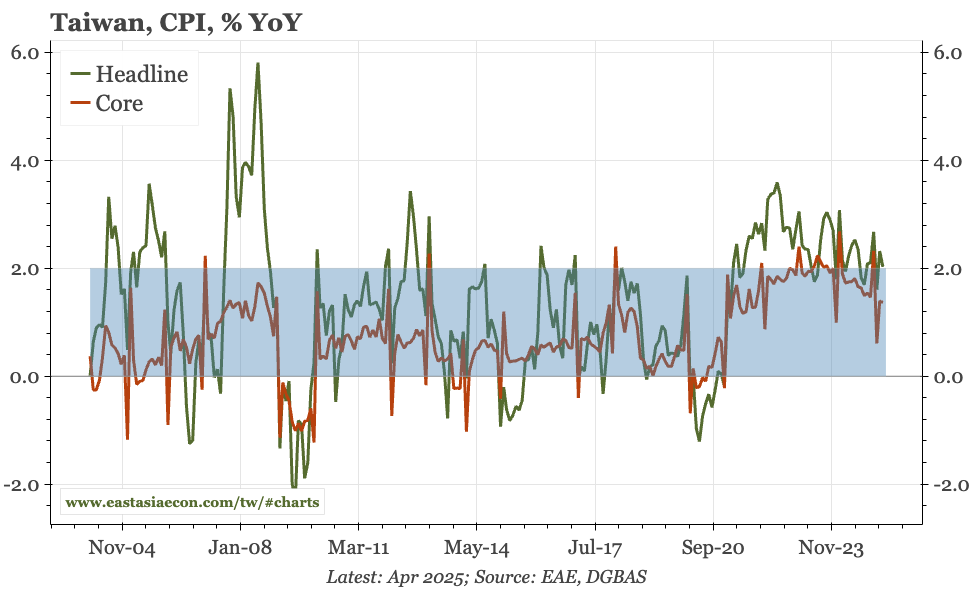

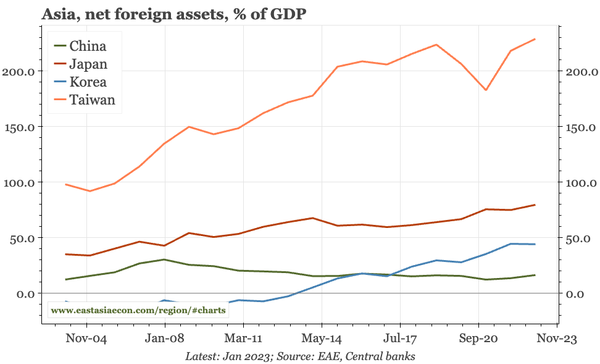

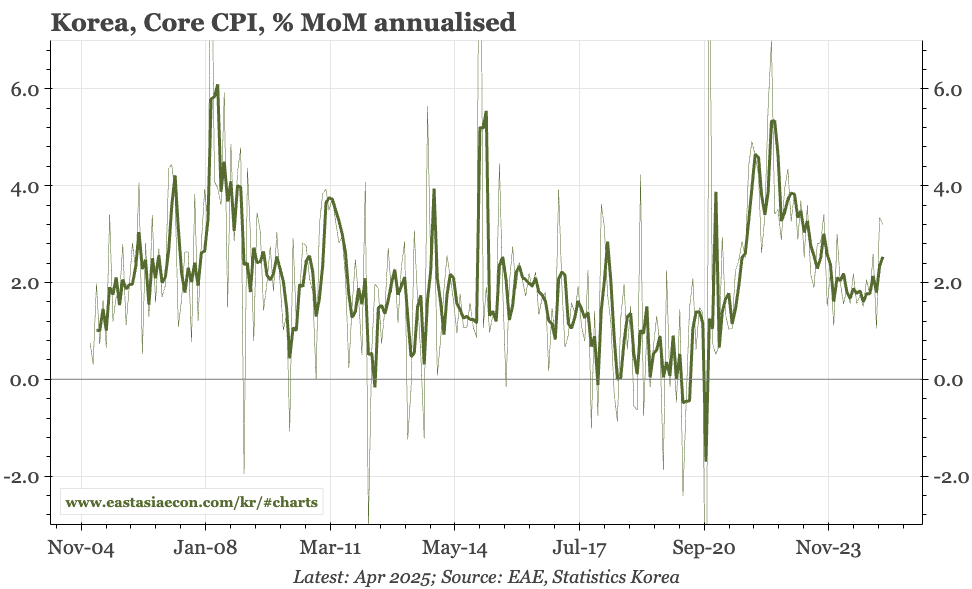

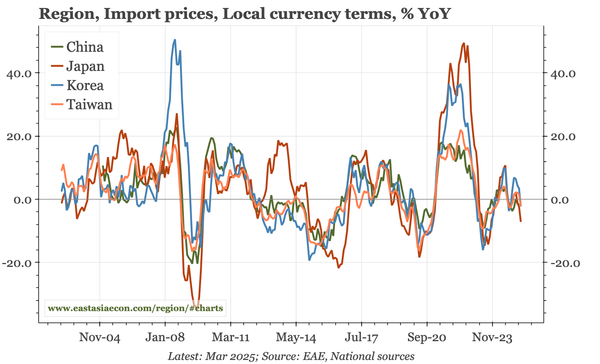

Region - uniform falls in import prices, but inflation diverging

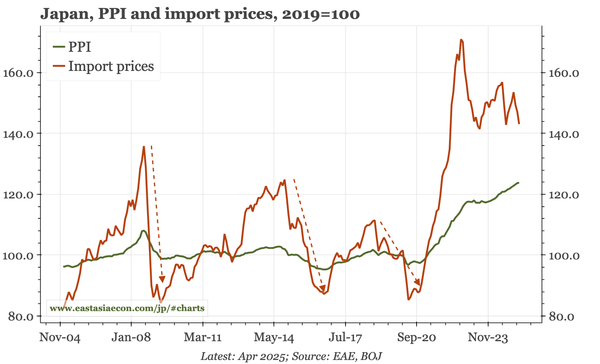

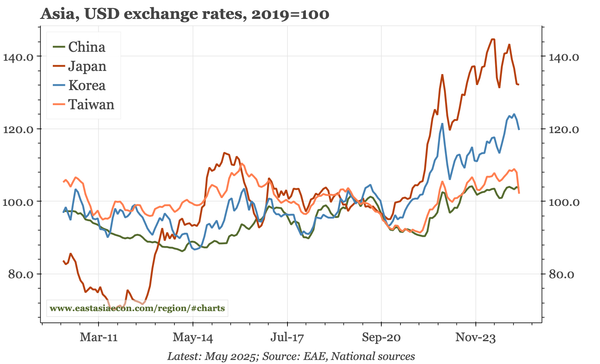

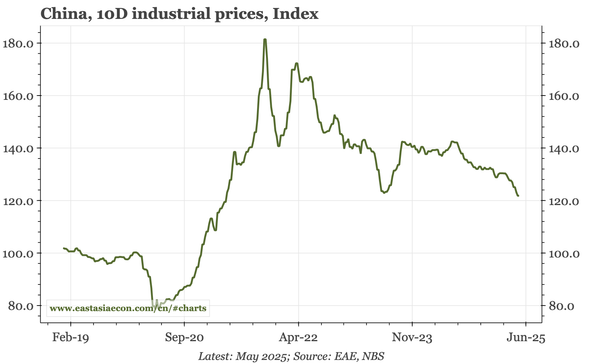

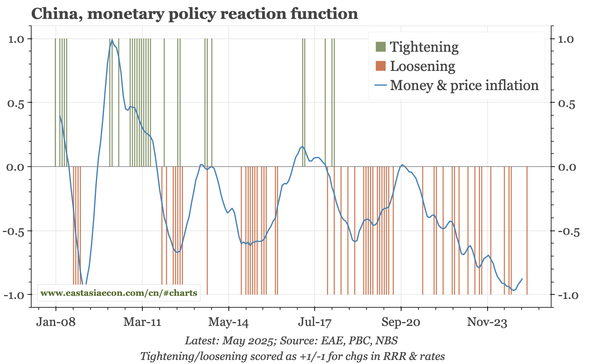

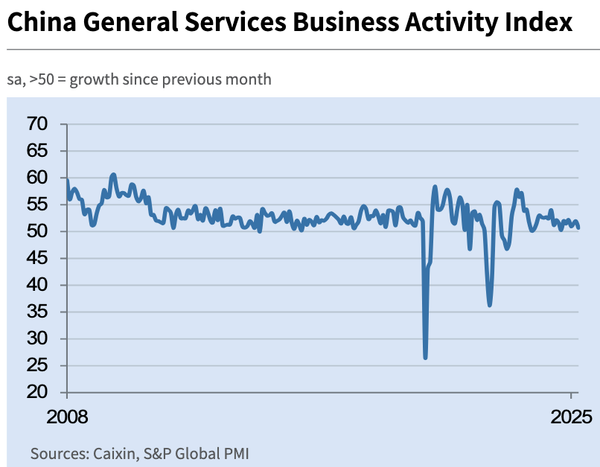

YoY import prices are falling everywhere. The implications are mixed. It is contributing to a drop in PPI inflation in Korea, but an intensification of deflation in China. In Japan, meanwhile, PPI inflation remains elevated, supported by the cumulative rise in import prices of recent years.