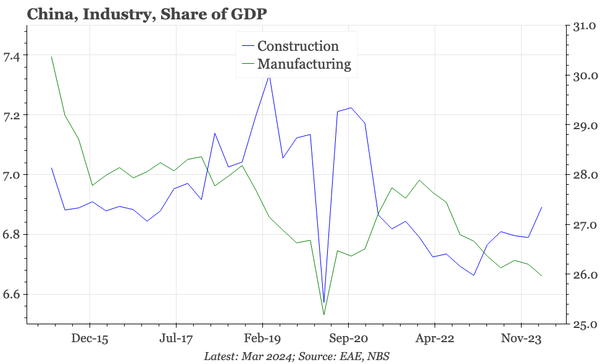

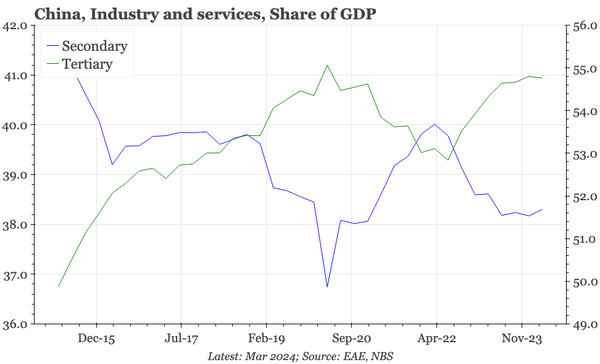

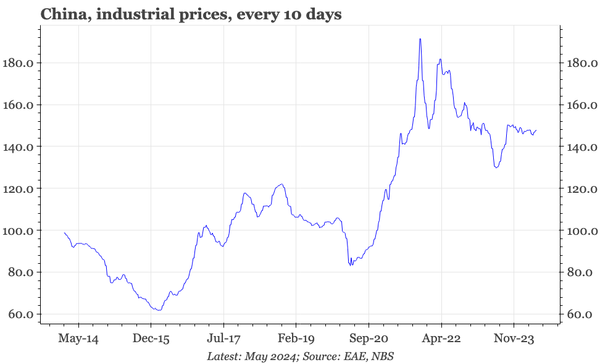

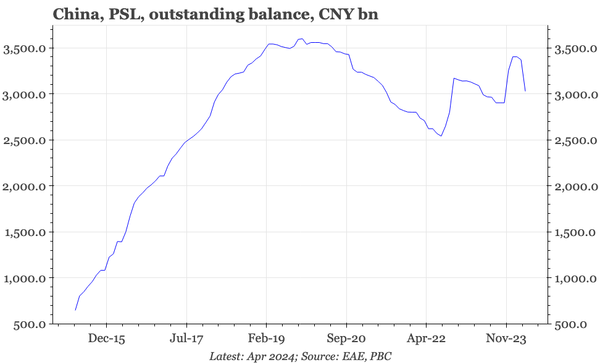

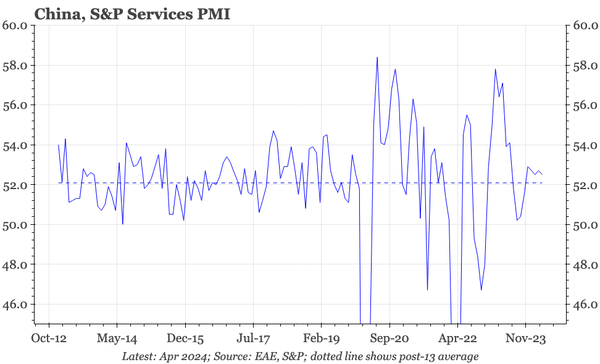

China – the big shift in consumer behaviour

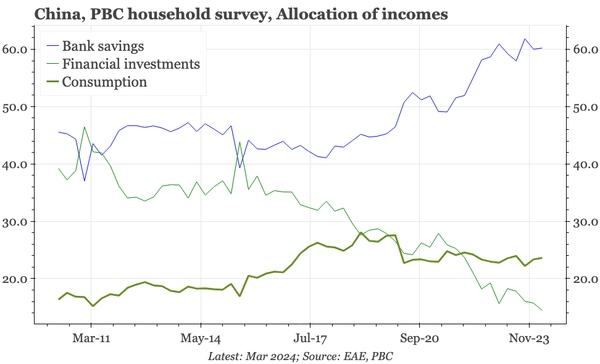

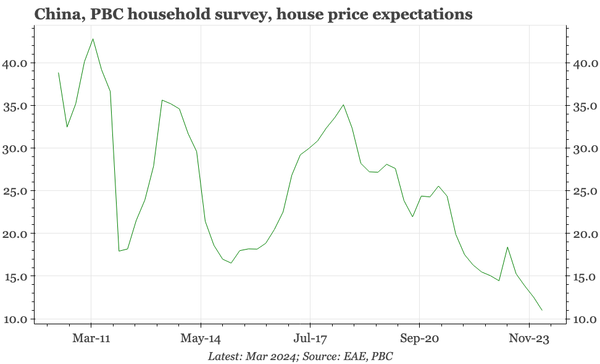

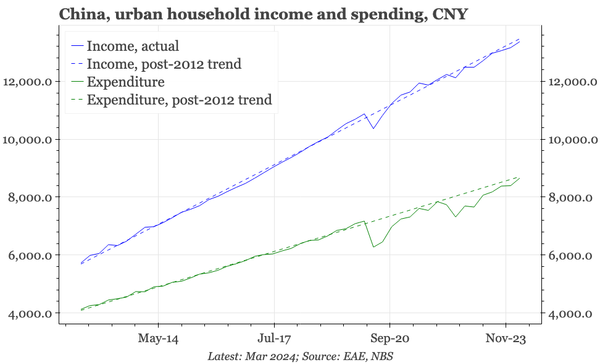

The big change in household behaviour isn't from spending into saving – in both respects, pre-covid trends have been regained. Rather, the shift is savings into bank deposits and out of financial and property investments. That matters for inflation, and for policy.