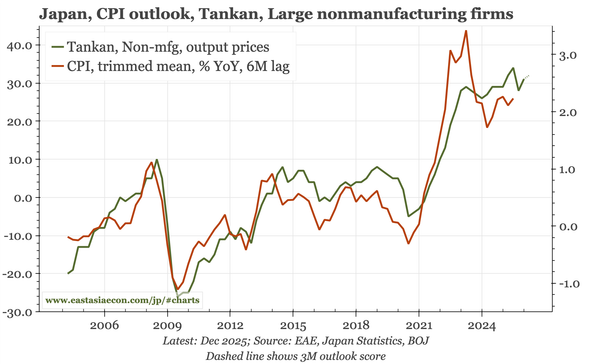

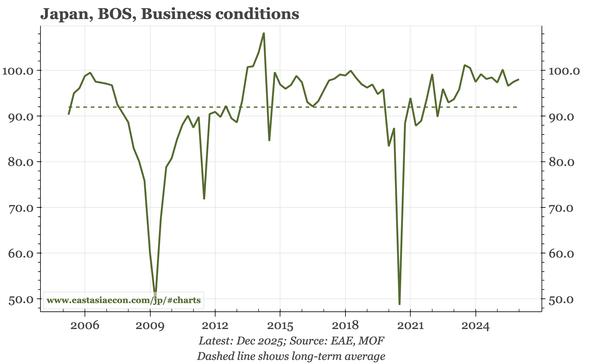

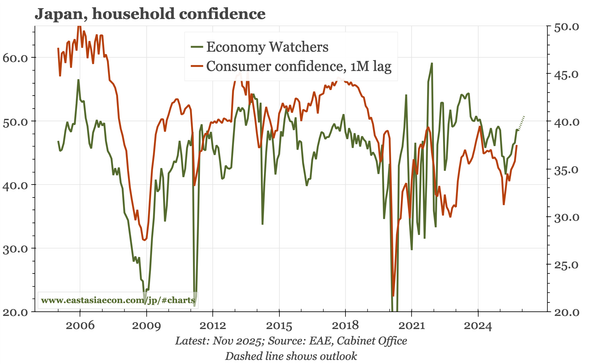

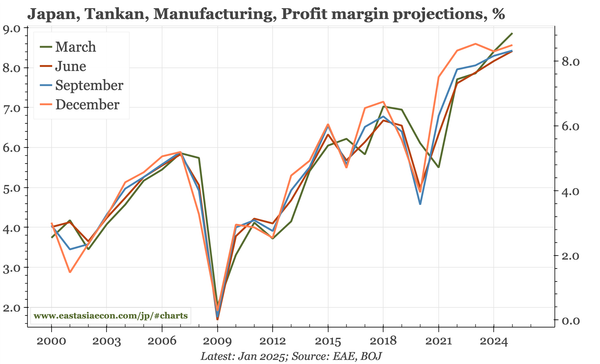

Japan – strong Tankan details

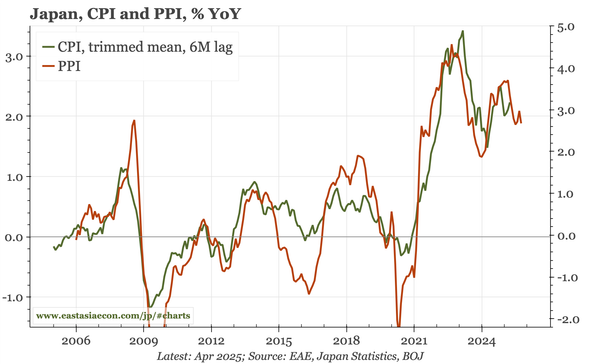

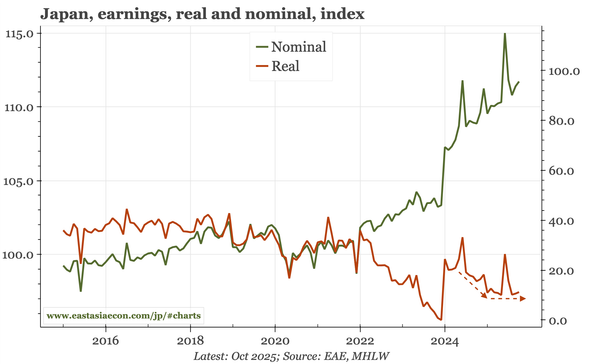

The BOJ has been concerned that tariffs would reduce profits, cutting into wages and capex. The Tankan shows no evidence of that: profit and investment expectations remain firm, as do inflation expectations, with the backdrop being a labour market that is tight for all industries.