East Asia Today

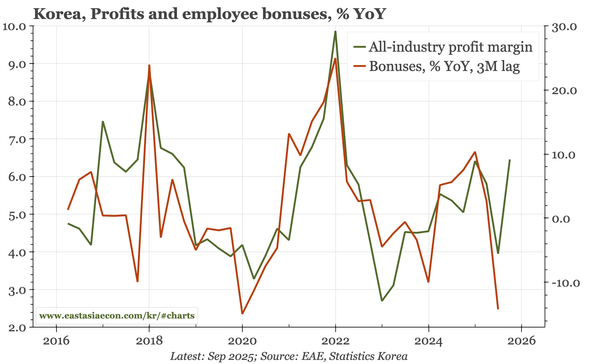

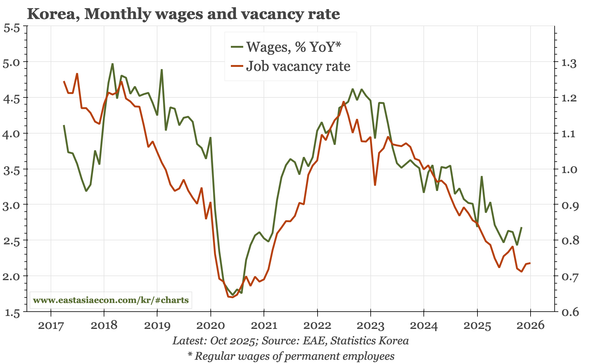

Japan consumer confidence and export data show a further lessening of the two big negative shocks of 2025. Consumer confidence has bounced in Korea too, but that isn't based on a strengthening labour market. Also today, an announcement: subscribers can now access all our data via an API.

East Asia Today

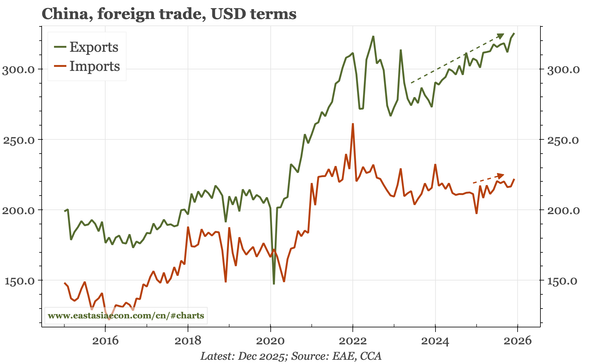

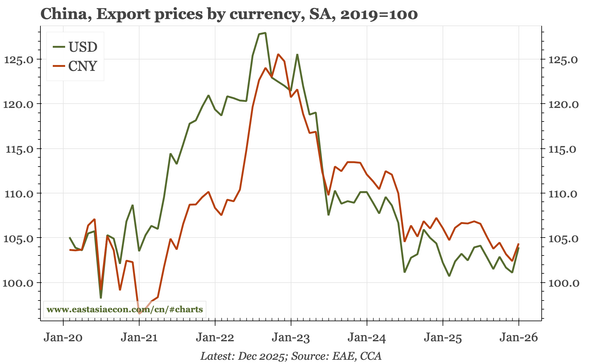

In light of Trump's threats against South Korea, an update on tariff levels in the region. Levies on China are highest, but China's USD export prices have been rangebound for 18M, and the stability of PPI in 2H25 has continued into 2026. Finally, my latest video discussing fiscal fear in Japan.

East Asia Today

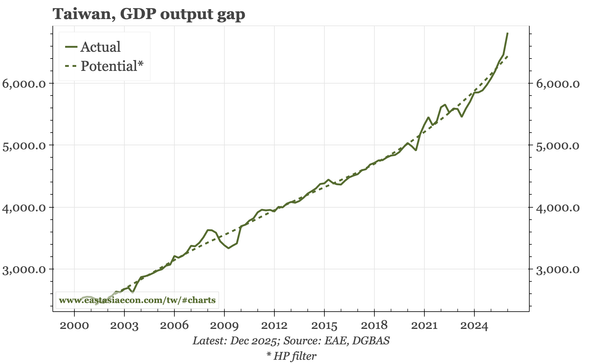

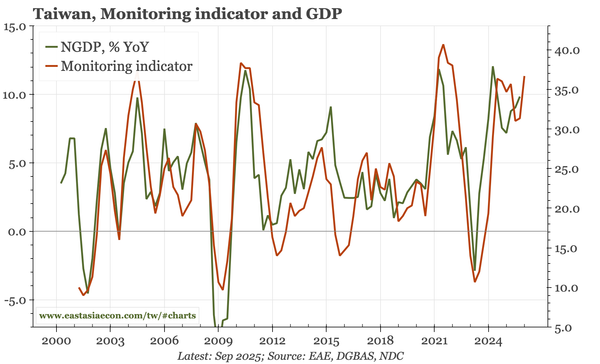

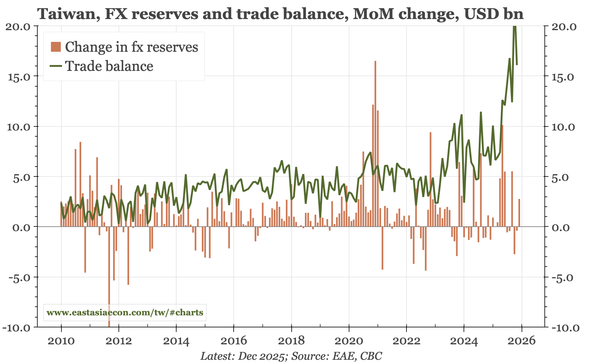

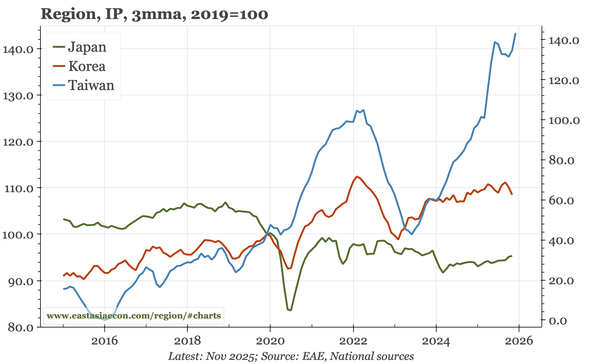

The BOJ didn't say much new today, but the authorities overall did make more of an attempt to put a lid on recent market volatility. In Korea, both consumer confidence and house price expectations remain strong. Taiwan retail sales slowed into end 2025, but IP took another step up.

East Asia Today

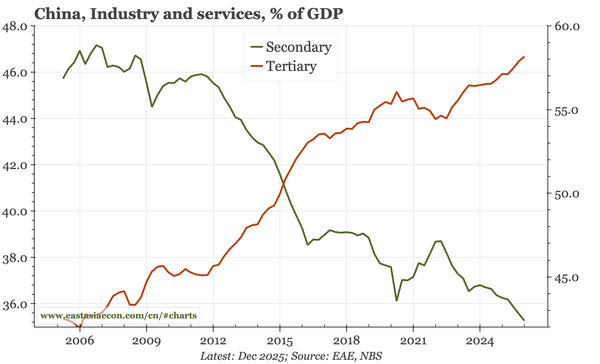

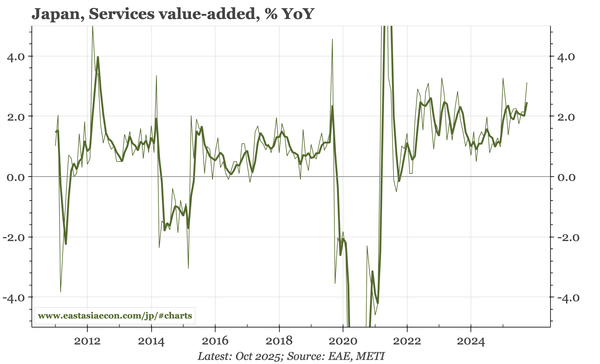

Detailed Q4 GDP data for China show construction (especially) and manufacturing falling further as a proportion of output, but services rising. In Korea, PPI inflation in December remained at 1.9% YoY. Taiwan export orders crept up in last month, another sign that activity remains resilient.

East Asia Today

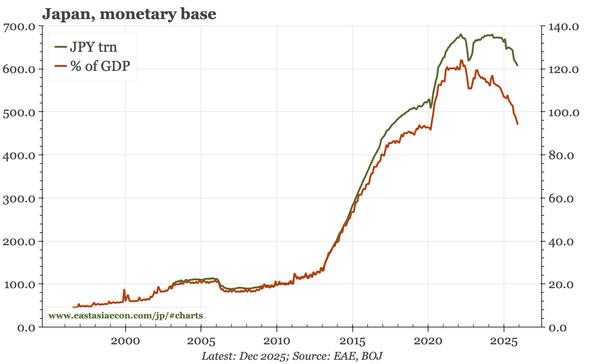

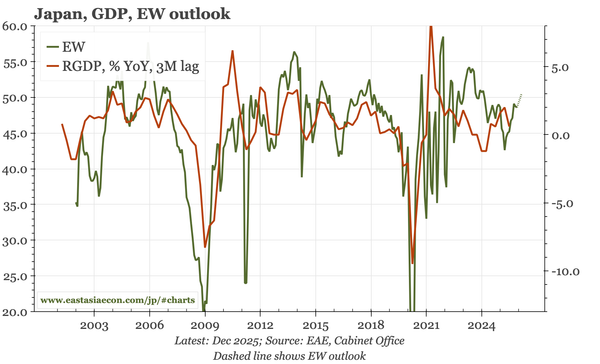

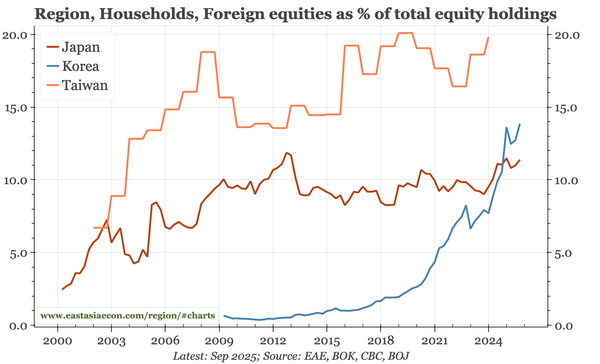

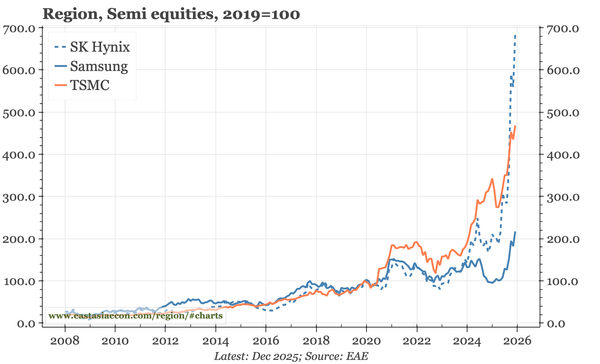

Some charts showing how Korea is structurally converging with Japan and Taiwan. One area of convergence is the current account surplus, which across the region is large and growing, now up to 6% of GDP in Japan. Other data today in Japan reiterate the improvement in cyclical momentum in late 2025.

East Asia Today

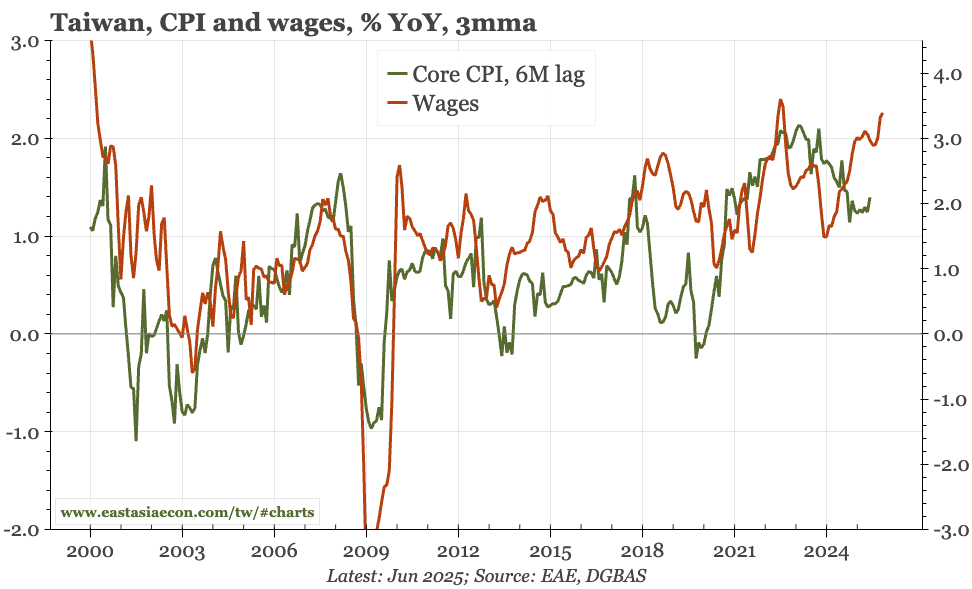

A longer note summarising cycle and structure and arguing that risk-reward is moving in favour of Asian currencies. Against that framework, today's export data for the first 10 days of January in Korea were soft. But Taiwan wage data for November tick the right boxes.

East Asia Today

More charts than usual on Japan today, with the Q3 sakura report and output gap from the BOJ, November wages, and December consumer confidence. Also, Q3 flow of funds data for Korea, which offers another perspective on the outflows that have been weighing on the KRW.

East Asia Today

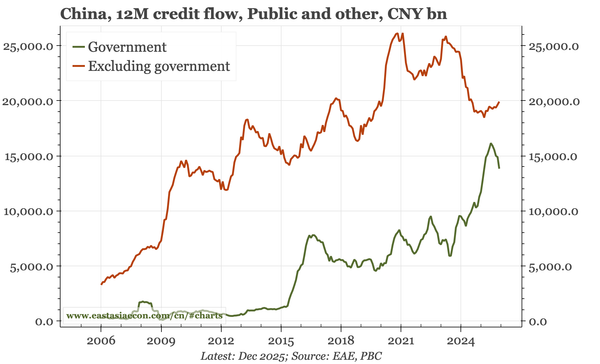

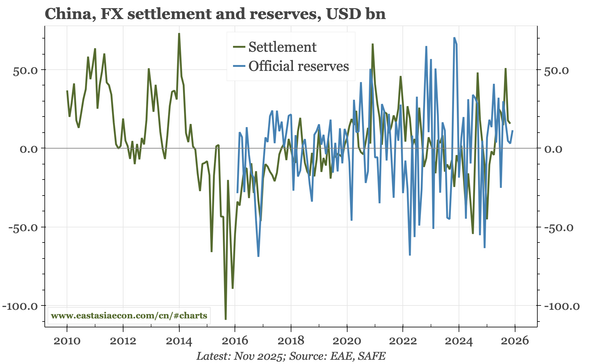

Data on FX reserves and PBC liquidity operations in December suggest the PBC balance sheet has become more supportive for growth. The Japan services PMI was weaker, but the commentary doesn't suggest a real change in direction. Services prices suggest core inflation in Taiwan has bottomed.

East Asia Today

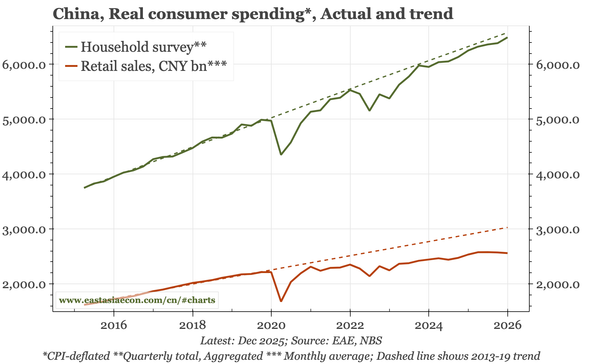

Looking through the data releases over the two weeks I've been away, and two themes stand out: rebounding activity, and firmer inflation. Both trends are most obvious in Korea. The picture is more mixed in China, but even there it looks like less deflation through to Chinese New Year.

East Asia Today

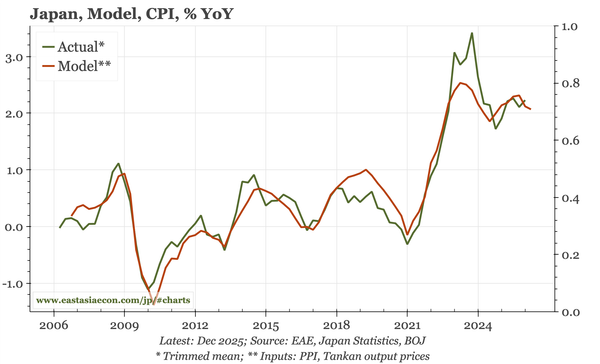

In today's daily: China monetary developments, Japan CPI, Korea PPI, highlights of the BOJ meeting, and a link to my latest podcast. From today, I am taking a couple of weeks off. Thanks for your interest this year, I hope you've found the content useful. Happy Christmas, and best wishes for 2026.

East Asia Today

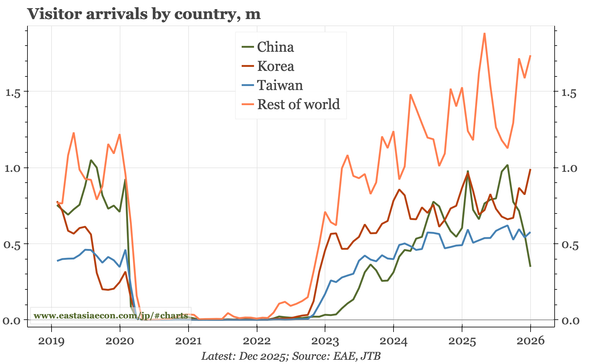

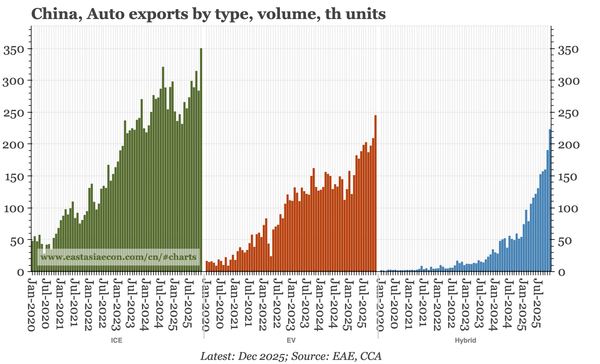

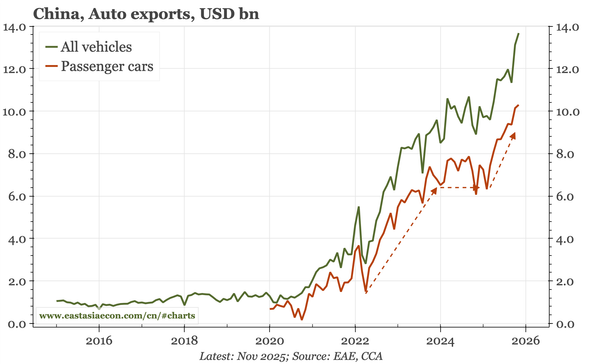

Detailed trade data show hybrids becoming the big driver of China's auto export surge. The political tensions with China have yet to derail Japan's tourism industry. In no surprise to anyone, Taiwan's central bank kept policy on hold in its Q4 monetary policy meeting.

East Asia Today

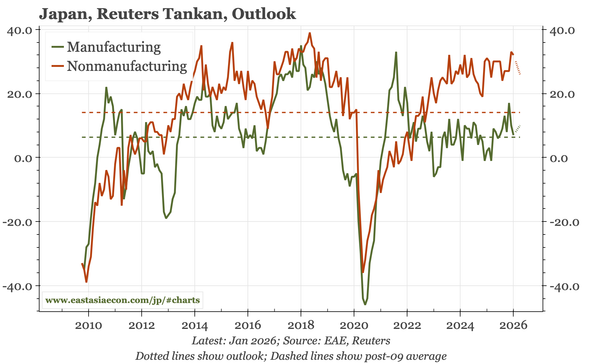

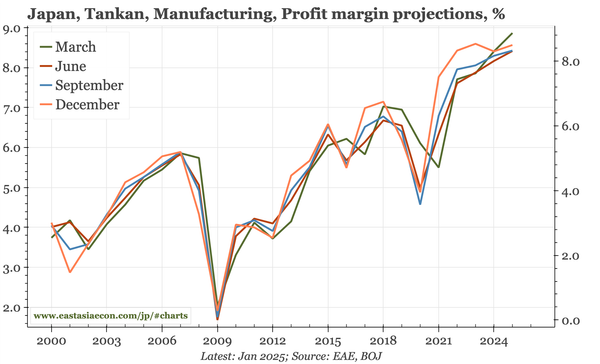

In addition to all today's data from China, some comments on Friday's monetary release and yesterday's high-frequency price data. In Japan, in addition to the Tankan, the BOJ today released the results of a special wage survey. Taiwan FDI data show investment in the US this year falling to USD4bn.